Why we won't see a repeat of the 1970's Rate Hikes

Interest-Rates / Global Financial System Sep 21, 2023 - 10:28 PM GMTBy: Nadeem_Walayat

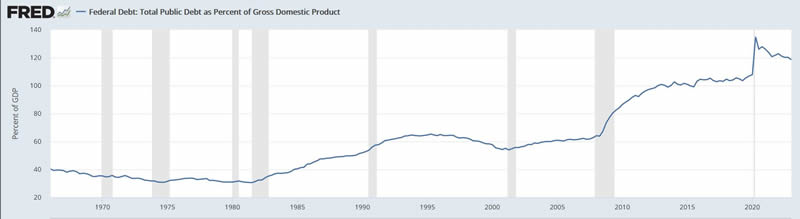

Doom merchants continue to run off to the 1970's rate hikes that culminated in eye watering 15% completely miss what's staring them in the face for why that CANNOT happen this time! It can't happen because Debt to GDP is triple that of the 1970's! 120% vs 40%, Raising the Fed funds rate to 15% again would be akin to a 45% rate today.

There is no way debt interest is going to reach such extremes as the following interest burden chart illustrates that the US is already paying an eye watering $1 trillion in interest vs $600 billion a year ago! And despite this huge smoking gun politicians peddle the tripe of seeking to balance the budget, what a con!

There is no balanced budget and falling inflation with debt interest passing $1 trillion, what you actually get is a ratcheting higher of bond market manipulation, the bond markets are the most manipulated markets on the planet, logic would dictate that as the government prints money (bonds) rates should rise, that is not going to happen because the Fed SETS the interest for US bonds NOT the markets where the pressure valve is INFLATION, RISING PRICES! RISING ASSET PRICES! RISING STOCKS AND HOUSING PRICES! EXPONENTIAL!

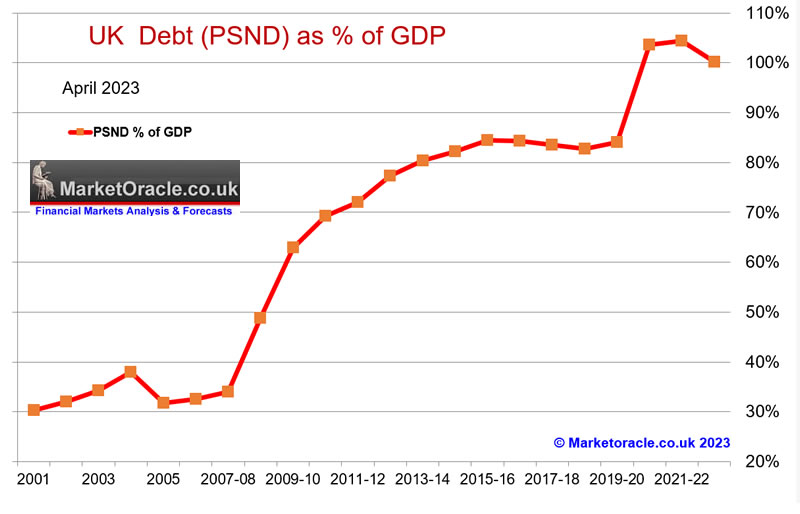

And it's a lot worse than that in the UK as we have a pin prick of reserve currency of the US, so have no choice but to follow the Fed's lead else pay the price of bond market panic as we witnessed September 2022 when Liz Truss's government had deluded themselves that the UK was an independant nation, free to make it's own decisions, well the Bond Market engineered by the Fed soon dealt with that and both Chancellor and PM were soon gone, replaced with a good pair of lap dogs that since have obediently done their banking masters bidding.

Whilst debt to GDP is hovering at 100% despite deploying the same price deflator con trick, is set to ratchet higher as the Tory government attempts to bribe voters in the run up to next years general election.

That and Britain's financially clueless government sold a lot of INFLATION LINKED BONDS so the interest payments are indexed to RPI which tends to average about 0.7% above CPI, well done Einstein's! They can't even do a proper job of defrauding the public, all they had to do was sell 1% bonds during 2020 instead the morons sold INFLATION LINKED BONDS thus 30% of UK bonds are inflation linked. Of course those who bought long dated Inflation linked bonds will be down due to the fact that RATES have RISEN, just less so than regular Gilts.

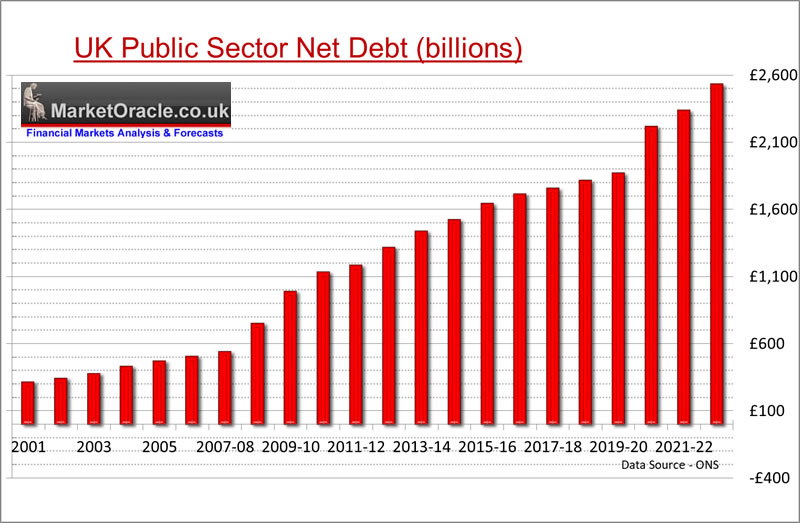

The UK Debt mountain continues to grow...

