Stock Market Trend Forecast to Jan 2025

Stock-Markets / Stock Markets 2024 Nov 02, 2024 - 11:31 PM GMTBy: Nadeem_Walayat

Dear Reader

This extensive analysis Stock Market Trend Forecast Sept 2024 to Jan 2025 was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

But first I finally got around to creating a video on the US Presidential Election 2024.

My most recent analysis -

Bitcoin Break Out, MSTR Rocket to the Moon! AI Tech Stocks Earnings Season

CONTENTS

Bitcoin Seasonal Trend

BItcoin Breaking Out

Bitcoin Big Picture

MSTR $272 �� ����️������������ ������

MSTR Dream For Some WIll be a Nightmare for Most!

AI Stocks Portfolio Earnings Season

30th - Microsoft $427 - EGF's +2%, +19%, Dir +1%, PE 36.2, PE Range 89% / 38%

30th - KLAC $674 - EGF's +15%, +30%, Dir +14%, PE 28, PE Range 170% / 104%

30th - GPN $101 EGF +11%, +12%, Dir +7%%, PE 9.1, PE Range -295% / -335%

31st - Arrow $134 EGF -25%, -5%, Dir +14%, PE 10, PE Range 92% / 104%

31st - AMAZON $188 - EGF's +12%, +25%, Dir -7%, PE 45 , PE Range -94% / -203%

31st - APPLE $233 - EGF's -11%, +8%, Dir 0%, PE 35 , PE Range +161% / +127%

BPMC has left the building.

The Coming AI IPO Bubble

ISRAELS NUCLEAR BLACKMAIL

The US Dollar is FINISHED MANTRA

Bonds SUCK!

The Housing Market 18 year / 18.6 Year Cycle

......

Stock Market Trend Forecast Sept 2024 to Jan 2025

Election 2024 - "Wherever men rule by reason of their wealth, whether they be few or many, that is an oligarchy." Aristotle 350BCE.

The US and all western nations are oligarchy's where decisions are made in the interests of the ruling Elite. Without a mechanism to strip individuals of extreme wealth then there is no democracy. The system is designed to enrich the elite through government spending, inflation and taxation that benefits the rich and keeps the masses poor i.e. government contracts for corporations owned by the elite, inflation ensures the masses work to pay the bills rather than accumulate wealth that gets inflated in value, the masses pay high taxes whilst the elite dodge taxes as the tax code has been written to their advantage. Has the US ever had a real democracy? Or is that the american oligarchy has been pulling the strings since they seized power from the tyrant King of England. Elections are necessary to give the illusion of democracy.

Ryan Wesley Routh, sounds like another one of those cat eating migrants crossing the southern border..... radicalized by MSM - ABC, CBS, CNN, MSNBC, PBS and NPR

