Stock Market Seasonal and Presidential Cycle Analysis, Bitcoin Final Warning!

Stock-Markets / Stock Market 2023 Nov 05, 2023 - 04:00 PM GMTBy: Nadeem_Walayat

Your analyst back from scam central (Istanbul), tourists need to factor in a getting scammed tax when visiting. Since my last article the S&P hit a low of 4333 followed by an ABC rally to a swing high of 4533, whilst a consolidation of the advance was expected, still this was more powerful than how I imagined it would play out ahead of targeting sub 4200 by Mid October and thus presents a significant deviation against my original trend forecast of some 11 months go.

Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

S&P targets a trend to 4600 by Mid Summer 2023 before correcting to below 4100 by late October.

The S&P breaking to a new bull market high would act to end my trend forecast, but we are NOT there yet hence the title of this article, the stock market should be ready to tumble! Either that or it is time to for a repeat of last years in-depth analysis to conclude in a trend into the end of 2024.

Therefore this analysis seeks to determine what is most likely to transpire over the coming weeks either the anticipated correction to sub 4200 by Mid October or the unexpected resumption of the bull market towards a new high after a relatively mild correction to 4333.

This analysis Stock Market Ready to Tumble was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

And gain access to my most recent analysis -

And access to my exclusive to patron's only content such as the How to Really Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide 2023

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

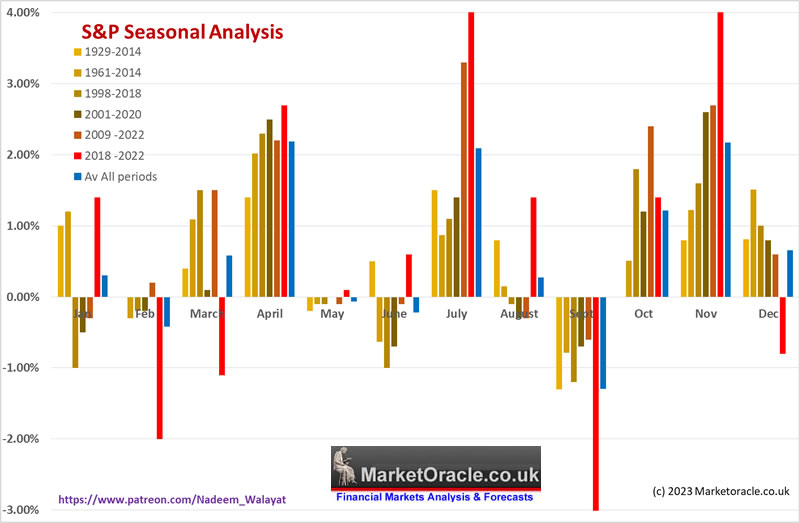

Seasonal Trend Analysis

The seasonal pattern suggested that after a pause in Feb the stock market should trend higher into early May for a weak May before correcting into late June follower by a strong July rally into Mid August before ending flat on the month, then followed by a weak September likely into early October that resolves in a rally into late December.

So how have things actually panned out?

Strong January - check

Weak Feb - check

Strong March - check, yes the low came in March but the ended strongly higher.

Strong April - check

Flat May - check

Down June - FAIL - June was one of the strongest months of the year which caught many off guard.

Strong July - Check

Flat August - FAIL - August ended DOWN 1.8%.

So out of 8 months 6 checks and 2 fails for a 75% hit rate, which is pretty good for ONE tool! The various time frames also give insight into probabilities, for instance both June and August showed variability and thus one would not take the seasonal pattern too literally for these months. Whereas there is little variability for September, October and November, whilst variability for December implies the month could turn out to be much weaker than most will be expecting going into December and stocks could even end down on the month!

As for 2024, a weak December would set the scene for a strong January but I am starting to go a little off script here as the focus of this analysis is September and October and not 2024..

