Corporate Industrial Bond Yields Strongly Support Economic Deflation Thesis

Interest-Rates / Deflation Nov 11, 2008 - 12:37 PM GMTBy: Mike_Shedlock

As one might expect in a credit crunch, default risk is rising. One measure of that risk is corporate bond yields. Let's take a look and see how various grades of bonds are performing.

As one might expect in a credit crunch, default risk is rising. One measure of that risk is corporate bond yields. Let's take a look and see how various grades of bonds are performing.

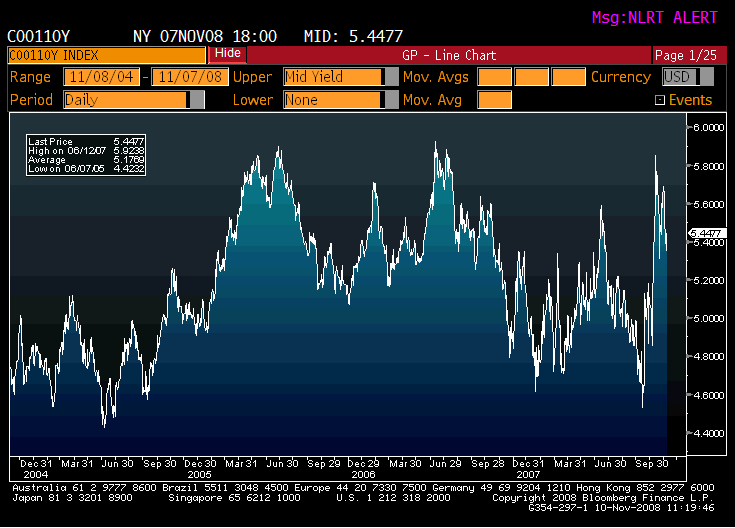

Bloomberg AAA Rated Industrial 10-Year Bond Index

Bloomberg A Rated Industrial 10-Year Bond Index

Bloomberg BBB Rated Industrial 10-Year Bond Index

Bloomberg B Rated Industrial 10-Year Bond Index

The above charts are courtesy of Bloomberg sent to me by Chris Puplava at Financial Sense . The idea for this post came from Bennet Sedacca who posted one of the above charts on Minyanville .

As you can see, only AAA rated bonds are performing well. This is strong evidence that we are not in a period of "disinflation" as some claim. In a disinflationary environment, one would expect risk premiums to drop not rise. Action here is consistent with rising default risk, which is what one should expect in deflation.

Those harping about prices of consumer goods, food, services, etc., are missing the boat about what deflation is and what one should expect in deflation. Trillions of dollars of debt are being wiped off the books via bankruptcies and foreclosures while inflationistas worry about the price of eggs going up by 35 cents. It is truly mindless.

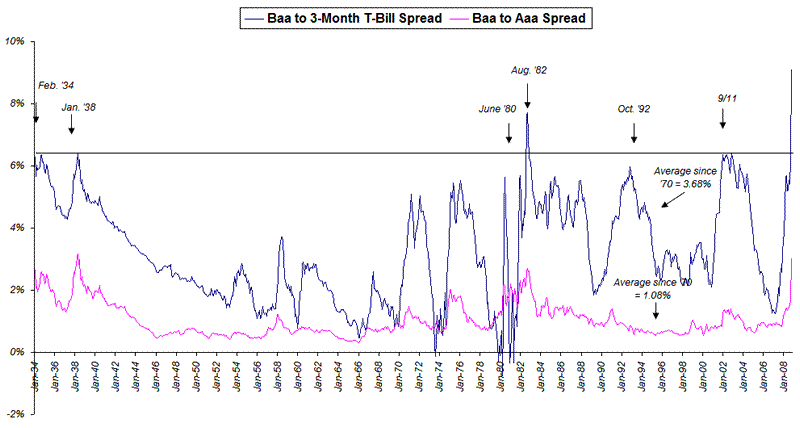

Baa to 3 Month T-Bill Spread

The above chart sent by my friend "BC" is quite telling. It shows risk premiums of Baa rated bonds over 3-Month T-Bill rates going all the way back to 1934. This spread is at an all time high. Otherwise, the highest points on the chart are during the Great Depression and the stagflation period in the 70's and 80s'.

So which one is it, Stagflation or Deflation? This is where it pays to evaluate more than one indicator at a time. To resolve the question, one needs to look at other factors such as the treasury yield itself.

30 Year Bond Yields

The idea of stagflation is simply not consistent with falling treasury yields, especially 30 year bond yields near 4%. Disinflation is consistent with falling treasury yields as is deflation. However, as noted above, rising corporate bond yields are not consistent disinflation. And finally, inflation is not consistent with collapsing 30 year bond yields.

One cannot cherry pick data, one needs to look at all of it and see where the preponderance of the evidence is. In addition to the above charts one must also consider collapsing commodity prices and a collapsing stock market, both of which are consistent with deflation. Periods of disinflation are where the equity markets make the greatest gains.

Inquiring minds should also consider Parents Pull Kids From Day Care (And Other Deflationary Topics) for a look at base money supply and how that supports the deflation thesis.

Thus the data are crystal clear. We are not in a period of inflation, we are not in a period of stagflation, we are not in a period of disinflation.

If you exclude all the options proven to be impossible, the remaining option no matter how unlikely it may seem at first glance, must be the correct answer. That answer is deflation. We are in it, and have been for some time.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.