CONTENTS

The Correction Window

US Interest Rate Cut Incoming

Stock Market 2024 Road Map

Stock Market and Presidential Elections

September the Weakest Month of the Year

Stock Market Trend Forecast Sept to Jan 2025

Stocks Bull Market Big Picture

2027 Destiny with a Bear Market

The AI Mega-trend is EXPONENTIAL

Why AI WILL Kill Jobs - The Robots Are Coming

AI Means Rendering in Real Time

AI Stocks Portfolio

INFLATION MEGA-TREND Tsunami Waves Current State

GBP Bull Market Trend

US House Prices

US Housing Stocks Current State

UK House prices

Presidents are Puppets on a String

US Presidential Election 2024

Bitcoin $60k

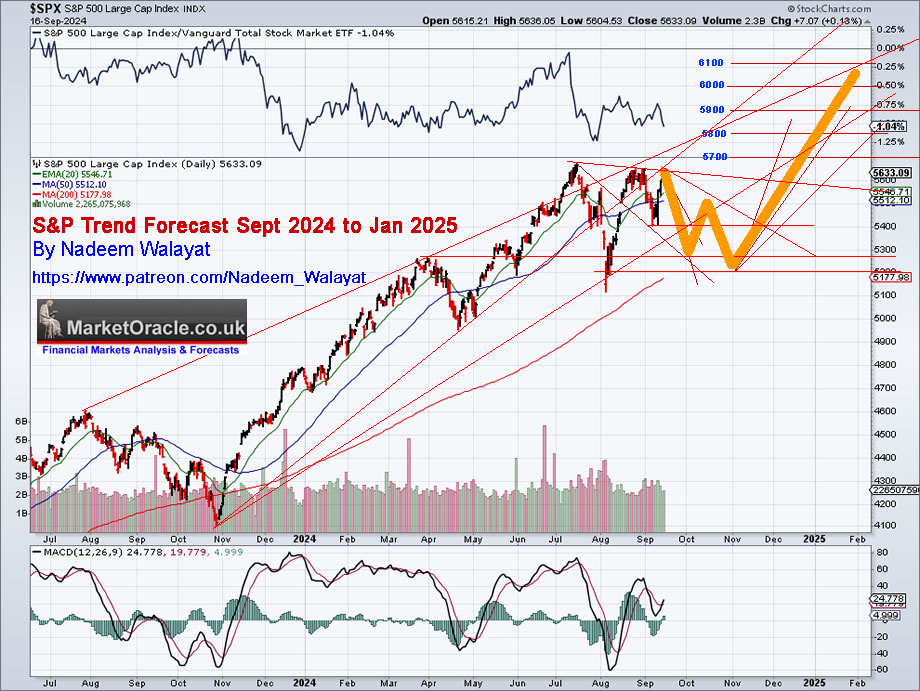

The Correction Window

Expectations for the final leg down of the stock market correction that extends into Mid October correction window to be underway following this weeks rate cut.

Actual C wave trend is very volatile where the initial downdraft from B caught many by surprise given that the S&P was within touching distance of it's all time high and same for the most recent rally as evidenced from comments the trend is definitely not pretty and despite the S&P being back over 5600 we remain within the correction window as I keep reminding patrons in the comments.

If I had to put a number on where the C wave could finally bottom out then that number would be around 5300 for a higher low that would set the scene for a strong bull run into the end of the year following October volatility and the election result.

US INTEREST RATE CUT INCOMING

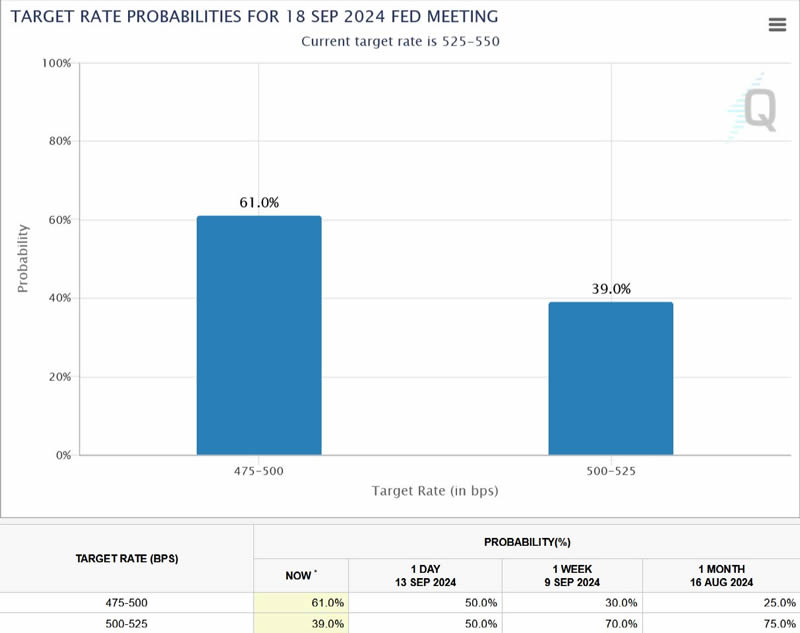

Fed decision on Wednesday at 2pm EST, 7pm UK time. My expectation has remained constant for several months for a 0.25% rate cut which should be followed by at least one more cut before year end, probably at the December meeting.