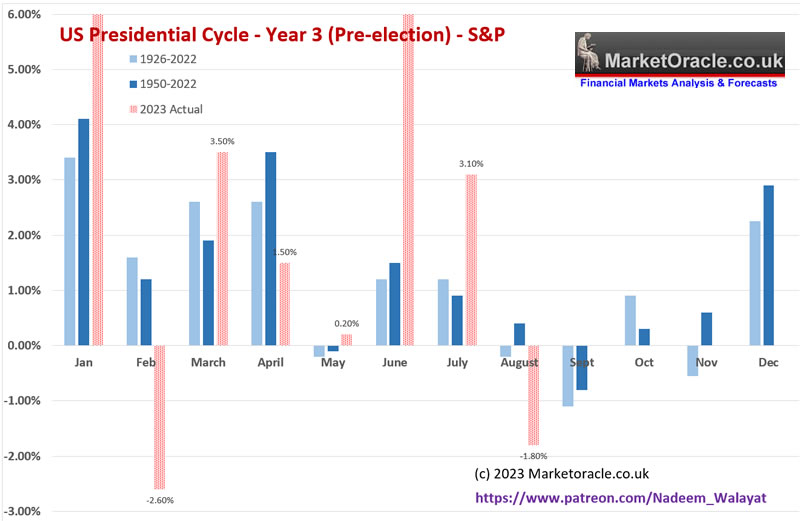

Presidential Election Cycle Seasonal

Seem's like everyone's woken upto the importance of the US presidential election cycle. However as is the case with the seasonal pattern it is not the holy grail, has a similar 75% hit rate to the all years seasonal pattern where the real value is when one puts both together. In which respect confirms September should end DOWN, October higher whilst November and December could switch places, i.e a weak November would imply a strong December and visa versa.

So the seasonal point to a weak September into early October and then a rally into the end of October so are supportive of my view that the stock market is ready to tumble.

S&P Measuring Move

Rally from 4333 to 4540 is 207 points, 4333 - 207 points = 4126. Not a forecast rather another piece of the puzzle eyeballing sub 4200, and my long standing objective of 4150 as being probable.

So stock market eyes sub 4200, and eying achieving 4150 with possibility of overshoot to just under 4100 over the next 4 to 6 weeks. Therefore the market is primed to snap back inline with my trend forecast by means of taking a significant tumble over the coming weeks where we can all look for catalysts for but the forecast remains blind to all that has transpired since it was posted 10 months ago!

Loads of Money!

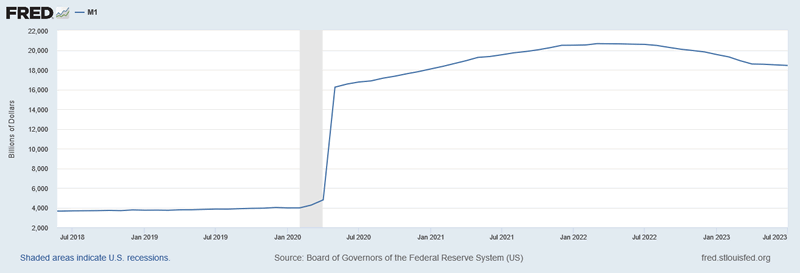

The key fundamental that counts for why the inflation of 2022 into 2023 was so obvious as early as March 2020 is the expansion in the money supply!

Rampant money printing! And I am mot saying this with the benefit of hindsight as I wrote at the time in March 2020 "get ready for very high inflation by investing in assets that are leveraged to inflation such as AI tech stocks and housing".

Yes the government / Fed panicked and have tried to bring INFLATION under control by reducing the money supply which is down about $2 trillion from it's peak. However the problem is that whilst during the reduction phase we will get lower manipulated CPI lie inflation. However as soon as the money supply starts expanding once more then the INFLATION will take off like a rocket again because folks will remember what happened during the inflation of 2021 to 2023, thus the velocity of money has INCREASED! The decades long trend that probably stretches back to the mid 1990's has REVERSED! You will see this when relatively little expansion of the money supply ignites a surge in inflation that will catch the EconoFools by surprise.

Do not be under any illusion! The fall in the rate of inflation due to monetary and economic contraction will be TRANSITORY! And worse for other western nations such as the UK who have very weak money printers vs that of the US.

