Stocks, Bitcoin and Crypto's Under President Donald Pump

Stock-Markets / Financial Markets 2025 Feb 08, 2025 - 10:43 PM GMTBy: Nadeem_Walayat

This article Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump! was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-ups . https://www.patreon.com/Nadeem_Walayat.

Most Recent Analysis -

President Chaos Delivering Tariffs Buying Opps - Earnings GOOG, AMD, QCOM, RBLX, AMZN

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

The brainwashed masses think that Donald Pump or Karamal Parris will win and save America! Despite every President in history never delivering on what they promised, all that they will do is PRINT MORE MONEY and leave office a lot richer than they were before taking office.

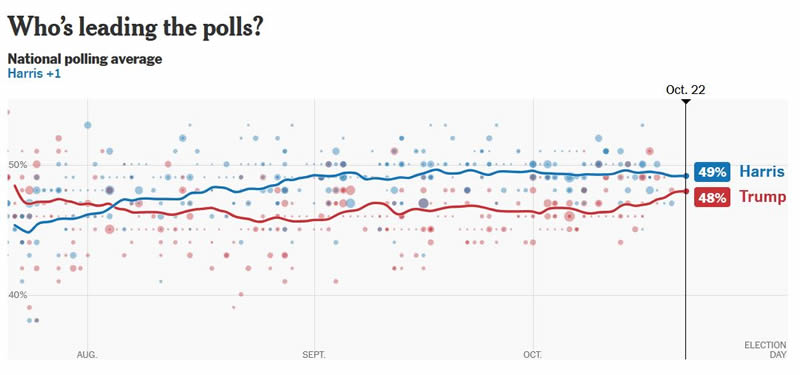

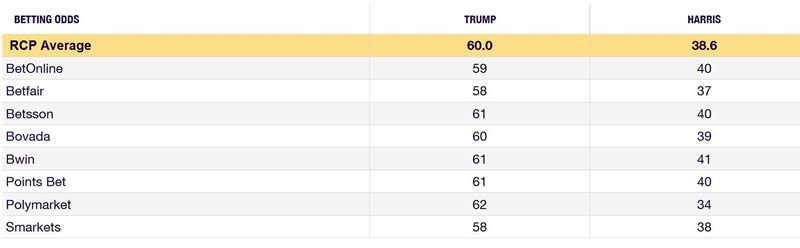

My view that President Pump will win has stayed constant all year regardless of what the opinion polls have stated as they whipsawed between giving Parris a Lead over Pump. Latest polls continue to give Harris a coin flip lead over Trump after taking over from lost all of his marbles Biden.

I would place bets on Pump to win but the risk / reward is just no there unlike in 2016 when the odds were +80% for Killary Klingon to win!

So probability continues to favour a President Donald Pump election victory in under 2 weeks time. and who knows it could turn out to be a match made in heaven.

Test for Allen Litchman and his 13 keys that gives this election to Kamala Harris.

Watch this space for Litchman to come out with excuses of why his so called 100% correct Keys system got 2024 WRONG!

It's earnings season again already!

Two Ai giants reported last week - ASML Dumped (as expected) and TSMC pumped to a New all time high (also as expected) as I commented ahead of the event -

TSMC - $187 - EGFs 15% / 32%, Dir 11%, PE range 122% / 79%

Earnings beat, we are in a correction window but I suspect TSMC will be strong, could see a new all time high, though a dump like ASML would be nice.

CONTENTS

Stock Market Correction Window

Stocks Bull Market Smoking Gun

Stock Market Intra Year Cycle

The Risks are to the Upside!

DOCU LIVES!