MSM and the blogosfear continues flail in all directions with the likes of the Fed Watch CME tool now giving a 61% probability for a 0.5% rate cut vs 30% barely a week ago.

0.25% cut - Expected, sends a message for the start of a measured and calm rate cutting cycle.

0.5% - Implies Fed has made a mistake by keeping rates too high for too long which will thus prompt recession worries across the markets.

No cut - Implies Fed expects inflation to be hotter than expected, increases market uncertainty due to not knowing when rates will be cut.

Thus the Fed 'should' opt for the calm and measured approach by cutting rates by 0.25%. The fact that the market is now discounting a 0,5% cut implies markets will be disappointed and thus feed into expectations for the correction window to target trading below the recent low of 5380 hence targeting 5300. It also illustrates that the market is often wrong in it's expectations, the madness of the crowd and all that.

What happens to the stock market following rate cuts?

It all depends on whether the cuts are calm and measured or done in a panic, a steady stream of 0.25% cuts should be positive and supportive of the bull market as the risk free rate goes down and thus earnings multiples go higher. A 0.5% cut would reek of panic and loss of control triggering market uncertainty to be taken as a warning of something bad brewing under the economic hood that will be negative for stock prices at least in the immediate future.

The big picture is a rate cutting cycle is bullish for stocks and thus acts as a wind behind the bull markets sails, the lower rates the easier it becomes for stocks to go up, even garbage stocks find a bid as money chases yield, Last time I looked there was about $1.4 trillion parked in money market accounts that as rates are cut much of which will find it's way into stocks hence drive stock prices higher into the next bubble mania top.

Stock Market 2024 Road Map

Stock market road map for 2024 is for a volatile uptrend into early August, a sizeable corrective swing down into Mid October followed by a powerful bull run into end of the year which is pretty close to current correction window expectation.