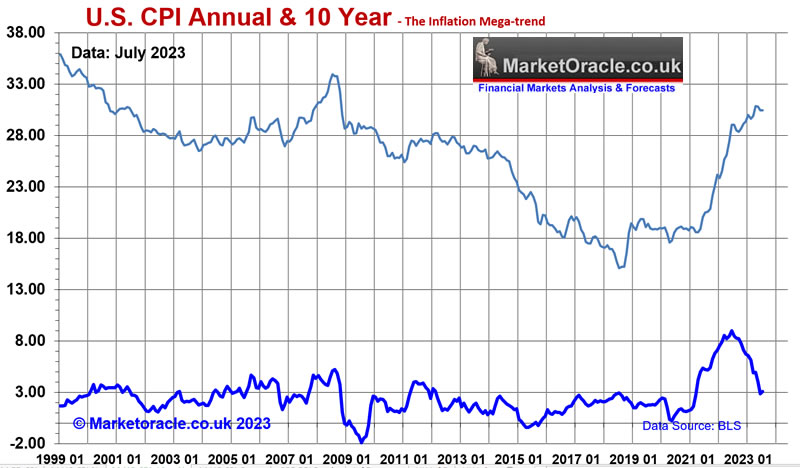

Therefore nothing has changed, vs I warned 3 years ago that high inflation will run for the whole of this decade where we will see waves of HIGH inflation followed by temporary periods of disinflation as the central banks hit their respective PANIC buttons, all whilst the REAL inflation pain for the MASSES will get worse with each passing year for the fundamental fact that the official inflation indices are FAKE! Real inflation is typically X2 to X3 the official inflation indices!

So the only way to protect ones wealth is by riding the Inflation waves by being exposed to assets that cannot be easily printed such as housing and stocks that don't tend to dilute or those that do that have huge revenue and earnings growth courtesy of AI and INFLATION! Everything that has happened over the past 3 years has acted to reinforce the INFLATION MEGA-TREND and what one should do to protect oneself from it's consequence, where we get BUBBLES such as 2001 that POP into bear markets such as 2022 to capitalise upon, I'm not saying it's going to be easy to do so just as the 2022 bear market was NOT easy to capitalise upon which was apparent by Mid October when this is what it was like to BUY those falling AI tech knifes as I ramped up my exposure to beyond 95% invested.

There will be severe draw downs that WILL BE PAINFUL, that as I voiced in Mid October 'should' prove temporary and hence all one can do is to GET THE JOB DONE! Either that or invest and forget and ride out the draw downs.

The politicians only know how to do one thing well which is to PRINT MONEY! Mark my words it won;'t be long before US M1 money supply surpasses it's 2022 $20.6 trillion peak.

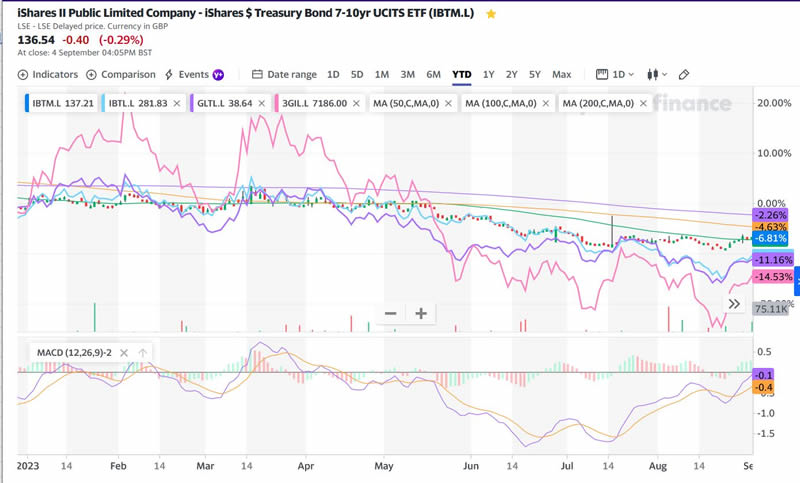

Bond Market Reacts to REAL INFLATION

Fake CPLIE has tumbled in the US and UK but the yields instead of falling have risen, why because real inflation persists! Where even when using official data we see this manifest in the 10 year rate that remains in an uptrend all whilst the econofools focus on the annual rate. Yes the annual rate is heading lower, may even touch 2% by Mid 2024 but the 10 year rate won't fall instead it will keep climbing higher to illustrate the REAL inflation pain that ordinary folk will experience just as I have been warning would transpire for several years is now coming to pass, FAKE smoke and mirrors annual CPLIE vs continuing real inflation pain!

Real inflation is twice CPLIE. and thus yields have risen as the market discounts higher REAL inflation which breeds opportunity for investing in bonds.

The Bond bear market is in it's last innings, failure to break to a new low would mark a higher low, of course I would prefer a lower low so as to allow for greater accumulation. but it would be a sign that the bear is over and thus target a break above the series of highs along $107 to mark the start of a 2 year bond bull run to deliver an estimated 50% return on the bond portfolio..