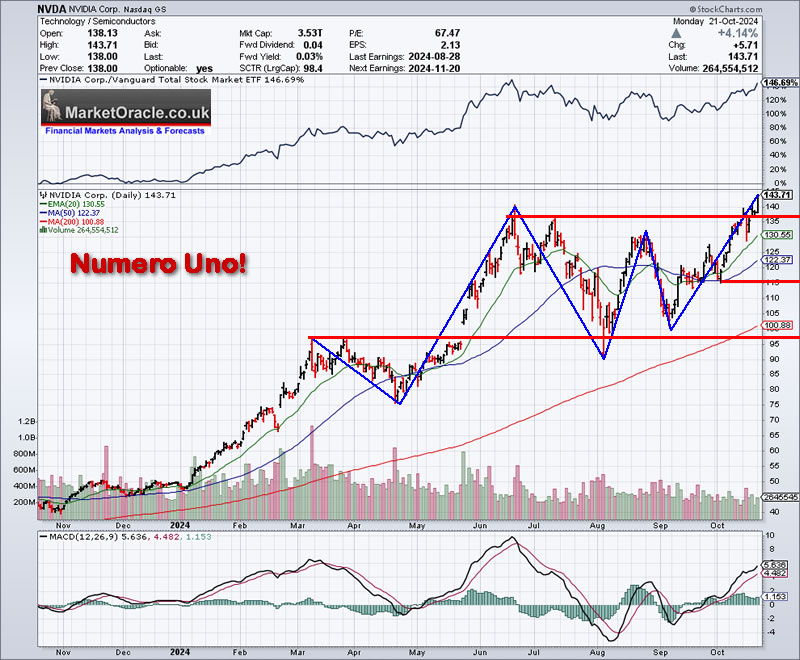

Nvidia Numero Uno

TRIMMING VS REBUYS

S&P ETF Passive Investing Bubble Mania

AI Stocks Portfolio Q3 Earnings Season

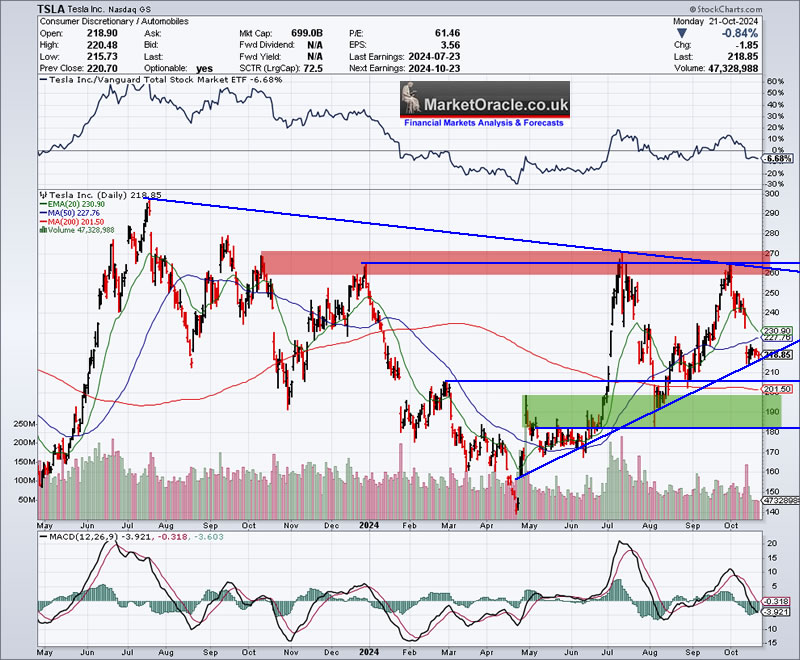

23rd - TSLA - $218 - EGF -7%, +13%, Dir +16%, P/E 93, PE Range 208% / 161%

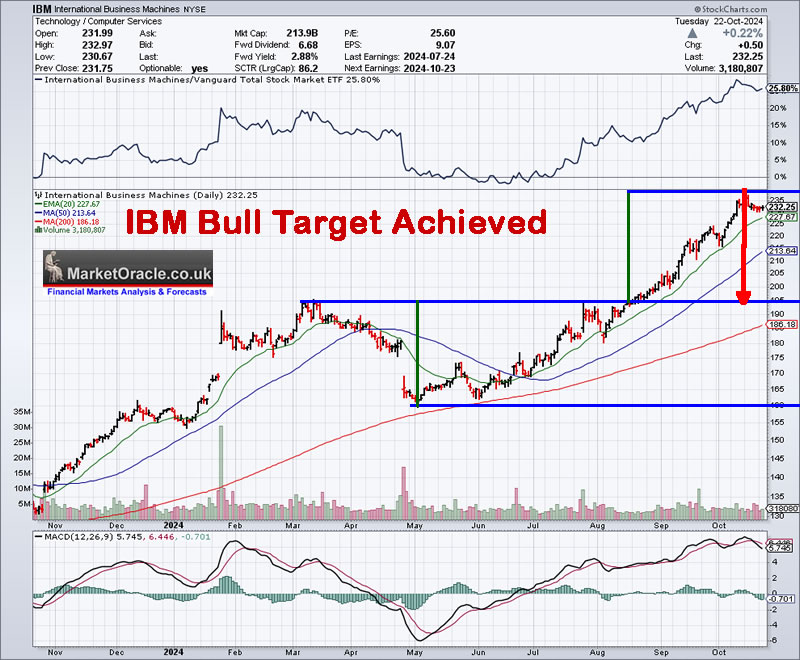

23rd - IBM $232 - EGF -8, +1%, Dir +14%, PE 22.8, PE range 102% / 69%

23rd - Lam Research - $73.1, EGF +6%, +27%, Dir -3%. PE 24.1, PE Range 102% / 69%

24th - WDC $67, PE -177

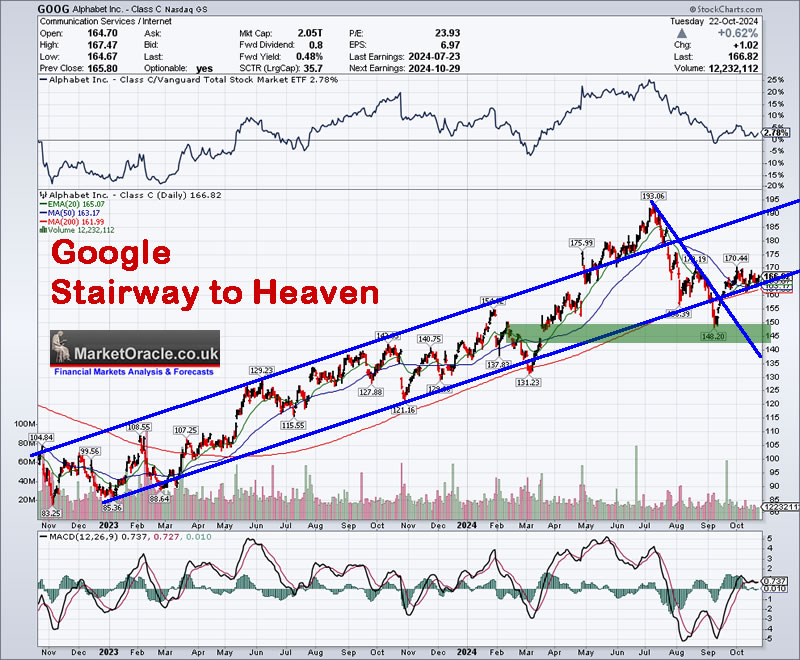

29th - Google $166 - EGF +7%, +17%, Dir -8%, PE 23.9, PE Range 60% / 24%.

29th - AMD $154 - EGF's +15%, +54%, Dir +19%, PE 55, PE Range 95% / 51%

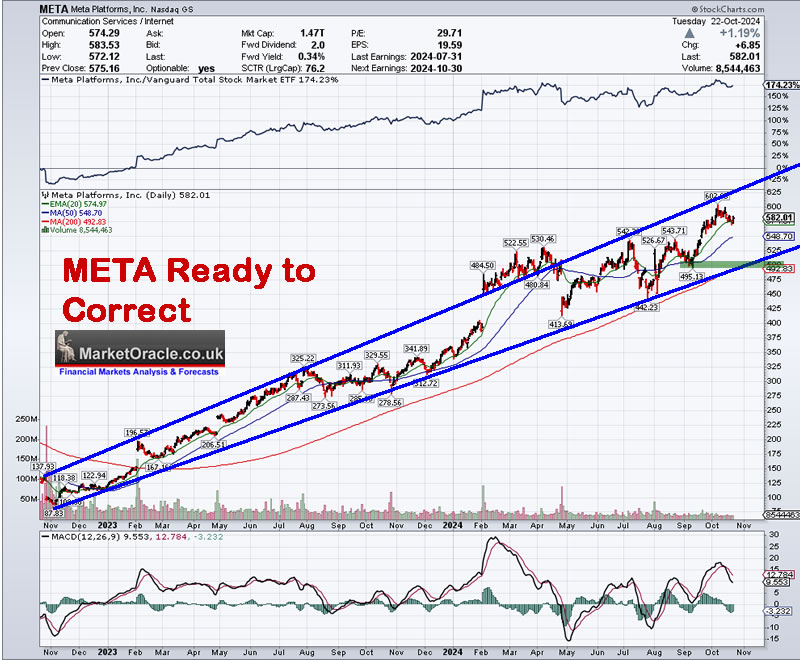

30th - META $582 - EGF +5%, +16%, Dir -1%. PE 29.7, PE Range 124% / 95%

Bitcoin Blood Bath Revisited.- PAIN IS GOOD!

Bitcoin Gift Bull Market Targets

BItcoin on the Launch Pad Awaiting President Donald Pump!

