Taiwan 2024 Election: Militarization or Development

Politics / GeoPolitics Nov 28, 2023 - 07:36 PM GMTBy: Dan_Steinbock

Taiwan's elections loom just a few weeks away. Continued militarization would undermine past economic success. Taiwan is at its ultimate crossroads.

Taiwan’s presidential elections will be held on January 13, 2024. Re-elected in 2020, the incumbent President Tsai Ing-wen cannot seek a third term.

Tsai’s Democratic Progressive Party (DPP) has been a divisive force that has benefited from President Obama’s pivot to Asia, Trump’s efforts at effective normalization and Biden’s attempt to capitalize on the consequent tensions to contain China’s economic rise regionally and globally.

But nothing in this election is what it seems to be.

DPP’s “American way”

After two consecutive terms, the incumbent Tsai resigned as DPP Chair in 2022, following the party’s poor performance in the local elections that caused great concern among the DPP leadership. Afterwards, Vice President Lai Ching-te (also known as William Lai) was “unanimously elected” to succeed her as the party chair.

Tsai beat Lai in the 2020 primary. To unify the DPP, Lai was then selected to be Tsai’s running mate. There was no primary.

A legal trade scholar, Tsai spent years in the United States and the UK prior to her political career. Similarly, Lai, a public health expert, studied in the US. Recently, he named Hsiao Bi-khim, Taiwan’s envoy to the US as his running mate. Born in Japan, Hsiao grew up in Taiwan but moved to the US as a teenager in the early ‘80s. A political operative, she became active in DPP in the US, not in Taiwan. She renounced her US citizenship only in 2000.

In brief, Tsai, Lai and Hsiao have, as they say, "very intimate ties" with Washington. That seems to be the new norm from Afghanistan and Iraq to Ukraine and Israel.

Failed opposition unity

Until recently, the presidential election was dominated by four candidates: Lai Ching-te representing the incumbent DPP; medical professor Ko Wen-je, the former mayor of Taipei, representing the center-left Taiwan People’s Party (TPP); Hou Yu-ih, a police director and former mayor of New Taipei and of the major opposition party Kuomintang (KMT); and Terry Gou, founder and ex-CEO of Foxconn, the world’s largest multinational electronics contract manufacturer (Figure 1).

Figure 1 The Big-4

Source: Wikimedia Commons

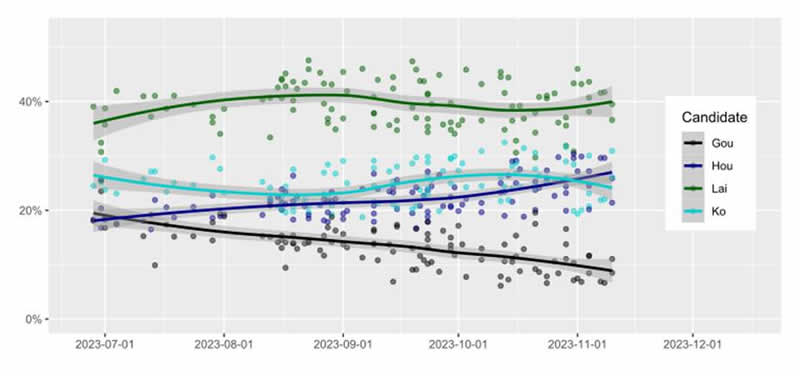

What complicated projections was Lai’s inability to raise his ratings and the effort by the KMT and TPP to combine their ticket. United, the two parties could have garnered up to 50% of the Taiwanese vote (Figure 2). But mired in a contest over which party should field the candidate for president and which for vice-president, the TPP and KMT failed to agree on a joint presidential ticket.

Figure 2 Taiwan’s election polls in mid-November 2023

Sources: Local regression of Taiwanese 2024 election polls

Now each has chosen his running mate. Hou opted for the fiery media personality Jaw Shaw-kong, who in the '90s led a pro-unification party. Recently, Jaw has reiterated his view that unification is the prime way to avoid a major conflict. He believes most Americans don't want a war in Taiwan Strait, but believes that the US military-industrial complex does.

Ko's running mate is a TPP lawmaker Cynthia Wu, whose family is a major shareholder of conglomerate Shin Kong Group. Like DPP leaders, Wu has close ties with the West. She is an ambitious ex-Merrill Lynch banker who used to serve as an assistant for Peter Lilley, ex-minister of the Conservative Thatcher and Major cabinets; a pro-Brexit right-winger who the satirical Spitting Image oncedepicted as a Nazi commandant.

The KMT/TPP combine would have been DPP’s nightmare. But the failed joint ticket is manna from heaven to the DPP, which Beijing considers secessionist.

What makes this scenario problematic is that it is a political stalemate that fails to reflect the voters’ views. Currently, one of every three Taiwanese supports DPP’s highly confrontational policies toward China. By contrast, almost every second Taiwanese would prefer a less confrontational stance and greater focus on domestic economy. The changing status quo is reflected by the tight legislative race. Currently, the DPP has a majority, but the party may fail to maintain its hold over the unicameral legislature.

US arms sales and Taiwan’s escalating militarization

If tensions have escalated in the Taiwan Strait, much is due to Washington’s multi-billion-dollar military aid for Taipei in recent years, including an $8 billion deal to deliver 66 F-16 fighter jets by 2026.

