Combating Credit Based Derivatives Deflation

Interest-Rates / Deflation Nov 13, 2008 - 05:29 PM GMTBy: Mick_Phoenix

Welcome to An Occasional Letter. This week we pick up from the end of this article as we begin the process of peering into the future to assemble the next stage of the scenario I have followed over the past 6+ years.

Welcome to An Occasional Letter. This week we pick up from the end of this article as we begin the process of peering into the future to assemble the next stage of the scenario I have followed over the past 6+ years.

However before we start I have recently had numerous e-mails asking to join my mailing list. I thank those people for their interest but I no longer run a mailing list since converting to a subscription only website. If you would like to know more, visit An Occasional Letter for details.

To find out why I think the US Federal Reserve (and all the Keynesian based Central Banks) will fail we have to re-visit the series of articles I called The Eggertsson Theory in which I laid out the blueprint for current and future US Fed and Treasury actions in combating a credit based deflation that morphs into a deflation of cash and cash assets. The articles were written without my personal bias. I wrote them as though I accepted that what the Fed did was the right thing to do. Within the articles is a seemingly simple method of avoiding a deflationary episode or a repeat of the Japanese experience.

I quote from "The future actions of the Federal Reserve and US Government are known" which is an interpretation of the work of G B Eggertsson in "The Deflation Bias and Committing to Being Irresponsible":

- "Let me explain why, for the Fed and Government, there was no "Minsky Moment" but rather a progression of an already foreseen problem. To do this we need to look at why the Japanese Government and Bank of Japan failed to break out of a deflationary scenario. Again I quote from G B Eggertsson:

- "The deflation bias is closely related, and in some sense, a formalization of, a common objection to Krugman's policy proposal for the BOJ. To battle deflation he suggested that the BOJ should announce an inflation target of 5% for 15 years. Responding to this proposal, Kunio Okina, director of the Institute for Monetary Studies at the BOJ, said in DJN (1999): "Because short-term interest rates are already at zero setting an inflation target of say 2% would not carry much credibility." Similar objections were raised by economists such as, e.g., Dominiguez (1998), Woodford (1999), and Svensson (2001)"

At face value the remarks above would seem to support the Keynesian approach, that at low nominal interest rates, Government deficit spending and quantative easing failed to ignite the inflation required to break out of a deflationary spiral.

Within the quote though is the important point of inflation expectations. It is here that the importance of Bernanke's discussion of a targeted inflation rate and subsequent Fed warnings about inflation expectations remaining anchored becomes central to the main thrust of policy direction.

As we have seen, since 2000 the US Government has run a deficit whilst enabling tax cuts and rebates. The Fed allowed looser lending standards and brought down interest rates, in response to a business led recession. Rather than attempt to hide any inflationary tendencies inherent in these policies, the Fed has become more vocal about inflation ranges with the rhetoric pointing to overshoots of the target range. Inflation expectations amongst business and consumers have, somewhat naturally, been kept high.

The Fed is often measured by its inflation fighting credentials. I believe this is misplaced. The Fed should be viewed as a credible deflation fighter. The Fed had to establish an inflation target, either implicit or within a range, to ensure that further inflation was to be expected in the future. Why? It is all down to inflation expectations. Japan is unable to break out of its deflationary scenario because no one expects inflation to happen and therefore business, credit and the consumer act accordingly, ensuring demand is constantly put off to a later date. (Why buy today if it is cheaper to buy tomorrow). "

In other words Bernanke believes that if he sets an inflation expectation in the minds of Banks, Business and the Public they will react by planning their spending and investment to match such an environment. However if the inflation expectation is not believed then spending will not happen, cash and cash like assets will be hoarded (saved) in expectation that such assets will appreciate. This will remove cash and cash like assets from circulation in the economy (and when talking about the dollar we have to look at the global economy) and any increase in monetary supply will also be absorbed into savings.

This has major implications moving forward when combined with expected future losses on credit based asset derivatives (IMF - Assessing risks to global financial stability):

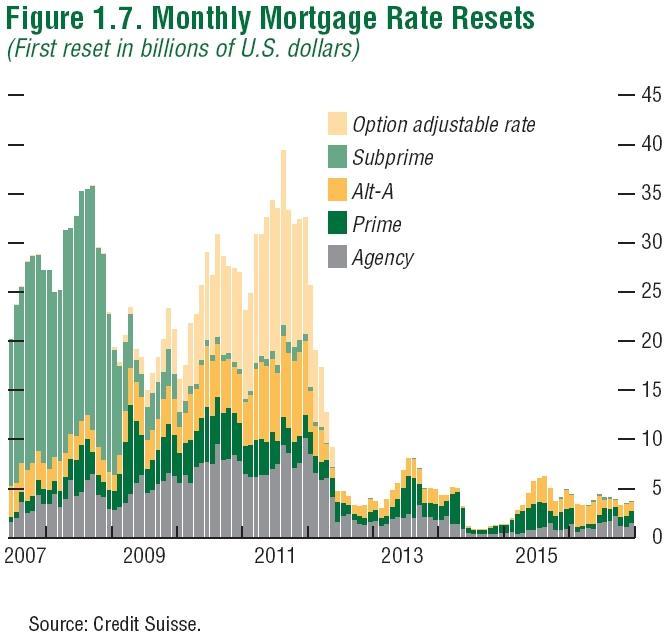

We are in the first wave of a 3 fold reset of debt. Whilst previous resets have been enabled by a large pool of mortgage products available to the public, that pool has now dried up.