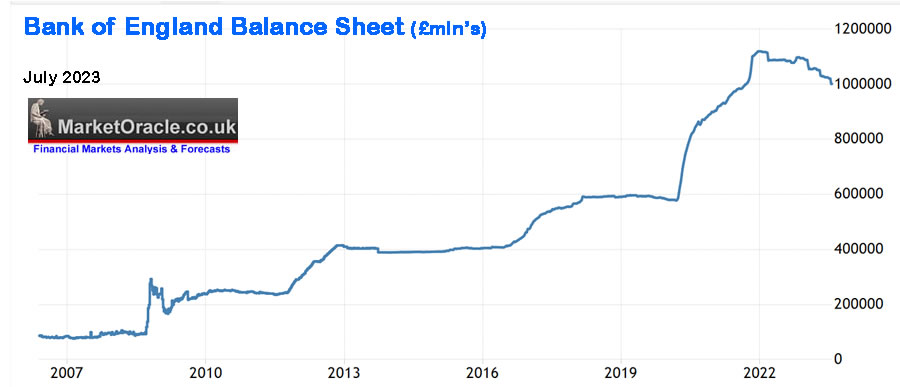

Though of course reality is far removed from the smoke screen put up by the bankster's,effective Debt to GDP is 65%! Yes that's right 65% not 100%! How did they pull this slight of hand? Quantitative Easing, about £800 billion of UK bonds are parked on the Bank of England's balance sheet plus about 200 billion other assets! And the price paid for this con trick is INFLATION!

The upshot of this is that the UK government pays ITSELF interest on about 1/3rd of it's debts because the Bank of England just printed the money and bought the bonds from the bond market, the same way the Fed has in the US, which is why INTEREST RATES CANNOT GO UP because if needs be the Bank of England could buy ALL UK Government bonds thus set whatever interest rate the Bank of England wants it to be, what the Bank of England cannot control is the fx rate and thus inflation, the greater the money printing fraud the weaker the currency. HOWEVER since all governments are perpetuating this mega-scam which means ALL currencies are FALLING together! All you see in exchange movements are the differing rates of falling currencies that gives the illusion of one currency rising against another when in reality they are ALL perpetually FALLING!

Remember what we are witnessing on these graphs is an increase in the SUPPLY of BONDS, the government is printing bonds in response to which the market demands HIGHER INTEREST RATES where the only reason why rates were low over the past decade was due to Quantitative Easing i.e. the central banks BUYING bonds and then RETURNING most of the interest paid on the bonds back to the treasury. This IS the game they will resume playing and in many ways already have to limited extent. Still QE proper WILL resume as soon as the politicians order their central banks to do so. It's as simple as that, the government will order the central banks so monetize debt which will FORCE interest rates lower for the government, not for anyone ese as there is no free lunch, someone has go to pay! in the 2010's it was savers who paid, going forward it will be every borrower other than the government who will pay in higher interest rates. Which means whilst rates on government bonds will come down they won't necessarily for instance for mortgages.

What does all of this mean? It means that whilst inflation is falling (the rate of price increases) it WILL prove temporary and will resolve in another spike higher, probably a lot sooner than most imagine it will given the slowing economy, due to the fact that rampant debt printing not only continues but is set to accelerate that will soon be accompanied by QE debt monetization that will fuel the next inflation wave because given the magnitude of the debt bubble they cannot ever allow it to Deflate! So all those who have been barking about deflation for the past few decades will continue to be wrong because the system WILL NOT ALLOW FOR DEBT DEFLATION! Which is what we see with the likes of QE4EVER, every time the debt bubble appears to be on the verge of bursting they up the anti by INFLATING the DEBT bubble further and with it comes INFLATION where our focus as investors is on ASSET PRICE INFLATION.

So if you take away only one message from this article it is that there will NEVER BE DEFLATION! And thus ASSET prices no matter how far they deviate from their highs during bear markets and corrections WILL ultimately resolve to NEW HIGHS. It is by design, the system cannot allow for any other outcome! Hence my Buy the deviation from the highs mantra.

This article is excerpted from my extensive analysis Inflation Bond Fire of the Vanities Breeds Opportunity that was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my most recent analysis -

- Stock Market Ready to Tumble

- Stock Market Correction Counting Down to Nvidia Earnings Bloodbath?

- Inflation Bond Fire of the Vanities Breeds Opportunity

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series/

Change the Way You THINK! How to Really Get RICH Guide 2023

Here's what you get access to for just $5 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top followed by correction to below 4150 into October 2023.

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimmed the FOMO to buy the Dip analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.