Crypto Market Caps

SCALING OUT OF THE BULL MARKET

UK Budget 2024

Stock Market Correction Window

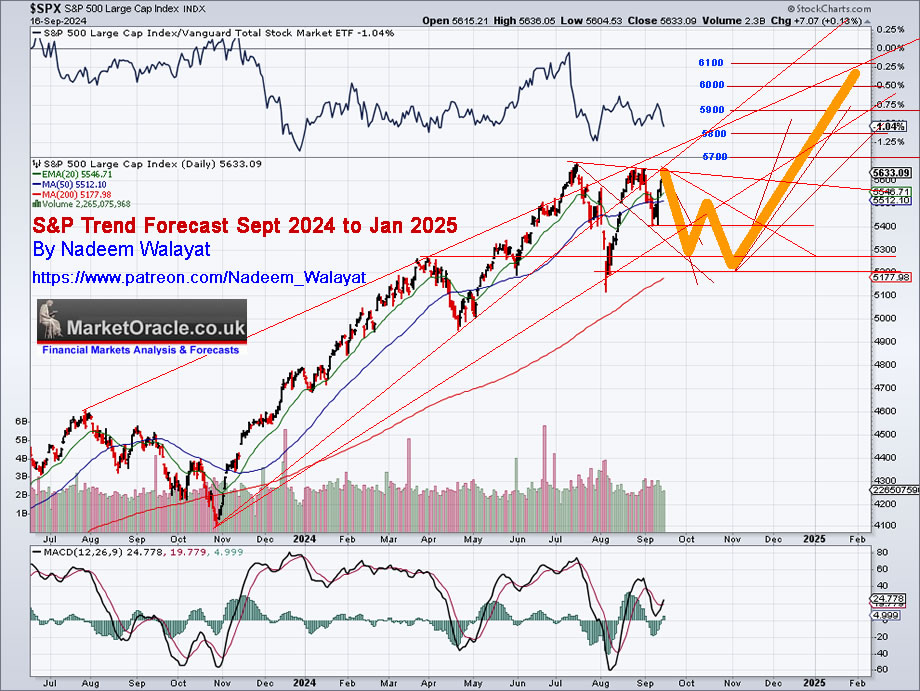

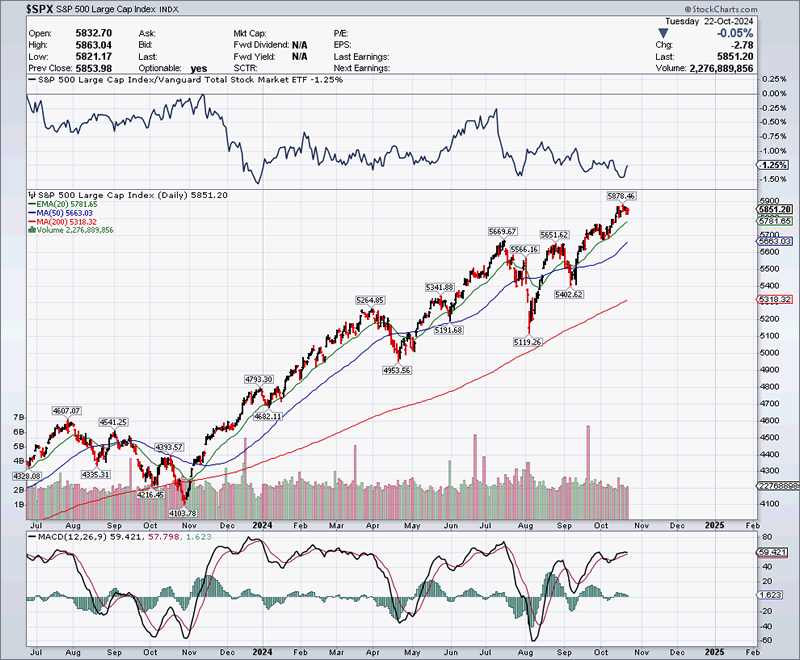

Stock market as measured by the S&P is refusing to correct, despite the fact that key target stocks such as ASML, KLAC, LRCX have been correcting which illustrates once more that the S&P is a nothing the burger, nevertheless with the S&P at 5850 and my year end target of 6000, it does look like a santa rally into the end of the year will take the S&P to over 6000, best guess would be somewhere between 6100 to 6200 as the market accelerates into the third year of the bull market which my last analysis concluded in a 2025 S&P target of between 7200 to 7800, all whilst I hear folk wibble wobble in the comments i.e. ASML drops on BAD NEWS! So is it still a buy? JEEZ LOUISE! Folk have been waiting for ASML and KLAC amongst others to drop so when they do folk go all wobbly knee'd! This illustrates that investing is less about how much you know but how tough of a stomach you have because most folk FEAR holding stocks, any dip and they start pooping their pants. How are you going to stay invested if you poop your pants every time a stock dips?

This is the secret to investing, it's all to do with ones state of mind, the sooner folk realise this and act on it the better.

I can't tell you what to do with your money all I can do is show you what I am doing with mine, and I have been accumulating target stocks as they dip. Yes, stocks fall on bad news, SO WHAT? See all those lows on the price charts that folk in hindsight wish they had bought at but didn't at the time it's because all of those dips were accompanied by BAD NEWS!

BAD NEWS IS GOOD NEWS! Because now one gets to BUY at a discount to the high IN A BULL MARKET!

I hope this message gets through that I iterate from time to time, STOCKS FALLING ON BAD NEWS IS HOW ONE GETS TO BUY TARGET STOCKS AT A DISCOUNT! Which is why I don't even pay attention to the news, don't watch or read the earnings calls, all I want to see is the numbers, and an opp to either BUY the DIP or SELL the RIP as we got with TSMC, which I flagged ahead of the event that it was likely to set a new all time high on earnings, whilst ASML was likely to take a dip.

Bottom line we are in the last innings of the correction window which despite what the S&P nothing burger is doing IS delivering buying opps in key target stocks ahead of the anticipated post election bull run not just into the end of the year but well into 2025. So now is not the time for wobbly knees, now is the time to take earnings season volatility and the opportunity it delivers as we just experienced with ASML and TSMC. ASML dumped delivering an opp to add, TSMC pumped delivering an opp to trim.

Yes we are NOT going to see S&P 5200 in the less than 2 weeks left, but Q3 earnings will deliver volatility in target stocks to capitalise upon which is the focus of this article thus S&P 5600 should be doable.

Stocks Bull Market Smoking Gun

One of the key mega-trends driving the asset markets is rampant money printing underway by all governments as investors recently got a taste of when Chinese stocks rocketed higher following the PBOC announcing it's asset buying money printing programme of $1400 billion which was a drop in the ocean as compared to what the US is engaged in, printing $500 billion in just a few days, that's why stocks are pumping higher during October and have been in a relentless bull market all year.

Asset prices are leveraged to inflation and the primary driver of inflation is rampant government money printing that is on a parabolic curve. Where many instead of trying to capitalise on the trend underway opt to play safe with BS such as S&P ETF trackers that WILL not deliver 1/3rd of what folk expect to deliver i.e. 10% per year! Whilst this also means Fed rate cuts are a nothing burger, i.e. higher forward inflation means higher forward interest rates! Whichever way one looks at it, bonds suck! You can;'t expect a real terms increase in bond prices when governments are printing $500 billion of new bonds over a few days!