This answers a variety of current behavioural patterns seen in the Banking sector. We are not just suffering from the effects of a rebuilding of reserves after current write-downs, we are seeing banks preparing for the future by continuing to build reserves in anticipation of future write-downs.

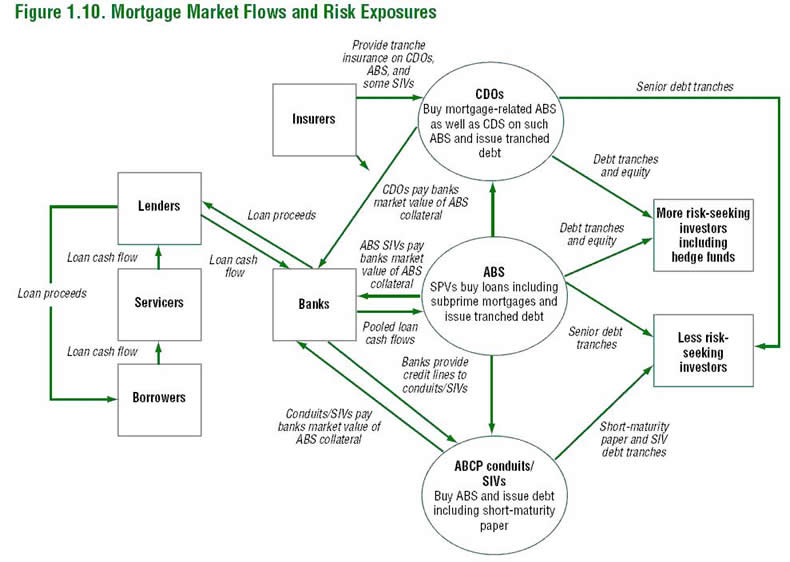

The following diagram for the IMF shows why Greenspan (and others) was so wrong about innovative derivative products spreading risk:

As one would intuitively expect the flows have to go through the Banks to be re-distributed and so does the risk. A breakdown in the flows and therefore an increase in risk must reflect on the Banks abilities to continue to allow the business model to work. The securitization of debt into various innovative packets has not removed the risk or decentralised the effect of default. The very reason for such securitization, to spread risk so as to avoid a concentration of the effect of default has spectacularly failed.

Despite the claims of the US Fed, the Treasury and all other Central Banks and Governments that the bailout of banks was/is/will be necessary it is clear to see that the funds supplied will go no further than bolstering the reserves of the Banks to offset current and future losses. Those funds will not re-invigorate lending, the left hand side of the chart above has closed down for business until the right hand side of the chart can be assessed and the possible default / write-down events have passed. Looking at the first chart we can see that the potential length of this credit bubble deflation will last until 2011/2.

Without Banks willing to lend until they can see the light at the end of the tunnel, any attempt to reflate or inflate the global economy will fail. Any cash or cash like assets made available will be hoarded, not just by Banks but by business and the public. We are facing a global economy that will resemble Japan's so called lost decade (or 2).

Without Banks willing to lend until they can see the light at the end of the tunnel, any attempt to reflate or inflate the global economy will fail. Any cash or cash like assets made available will be hoarded, not just by Banks but by business and the public. We are facing a global economy that will resemble Japan's so called lost decade (or 2).

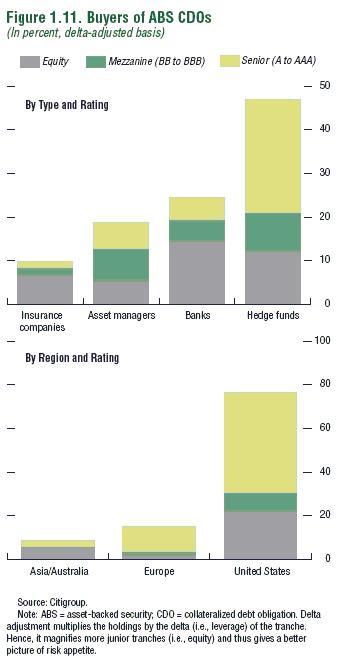

At this point I would like to issue a warning about those who say Europe has a bigger exposure to the US mortgage market than the US:

There are no avenues left to explore if Banks wish to off load mortgage debt, the risk takers have problems of their own as they unwind leveraged bets. Funding for future purchases will be unavailable, most Hedge Funds will disappear.

Without the inflationary expectations of a continued introduction of cash and credit into the economy, rather than just the bolstering of Banks reserves (and those corporations with large scale credit lending liabilities) then spending patterns will not follow the usual recovery pattern. Spending current income is only made possible if prices in the future are expected to be higher.

If those goods and services do not appreciate in price or, as I believe will happen, fall as competition for a scarcer cashflow intensifies then cash will not be put into the economy. Asking for more now is not the action of a hungry boy desperate for nutrition; it is the prudent act of acquiring an asset that may well appreciate in the future. I do not expect any future tax rebates to revive consumer spending, instead we will see either a reduction of debt and/or an increase in savings.

Many ask what the next bubble is. I suspect it may well be already building, only this time there are no derivatives or commodities are involved. The accumulation of cash in an environment were Banks are required to continue to seek the same asset to bolster reserves and offset losses might well be the smartest move over the next 3 years or so.

Next week we start to bring together the various strands of thought and look to map the road ahead.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.