Quad Witching Cracks Stock Market Nuts

Stock-Markets / Financial Markets 2023 Nov 18, 2023 - 10:26 PM GMTBy: Nadeem_Walayat

The S&P is complying with trend forecast expectations that saw Friday's Quad Witching day end down 1.22% at 4450, where some hours before the open I commented -

"It's QUAD Witching DAY. There is a 90% probability for a STRONG DOWN DAY! Which given where the likes of Apple are perched just above support should act as a catalyst for the the sell off into October."

Whilst apparently someone called Cem Karson was eager to convince folks that a correction was 'almost impossible!'

The S&P continues to target sub 4200 by Mid October after having generated a kink in the MACD indicator.

And as per October 2022 analysis - .

Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

S&P targets a trend to 4600 by Mid Summer 2023 before correcting to below 4100 by late October.

This analysis Quad Witching Cracks Stock Market Nuts was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And gain access to my most recent analysis -

- AI Tech Stocks - The Good, the Bad and the Ugly

- Last Chance to Get on Board the Bitcoin Crypto Gravy Train - Choo Choo!

- AI Stock Market CRASH WARNING Going Into Big Tech Earnings Week

- Stock Market Earnings Season Buying Opportunities

And access to my exclusive to patron's only content such as the How to Really Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide 2023

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

Since which several stock nuts have cracked most notable of which are ASML, KLAC, LRCX, AMD, AMAT...

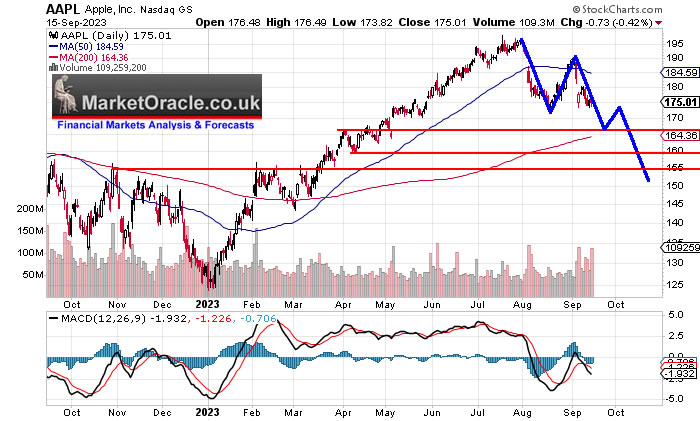

Though the biggest nut of all Apple at $175 remains pending a break below $174 to target sub $160 which would deliver the S&P trend to sub 4200 with my central target of 4150. I plan to do most of my buying in the $160-$145 range.

Meanwhile there are some AI stocks such as Google that remain strong with no sign of any reversal which is why I have repeatedly warned not to get carried away with trimming Google. It's amazing to think that the MSM nothing burgers were busy convincing the retail crowd that Google at sub $90 was FINISHED due to Chat GPT killing search. Well six months on Google is near 60% higher! Whilst no longer cheap, nevertheless the metrics are strong i.e. EGF's and its fundamentals score. It is NOT easy to buy a stock when it is cheap, people want assurances that largely only be known with the benefit of hindsight and thus all one has is ones experience, metrics and rules that tell you what to do if one is able to tune out MSM and the BlogosFear, just look at the chart the cheaper Google got the less folks wanted to buy and even considered selling, go back and read the comments at the time.

At best GOOG could trade to sub $130 to target $120, but there is no sign of that happening yet.

