Stocks Bull Market Phase One End Game Sector Rotation

Stock-Markets / Stock Market 2023 Aug 19, 2023 - 11:11 PM GMTBy: Nadeem_Walayat

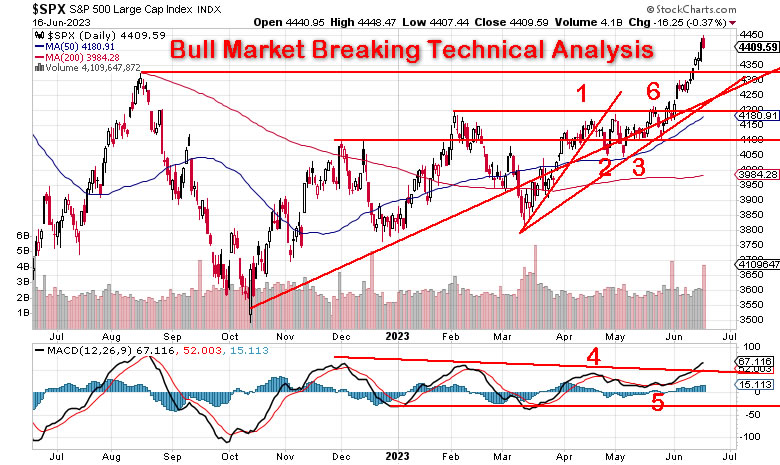

The stock market ended the week at S&P 4410 off a new bull market high of 4448 against my expectations for a fuzzy week to deliver a correction this week enroute to the 4500+ final destination by late July to complete the first leg of this bull market and to herald a significant correction into October as illustrated by my original road maps -

Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

S&P ultimately target a trend to 4500+ by Mid Summer 2023.

In terms of the current state of the trend forecasts then the indices are now in the window for setting their final highs i.e. the first peak Mid June followed by a correction and then the final second peak by late July. The Dow was forecast to trade to a high of 34,800 by now vs Friday's High of 34,588. Whilst the S&P at 4480 vs Friday's high of 4448, so we are in the end game in terms of further upside price action following this weeks correction it will have another shot at pushing higher where my original forecast concluded that it would fail to do so which following a second failed attempt would usher in the significant correction into October.

Why were so many on the wrong side of this rally?

Because the bull market literally broke TA, it's not often when a series of technical indicators FAIL 6 times in a row! Which triggered panic buying first following Nvidia's earnings and then on the S&P trading 20% above it's low as being the day when the bears capitulated and turned bullish as illustrated by investor sentiment indicators.

(Charts courtesy of stockcharts.com)

Whilst the S&P has been marching higher the AI tech stocks have been rolling over one by one in a process of sector rotation from the overbought tech stocks into the unloved sectors that helped push the S&P higher with Apple being the one that will deliver the correction in the indices. Most of the tech stocks have more than achieved their targets for summer highs, for instance the target for AMD was $108 instead it FOMIO'd to $130! Moves replicated across most stocks hence prompting heavy trimming.

Stocks showing signs of having run out of steam and the first to roll over into a correction are LRCX, AMZN, ASML, MU, NVDA, and AMD.

The S&P is now in the window for a short correction ahead of it's likely final attempt to achieve 4500+ by late July, how low could the correction go? To somewhere between 4200 and 4140, that will likely see more sector rotation which means most tech stocks have seen their highs for the year and it will be up to the laggards to try and push the S&P to a new high.

This article was first made available to Patrons who support my work Stocks Bull Market Phase One End Game Sector Rotation. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

And my most recent article - Inflation Bond Fire of the Vanities Breeds Opportunity

SECTOR ROTATION

In the comments some patrons have asked what sectors and stocks they should rotate into. The public portfolio includes a sprinkling of none tech stocks such as the healthcare sector, as well as GPN and ULH amongst a few others, Including the four US housing stocks as of February 2023 which offers some scope for rotation, the problem with other sector stocks is that they are NOT going to fly high like the AI tech stock stocks, so rather than rotate out and into something else my default position is to increase percent cash for further opportunities to accumulate into target AI stocks.

Nevertheless I do engage in limited sector rotation IF there is an opportunity to accumulate, one such sector would be the metals and mining stocks that play a part in the AI and Climate Change megatrend's as the following four illustrate where CCJ, and BHP are from my legacy invest and forget portfolio that I do not actively monitor.

