Dead Ends Ahead for Silver Price

Commodities / Gold & Silver 2023 Sep 24, 2023 - 05:59 AM GMTBy: P_Radomski_CFA

With the fundamental roadblocks adding up, silver confronts a bearish outlook at nearly every turn.

With the FOMC’s hawked-up SEP and Powell’s inflation focus upending several risk assets, rising real interest rates continue to weaken silver’s bull thesis. And with the Fed chief promising more of the same on Sep. 20, higher interest rates and/or a recession are both bullish for the USD Index. Powell said:

“The worst thing we can do is to fail to restore price stability, because the record is clear on that. If you don’t restore price stability, inflation comes back and... you can have a long period where the economy is just very uncertain, and it’ll affect growth. It... can be a miserable period to have inflation come constantly coming back and the Fed coming in and having to tighten again and again.”

Thus, with Powell keen on avoiding the mistakes of the 1970s, the soft landing narrative should disintegrate as the inflation fight continues. For example, the National Association of Homebuilders (NAHB) released its Housing Market Index (HMI) on Sep. 18. The report stated:

“All three major HMI indices posted declines in September. The HMI index gauging current sales conditions fell six points to 51, the component charting sales expectations in the next six months also declined six points to 49 and the gauge measuring traffic of prospective buyers dropped five points to 30.”

Worse Conditions Ahead

More importantly, the drag was driven by higher long-term interest rates, which we warned were the key ingredient for a recession. And with the rate surge still ongoing, the situation should worsen and help push gold off the recessionary cliff.

Please see below:

Likewise, while homebuilder confidence has come under pressure from higher long-term Treasury yields, there is still plenty of room to fall.

Please see below:

To explain, the green line above tracks homebuilder confidence, while the red line above tracks homebuyer confidence. If you analyze their movement, you can see that the pair were largely interconnected since the 1980s. Yet, with unaffordability pushing the red line to/near its all-time lows, higher long-term interest rates make the situation even gloomier. As such, the data does not support a soft landing.

Speaking of which, RedFin – a U.S. residential real estate brokerage and mortgage origination company – revealed on Sep. 14 that “the median U.S. monthly mortgage payment hit an all-time high of $2,632 during the four weeks ending September 10.” And again, long-term interest rates are higher now, which means even worse conditions in the weeks ahead. The report added:

“It’s more expensive than ever to buy a home, with monthly payments at a record high due to stubbornly high rates and home prices. Although the weekly average mortgage rate has declined slightly from August’s two-decade high, it’s still sitting above 7%. Prices are up, too, increasing 4% year-over-year (YoY).”

Please see below:

Oil Is a Bad Indicator

While some view higher oil prices as an indicator of economic prosperity, the harsh truth is that crude is a late-cycle darling that only dampens the economic outlook. Remember, higher oil prices increase gasoline and heating costs for Americans. And with the colder weather poised to bite over the next 60 days, that’s less disposable income to spend on S&P 500 companies’ goods and services.

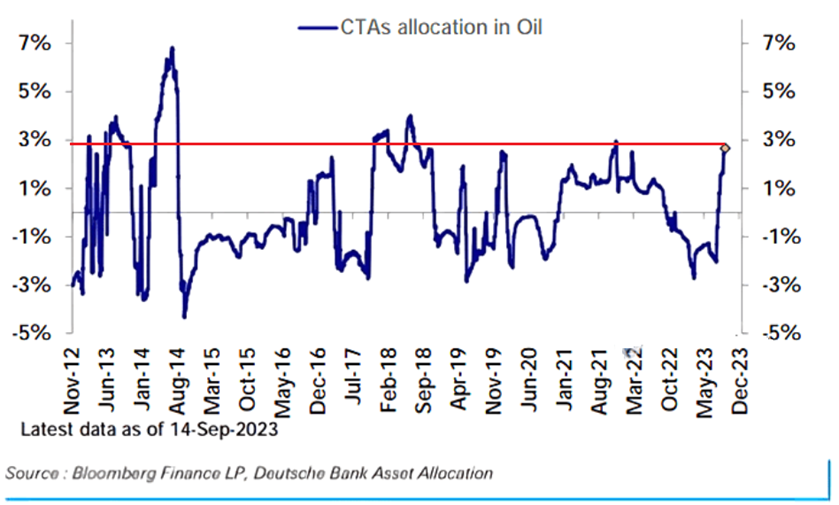

Furthermore, with the CTAs’ (algorithms) momentum bets boosting prices, the unraveling should be swift when the recession scars become more obvious.

Please see below:

To explain, the blue line above tracks CTAs exposure to oil. If you analyze the horizontal red line, you can see that the bulls are nearly all in, and a major liquidation is unlikely to help the S&P 500 or the PMs. In other words, when volatility strikes and is a function of real fear, the ramifications are highly bearish for risk assets like silver and mining stocks.

Overall, soft landing expectations and FOMC belief helped elicit a prominent bond-market sell-off. Yet, the irony is that higher long-term interest rates only increase the chances of a recession, which negates the two catalysts that pushed them higher in the first place. But, the USD Index should be a profound winner from the rate re-pricing, while the PMs will likely come out on the losing end.

To understand how to read and react in real-time, subscribe to our premium Gold Trading Alert. We’ve made money on 10 consecutive trades and think even more profits will blossom in the fall and winter months. Moreover, combining the technicals with the fundamentals allows you to manage risk when liquidations unfold.

By Alex Demolitor

Alex Demolitor hails from Canada, and is a cross-asset strategist who has extensive macroeconomic experience. He has completed the Chartered Financial Analyst (CFA) program and specializes in predicting the fundamental events that will impact assets in the stock, commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found above represent analyses and opinions of Alex Demolitor and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Alex Demolitor and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Alex Demolitor reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Alex Demolitor Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.