Why Stock-Market Success Is Usually Only Temporary

Stock-Markets / Stock Markets 2024 Aug 30, 2024 - 05:48 AM GMTBy: EWI

Here's a sample of record sentiment readings for stocks

Recession coming or not, people are still EXTREMELY bullish.

Read this excerpt from the May 17, 2024 Elliott Wave Theorist:

Record Sentiment Readings for Stocks

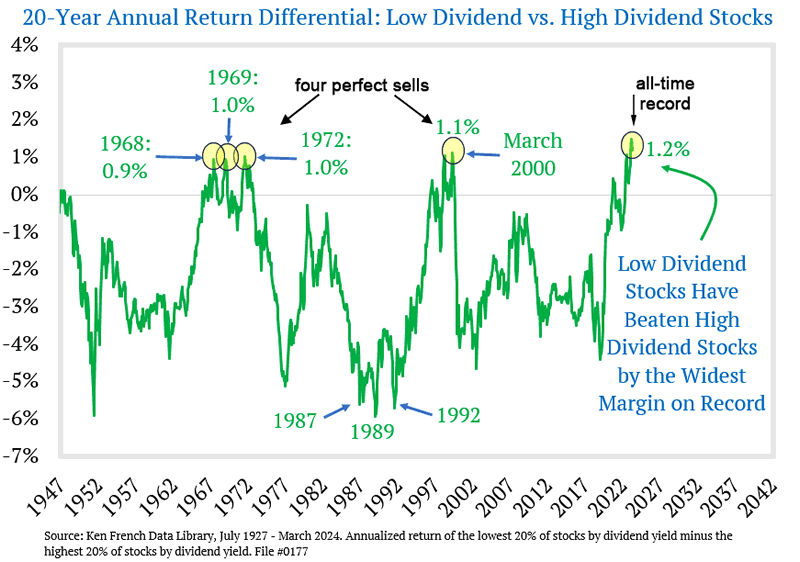

Investors are enamored with stocks that pay little or nothing in the way of dividends. The extent of that bias has now reached an all-time extreme. The chart below shows the history of investors' preferences for low vs. high-dividend stocks, on a 20-year return basis. ... Here in 2024, the preference for low-payout stocks over high-payout stocks just established a new record.

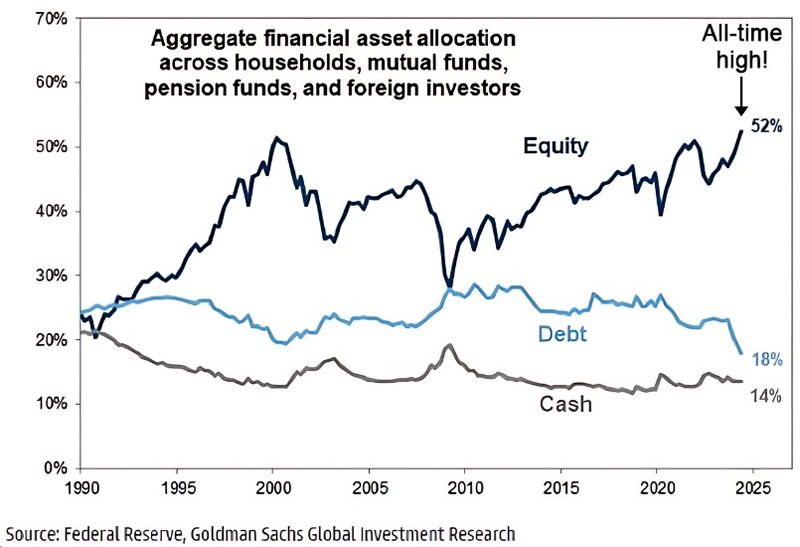

On May 15, Goldman Sachs published a chart showing record equity allocation among a broad spectrum of investors.

[And,] on May 4 and 14, respectively, the Financial Times of London showed that retail investors' gorging on equity ETFs leveraged by two to three times has approached the 2021 extreme, while the total flow of retail money into the stock market has exceeded that of 2021.

[Finally,] here is the title of an opinion piece, published by Bloomberg on May 9:

It's Dangerous to Stay Out of Stocks

Research from Barclays provides fresh evidence that you should almost always have

some money in equities

No one expressed this attitude in 1974, 1988 or early 2009. Today it is gospel.

The consensus is always to be in cash at major bottoms and fully invested at tops. The reason for this inevitability is that pessimism makes market bottoms, and optimism makes tops. In both environments, few can see the inevitable turn. Success among the crowd is always temporary.

Exclusive Market Insights – Straight to Your Inbox

This article was syndicated by Elliott Wave International and was originally published under the headline Why Stock-Market Success Is Usually Only Temporary. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.