In the past, U.S. stated policy toward Taiwan prioritized peace and stability across the Taiwan Strait. Today, the strategic objective seems to be the preemption of China’s economic rise. From Beijing’s perspective, the US is exploiting Taiwan as a pawn in its not-so-grand chessboard, to undermine China.

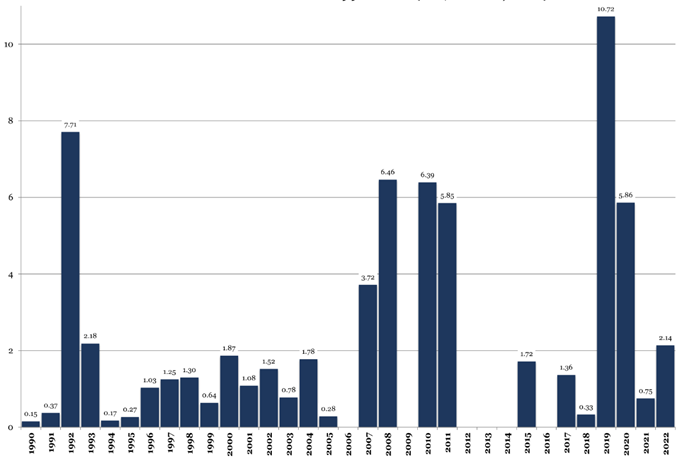

These concerns and China’s large-scale military exercises in the area have intensified in parallel with US military escalation. Between 1950 and 2022, Taiwan was the 4th largest purchaser in the US foreign military sales; in 2020-22 combined, the largest (Figure 3).

Figure 3 Taiwan Arms Sales 1990-2022

Sources: FMS Data from the Defense Security Agency (www.dsca.mil); Kan, S. 2015. Taiwan: Major US Arms Sales since 1990. CRS Report RI30957, Jan 5; last updated Dec 28, 2022 by US- Taiwan Business Council

In July, the Biden administration announced it would transfer $345 million in defense items to Taiwan, which were later coupled with $135 million via military financing programs. The latter are likely to include portable air defense systems, small arms munitions and reconnaissance equipment. Thanks to US foreign assistance, Taiwan is also authorized to Pentagon’s stocks up to $1 billion annually in defense articles, services and training.

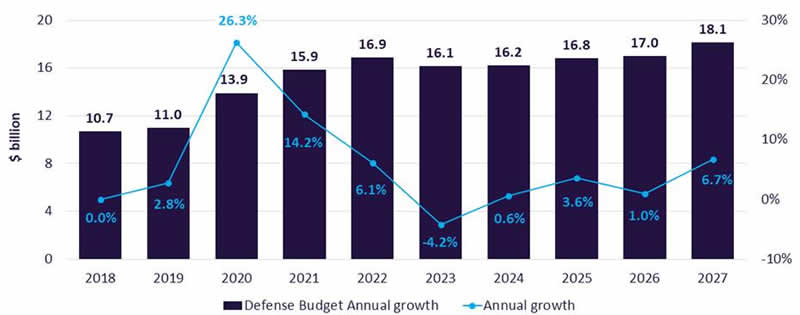

In August, Taiwan announced plans to increase its total defense spending to a record $19.1 billion, equivalent to 2.6% of GDP. That outpaces even NATO allies, such as the United Kingdom, France, Italy, and Germany (Figure 4).

Figure 4 Taiwan’s Defense Budget ($ bn) and Growth Rate (%)

Source: Ministry of Finance, Republic of Taiwan

However, all military expenditures have opportunity costs. And the cold reality is that with increasing militarization these costs are climbing, fast.

Taiwan’s double-whammy

In the first half of the year, Taiwan’s GDP shrank, despite a rebound in the second quarter. The main risk to the outlook is persistently weak global demand, which continues to weigh on exports.

Worse, exports to China, which Washington seeks to isolate, have not picked up in recent months despite continuing rebound there. China remains Taiwan’s primary export market for electronic components, accounting for more than half of the total. And China plays a critical role in a host of other Taiwanese industrial sectors.

Still worse, any reconfiguration of supply chains in advanced technology, which the US is promoting in the name of “national security,” can further dampen Taiwan's exports.

Bluntly put, Taiwanese economy is heading toward a double-whammy. On the one hand, DPP's leaders have pushed the island into the Pentagon's arms, which is penalizing the island’s economic futures. On the other, this very same effort is associating Taiwan with the West’s cost-of-living crises and secular stagnation.

It’s a fatal embrace.

From politics of distraction to economic traps

In the late 20th century, Taiwan joined the newly-industrialized Asian dragons by focusing on economic development. But since 2016, the DPP has shifted national focus toward geopolitics. Such politics of distraction can sideline but not overcome the impending economic landmines. You can't have your cake and eat it too.

In the past months, private consumption still bolstered growth, but the positive effects of loosened COVID-19 restrictions have waned and the export-oriented economy must now find new drivers of growth, as the Asian Development Bank recently suggested.

In Taiwan, the key challenge is to translate the economic frustration of the people into a viable political force. Geopolitics is a recipe to a national disaster with regional, even global repercussions.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2023 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.