Freeport-McMoRan (FCX).

Global Copper Miner FCX pays a dividend of 1.5% AI is going to need a LOT of COPPER!

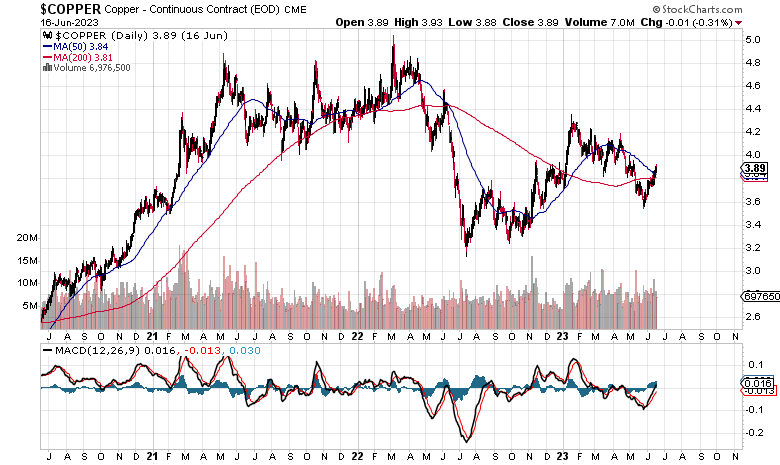

Copper price has been in a bumpy bear market since the herd started piling into commodities early 2022, yes right at the TOP!, You only need to go and read the headlines of how the Ukraine invasion is going to see commodity prices soar as well as many comments at the time if commodities were a good investment. We'll here's your answer, when trend becomes the NEWS then that's the TOP!

So FCX should track the copper price which despite a bounce off the July 2022 low remains in a bear market as we continue to head into late 2023 economic weakness when demand for metals should hit a low point.

FCX appears to be targeting the $32 to $25 range, within which I would seek to accumulate a position for the long-run. Yes we can fantasise about $5, and if it happens (I doubt it) I will buy more FCX. But realistically given where we are then $32 to $25 looks achievable if the global economy continues to slow over the next 2 quarters as I suspect it will, thus earnings will contract allowing for the buying range to be achieved before recovering next year. The stocks share dilution rating is stable at 99%.

Albemarle (ALB)

ALB produces specialty chemicals for energy storage which given Elon Musk wants everyone to have a Tesla Wall insatlled should continue to see this $27 billion stock trend higher.

ALB set a high of $332, currently trading 1/3rd lower at $233, bouncing off a recent low of $171, it should still revisit at least $180, thus I will probably seek to accumulate a position in the range of $180 to $140. The stock trades on P/E of 7.6 that will likely rise as earnings contract this year before expanding once more next year.

BHP / BHP. L

A range trading metals and mining stock that put in a high of $93 in 2011 with it's current range of $70 to $48, or on the LSE £28.5 to £20.5. Expected economic weakness should see BHP dip to $48 from where I would seek to accumulate in the range $48 to $40 (£20.50 to £18.00). BHP pays a huge 8.4% dividend, so collect the dividend whilst waiting for the price spike to $70 to distribute into, a good invest and forget stock as one expects to get a 80% gain in 10 years even if the stock price stays put and that's before one factors in inflation!.Also buys back shares.

CCJ / CCO.TO

And finally URANIUM! Cameco a canadian company listed on the NYSE and Toronto stock exchanges. It's a range trading stock if one remembers to reinstate expired limit orders! Set a high of $55 in 2007, though the effective upper range is $44. CCJ is currently under going a moon shot which has had me trimming my holdings, it's a case of accumulate sub $18 and start distributing above $32, there is nothing to suggest this stock is not going to stay range bound, but you never know. So the buying range would be $18 down to $12, Selling range $32 to $44 whilst leaving a core position for a potential $55. I would not go over board with CCJ because it does not pay much of a dividend i.e. just 0,3% so not a good invest and forget stock,

So these four stocks highlight the difference between the AI tech stocks and Metals and Mining stocks which apart from ALB are range trading stocks with some that pay a healthy dividend, whilst the probability for a breakout is low also the probability for NOT bouncing back from an extreme lows is even lower as the AI Mega-trend is hungry for metals,.