Bottom line is continue to keep a close eye on the debt smoking gun so you don't get side tracked by the nothing burgers MSM keeps focusing on. And don't be under any illusion as all of governments are not doing the same, as illustrated by the recent $500 billion money printing binge by China.

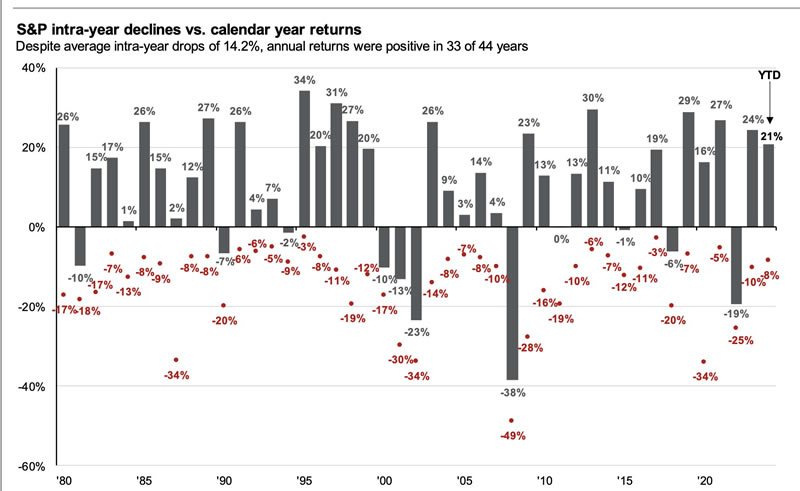

Stock Market Intra Year Cycle

Doom and Gloom vs reality of the fact that -

a. Any single year has a 75% chance of being an UP Year

b. The average drop during a year (peak to trough) is 14.2%.

This tells you to BUY THE DIP in target stocks because (mantra time) The greater the deviation from the high in target stocks then the greater the buying opportunity being presented, and as you can see from the graph bull markets tend to run for at least 3 years in a row, so no matter the draw down during 2025 it will likely end strongly higher as per my previous analysis that concluded in an expectation of S&P between 7200 to 7800 by the end of 2025.

The Risks are to the Upside!

Just so that we are reading from the same page - A Correction is a Correction is a Correction, 5500 vs 5750 is not even 5%! Primary focus is to remain exposed to the AI mega-trend stocks and seek opps to accumulate as they come along, look at what happened to Chinese AI tech stocks!

I am always more positioned towards accumulating than distributing because I understand that the risks are the UPSIDE! Especially in AI tech stocks, but even I can make mistakes such as selling out of Nvidia at a 3X profit at around $40, what did Nvidia do it 3x'd again! Of course I was not just sat twiddling my thumbs as I continued to hold large positions in other target stocks such as META. Look at the 2022 bear market, what would have happened if one sold NOTHING going into and during it, yes it would have been painful and mentally draining with all that doom and gloom and little one could do about it other than make the mistake of SELLING! Which is why one of my primary rules is to never sell at a loss, stops one from doing something stupid like selling out of META at $100 as some patrons were asking if they should do at the time. Nevertheless if you had held on for dear life you would now be up many multiples of the price you paid even towards the end of the the 2021 bull market!

So do not fear falling prices, even bear markets, the pain of which can be countered by maintaining a healthy cash balance so as to capitalise on such events that is fed by trimming whenever stocks FOMOd so no matter how many dips one buys when never runs out of cash to buy the next dip as bear markets are just temporary draw downs that folk with hindsight look back on and wish they had bought the likes of Nvidia at anywhere near $20 whilst at the time $20 would have suffered a 50% draw down! Which is why I was stating throughout 2022 that investors no matter at what price they buy have to be mentally prepared for a 50% draw down because such draw downs are NORMAL for virtually EVERY STOCK! So just get the job done and thank me in a few years time.

Yes that's right 50% draw downs are normal and that is why most investors can't take the heat because their brains can;t handle a 50% draw down, most can;t handle a 10% draw down! But as I voiced during 2022, bear markets are NOT for making a profit, bear markets are for GAINING EXPOSURE! If you cannot handle a 50% draw down then you are not going to make it investing in the stock market.

DOCU LIVES!

Back from the dead, in a stealth bull market, a year ago it looked finished, kaput folk wanted to exit and buy something else, my response I never sell at a loss, now 2xd. I can't imagine anything worse then selling out of a stock that then goes on to 2X or more. For folk today holding the likes of INMD and MED, I don't see why these two can't also at least x2 off current prices, so it aint over until the stock goes bust.

(Charts courtesy of stockcharts.com)

Nvidia Numero Uno

Here's another reminder if one was needed that Nvidia is NOT A NORMAL STOCK. Nvidia IS the AI MEGATREND!

So the objective is to GET and MAINTAIN EXPOSURE!

As I have stated before I expect Nvidia to X2, off of $120 with $198 acting as a way point along the path to $240, so one has to becareful whenever considering trimming and trying to hold out for the best price on the dips as I often get asked when will Nvidia correct so that they can buy despite the fact it traded down to $90 early August and $101 Mid September, I mean that's two opps in 2 months! Yes IF we get lucky then election volatility could deliver a third opp but it would be GETTING LUCKY! Looking at the chart it's going to be tough to see anything better than about $115,

TRIMMING VS REBUYS

Trimming i.e. taking profits acts to reduce the average cost per share whilst re buying on a dip or even in some cases at a higher price obviously acts to increase the average cost per share which acts to lever up as the price goes up i.e instead of reducing exposure one is fixated on increasing exposure as a function of recycling profits back into stocks (or crypto's) as well as investing fresh funds which is why Index investing does not work in practice..

So the higher the prices go the more folk tend to buy target stocks as they seek to recycle profits back into stocks AND invest fresh funds in what amounts to chasing the dragon all the way to the final tops and then compound their error by buying the dip into bear market oblivion which luckily for the likes of AI tech stocks there tends to be a light at the end of the tunnel courtesy of the AI mega-trend but not so for many other stocks and crypto's.

This means one needs to have mechanisms to reduce exposure to over valued assets which is what the spreadsheet attempts to deliver across a number of columns such as V and W whilst that is less possible for Crypto's which are more a case of playing musical chairs where one seeks to reduce exposure during ones best guess of how far the crypto pump could go!

S&P ETF Passive Investing Bubble Mania

Every now and then up pops the proverbial just invest in the S&P ETF comment, easy money average of about 12% per year. After all all of the turd holdings that tend to go bust from time to time are hidden from view so what folk don't see can't hurt them psychologically unlike a list of stocks that folk have accumulated into where the investors eye of sauron tends to home in on the few that are failing to deliver, you know the likes of MPW and MED as if the SPY ETF does not hold a lot more of the same hence why folk are content with under performance, 12% that's not even keeping pace with money supply.

Making money on the stock market is not easy, so I can well understand why folk give up and opt for an S&P ETF, I mean it is a lot of hard work, a steep learning curve and no there is no easy way out of this by investing in a managed fund because you are effectively giving your money to sales men who are focused on creaming their 1% to 4% annual fee and thus the probability of beating even something crappy like the S&P is low.

