US Interest Rates - When WIll the Fed Pivot

Interest-Rates / US Interest Rates Mar 01, 2024 - 04:36 AM GMTBy: Nadeem_Walayat

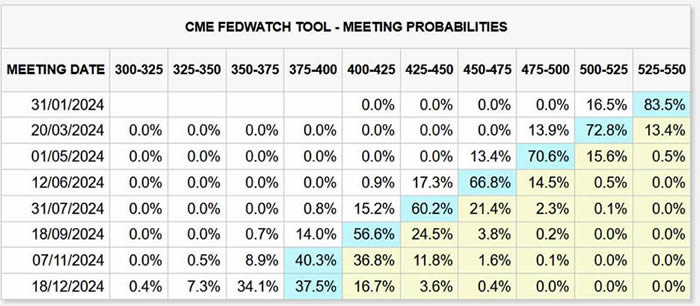

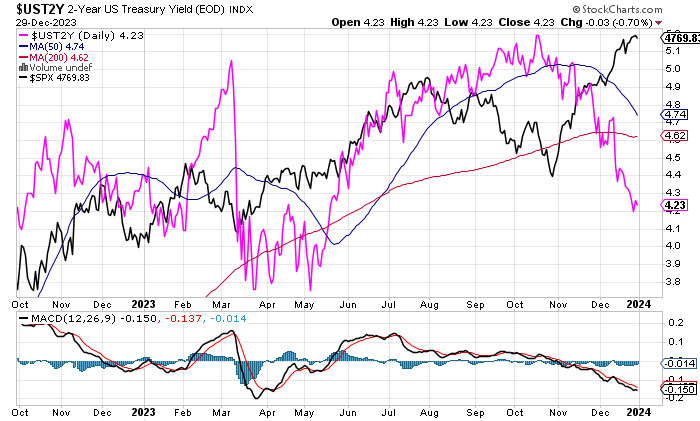

The current Fed Funds rate is 5.25% with he market expectations for the cuts to commence March 2023, though the market has been wrong for the whole of 2023 when Fed rate cuts were always seen as starting some 6 months into the future! In reality it does not matter when the Fed cuts rates because the Fed FOLLOWS the market rates not sets them. And the market rates as evidenced by bond yields has been falling for the past few months.

(Charts courtesy of stockcharts.com)

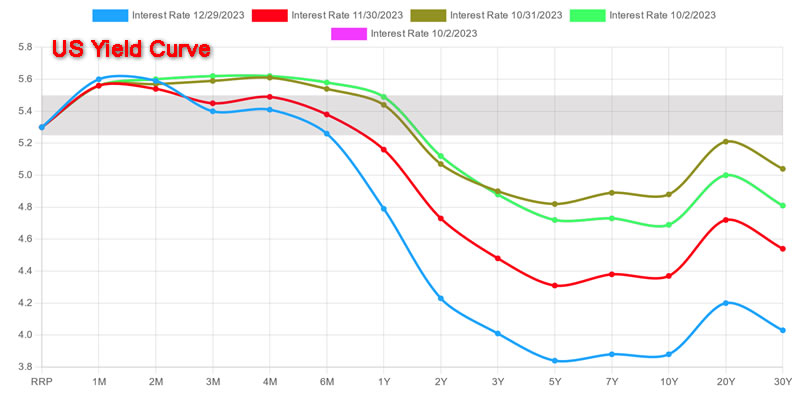

So whilst there has been no movement on the short end, the long end has seen a huge moderation in yields with the 10 year falling from 4.9% 3 months ago to 3.9% today which illustrates the point that the Fed FOLLOWS the market rather than leads the market as most financial instruments such as mortgages base their rates on the longer end of the yield curve and thus have effectively experienced a 1% cut in their interest rate.

So even though what the Fed does is a nothing burger, i.e. follows the market rather than leads, nevertheless the lemmings that are market traders and fund managers tend to react to the Fed to an extent that it can deliver short-term volatility especially if taking place at times of expected market Junctures such as the scenario that the current upswing should terminate during January which could be timed to take place with the 31st Jan Fed decision, though in respect of which there is an 83% probability for no change in the Fed funds rate.

However by March with CPI under 3% the Fed should start to reduce the Fed funds rate to track falling inflation given by then the gap will be over 1.5% that could see the rate drop by 0.75% by the time of the June 12th meeting.

What does this mean for the stock market.

It does imply economic weakness because as the Fed keeps reminding us it is not going to cut the fed funds rate anytime soon, so there is economic pain for the consumer on the short-tend, but rates on the longer will continue to improve depending on how tight the credit markets are, it's basically a balancing act between trying to keep a lid on inflation so depress the economy but not to the extent to trigger inflation as that would make the US debt to GDP state even worse.

The Fed is trying to engineer a weakly growing economy engineered to depress long-rates for the treasury to issue bonds at as low a coupon as possible below 4%.

A balancing act for the economy and the stock market which implies volatility with an upwards bias, i.e. the stock market should end 2024 higher then where it began, 2023 saw a 24% advance, it's not going to be 24% because this is balancing act that most are blind to i.e. everyone is waiting for the inversion to end and then rates to be cut, which as things look neither of which may happen much during most of 2024.

This video is an excerpt from my in-depth analysis and concluding S&P detailed trend forecast for 2024 - S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024 has first been made available to patrons who support my So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, this is your last chance to lock it in now at $5 before it soon rises to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Analysis that seeks to replicate the accuracy of 2023:

S&P Stock Market Analysis, Detailed Trend Forecast Jan to Dec 2024

CONTENTS

Investing in the Stock Market is Like Boxing With Mike Tyson

Keep Calm and Carry on Buying Quantum AI Tech Stocks

Synthetic Intelligence

The Roaring AI 2020's

Stock Market 2023 Trend Forecast Review

STOCK MARKET DISCOUNTING EVENTS BIG PICTURE

Major Market lows by Calendar Month

US Exponential Budget Deficit

QE4EVER

US Stock Market Addicted to Deficit Spending

INFLATION and the Stock Market Trend

US Unemployment is a Fake Statistic

S&P Real Earnings Yield

S&P EGF EPS Growth

When WIll the Fed Pivot

Stocks and Inverted Yield Curve

The Bond Trade and Interest Rates

US Dollar Trend 2024

US Recession Already Happened in 2022!

US Presidential Election Cycle and Recessions

Margin Debt

Stock Market Breadth

Stock Market Investor Sentiment

Bitcoin S&P Pattern

SP Long-term Trend Analysis

Dow Annual Percent Change

Stock Market Volatility (VIX)

S&P SEASONAL ANALYSIS

Correlating Seasonal Swings

Presidential Election Cycle Seasonal

Best Time of Year to Invest in Stocks

Formulating a Stock Market Trend Forecast

S&P Stock Market Trend Forecast Jan to Dec 2024

Quantum AI Tech Stocks Portfolio

Primary AI Stocks

AI - Secondary Stocks

TESLA

Latest analysis - How to Profit from the Global Warming ClImate Change Mega Death Trend

I'm a climate change denier! I deny the right of climate change to prevent me from getting richer! Large swathes of planet may become a scorched earth but.....

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide 2023

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your crypto's accumulating analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.