Gold and the Long-Term Inflation Cycle

Commodities / Gold & Silver 2024 Mar 11, 2024 - 09:35 AM GMTBy: Clif_Droke

Of the many factors that determine gold price trends, the long-term cycle of inflation and deflation is of singular importance. The cycle in question corresponds closely to the 50-to-60-year economic periodicity known as the Kondratieff Wave (or K-Wave), but is in fact a separate cycle. As we’ll discuss here, the cycle tells us to expect a gradual acceleration of inflationary pressures between now and the year 2029, with particular significance for gold investors.

The K-Wave was brought to renown in the 1920s by the Russian economist Nikolai Kondratieff and is widely regarded as the predominant economic super cycle. This cycle arguably represents the most casual approach to identifying the real supply/demand conditions of any free market economy and is especially applicable to the United States. (Cycle analysts have even identified this cycle as existing as far back as thousands of years ago in Assyria and the Roman Empire.)

Commenting on the K-Wave, the late cycle analyst Samuel J. Kress—whose eponymously named Kress Cycle of 60 years duration closely corresponds to Kondratieff’s long-wave cycle—made the following observation back in 2002:

“The K-Wave is the manifesto of economic determination. It is the ultimate boom/bust condition. The cycle is caused by the beginning of acquisition and the ending liquidation of debt. Debt creates a false or created incremental demand in addition to intrinsic, real demand. When debt assumption becomes excessive, the system becomes illiquid. At that time, debt must be reduced to alleviate the pressures of illiquidity. This waning demand is reflected in reduced overall economic activity and [corporate] earnings. In turn, this begins the momentum likened to a snowball rolling downhill. Once debt is liquidated, the system re-liquifies, debt is reacquired and the economic super cycle begins anew.” [Kress, The Reign of the Bear, 2000-2014]

Kress maintained that the last K-Wave that bottomed in the previous decade was the fourth one since the U.S. gained its independence in 1776. He depicted the K-Wave as it pertains to consumer price inflation, dividing it into five phases:

- Inflation: 1949-1965

- Hyper-Inflation: 1965-1980

- Disinflation: 1980-2000

- Deflation: 2000-2010

- Final Bottom: 2010-2015

Similar to the K-Wave, the 60-year long-term cycle of inflation/deflation identified by Kress contains several smaller component cycles, each having its own significance to financial markets, consumer prices and even to extended periods of war and peace.

Indeed, Kress noted that two wars typically occur in every K-Wave: the first at the end of deflation and beginning of inflation (Parts V and I, shown above), and also at the end of hyper-inflation and the beginning of disinflation (Parts II and III). In the fourth (most recent) K-Wave, World War II ended in the mid-1940s and the Vietnam War ended in the mid-1970s.

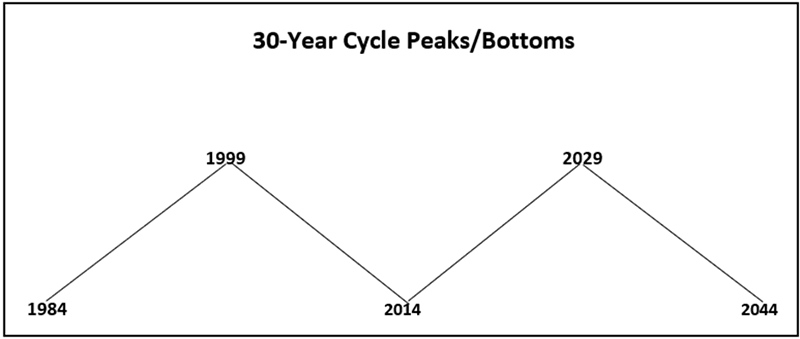

Kress’s supposition was that the first 60-year cycle of any significance for the United States can be identified as beginning in the year 1774, which closely coincided with America’s Revolutionary period between 1775 and 1783. The 60-year cycle is comprised of two 30-year cycles, each of which has a peak at the midway point of 15 years (an important point to remember when analyzing inflationary and deflationary periods).

The composite 60-year cycle carries not only the seeds of economic expansion and contraction (inflation and deflation), but the bottoming of its 30-year component cycle is sometimes accompanied, or followed, by war. This was true in the immediate wake of the years 1774 (Revolutionary War), 1864 (Civil War), 1894 (Spanish-American War) and 1954 (Vietnam).

Even when the 30-year cycle’s bottoming doesn’t produce “hot” wars, a “cold” war often accompanies it which is characterized by heavy war-time spending levels. This point is worth emphasizing, for it serves as a key impetus for strengthening gold prices.

The most recent 60-year cycle of deflation—as well as its 30-year component—bottomed around 2014-15, and with it a new long-term cycle of inflation was born. As the 60-year cycle can be divided into two 30-year cycles, so the 30-year cycle can be divided into two 15-year half-cycles. This is an important variable for gold investors to keep in mind, for its upcoming peak of the latest 30-year cycle that should produce some intensive upside pressure for the yellow metal’s price.

Unlike bonds and real estate, which each benefit and fail from the former and latter stages of the long-term cycle, gold benefits from both stages of it. Kress explained gold’s ability to benefit from both runaway inflation and deflation as follows:

“When the latter stages of inflation begin, gold is perceived as the ultimate hedge. During the hyper-inflation of the 1970s, gold increased in value approximately 20-fold, and then began its bear market in the early 1980s with disinflation. When deflation/depression begins, the price of gold is perceived as the ultimate storehouse of value.” [Kress, Taming of the Bear, 1999]

With deflation long since in the rearview mirror, a new inflationary super cycle has been underway for the last several years and is approaching the first of at least two acceleration phases: the first one is scheduled for around the years 2029-2030 when the 30-year component of the super cycle is due to peak. In other words, we should begin to see consumer price inflation accelerate higher as we draw closer to the end of the current decade.

With inflation’s intensification should come growing demand for gold as a hedge against higher living costs, just as it did in the prior inflationary period of the 1970s. Accordingly, gold or a derivative thereof, should constitute at least a conservative weighting in one’s portfolio with a dollar averaging approach during the coming two years.

About the author: Clif Droke is a veteran gold market analyst and published author. He can be contacted at clifdroke@protonmail.com

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.