Index investing is investors blindly funneling their money into something they don't understand, the observed S&P parabola is due to the fact that trends are made at the margins, i.e. $1 of buying equates to approx $5 of upwards pressure on stock prices. The problem with this is VALUATIONS! Folk are INVESTING IN OVER VALUED AND UNDER VALUED STOCKS! So it really is literally investing blind, you are buying stocks that are FOMO-ing into their highs, stocks that the smart money (You and Me) are TRIMMING! Whilst under buying exposure when stocks are CHEAP. That gives a huge advantage for active investors over the dumb money that is relentlessly blindly driving the bull market higher by making over valued stocks even more over valued, and giving value to turd stocks which is what folk such as you and I capitalise upon all the way to the bubble mania peak by which time passive investors will have levered up to maximum exposure whilst active investors should have trimmed and re bought their way to the point where most of their positions are effectively FREE!

So what happens during the eventual bear market?

Passive investors are fully invested, only able to buy the dip by means of fresh money (earnings). Whilst active investors have cash on account that could range from 30% to 60% of the portfolio, after all they have put in the work, understood the lay of the land, trimmed into over valuation and thus are not left 100% invested by the top but anywhere from 70% to 40% invested, yes it is near impossible to be completely out of the market without the benefit of hindsight just as it is near impossible to buy THE LOW without the benefit of hindsight, but if one can get to under 50% invested by the top then that is mission accomplished and similar 90% invested by bear market bottoms i.e. by the end of the last bull I got down to 40% invested and by the end of the last beat I got up to about 96% invested which is the best one can hope to achieve, whilst I have been coasting along at about 80% for the whole of 2024 as the trim and rebuy game acts to whittle down my average cost per share.

Don't get me wrong we need the dumb money to blindly buy the index ETFs because that's what is acting to deliver the bull market that relentlessly climbs higher, same as when the dumb money panic sells out during the bear market to deliver those deep draw downs to capitalise upon, so the less thought most put into investing the better for smart money to capitalise on so long live the mantra of Just put your money into an S&P ETF index tracker!

How to tell if you are the dumb money?

"I want a good stock to invest in over the next 3 to 5 years"

That's what dumb money focuses upon, as if FEAR and FOMO follow a schedule , take a look at AMD 2024.

Why is the stock down from $228?

Because it FOMO 'd to a ridiculous valuation i.e. PE range of over 200%.

Will it soon go back to $228 ?

Probably not for at least a year until earnings play catch up i.e. at $160 PE range is 100%, so still not cheap so only FOMO can drive it back to $228, which if it happens would once more prove temporary.

AI Stocks Portfolio Q3 Earnings Season

The way I play earning season is to have my buy and sell limit orders already in place ahead of the event and very rarely do I sit and watch the markets trade as one is going to only be focused on just one stock at any one time, also whilst waiting on limit orders where I am eager to accumulate a position I nibble a little every other day, after all that is how I accumulated the bulk of my bitcoin position from October to December 2023 whilst waiting on a 'chance' drop down to $25k that many including myself thought probable but given the risk / reward at the time of a drop from $29k to $25k vs upside of $100k the primary focus was to gain exposure and if the drop happened GREAT, if not well one needed to get the job done.

So as I post in the comments from time to time a list of stocks to nibble on whilst waiting on limit orders to get filled, currently include LRCX, AMAT, Google, KLAC, Samsung, FSLR, RDFN, LOGI and ASML, so folk have no excuse to not be aware of the opportunities that present themselves in real time as opposed to looking back with the benefit of hindsight in some months time and wish one had bought, we are in the correction window and these are where the opportunities are right now as I write.

Portfolio Spreadsheet EGFs updated in advance of earnings - https://docs.google.com/spreadsheets/d/1CFfTkXm6Kpgp5YyJZ0H_0Bv4uv-xzq68i2cLvMFAvDg/edit?usp=sharing

23rd - TSLA - $218 - EGF -7%, +13%, Dir +16%, P/E 93, PE Range 208% / 161%

TESLA betting on the robot future getting discounted in the present to deliver an eventual trend to over $500! So at $218 we are some way off from realising that objective which is good in terms of buying the dip for way points of $300, $400 on the way to $500+ In the meantime one seeks to capitalise on Tesla's wide trading range of $170 to $300 which even a fraction of has afforded opportunities over the past few years to buy the dips and trim the rips.

The EGF's remain very weak relative to all other primaries which is probably why it should not really be a Primary, but it is where it is. Higher risk, for higher potential reward with higher volatility. Will TESLA beat earnings? EGF at -7% implies an earnings miss but the direction of travel is strong which implies the stock price dips and then reverses higher on poor earnings maybe by the following days open or soon after.

(Charts courtesy of stockcharts.com)

Buying range is $202 to $172 so I will be seeking to capitalise on earnings volatility by buying a probable immediate dip to under $200 with a view to trimming what I bought on a pump to over $260 all whilst seeking to maintain exposure at around 100% invested (current 106%), so that I have room to both buy and trim. Tesla is not a hard stock to capitalise on it's range, just scale in sub $200 and scale out over $260 and one can chip away at ones average buying price by at least 30% on sales turned over during each swing, so as long as TESLA continues to range trade it does not worry me how long it takes Tesla to breakout, in fact I will probably miss the trading range once the eventual breakout happens, and that it is definitely NOT a cheap stock so I will likely soon see it switch places with ASML.

Bottom line TESLA is a RANGE TRADER with the risk to the upside i.e. eventually it will enter into a bull run to new all time highs, until then I will continue to range trade it for typically 30% return on each trough to swing high.

23rd - IBM $232 - EGF -8, +1%, Dir +14%, PE 22.8, PE range 102% / 69%

The sleeper has definitely awoken this year and then some, I remember telling folk for several years with weak stomachs when it was trading sub $130 to focus on $200 as where IBM was headed, which it achieved, retreated from before blasting through. IBM has done what all AI tech stocks are expected to do that regardless of the doom and gloom for which IBM has had plenty i.e. most considered it to be a DEAD stock. but at the end of the day it delivered on the AI Mega-trend and now FOMO juices are flowing sending it well beyond $200 reaching a high of $238.

EGF's are poor but the direction of travel is good, whilst PE range is at the max which translates into a stock that needs to take a breather which is what the Metrics suggest so an earnings miss is likely and thus I suspect IBM is ready to correct to below $200, and it could trend down to about $183.

(Charts courtesy of stockcharts.com)

The bottom line is that $238 is as good as it gets for some time for this slow growth AI tech stock that yields 2.9%, IBM was never going to do an Nvidia, still it has broken out and thus is in a clear bull market that given the FOMO moon shot should now resolve in a correction towards $180.

