Is Bitcoin Still an Asymmetric Opportunity?

Currencies / Bitcoin Apr 29, 2024 - 05:37 PM GMTBy: Submissions

What’s that screeching sound?

- Does this make you nostalgic?

I can still hear the screeching sound of my old dial-up struggling to connect to the internet.

Remember those days? I’d fight with my brothers and sister for a turn on our one family computer.

Slow websites. Frozen pages. Dropped connections. The early days of the internet were rough.

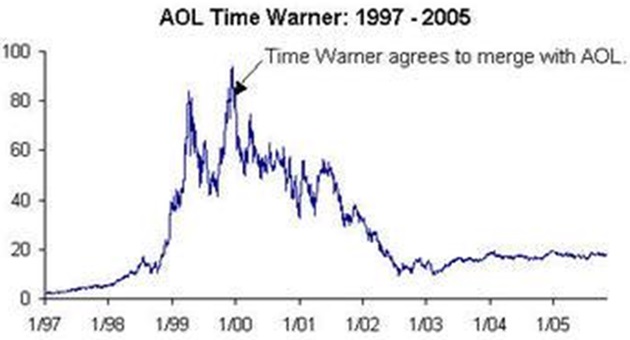

But if you had the foresight to invest in AOL during those days, you could’ve made good money. AOL went from a few bucks a share in 1997 to nearly $100/share (split-adjusted) by 2000, before merging with Time Warner and dropping during the dot-com bubble.

Source: Seeking Alpha

Of course, that’s not the only example.

Investors who backed new types of companies like Amazon (AMZN), Google (GOOG), and Cisco Systems (CSCO) when the web was in its infancy made life-changing money.

The lesson: It paid to make smart bets on the internet when it was still messy.

I bring this up because crypto is a lot like the early days of the internet.

Not user friendly. Messy. Takes effort to navigate.

According to RiskHedge’s resident crypto expert Stephen McBride, that’s our opportunity.

- “All groundbreaking new technologies suck at the beginning.”

Crypto’s come a long way in the last couple years.

There are now 580 million crypto holders worldwide—a number that grew 34% in 2023.

But there’s still a long way to go. Stephen:

Today, the crypto user experience sucks.

There’s no way a billion people will use crypto in its current form. And that’s our opportunity.

Just like the internet, crypto will become much easier to use. This is going to attract hundreds of millions of new users, fueling years of rapid growth for crypto businesses.

By investing now, you can set yourself up to profit from this growth. The vast majority of investors won’t put the effort in. That’s why they’ll only ever read about the big money crypto investors can make.

The frustrating user experience means we’re still very early to crypto.

- And keep in mind... crypto is still tiny.

Relative to real estate, the S&P 500, and gold... crypto is barely a blip:

In fact, Microsoft (MSFT)—one company—is larger than the entire crypto market. So is Apple (AAPL). And Nvidia (NVDA) isn’t far behind.

So crypto is new(ish), small, and rapidly improving.

That makes it a great source of potentially asymmetric returns.

In investing, “asymmetric” means the potential upside of an investment is much greater than the potential downside.

Symmetric investing is when an investor risks $500 for a chance to make $500. Or $10,000 for a chance to make $10,000.

Asymmetric investing is risking $500 for the chance to make $10,000.

Of course, booking 1,000%+ gains is easier said than done, and it requires taking greater risk.

That’s why asymmetric investments should be no more than a small part of your overall portfolio. Stephen recommends putting only 1%–2% into crypto, max.

- Is bitcoin still an asymmetric opportunity?

Depends on the timeframe.

Bitcoin trades for about $62,000 as I write. Stephen expects it to hit at least $150,000 this cycle. That’s a little more than a double. Symmetric.

Given time, could bitcoin reach $1 million? If its adoption curve continues, absolutely. But it’s highly unlikely to shoot up 10X or more quickly, as small cryptos often do.

Stephen says the #1 asymmetric opportunity today is in the smaller, lesser-known cryptos. The crypto market is still so small and so new, there’s room for exponential growth.

Chris Reilly

Executive Editor, RiskHedge

To get more ideas like this sent straight to your inbox every Monday, Wednesday and Friday, make sure to sign up for The Jolt, a free investment letter focused on profiting from disruption.

Expect smart insights and analysis on the latest breakthrough technologies, the big stories the mainstream media isn't reporting on, and much more... including actionable recommendations.

Click here to sign up.

© 2024 Copyright Chris Reilly- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.