S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024

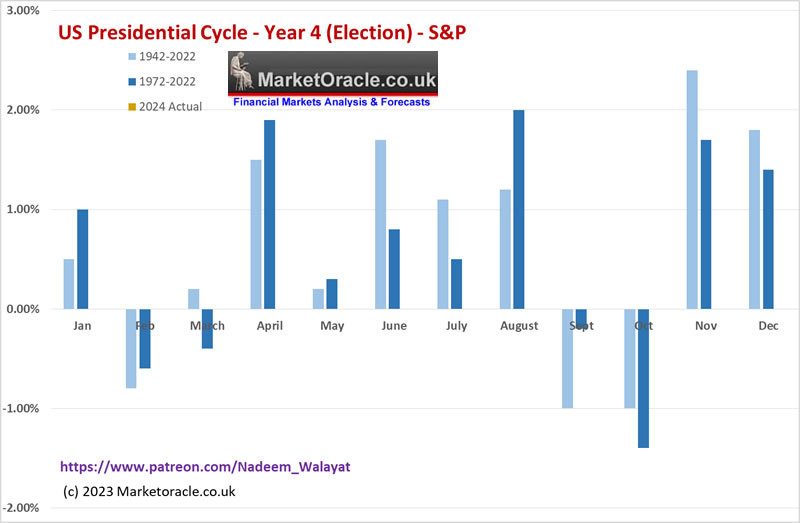

Stock Market and Presidential Elections

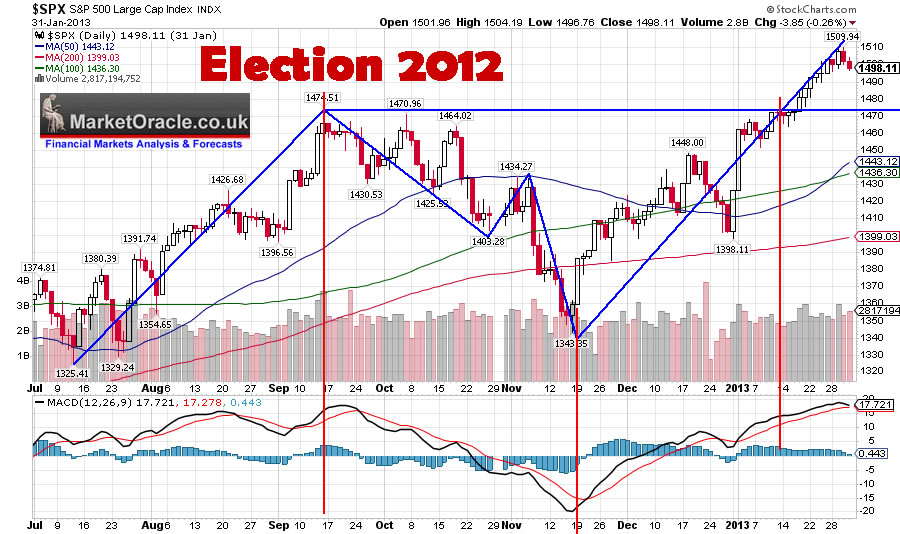

2012

(Charts courtesy of stockcharts.com)

Top Mid Sept 1472

Bottom Nov 19th 1343 -8.8%

late Jan High 1510 +12.4%

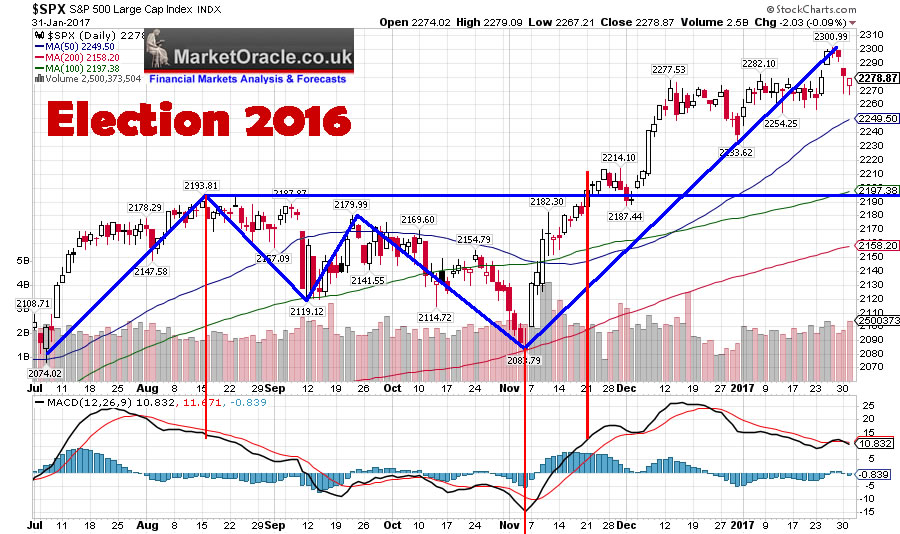

2016

Top Mid Aug 2194

Bottom Early Nov 2082 -5.1%

High Late Jan 2301 +10.5%

2020

Top 2nd Sep 3588

Bottoms 23rd Sep 3210, 31st Oct 3235 -10.5%

Top 25th Jan 3872 +20.6%

2024

Top Mid July 5670

Bottom Early Aug 5100 - 10%, Late Sept 5300?

Top Late Jan + 15%-20%, so 5850 to 6100...