23rd - Lam Research - $73.1, EGF +6%, +27%, Dir -3%. PE 24.1, PE Range 102% / 69%

Lam Research had a spectacular X2 bull bull run off it's October 2023 $57 low, so no matter how good the stock is by the $113 high was very over extended as illustrated by the high PE of range at the time of over 200%, a screaming sell hence I sold LRCX hard down to just 20% invested given what was most likely to transpire, a deep correction down to a low of $72 where LRCX is attempting to put in bottom for it's next bull swing.

EGF's are strong and the PE ranges have moderated which suggests to expect a positive earnings surprise and any further dip would be a bonus to capitalise upon. During the correction I have built up my exposure to 56% invested, as I continue to nibble away at the stock at -35% from it's high in the countdown to possible earnings volatility as we saw with ASML.

Bottom line LRCX has stable earnings growth but has experienced a lot of FOMO that since has seen the stock price correct down to $71 as I flagged to expect to happen months ago. Where a new all time high depends on earnings growth so I doubt we will see such a move any time soon, probably not until well into 2025, in the meantime I am continuing to accumulate LRCX at a 35% discount or better though downside from here looks limited.

24th - WDC $67, PE -177

WDC FOMO 'd to the moon! Prompting heavy trimming that I sought to reaccumulate to some extent on the short lived dip to $53, in fact the correction bottomed virtually at it's exact target low as per my article of Mid April -

The usual metrics are broken due to WDC transitioning from being a LOSS maker to becoming profitable where the forward PE of range is the most reliable indicator at 44% which means at $66 WDC IS cheap. We got a dip down to $53, given forward PE range of 44% it is unlikely we are going to see a repeat, at best we could get lucky on earnings volatility and see $60, but the fact that WDC has been trending strongly higher suggests WDC is itching to break above its $81 high so risks are definitely to the upside. Buying range remains at $64 to $54 in attempts to capture further dips before the stocks next leg higher.

29th - Google $166 - EGF +7%, +17%, Dir -8%, PE 23.9, PE Range 60% / 24%.

Google topped at $193 following which entered a significant correction all the way down to $148 early September so when folk say when is the correction going to happen well here's one staring them in the face. Numero dos corrected by 25% and is still trading 14% off it's high all whilst being the cheapest AI tech stocks on the list as evidenced by the PE ranges of 60% and 24%! hence why I am 91% invested going into earnings season as the stock looks set to literally climb a wall of worry as virtually every week there is a bad news for why it is going to soon die. Just Keep Calm and carry holding Google.

Google climbing the stairway to heaven -

The stock price is trading back into it's stairway to heaven channel and thus presents an opportunity to accumulate where earnings volatility may deliver another brief dip to below $160, but the stock is cheap so I would not get greedy chasing a few dollars and miss the big picture trend.

29th - AMD $154 - EGF's +15%, +54%, Dir +19%, PE 55, PE Range 95% / 51%

AMD is in a losing race against Nvidia that it can not win though it doesn't really matter as second place is good enough!

The EGF's are very good whilst the PE and PE of range remain a little elevated even after a 36% drop which illustrates just how nuts AMD's FOMO rally to $228 truly was that prompted me to sell down to about 32% invested, since which time I have added back to stand at 81% invested. As I stated at the time we are not going to see AMD trade back to $228 anytime soon, clearly AMD is in a trading range of about $190 to $130 which is what folk should focus on whilst one waits for earnings to play catchup which they are i.e. I expect AMD to deliver an earnings beat as per strong EGF's, but that does not mean it won't prevent AMD from dipping to under $140 once more as the stock continues to suffer from FOMO Indigestion due to its run to $228 that most investors mistakenly fixate upon hence in reply to comments when do I think AMD will trade back to $228, my response probably for not at least a whole year!

Bottom line AMD is in a trading range of about $190 to $130 pending a resumption of it's bull run to new all time highs during 2025

30th - META $582 - EGF +5%, +16%, Dir -1%. PE 29.7, PE Range 124% / 95%

META has had a spectacular bull run and refuses to retreat despite being over extended i.e at 124% of it's PE range, it does not appear that anything can knock this stock lower. EGF's are positive but not very strong so earnings could be mixed, which means META should at take a breather to at least target $540 and maybe trade down to $500, beyond that it's going to be a case of getting very lucky i.e. to see the likes of $450.

I have continued to trim META during it's rally to $600 to now stand at just 17% invested though it still is a sizeable position at 3.8% of my portfolio, so I am more than ready to buy any dip, $540 to $500 looks doable on a weak earnings report as being flagged by the EGF's.

I will cover more stocks in earnings part 2 that I aim to post early next week to include -

30th - Microsoft $427 - EGF's +2%, +19%, Dir +1%, PE 36.2, PE Range 89% / 38%

30th - KLAC $670 - EGF's +15%, +30%, Dir +14%, PE 28, PE Range 170% / 104%

30th - GPN $99 EGF +11%, +12%, Dir +7%%, PE 9.1, PE Range -295% / -335%

31st - Arrow $134 EGF -25%, -5%, Dir +14%, PE 10, PE Range 92% / 104%

31st - AMAZON $190 - EGF's +12%, +25%, Dir -7%, PE 45 , PE Range -94% / -203%

Bitcoin Blood Bath Revisited.- PAIN IS GOOD!

What investing experience delivers is conviction and a strong stomach in that what the market is doing at any particular point in time does not cloud ones judgement which thus enables one to have a subdued emotional response at market extremes both in terms of FEAR at the lows and FOMO at the highs and thus one tends to act more rationally than is usually the case as I often encounter in the comments, the July 2024 crypto bloodbath illustrates this, which means successful investing is not a learning process but an experiencing process meaning that reading about investing in books, watching youtube videos, doing coursers, watching the talking heads on CNBC is not going to cut it, you are going to have to ACTUALLY EXPERIENCE what it is like at market extremes and that is what conditions one to become a successful investor. The more engaged you are with the market at times of market extremes then the more you will be conditioned to become a successful investor.

8th July - The Most Hated Stocks Bull Market in History! Crypto July Blood Bath

There is nothing much to add until BTC breaks above first $72k, and then $74k to likely target a trend to $100k+ all one can do is to accumulate the deviation from the high even if it sets a fresh low to target $52k and yes there is always the risk that this it, after all one does not get X2 to X5 without the associated risk, remember Bitcoin bottomed at $16k, and as I flagged in my last chance to board the Bitcorn gravy train article at $25k back in October 2023, so $56k is hardly buying bitcorn anywhere near it's 2023 lows.

Still I expect bitcoin to at least x2 from here, with my base case being $135k, and alt coins many times that given where they currently trade i.e. Solana $135 probably targets a FOMO to between $500 and $750, though again, that carries a risk that it doesn't see $500 instead sees $50! Cannot get such potential rewards without the associated risk, especially given that I flagged to patrons I had started buying Solana way back in my November 2022 article when Solana was trading at $9.

The bottom line is that we are just 100 days past the halving and what BTC is currently doing is normal, i.e. a post halving correction and where corrections go this bull market's so far have been relatively mild compared to past bull markets as I have covered in previous articles. Thus we should get at least one more powerful FOMO leg higher to north of $100k before the bubble pops.

