UK Budget 2024 - What to do Before 30th Oct - Pensions and ISA's

Politics / UK Tax & Budget Oct 27, 2024 - 09:26 PM GMTBy: Nadeem_Walayat

The Labour government budget is set to punish those who work hard and reward those on benefits by seeking to fill a £22bn hole in the finances though not by raising income, tax or VAT. So the plan is to hit those with assets which means the Labour government is coming after many folk who would not consider themselves as being rich. perhaps all it takes is living in a property worth £1 million will put folk in the cross hairs of the Liebour government.

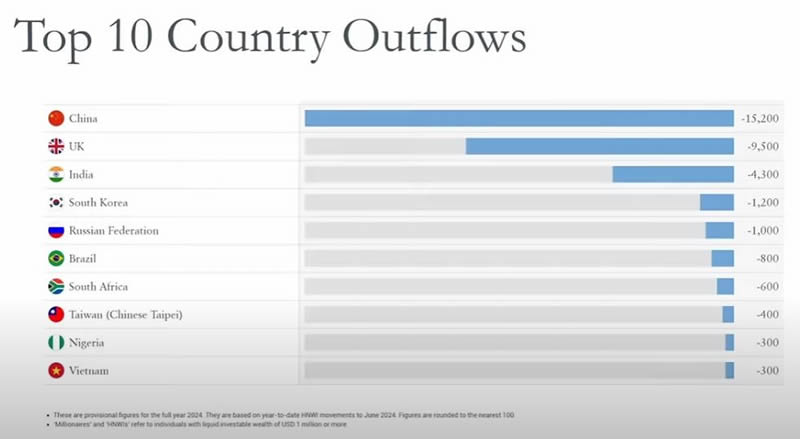

Meanwhile the real rich are running away from the UK in their thousands and taking their wealth with them to places such as Dubai

WEALTH TAX

All that hard work over a lifetime of saving and investing whilst others have splurged or sat idle on benefits is now could get punished with a wealth tax which will probably be based on property values. Anyway it will send a message that HARD WORK, Savings and Investing for ones future does NOT PAY!

PENSIONS

Labour eyes hitting those who save for their retirement, the message being folk should save nothing for retirement and instead rely on state handouts. There is a high risk of employer contributions getting hit with a 13.8% NI TAX.

LANDLORDS

Prepare to DIE! Liebour is set to pile a whole pile of poop on your business models such as inability to get your property back from tenants without entering a lengthy legal battle which effectively cripples all those without a legal department to handle all of the paperwork involved.

CAPITAL GAINS TAX

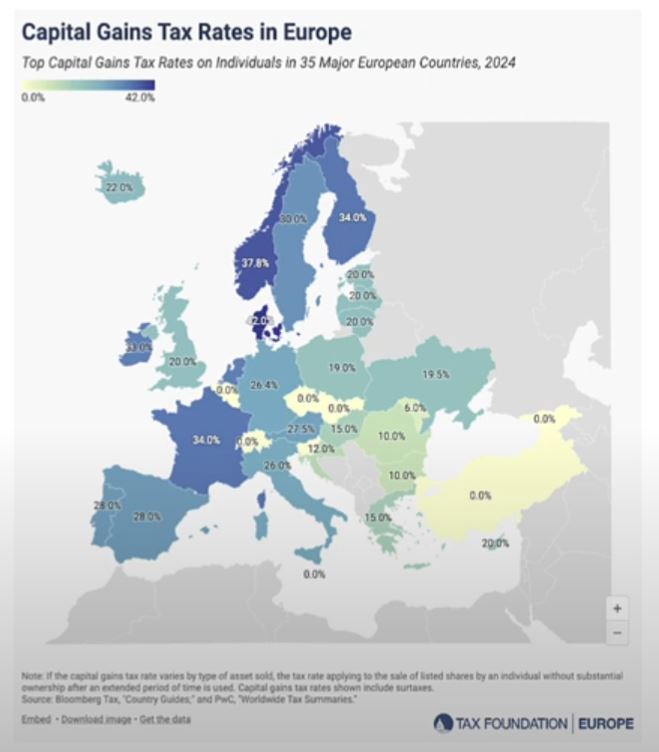

The Tories had already crippled the allowance for Cap Gains now Labour seeks to finish the job by upping the starting tax rate to the base rate of 20%, up from 8.75% with the marginal rate rising from 20% to 39% which would make it the highest in Europe!

All that hard work to work towards building capital to invest which is TAKING A RISK! i.e. the risk of capital loss! And the thieving scum bag government taxes folk 20% on the gain BEFORE INFLATION STEALTH THEFT! Which means it would no longer be worth the effort of for instance investing in crypto or stocks outside of tax free wrappers! Thus the government can expect to yield LESS tax in future years as people become less likely to sell assets so fewer transactions. Whilst the rich will seek to offshore their assets so less capital gains tax and income tax.

