Stocks: What This "Record Extreme" Indicator May Be Signaling

Stock-Markets / Stock Markets 2024 Mar 09, 2024 - 10:29 PM GMTBy: EWI

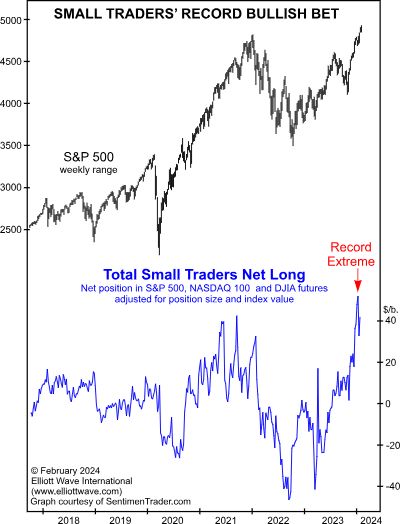

"The total easily exceeds the prior net long extreme"

When most everyone agrees on the future trend of a market, it's almost guaranteed that the market will go in the other direction -- sooner rather than later.

The reason why is that there is no one left to convince, hence, the market in question will likely have difficulty going in the predicted direction.

As Robert Prechter notes in a classic Elliott Wave Theorist (a monthly publication which analyzes major financial and cultural trends):

The more convincing the arguments seem, the surer one can be that a consensus is signaling a turn in the other direction.

With that in mind, consider this chart and commentary from the February Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets:

[A] new record was recently reached in the net long position of Small Traders as published weekly in the Commitment of Traders Report. The combined net long futures position of Small Traders in the S&P 500, NASDAQ 100 and DJIA soared to an all-time high of $51.59 billion on January 9. The total easily exceeds the prior net long extreme of $42.06 billion in September 2021.

As you may recall, that prior peak reading in investor sentiment occurred just weeks before the November 2021 top in the NASDAQ indexes.

That doesn't mean that the exact same scenario will play out again.

However, keep in mind that the patterns of investor psychology tend to be similar each time around -- as markets go from an uptrend to a downtrend and then back again.

And these patterns don't just apply to the typical retail or Main Street investor, they also apply to money managers who may oversee portfolios in the tens of billions of dollars. Here's a quote from another classic Theorist:

Small traders are typically on the wrong side of the market at the turns. You might think that large traders, because they have a lot more money, are right a lot, but they are likewise usually wrong at the turns.

The repetitive patterns of investor psychology show up as Elliott waves on the charts of widely traded financial markets.

If you are unfamiliar with the Wave Principle, read Frost & Prechter's Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here's a quote from this "must read" book:

Without Elliott, there appear to be an infinite number of possibilities for market action. What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott's highly specific rules reduce the number of valid alternatives to a minimum.

No analytical method can guarantee a particular outcome in financial markets but given Elliott waves reflect the repetitive patterns of investor psychology, the knowledge those waves provide about the market's position within the behavioral continuum is extensive and second to none.

You may be interested in knowing that you can access the online version of the book for free once you join Club EWI, the world's largest Elliott wave educational community.

A Club EWI membership is free and allows you access to a wealth of Elliott wave resources on investing and trading without any obligations.

Just follow the link to get started: Elliott Wave Principle: Key to Market Behavior -- get instant and free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Stocks: What This "Record Extreme" May Be Signaling. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.