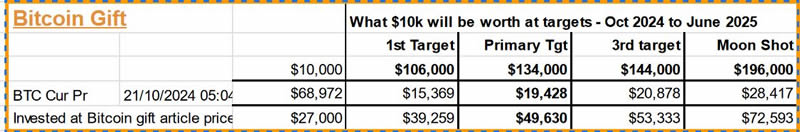

Bitcoin Gift Bull Market Targets

A year ago I stated bitcoin bull market targets and as per crypto spreadsheet -

They still look good a year on i.e. we are tracking towards achieving primary target of $134k by June 2025. Thus has acted as a good road map so as to avoid one succumbing to fear on the dips. $100k is my minimum target, $134k is primary, by which time I will probably have sold 80% of my crypto, beyond that is pure FOMO MANIA.

BItcoin on the Launch Pad Awaiting President Donald Pump!

Though a President Harris would not make any difference to what's to come....

The Bitcoin pressure cooker is about to pop its lid as everything is converging towards a breakout that sends Bitcoin racing past $100k well into February 2025. So when it pops it's lid I don't want to hear on any minor dip if I still think BTC is headed for $100k+, when that has remained my consistent message ALL YEAR! It's all one ever needed to know to dispel FEAR during every dip as illustrated by comments asking if I thought the Bitcoin bull could be over, nope, not then, not now, BTC has a destiny with $100k+

BTC at $67k awaits that blast off to well above $80k probably see $90k, it will also be a test for MSTR on how close we are to the crypto top, i.e. we should see MSTR trade to over $250, if it doesn't then that will be a signal we are in the last innings of this crypto bull market, if it goes to say $270 then hold on to your hats for FOMO mania to well north of $300, maybe even spike to something daft like $500, for now I am focused on first $250 and then $300.

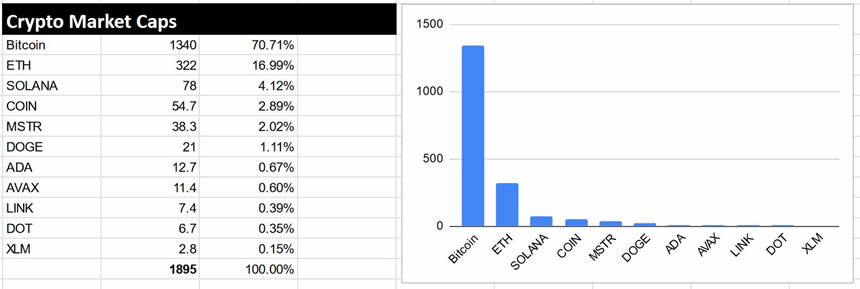

Crypto Market Caps

What most miss about crypto's and stocks such as MSTR is the MARKET CAP, BTC market cap is $1340bn, MSTR is $38bn, thus media hype can send MSTR to the moon! Similar for alt coins such as DOGE, All Musk needs to do is bark about Doge and it will X2.

SCALING OUT OF THE BULL MARKET

The higher the markets go be they stocks or crypto the less you want to have exposed, so ones cash on accounts should increase. At present I am 21% cash, 79% invested, though about 10% of which is in crypto's which I deem to be cyclical i.e. I am going to be out of crypto at the most by the end of 2025 and likely a lot earlier than that hence my percent cash will be a lot higher even if I don't sell a single non crypto asset. You can see this in progress in my portfolio where the percent hard cash invested in most AI stocks is getting pretty close to zero. Note this is a rough calc based on just the larger trades i.e. it's a manual exercise so impossible to do for the hundreds of small trades, nevertheless gives a window into the current state of actual risk of where I seek to reduce heavy exposure as the opps present themselves as illustrated by DOCU that 2x'd over the past year.

The key point is this by plowing ones profits back into stocks you will just keep leveraging yourself so that when the stock market turns you will lose ALL of your gains on a relatively small drop in stock prices hence have a mechanism to -

a. prevent you from FOMO-ing to a huge position into a handful of stocks.

b. Be able to recognise ones true risk i.e. the less hard cash invested the better which is a function of trimming and reaccumulating to limited extent i.e. back at the start of this bull market I was 96% invested with positions in most stocks well over 100% invested i.e. I was about 150% invested in TSMC vs 23% today.

The mistake most investors will make is to plow all of their profits back into the market so that when it drops they will lose ALL of their profits given that they will be TOP HEAVY! The time to be TOP HEAVY was during the bear market not over 2 years into a bull market.

Yes it is not easy! After all folk get used to making profits and then use those profits to buy more in either existing stocks or additional stocks, this is what happens during a bull market, folk get conditioned to accept FOMO, feel that the market can only go UP and thus take greater and greater risks thus keep an eye on your percent invested which for me is 80%, less 10% crypto equals less than 70% invested in stocks, which is how it should be.

In advance of the bear market I am investigating where to stuff my cash, other than be sat covering distant limit orders because one of the problems with having too much cash is that one gets itchy feet, one wants some action so talks oneself into buying garbage, after all it's just a few percent on the sidelines what harm can it do, the harm is that few percent can grow to 10%! and well then it's sat there waiting to recover, hence as per recent articles I am seeking strategies to sit out the next bear market in a mix of short-dated bonds US dollar and sterling, an inverse S&P ETF, and perhaps some range traders, all whilst seeking to retain approx 40% of my portfolio in key target stocks that will likely have little or no actual hard cash at risk.

As was the case during 2021 folk will say I sold too early, so were on my back to give them stocks to invest in, the likes of lesser over valued stocks such as the chinese stocks and Intel, IBM and so on, lower risk stocks at the time but they haven't quite panned out as expected! So the big risk for most investors will not be that they won't make big profits during the bull market but that they will not want the party to end so will plow the profits into chasing returns in stocks that look better valued on the premise that the laggards will get their chance to shine whilst the FOMO stocks take a breather. And then chase garbage stocks during the bear market. I can't tell you how many times folk asked me during 2022 to take a look at this or that crashed stock if it was now a buy, when I looked my reply to virtually all was that it looks like it could fall by another 50%.

So scaling out means scaling out, it does not mean to go and buy a lesser stock because one has gotten a taste for stock make profits and thus do not want the party to end which was why I started looking at select bond funds a year ago to limited extent i.e. I committed 1% percent to see what happens to learn from for when the time comes for the party to end, so far I have learned that bonds SUCK!

UK Budget 2024

Labour Government Budget Set to Punish Those Who Work Hard and Reward those on Benefits by seeking to fill a £22bn hole in the finances though not by raising income, tax or VAT. So the plan is to hit those with assets which means the Labour government is coming after many folk who would not consider themselves as being rich. perhaps all it takes is living in a property worth £1 million will put folk in the cross hairs of the Liebour government.

