Stock Market FOMO Maniacs Rug Pull Imminent? US House Prices Trend Current State

Stock-Markets / Financial Markets 2023 Aug 14, 2023 - 07:38 AM GMTBy: Nadeem_Walayat

Dear Reader

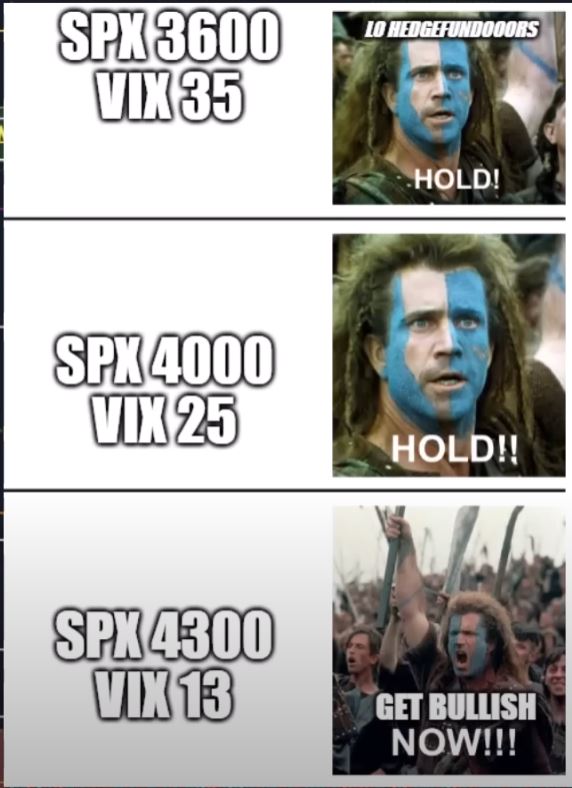

We have CP LIE Tuesday and then the Fed rate meeting Wednesday in advance of which retail investors and many fund managers woke up June 1st to realise that there is a bull market underway and literally PANIC bought like a herd galloping towards the edge of the AI cliff.

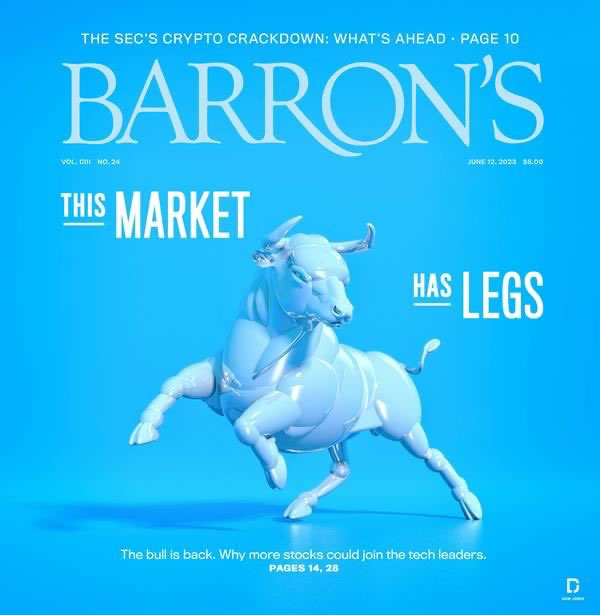

Barrons also FOMO 'd turning bullish at 4300!

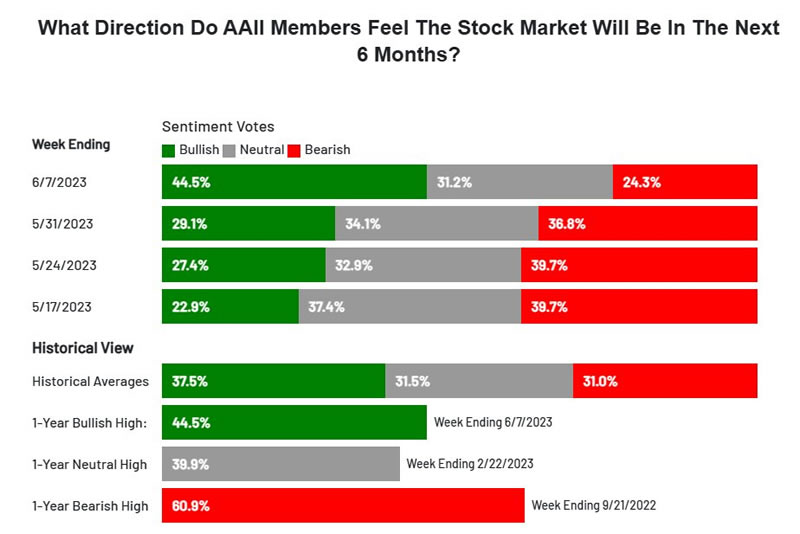

The AAII Switch Got Flipped!

