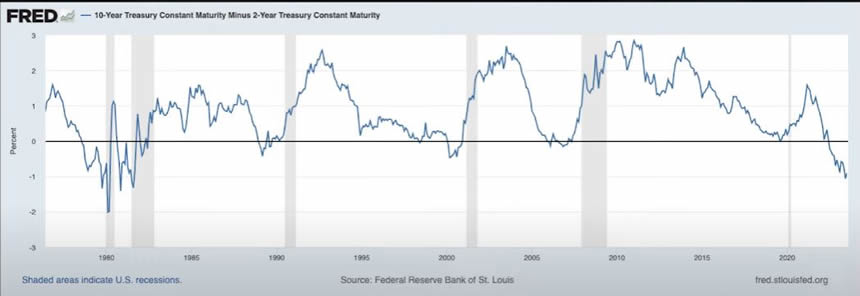

US Bond Market Yield Curve Inversion Current State

Interest-Rates / Inverted Yield Curve Sep 03, 2023 - 11:00 PM GMTBy: Nadeem_Walayat

The yield curve is the Ten Year yield Minus 2 Year Yield - What it shows is when short money is more expensive (higher rates) then long money, why is that? Forward economic weakness thus lower forward rates? Yes that is a valid argument but I suspect that in large part is the WRONG conclusion, it is after all the consensus view, what the econofools regurgitate across MSM, long rates are lower because the market is discounting future interest rate cuts is WRONG!

Maybe if they weren't prone to following the herd they would realise that the government wants lower longer term interest rates so that it pays LESS interest on the debt it issues! That and market rates for loans tend to be more sensitive to the short end so if the government wants to reduce economic activity to curb inflation then the yield curve inverts by design and not as an act of god to warn of a recession. Understand this the bond markets are very heavily manipulated where the central banks stand ever present to intervene to unlimited extent to ensure the bond markets do exactly what they want them to do so that the government can continue printing debt whilst paying a low interest rate.

The rest of this extensive analysis Inflation Bond Fire of the Vanities Breeds Opportunity was first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my most recent analysis -

- Stock Market Correction Counting Down to Nvidia Earnings Bloodbath?

- Inflation Bond Fire of the Vanities Breeds Opportunity

And gain access to my exclusive to patron's only content such as the How to Really Get Rich series/

Change the Way You THINK! How to Really Get RICH Guide 2023

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top.

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimmed the FOMO to buy the Dips analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.