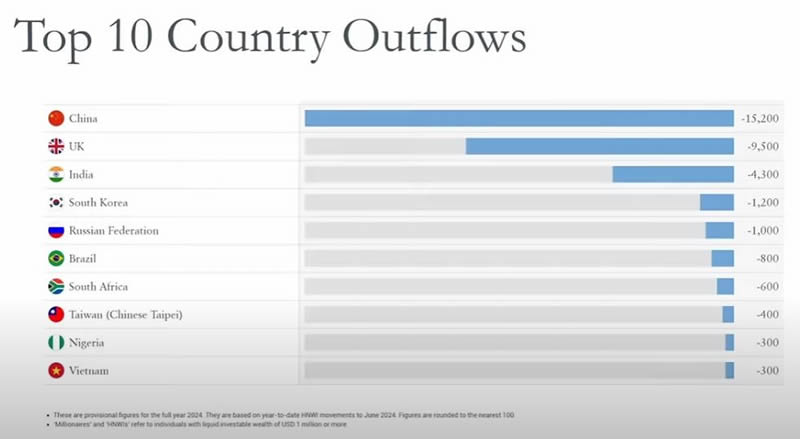

Meanwhile the real rich are running away from the UK in their thousands and taking their wealth with them to places such as Dubai

WEALTH TAX

All that hard work over a lifetime of saving and investing whilst others have splurged or sat idle on benefits is now could get punished with a wealth tax which will probably be based on property values. Anyway it will send a message that HARD WORK, Savings and Investing for ones future does NOT PAY!

PENSIONS

Labour eyes hitting those who save for their retirement, the message being folk should save nothing for retirement and instead rely on state handouts.

LANDLORDS

Prepare to DIE! Liebour is set to pile a whole pile of poop on your business models such as inability to get your property back from tenants without entering a lengthy legal battle which effectively cripples all those without a legal department to handle all of the paperwork involved.

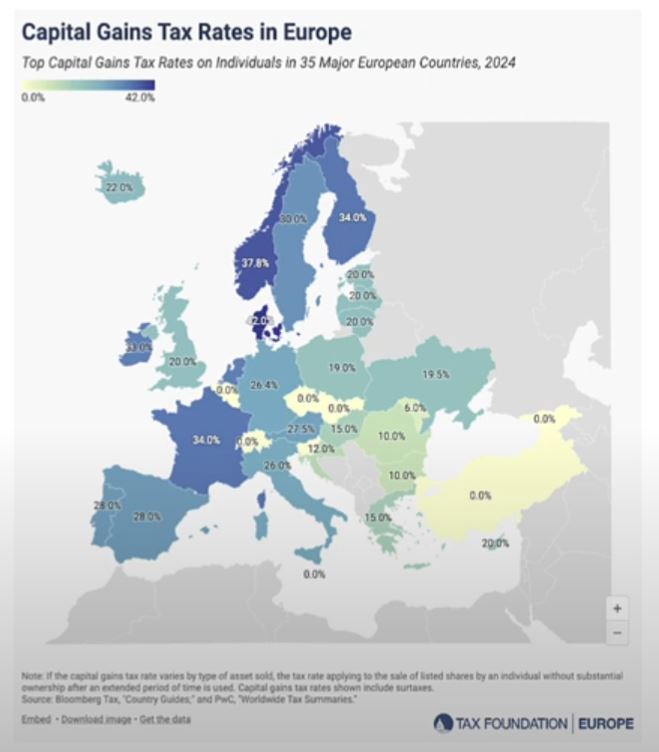

CAPITAL GAINS TAX

The Tories had already crippled the allowance for Cap Gains now Labour seeks to finish the job by upping the starting tax rate to the base rate of 20%, up from 8.75% with the marginal rate rising from 20% to 39% which would make it the highest in Europe!

All that hard work to work towards building capital to invest which is TAKING A RISK! i.e. the risk of capital loss! And the thieving scum bag government taxes folk 20% on the gain BEFORE INFLATION STEALTH THEFT! Which means it would no longer be worth the effort of for instance investing in crypto or stocks outside of tax free wrappers! Thus the government can expect to yield LESS tax in future years as people become less likely to sell assets so fewer transactions. Whilst the rich will seek to offshore their assets so less capital gains tax and income tax.

In comparison to the US for most at them moment the cap tax rate is 15% on investments held for over 1 year. So Liebour hiking from 20% to 40% would no longer make investing in stuff such as crypto worth the effort and risk, given that +50% of the gain would be stolen by the government by means of tax and inflation.

What to do ?

Crystallise gains before the budget at the current cap gains tax rate which could result in a market panic in some assets as many rush to lock in a lower tax rate. What I will do is a lot fewer transactions outside a tax free wrapper so whilst initially there may be a tax hike in future years I will pay LESS tax.

ISA

The final nail in the coffin could come if Liebour cripples ISA's by putting a lifetime limit of say £100k on ISA's. This is probably not going to happen but if it does will hasten the flight of capital out of the UK. Under Liebour hard work and saving for ones future will no longer pay

These are just a few of many take from the middle class to give to those on benefits for life policies that the Liebour government will soon announce during Octobers budget.

Earnings continue in Part 2 early next week.

Your buying the dips in target stocks analyst.

This article was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-ups . https://www.patreon.com/Nadeem_Walayat.

Most Recent Analysis -

President Chaos Delivering Tariffs Buying Opps - Earnings GOOG, AMD, QCOM, RBLX, AMZN

Recent analysis includes -

Earnings Black Swans - MSFT, TSLA, META, AAPL, KLAC, IBM, INTC

Trump's Squid Game America, a Year of Black Swans and Bull Market Pumps

CONTENTS

The External Revenue (Inflation) Service

The Next Wave of the Inflation CRISIS

UK Inflation Crisis

CPLIE - BTFD!

How to Hack the Inflation Wage Slave System

GOLD Price Trend

Silver Price Trend

Sterling Cyclical Bull Market

US Dollar Topping

Japan Rate Hike - Black Swan Panic Event Incoming?

Why Recession Fears Are a Nothing Burger

Stock Market Post Election Year Five Nights at Freddy's

Stock Market Deviation Against the Trend Forecast

Stock Market Forecasts Redux

Nvidia DIGITS Mini PC

Your Only Defence in the Age of AI is Your Stocks Portfolio!

Tesla Stock Slide

Tesla - Secondary

AI Stocks Portfolio

TSM Signals AI Trend is Strong!

SMT.L Garbage Recovers

Bitcoin Target

China Has Lost the War Even Before the First Shot is Fired

First 100 Days of the Trump Reich

California's Burning Climate Change Consequences

UK ISA Platforms

What Brit's Need to to do Get £11.5k per annum for FREE!

Squid Game Stock Market 2025, S&P Detailed Trend Forecast

Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

Stocks Santa Rally, Bitcoin Final Pump and AI Stocks Buying Gifts

Trump Stocks and Crypto Mania 2025 Incoming as Bitcoin Breaks $100k Barrier

Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

And access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide 2023

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.