(Charts courtesy of stockcharts.com)

Target bond funds IBTM.L, IBTL.L, GLTL.L. 3GIL.L have continued to delivery opportunities to accumulate into, where I seek bonds to total roughly 2% of my portfolio (current 1.2%).

The bankrupt banking crime syndicate ensures that the Fed is not going to be able to keep rates high for long due to the risk of the crime syndicate starting to blow up again just as several regional banks did earlier this year which made a mockery of the Fed's Stress testing propaganda.

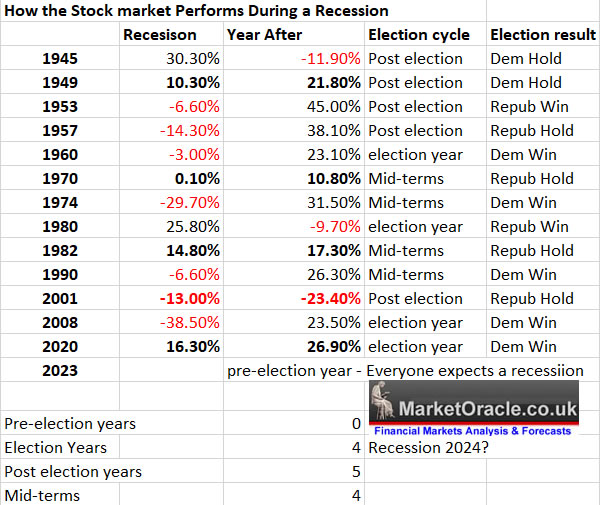

A Recession is Brewing

A reminder that a recession is brewing as illustrated by the US Presidential Election Cycle and Recessions analysis (Stock Market Gasping to Reach 4000 Ahead of Earnings Season, Dow New All Time High 2023?)

A recession was never probable for 2023, an MSM always imminent nothing burger that we have been exposed to since Q1 of 2022, hence why most were caught wrong footed and failed to invest going into the October 2022 low as all expected an imminent recession to deliver S&P 3200 or lower as illustrated by the high priests of nothing burgers JP Morgan.

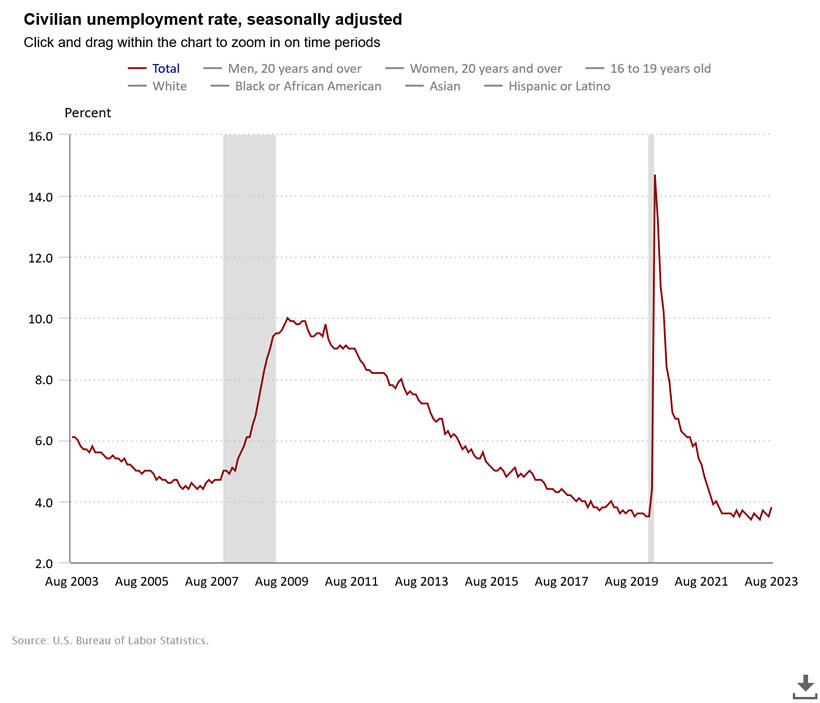

A recession is brewing, when I look at the likes of the Non Farm payrolls unlike most out there I don't strength, instead I see a MARKET JUNCTURE!