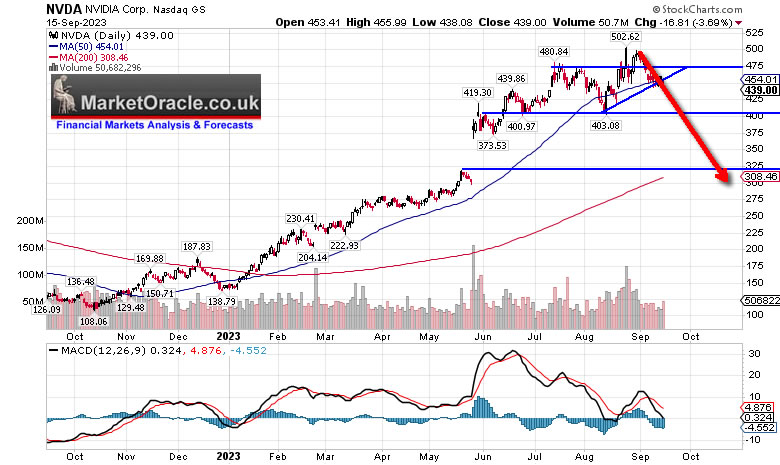

NVIDIA

Nvidia is another nut waiting to crack. It's pending a break below $400 to target sub $330, which if achieved I imagine would overshoot down towards $260. So Nvidia has huge downside potential, hence why I only hold 1% of target exposure but it needs to break below $400 to kick start the bulk of the down move.

TSMC

TSMC peaked early June, traded down by 20% since into a sticky support zone where buyers are stepping in to accumulate so there does not appear to be much scope for further downside, i.e. there is a lot of buying under $90, at best we could see $82 during a market slump.

Micron

Still trading near it's high Is primed for a sell off to at least $61, and likely sub $60.

When you look a the differing trends of these 5 stocks one should realise just how pointless it is to base ones decisions off indices such as the S&P or Nasdaq.

AI Tech Stocks Portfolio

Current state is 78% invested, 22% cash where I am currently targeting being about 86% invested.

https://docs.google.com/spreadsheets/d/13gDntQuyDP3db7WqEvOXftOxVVTJyYyB_s-O0XW2EIk/edit?usp=sharing

Stocks in or very near their buying ranges and how far they have deviated from their 52 week highs.

AMD -24%

TSM -20% - Not much downside.

Qualcom -19% - Could go sub $100.

ASML -23% - I am eager to load up the back of the truck, buying opps don't come along often.

Pfizer -38%

LMT -17%

RTX -28%

UKW -17%

DIODE -21%

CRUS -34%

HPQ -19%

KLA - 13%

PRX -19%

INMODE -30%

MPW -55%

RDFN -53%

Tencent -24%

MGNI -49%

Roblox -41%

DOCU -37%

Which illustrates why the S&P is a nothing burger, folks waiting for the S&P to top missed many highs for instance AMD topped out at $133 in Mid MAY! And now wait for the S&P sell off to buy though by the time they do they will likely find that many of their target stocks will already have bottomed and thus ask why is x going up when everything else is going down, when one should just take what the bull market giveths. Remember you cannot buy or sell with the benefit of hindsight.

New Column - What I am Currently Targeting % Exposure. Which gives a direction of travel of where I am heading towards in terms of each stock i.e. if the percent is higher then current Exposure then I am seeking to accumulate, if lower then I am seeking to trim which is what I pay attention to on a near daily basis. Keeps one focused on what one should be doing i.e. seeking to accumulate into Google rather than trim the highs. Whilst the column it replaced is in the last archive tab.