In comparison to the US for most at them moment the cap tax rate is 15% on investments held for over 1 year. So Liebour hiking from 20% to 40% would no longer make investing in stuff such as crypto worth the effort and risk, given that +50% of the gain would be stolen by the government by means of tax and inflation.

What to do ?

Crystallise gains before the budget at the current cap gains tax rate which could result in a market panic in some assets as many rush to lock in a lower tax rate. What I will do is a lot fewer transactions outside a tax free wrapper so whilst initially there may be a tax hike in future years I will pay LESS tax.

ISA

The final nail in the coffin could come if Liebour cripples ISA's by putting a lifetime limit of say £100k on ISA's. This is probably not going to happen but if it does will hasten the flight of capital out of the UK. Under Liebour hard work and saving for ones future will no longer pay. Add this years allowance in case the ISA is capped at £100k or the annual allowance is CUT.

If you have yet to open an ISA for the current tax year then T212 is doing a promo where we both get a free share by following this link https://www.trading212.com/invite/16aA4Pdcoi but you are going to have to act fast to ensure its opened and funded BEFORE the Budget.

PENSIONS

Make an employer contribution due to a high risk of employer contributions getting hit with a 13.8% NI TAX.

This article is an excerpt from extensive analysis Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump! that was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

CONTENTS

Stock Market Correction Window

Stocks Bull Market Smoking Gun

Stock Market Intra Year Cycle

The Risks are to the Upside!

DOCU LIVES!

Nvidia Numero Uno

TRIMMING VS REBUYS

S&P ETF Passive Investing Bubble Mania

AI Stocks Portfolio Q3 Earnings Season

23rd - TSLA - $218 - EGF -7%, +13%, Dir +16%, P/E 93, PE Range 208% / 161%

23rd - IBM $232 - EGF -8, +1%, Dir +14%, PE 22.8, PE range 102% / 69%

23rd - Lam Research - $73.1, EGF +6%, +27%, Dir -3%. PE 24.1, PE Range 102% / 69%

24th - WDC $67, PE -177

29th - Google $166 - EGF +7%, +17%, Dir -8%, PE 23.9, PE Range 60% / 24%.

29th - AMD $154 - EGF's +15%, +54%, Dir +19%, PE 55, PE Range 95% / 51%

30th - META $582 - EGF +5%, +16%, Dir -1%. PE 29.7, PE Range 124% / 95%

Bitcoin Blood Bath Revisited.- PAIN IS GOOD!

Bitcoin Gift Bull Market Targets

BItcoin on the Launch Pad Awaiting President Donald Pump!

Crypto Market Caps

SCALING OUT OF THE BULL MARKET

UK Budget 2024

Recent analysis includes -

Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

Stock Market Trend Forecast Sept 2024 to Jan 2025

Nvidia Earnings vs Stock Market Correction Window

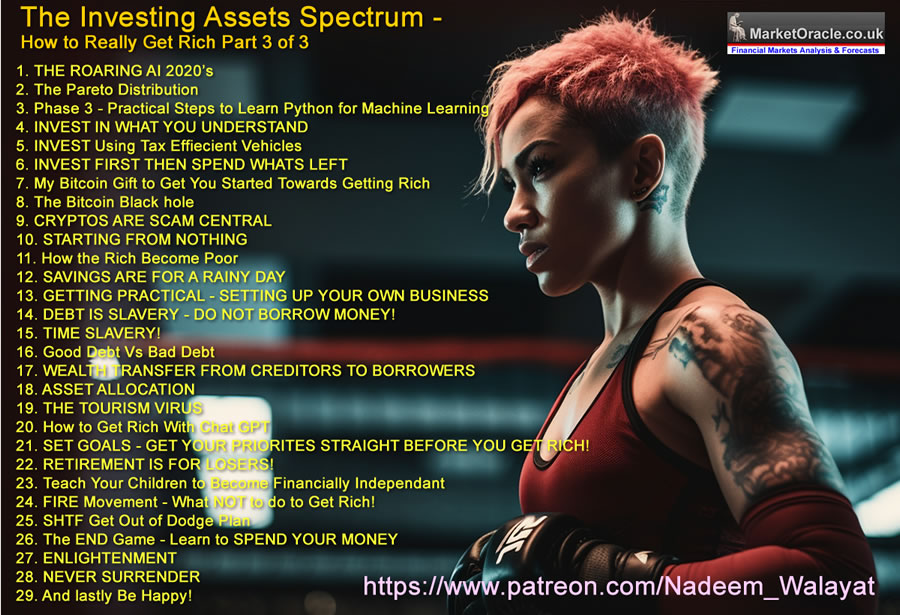

And access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide 2023

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.