Sentiment Speaks: Silver Is At A Major Turning Point

Stock-Markets / Stock Markets 2024 Sep 17, 2024 - 10:00 PM GMTBy: Avi_Gilburt

I want to start this article with a little background about Elliott Wave analysis, and begin with a quote from Paul Tudor Jones, one of the most successful money managers of all time:

"I attribute a lot of my success to Elliot Wave Theory. It allows one to create incredibly favorable risk reward opportunities"

Back in the 1930’s, an accountant named Ralph Nelson Elliott identified that markets represent unconscious, non-rational reactions which follow a repeating fractal pattern, which means they move in variably self-similar patterns at all degree of trends. This repeating fractal pattern represents overall societal sentiment which is governed by the natural law of the universe as represented through Fibonacci Mathematics.

Now, to be clear, people often mistake what I am saying as meaning that the patterns are what drive society. But, the truth is that the patterns represent the social mood of society en masse, and it is the societal sentiment that causes these fractal patterns we see in the market.

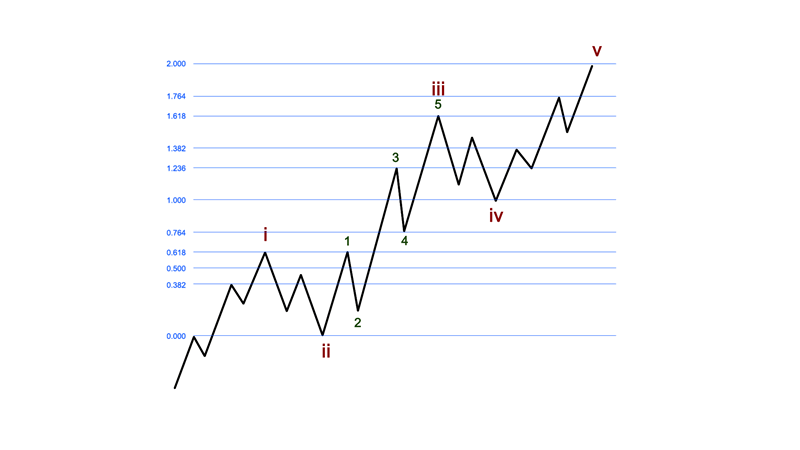

Most specifically, Elliott theorized that public sentiment and mass psychology move in 5 waves within a primary trend, and 3 waves within a counter-trend.

Once a 5 wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of “news.”

Also, take note that waves 1, 3 and 5 move in the direction of the general trend, and waves 2 and 4 are counter-trend moves. Moreover, take note that waves 1, 3 and 5 further break down into 5-wave structures – which I show as an example within the 3rd wave - whereas the corrective, counter-trend moves of waves 2 and 4 break down into 3-wave structures.

Now, I want you to take note that the segment one would want to trade is the heart of a 3rd wave, as they are the strongest segments of a rally in equities. And, while 3rd waves are still very strong in metals, their 5th waves are even stronger.

So, as an investor, you want to be layering into a market as a 3rd wave is about to begin. If you look at the chart above, the set up you are seeking is a i-ii, 1-2 structure, wherein you can move into the market during the wave 2 pullback, so you are prepared for the wave 3 of iii.

Silver is now developing a structure within its wave 2. The only question I have is if silver has begun its 3rd wave, or if there is one more drop to complete its wave 2 before the heart of the 3rd wave begins in earnest.

I will not bore you with the mathematical details as to how I calculated the resistance, but 31.73 is coming up as a very strong point for me over the coming week. Unless silver is able to blow through that resistance, we have a set up in place that can take silver down quite strongly over the coming weeks towards the 23.75-26.72 region to complete its 2nd wave.

Of course, if silver can blow through the 31.73 region and continue through 33.35, then we are on our way to our next target in the 37.25-40 region, and also on our way to much higher targets after another smaller pullback from that higher target region.

Taking a step back, I want this to be a lesson to anyone utilizing Elliott Wave analysis to its most powerful end. You must be as objective as possible when analyzing the charts you are trading. While it is so easy to simply just view the path you would most prefer due to a bias you have derived, whether that be due to having money invested in that particular direction or from some fundamental perspective, it is absolutely imperative to always be analyzing the other side of the market to understand where and how you can be wrong in your assessment. And, when there are levels that line up in an almost perfectly overlapping manner, you must take notice and recognize it as more than just a small probability that the market is presenting.

So, I would be watching your positions in silver over the coming week or two, as one more decline can still take shape before we are ready for the major break out.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets. He recently founded FATRADER.com, a live forum featuring some of the top fundamental analysts online today to showcase research and elevate discussion for traders & investors interested in fundamental rather than technical analysis.

© 2024 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.