All markets peak in Euphoria and so it is with US employment where what we hear today is of a soft landing, goldilocks, though it never tends to pan out that way, I recall for virtually the whole of 2007 and most of 2008 all we heard was soft landing BS in the housing markets, when as I concluded in August 2007 the housing markets were going to CRASH, enter into a severe bear market, banks would go bust! A year before the fact! Here you can read the original analysis for yourself - 22 Aug 2007 - UK Housing Market Crash of 2007 - 2008 and Steps to Protect Your Wealth

So why the soft landing mantra, why did they all stick their heads in the sand, FEAR and DENIAL that's why, it was too painful to contemplate that which was set to pass and hence most sleep walked into the Financial Armageddon of Mid September 2008 when Lehman's went bust and set all of the banking crime syndicate dominos to fall that we got a small taste of earlier his year with the regional banks. The banks ARE a CRIME SYNDICATE, it's how the system is structured, thus the banking crisis is PERPETUAL! Without END! The criminals are imbedded so deep that there is nothing that can extricate them from the system, all we can do is to limit exposure to the crime syndicate and it's inflationary consequences,

And this is before we even consider the fact that the official unemployment statistics are FAKE as I covered in an recent article so won't repeat here, just that so many folks are acting on the basis of inaccurate bad data hence tend to get caught off guard when they find that the real economy is in a recession whilst the official data states not.

So we will have a recession during 2024, the magnitude of which is unquantifiable at this stage because we don't know what could BLOW UP, but I am pretty confident that it will be good for US bonds at least, when things blow up the Fed steps in to pump money into the system, forcing bond yields down that ignites the next inflation wave as the Inflation Mega-trend is EXPONENTIAL, meanwhile the econofools peddle the false narrative of always imminent deflation, PAID STOOGES is what they are, Economics is a priest hood of paid stooges, a false religion!

And here's a tid bit of information you may not be aware of which is that Democrat presidencies tend to CREATE far more jobs than Republicans.

Stocks Portfolio

Updated strategy and trend status for Medium and High Risk stocks. All Medium risk are GREEN and most High risk stocks.

https://docs.google.com/spreadsheets/d/13gDntQuyDP3db7WqEvOXftOxVVTJyYyB_s-O0XW2EIk/edit?usp=sharing

The % from Top of Buying Range column is good for eyeballing opps, a red minus percent shows the level of opp, quick glance at it shows TSMC, ULH, and maybe MED, and Roblox, in the high risk. several more at +1% so worth a look to add to i.e. GFS, HP - though that was -10% just a few days ago. The column is good as it updates in real time as prices change. That's what I mostly use during a trading session, just the percent from the top buying level, so as to not waste time thinking, just pull those triggers, so, get used to glancing at that column for small buy opps that don't require much thought.

Best Stocks and Shares ISA

A patron asked what's the best stocks and shares cash ISA right now, the answer is Trading 212, commission free, platforms okay, it works, low fx fee, you can do your own more thorough research vs others to soon conclude that it's currently the way to go. Also helps spread the risk amongst ISA providers.

And there's a promo underway where we both get a free share upto £100 (pot luck, probably less than £30) using this link - https://www.trading212.com/invite/16aA4Pdcoi

BE Semiconductor

BESI.AS a dutch semiconductor mini ASML stock that looks interesting, though not at the current price of $107, IF it falls to sub $85 I'll start accumulating into this Euro 10 billion market cap stock and look to incorporate it into my high risk portfolio accompanied with more detailed analysis, but for now I have my eye on it should an opp to accumulate arise during a market correction.

Bitcoins FINAL Correction Underway?

Why is the bitcoin price falling if we are trending towards the SEC approving bitcoin etf's i.e. black rock?

I smell dark pools of capital at work engineering favourable price action to accumulate into. This could be the FINAL bitcoin dump before we wake up to a bull market to NEW ALL TIME HIGH's .during 2024 How low? maybe fall to 20k.... I will be scaling in as low as it goes, for the X4 to X5 payoff.

Target for next bull market is $98k to $130k to distribute into.

Where do I keep my crypto?

I use trust wallet, etorro platform (not wallet), have some on nicehash via mining, conbase and have a little left on binance having moved most off to trust wallet. If accumulation goes to plan then probably 2/3rds of my crypto will be on the etorro platform vs current 1/4.

This analysis Stock Market Ready to Tumble was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top, followed by correction into Mid October.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

And my most recent article - Quad Witching Cracks Stock Market Nuts

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimmed the FOMO to buy the Dip analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.