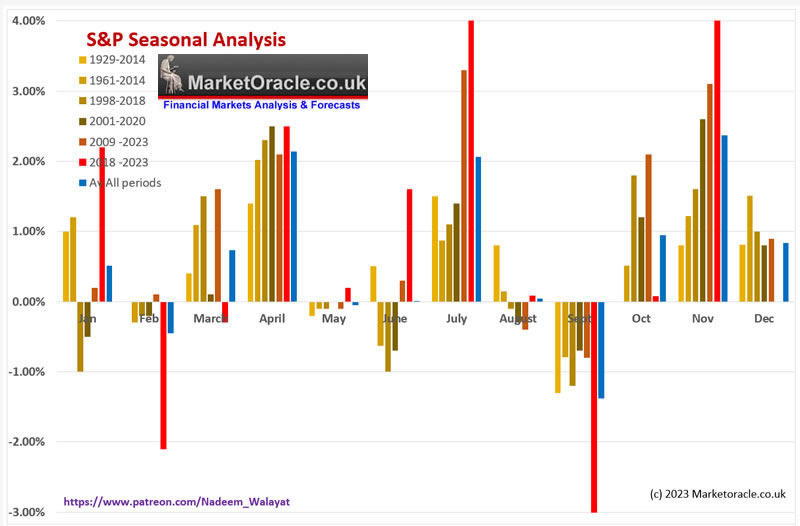

September the Weakest Month of the Year

With the S&P flying high at 5630 it may not seem like this month could turn out to be the worst of the year but that's what the stats show.

We are in the calm before the storm stage, though I doubt things will get as bad as August 5th which will probably hold as THE low for this correction.

Though don't be fooled by October's rosy outlook, in election years it tends to end lower than where it starts.

Stock Market Trend Forecast Sept to Jan 2025

Stock market looks like it's going to be volatile into the end of October, so despite current FOMO we are likely to see sub 5300 during October, it's not going to look pretty during October with a lot of false signals on either side, but the 5100 Aug 5th low should hold, then come end of October we should begin entering the window for a powerful rally that I suspect will have kicked off following the election, how high could the S&P fly? taking the above percentages from the 5100 low targets 5732, 5635 and 6150. I suspect the S&P will trade over 6000 during late January i.e. we may see some thing like 6060 which would be a powerful 19% jump off the 5100 low and about +9% on current. So take further downside chaos in the run up to the election as opportunities for further bites at the AI tech stock cherries before the post election FOMO , any way that is what I am positioned for as per this 4 month trend forecast chart of how things could play out into the end of January 2025.

And don't forget we are in a bull market so the risks are to the upside where the operative word for what is likely to transpire over the next few weeks is 'CORRECTION'.

What about the Yield Curve inversion Un inversion Recession Warning?

It's a NOTHING BURGER! All that time and effort expended over a NOTHING BURGER!

Stocks Bull Market Big Picture

The big picture remains in that the bull market will run for at least another year and likely into 2027.

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Therefore the following graph illustrates my road map forecast conclusion of how I expect the AI mega-trend to play out over the next 15 years and why I will continue the mantra of buy the dips and panics all the way towards liquidating holdings during the next mania peak when valuations go out the window and when I will likely heavily short these same stocks all the way down towards the buying opportunity of the 2030's.

So the bottom line is to capitalise on the bull market one needs to maintain exposure as the risks are to the upside, yes stocks go nuts and FOMO to ridiculous levels as the likes of AMD and Micron did this year and thus set themselves up for huge potential drops which have transpired, folk mistakenly look at the the highs of AMD $225 ad Micron $157 and comment on the subsequent collapse by asking why have they fallen so by so much and if they are still good AI buys, illustrates how little thought folk give into that which they are seeking to buy given that at these highs the stocks lost touch with reality as I posted at the time, hence I slashed my holdings down towards zero hard cash invested even though my default position would aim to maintain exposure as the bull has a lot further to run, but when faced with stocks going nuts to the upside one needs to do the sane thing which is to CUT exposure, yes there is the risk that stocks could go even more nuts to the upside but the risk for instance AMD falling to below $140 and Micron below $100 was a lot higher than missing out on a few more dollars of further upside FOMO for which one only needs to look at the spreadsheet metrics such as PE percent of range.

It's not complicated, all it takes is engaging ones brain cells, if folk did that then they would know WHY AMD fell to below $140! Instead many want any easy ride, a good stock pick for the next 3 years I get asked, well they are all good stocks if you buy them at the right price! They will be garbage if you buy them during their FOMO phases as probably some poor fools did with AMD on break above $200 and Micron above $150, after all the holy church of TA states that such breakouts are good thing! I.e. to buy strength, illustrates that on it's own TA does not work, it will lose you money, all these patterns that folk chase after are at best coin flips which is why you never hear me talk about Head and Shoulders, Wedges, Flags and Triangles, they are coin flips, you'll literally probably have better luck just flipping a coin! So as I often state forget about the highs and the lows because they only price that matter is that which one buys at and that which one sells at. But as sure as night follows day I'll be reading comments for months to come asking why is AMD lagging by being unable to break back above it's 2024 high!

