Got Copper or Gold Miners? Watch Out

Commodities / Metals & Mining Dec 15, 2024 - 11:03 AM GMTBy: P_Radomski_CFA

Copper, silver, and gold quite often move together, especially during the big moves.

Impending Massive Slide

And this is currently very helpful.

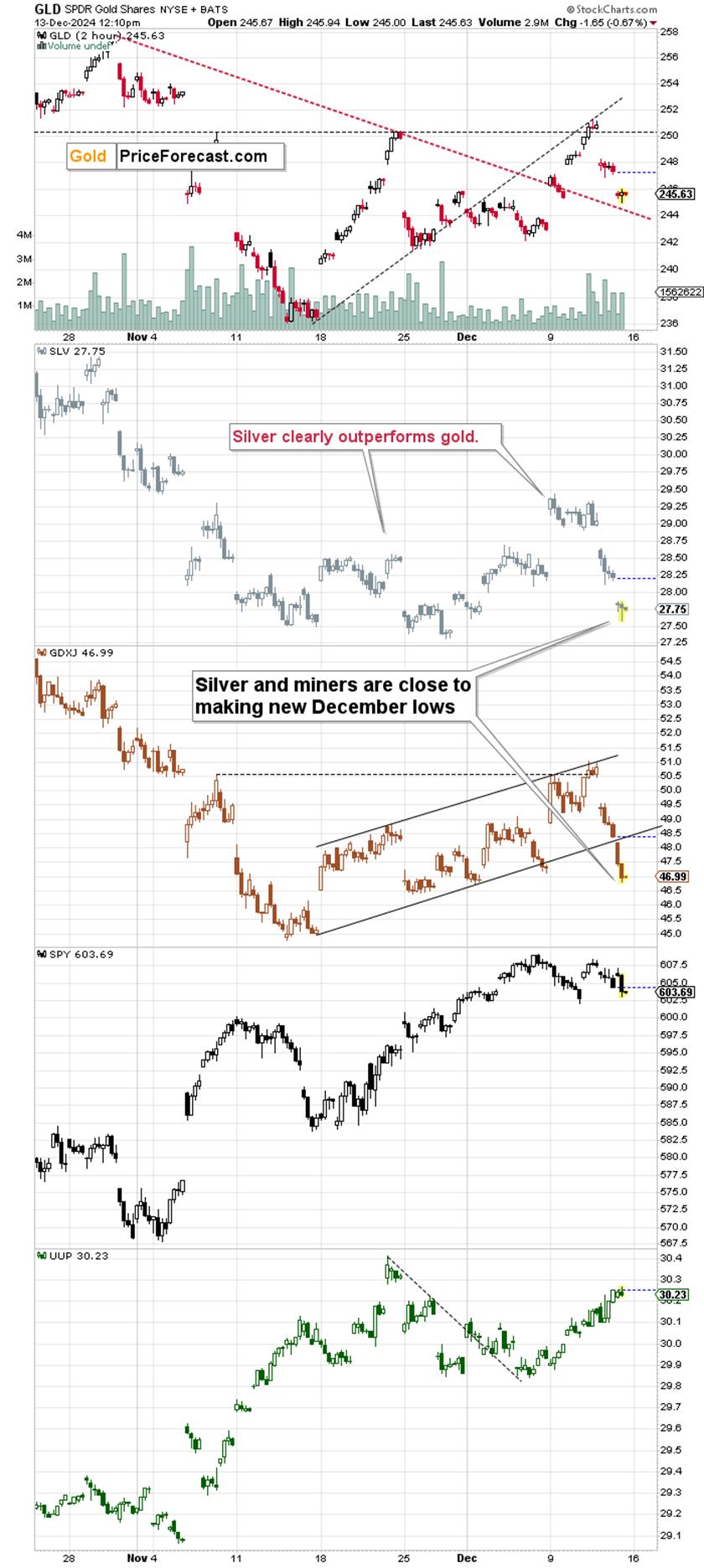

Given gold’s recent decline and a much bigger decline in silver and mining stocks, one might wonder whether miners’ and silver’s weakness are telling the truth about the precious metals market’s outlook, or if it’s gold that’s been holding up relatively well.

This is where looking at copper might be useful. This extra detail might make one or the other scenario more likely.

Let’s check the PMs first.

The GDXJ is down substantially, below our entry orders for the current short position (we had opened a long position in miners between Nov 14 and we took profits on Nov 21; we then entered a short position in the miners Nov 22 with GDXJ above $48) and the size of this quick decline is already bigger than what we saw in the previous weeks. That’s already a sign that this is more than just a correction – the same goes for the breakdown below the rising support line.

Silver is close to its recent lows as well.

Meanwhile, gold is above its declining support line as well as its December low (let alone its November low).

What can copper tell us here?

Copper recently invalidated its breakout above the declining resistance line. It’s done so in terms of the daily closes, which was already a bearish sign… But today we see something new. We see an invalidation also in intraday terms, which serves as an additional bearish confirmation.

Besides, FCX, the copper and gold stock (that we’ve been shorting as well) already moved below its previous December and November lows.

FCX’s relative weakness compared to the prices of copper and gold indicates that they are all likely to move lower.

And given today’s move below the rising support line, which is also the neck level of the head-and-shoulders pattern, it seems that we’re on a verge of a massive slide.

Since sizes of the declines that follow this pattern tend to be similar to the sizes of the head, it seems that we can see a decline to $30 or lower relatively soon – in the following weeks.

Short-Term Gold Rally Unlikely

A confirmation of the breakdown would increase the odds for this scenario even further, but even the relative weakness of FCX and invalidation of the breakout in copper make this large move lower likely.

This, in turn, makes a move lower in the precious metals market even more likely.

Besides, the USD Index is moving higher once again, which is a bearish factor for commodities and precious metals.

Yes, the USDX is once again above its 2023 highs. And since the correction was quite visible and managed to take RSI back to 50, it seems that another powerful upswing can start, especially that…

The USD Index’s biggest component – the EUR/USD pair invalidated its medium-term breakout and it even tried to break out once again – and failed.

This means that another round of declines is likely just around the corner. This is yet another reason to expect lower precious metals and – especially – mining stock values in the following weeks. Now, don’t get me wrong. Gold has merits as an investment, especially for insurance purposes, and especially if you allow it to earn interest, but for trading purposes, I don’t think that betting on its near-term rally is a good idea.

The above is up-to-date at the moment of posting this, and I’ll report any updates to my subscribers.

Naturally, the above is up-to-date at the moment when it was written. When the outlook changes, I’ll provide an update. If you’d like to read it as well as other exclusive gold and silver price analyses, I encourage you to sign up for our free gold newsletter.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.