Still it does bring home the fact that the meat and potatoes gains will come from the tech stocks and not other sectors, where the gains will be a lot less, so not something to get overly obsessed over as some do. Anyway these stocks offer additional opps to accumulate and distribute as and when opportunities arise, along with the healthcare and Housing stocks that differ from the AI tech stocks, and who knows the climate change herd may eventually repriced them higher. I have not made up my mind which if any of these stocks I will add to my public portfolio,.

AI Stocks Portfolio

MICRON ! MICRON ! MICRON! Definitely THE stock that looks set to lead tech pack lower. The rally to $75 was pure FOMO. I can easily see this stock sub $60 once more, maybe even sub $56. Though the thing is Micron falling does not mean EVERY tech stock will fall! That's the problem with indices, Micron yes, AMD also looks like it's done, others less so.

AI Portfolio New Column - Neural Net - Invest (Y/N) Column

An additional tool towards skewing decision making process for instance Nvidia is a YES whilst Micron is a a NO ,

The Yes / No are generated by a neural net based on EC ratio's. and should be taken as a skew rather than a switch.

Buying ranges for AI tech stocks have also been updated and the Investing Guide Expanded.

https://docs.google.com/spreadsheets/d/13gDntQuyDP3db7WqEvOXftOxVVTJyYyB_s-O0XW2EIk/edit?usp=sharing

My view is the tech's have had their run for the year, 2 months ago we could not have asked for anywhere near as good as the likes of AMD on $130, so they should now sit out the next 6 months, i.e. all will probably be lower by year end compared to where they are now, and some a lot lower (Nvidia).

Soaring UK Mortgage Rates Prompts MSM Housing Market Panic!

The fear peddling MSM are screaming housing market doom and gloom as UK mortgage rates soar to over 6 on the back of expectations of the Base rates rising to at least 5.5% (4.5%), in fact the market is pricing in a 6% base rate on the back of failure of UK inflation to fall (8.7%)..

I don't see UK base rates at 6%, UK base rates will top out at 5%, whilst inflation remains stubbornly high, the sterling bull market looks set to see sterling trade to above 1.30, probably as high as 1..33 this year as I suspected could transpire when sterling was plunging towards parity to the dollar and many were making the mistake of selling out of sterling for dollars right at the bottom! Which at the time I warned against stating that I would need a rate north of 1.30 to sell sterling for dollars.

Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

I would not be surprised if Sterling is above 1.30 by the end of 2023, with my central best guess being around $1.27 by late 2023. So I consider sterling today at $1.11 as being cheap in terms of the longer term outlook i.e. due a cyclical bull run within a secular bear market.

£/$1.33 would be a huge 33% JUMP agaInst last Octobers low which is DEFLATIONARY, just that it takes time for the deflation to filter through the supply chain with a similar bullish trend in the trade weighted index.

So UK rates are likely to peak at about 5% and then head lower as the headline UK inflation takes a tumble courtesy of sterling strength AND the base effect that sees the huge jump in October 2022 data of 2% leave the index on release in November 2023. So UK rate hiking cycle has perhaps 3 months left in it before a pause going into 2024, and then cuts track the CPII falling under 5%.

What does this mean for UK housing? It means the mortgage rate spikes are going to be temporary, before year end mortgage rates will be falling. Set that against the fact that in today's mortgage market 90% of borrowers have fixed rate mortgages, most fixed for over 5 years and over, about 1/3rd have 2 year fixes with many coming due during 2024 by which time mortgage rates will be falling.

So the spike in mortgage rates that MSM are panicking over is a nothing burger, it's impact on the UK housing market is nowhere near on the scale that which MSM are peddling,.

In fact given so much doom and gloom out there the UK economy could surprise to the upside, crunching the numbers I would not be surprised if by Q1 2024, the UK is one of the strongest of western economies, after all sterling strength is in part discounting relative economic strength. which would translate into further sterling strength during 2024, perhaps trade to as high as 1.38.

This article was first made available to Patrons who support my work Stocks Bull Market Phase One End Game Sector Rotation.. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

And my most recent article - Inflation Bond Fire of the Vanities Breeds Opportunity

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimmed the FOMO now buying the Dips analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.