2027 Destiny with a Bear Market

Destiny - An event that is going to happen no matter how much one tries to avoid it from happening which is pretty much how I see 2027.

As mentioned above the market is going to be in denial towards the stock market top much as was the case during 2021 when the mantra was that inflation was transitory and thus new highs were coming during 2022, go look at the expectations of all of the usual suspects, they were ALL bullish on stocks for 2022, even Tom Lee who every one fawns over today got 2022 completely wrong right at the top of the 2021 bull market, completely missed the incoming 2022 bear market.

Tom Lees is a perma bull! Which I suppose is better than being a perma bear, but those who listened to him saw their tech stocks portfolios die during 2022 to probably vomit out at the lows when the likes of Clown Cramer was proclaiming that META was finished at $100. That's what's in store for most investors during 2027. You won't want to hear me saying that I am selling out of stocks as was the case during 2021 because most will FOMO in towards the end and thus not have much of any profits to crystallise and hence watch their portfolios die as happened to many during 2021/ 2022, folk DID NOT WANT TO SELL! They wanted me to give them reasons to BUY stocks, I remember the last 3 months of 2021 well, buying the likes of IBM at $115, WDC at $50 where the plan was that some stocks will be able to ride out the storm of 2022 better than others as the future is unwritten, and so it will be for 2027, folk will want to buy going into the top, demand that I give them buying levels, I'll get criticised for missing 20%, 30% or more run ups in certain stocks as lost profits that folk could have made if they had not listened to me by selling earlier. Those who did not sell during the FOMO would ride the bear market all the way down to the October 2022 low, turning 50% profits into 50% draw downs or more with no money to BTFB.

WAR!

Escalating Russia / Ukraine conflict illustrates that Wars have unintended Consequences, 2027 is now just 2 full years away! War with China could turn into World War III as an escalating war in the Europe merges with the Asia War, to get to something along the lines of 10x the current conflict that will eventually deliver the mother of all buying opps. if we manage to survive it.

What if 2027 comes along and there is no war! HAHAHHAA Nadeem you were WRONG!

In which case I would be happy to be wrong! Because wars are very bloody ! A LOT DEATHS!

But the thing about destiny is that it still manages to become manifest!

Counting down the the risk of a Coronal Mass Ejection (CME) event that is set to see a peak in solar activity during 2025, a barrage if high energy particles disrupting our electrical infrastructure with the potential for catastrophic consequences, note that the risk is ongoing i.e. akin to playing russian roulette, so it's no good taking a sigh of relief if the world makes it through the peak of solar activity during 2025 and into 2026 as the risk of being hit by solar bullets will continue for some years after the peak.

This also begs the question, if something is destined to happen then is there such a thing as free will?

So if its not one thing it will be another that looks set to make the next great stocks bear market manifest during 2027, but there is plenty of price action between now and then to focus on, just keep in the back of ones mind that all bull markets eventually resolve in a 'temporary' bear market.

The AI Mega-trend is EXPONENTIAL

Folk in the media keep making the mistake of taking snapshots, for instance it's not where Chat GPT IS it's what it implies for what comes NEXT, this the problem with most analysts they think LINEAR when AI is exponential! As I have commented before OpenAI will probably DIE because it's just a milestone not the final destination! All these media fools spout the same garbage at each milestone that AI is over rated for the past decade and look where we are at! They cannot grasp what is happening because the human mind thinks in linear terms, it's default setting hence why most can't comprehend what's underway.

It's mid 2024 and as I mapped out 4 years ago the AI Mega-trend is in full swing, if you think its FAST now wait for the NEXT phase which should start kicking in pretty soon - QUANTUM COMPUTING BREAKTHROUGHS, it will be a WTF moment for most and given that cpus such as what Intel produce are knocking on the door of quantum effects i.e. quantum tunneling, we should be prepared for some major revolutions in the chips departments which means don't write off Intel just yet !