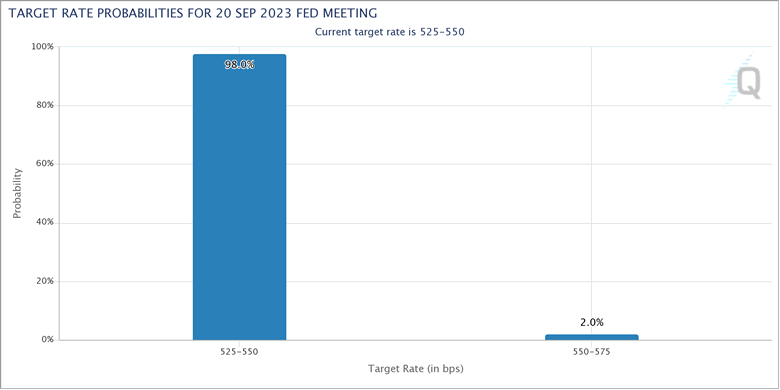

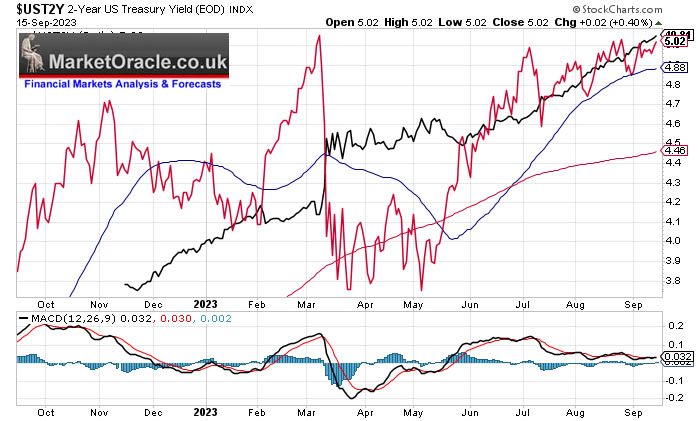

US Surprise Rate Hike?

The consensus view as illustrated by FedWatch's 98% probability that rates will be kept on hold at the 20th Sept Meeting.

But that's not what the bond market is suggesting when looking at the 2 year and 12 month, it's not showing signs of signaling a hold, I know it's going heavily against the consensus who are 98% convinced that rates will be kept on hold at the next meeting, whilst if a surprise rate hike does happen then that's going to see a sharp drop in stock prices.

THE BOND TRADE

Current state of where I am seeking to buy (top of the buying range)

IBTM.L 133.6

IBTL.L 2.72

GLTL 35.8

3GIL.L 65.2

Remember this is a trade and not something to get carried away with as I consider bonds a BAD longer term investnment, where I seek Bonds to comprise about 2% of my portfolio, so more a case of a relatively low risk hedge against a recession during 2024.

Argentina on the Brink of Economic COLLAPSE!

11% inflation, ELEVEN PERCENT per MONTH! That's 124% per year! What happens when Inflation is 124%? 118% INTEREST RATE! Good luck with trying to borrow anything in Argentina. The Cost of living crisis is on an whole different scale prompting Argentines to STOP using the Peso and switched to using the US Dollar, you do not want to hold any PESO's! As soon as Pesos touch your hand off you go and exchange it for US Dollars, not Gold, not Bitcoins but US DOLLARS!

This is one of the primary reasons why folks around the world invest in US stocks to escape weak domestic currencies, despite GBP having enjoyed a cyclical bull market off the Truss collapse, that has fulfilled my original objectives, the reality is that over the long run the the risks are to the downside, though thankfully not to anywhere near the extent of the Argentine Peso which is effectively a dead zombie currency.

Death of the Dollar they say. DEATH? More like increasing dollarisation of the World! This is a trend that has been in progress for many years all whilst the nothing burgers continuously report that the death of the Dollar is imminent! Run a mile from such clueless analysts! Every other currency will die before the US Dollar!

How to Bring Inflation Under Control

It's simple Push Interest Rates Above CPI and Inflation will come under control.

USA CPI 3.7%, IR 5.5% Spread -1.8%

UK CPI 6.4% IR 5.25% Spread +1.15%

Eurozone CPI 5.3%, IR 4.5% Spread +.8%

China CPI 0.1% IR 3.45% Spread -3.35%

Turkey CPI 60%, IR 25% Spread +35%

UK and Eurozone are going to experience more inflation pain

US for the time being has brought inflation under control though it's going to be tough to get to 2%.

Turkey has hyper inflation with no end in sight, destroying their currency, this is what happens when governments truly lose control of inflation, it is very difficult to bring back under control. Though it's not easy to capitalise on the inflation for instance traveling to Turkey is not going to yield any bargains for foreigners as locals are desperate to loot the tourists of their fx loot, which is not good for Turkey as it leaves a bitter taste amongst Tourists who will be less inclined to visit the likes of Istanbul..

Crude Oil Brief

Talking about inflation, crude oil price is looking bullish, if it breaks above $94 it could spike to $105.

I have accumulated a little into OXY, a look at oil stocks was on my to do list but I never got around to it. It's one of those times where most things say price should fall i.e. brewing recession but the chart says price could rise.

Coming soon - How to Really Get Rich Part 2 from which young Padawans will learn how to use the FORCE whilst avoiding succumbing to the Dark side!

This analysis Quad Witching Cracks Stock Market Nuts was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top, followed by correction into Mid October.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your cryptos accumulating analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.