As is the case today AI tech stocks are EATING everyone's earnings. The portfolio is Quantum AI tech stocks.

Chinese stocks like BABA and Bidu have huge multiple compression, it does not necessarily take good news to send these higher, just a change in sentiment.

Why AI WILL Kill Jobs - The Robots Are Coming

The carrion cry from AI proponents supported by academic economists is that AI will create MORE jobs as has been the case with every industrial revolution to date. Unfortunately what they don't understand is that with each iteration the well paid new jobs demand every greater HUMAN INTELLIGENCE no matter how intelligence is measured and frankly it's not easy for humans to increase intelligence, it's possible through study and practice but not easy and takes time, so the bell curve of demand for intelligence will increasingly push more humans out of the work intelligence pool.

The robots are coming and you won't be able to resist buying one. MSM will have them as bland but cute looking automatons,

Instead what will be sold will appeal to every prospective buyer, just as cars are today but more so.

AI Means Rendering in Real Time

It's early days in the realm of neural nets rendering worlds in real time but that's the direction of travel we are fast heading towards. Where the obvious disruption will be in the gaming sector, where the literal name of the game is game play being rendered in real time by game engines that will eventually will become obsolete as that is what the neural nets will soon be doing, everything rendered by the neural nets including characters in real time.

This puts a time limit on most gaming sector stocks, especially those that focus on rendering tools and services such as Unity. We don't know what gaming stock is going to survive AI rendering in real time, I'd happen a guess that it will be those with the largest user communities, the likes of Roblox and Future makers of the Grand Theft Auto franchise but we just don't know what will happen as AI continues on it's path of disrupting ALL business models, nothing can be taken for granted when studios of graphic designers rendering objects and worlds with the likes of Unity get replaced by neural nets.

What I am seeking to do is maintain exposure to Roblox for the time being whilst reduce exposure to the likes of Unity as opportunities materialise. Remember AI is disrupting EVERY SECTOR!

Quantum AI will eventually reveal that we exist in an simulation, particles change their behaviour when observed i.e. the double slit experiment implies particles are being rendererd.The universe itself is being rendered.

The remainder of this extensive analysis will be emailed out shortly

AI Stocks Portfolio

INFLATION MEGA-TREND Tsunami Waves Current State

GBP Bull Market Trend

US House Prices

US Housing Stocks Current State

UK House prices

Presidents are Puppets on a String

US Presidential Election 2024

Bitcoin $60k

Again For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Most Recent Analysis - Bitcoin Break Out, MSTR Rocket to the Moon! AI Tech Stocks Earnings Season

CONTENTS

Bitcoin Seasonal Trend

BItcoin Breaking Out

Bitcoin Big Picture

MSTR $272 �� ����️������������ ������

MSTR Dream For Some WIll be a Nightmare for Most!

AI Stocks Portfolio Earnings Season

30th - Microsoft $427 - EGF's +2%, +19%, Dir +1%, PE 36.2, PE Range 89% / 38%

30th - KLAC $674 - EGF's +15%, +30%, Dir +14%, PE 28, PE Range 170% / 104%

30th - GPN $101 EGF +11%, +12%, Dir +7%%, PE 9.1, PE Range -295% / -335%

31st - Arrow $134 EGF -25%, -5%, Dir +14%, PE 10, PE Range 92% / 104%

31st - AMAZON $188 - EGF's +12%, +25%, Dir -7%, PE 45 , PE Range -94% / -203%

31st - APPLE $233 - EGF's -11%, +8%, Dir 0%, PE 35 , PE Range +161% / +127%

BPMC has left the building.

The Coming AI IPO Bubble

ISRAELS NUCLEAR BLACKMAIL

The US Dollar is FINISHED MANTRA

Bonds SUCK!

The Housing Market 18 year / 18.6 Year Cycle

Recent analysis includes -

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

Also access to my comprehensive 3 part How to Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $7 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it next rises to $10 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buying the dips selling the rips analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.