FOMO IS EXTREME, and up until last week's AAII survey the only thing that was lacking was a bullish investor sentiment gauge to match the stock prices going nuts to the upside! Well we got that with a shockingly extreme jump in investor sentient reading that went from 29% bull to 44.5% bull in 1 week!. Normally I don't pay much attention to this, but that is a BIG JUMP! We have not seen readings as high as this since late 2001, the pumps are definitely being primed for a sell off.

This article was first made available to Patrons who support my work Stock Market FOMO Maniacs Rug Pull Imminent? US House Prices Trend Current State. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

And my most recent article - Inflation Bond Fire of the Vanities Breeds Opportunity

Red Lights and Sell Triggers

In my last article the fundamentals flashed RED WARNING lights on key AI tech stocks that encouraged me to trim the likes of Micron hard.

AMD - 5 Red Lights

Nvidia - 4 Red Lights

Apple - 4 Red Lights

ABBV - 4 Red Lights

Intel - 4 Red Lights

Micron - 3 Red Lights

Amazon - 3 Red Lights

Which was followed by hourly SELL triggers in my market brief for Nvidia, Microsoft, META, MU, ASML, AVGO, LRCX, AMZN that still stand, so tech stocks are rolling over.

CP LIE Tuesday

The smoke and mirrors annual inflation indices which mask the true magnitude of inflation pain that will run for the whole of this decade will Tuesday deliver a mix bag, a sharply lower headline rate falling towards 4%, whilst a stubbornly high core rate that will remain above 5% which is what the Fed is focused upon and thus likely to send yields higher. So the CPI should be a net bearish for stocks. Remember the Fed target is 2% not 5!

Fed Funds

Market rates are higher but the Fed tracker is now at a 77% probability for a pause.. Whilst my expectations are for another rate hike, what's uncertain is will that rate hike be this month or next month. A pause this month followed by a rate hike next month would chime with a rally into late July to target 4500 before the big sell off, which means the anticipated minor correction could fail to materialise, anyway it's going to be a close call and not done and dusted as what the Fed rate tracker implies.

Earnings and Recessions.

The Twitter bear mantra is that stocks cannot bottom whilst earnings are falling as illustrated by Morgan Stanley and their perma bear Mike WIlson.

Which prompted me to conduct a quick study to see if this consensus view is true as to when earnings bottom relative to stock prices -

1957 1 year later

1974 1 year later

1980 1 year later

1990 1 year later

2009 6 months later

2020 9 months later

Earnings bottomed AFTER stocks by typically 1 year! This illustrates why I don't pay attention to the views of others because all they usually tend to do is regurgitate inaccurate old wives tails .Someone at Morgan Stanley needs to turn that light switch on, better still fire all of their analysts and just become a patron for 5 bucks per month!

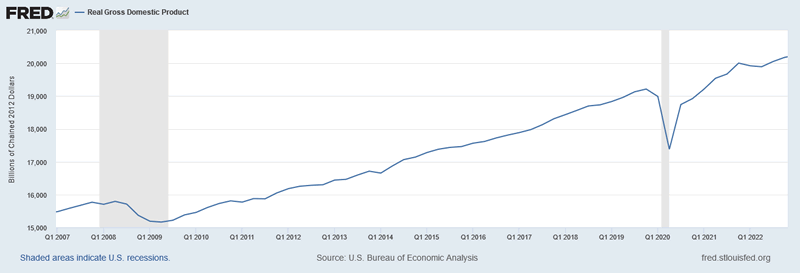

Whilst many are forecasting a recession based on old data what they fail to see is what's staring them in the face - THE STOCKS BULL NARKET! I am feeling richer, you are feeling richer, everyone invested in stocks is feeling richer and probably similar for home owners, and what do people do when they are feeling richer? SPEND MONEY! The stronger the bull market the more likelihood is that the US is heading for a soft landing.

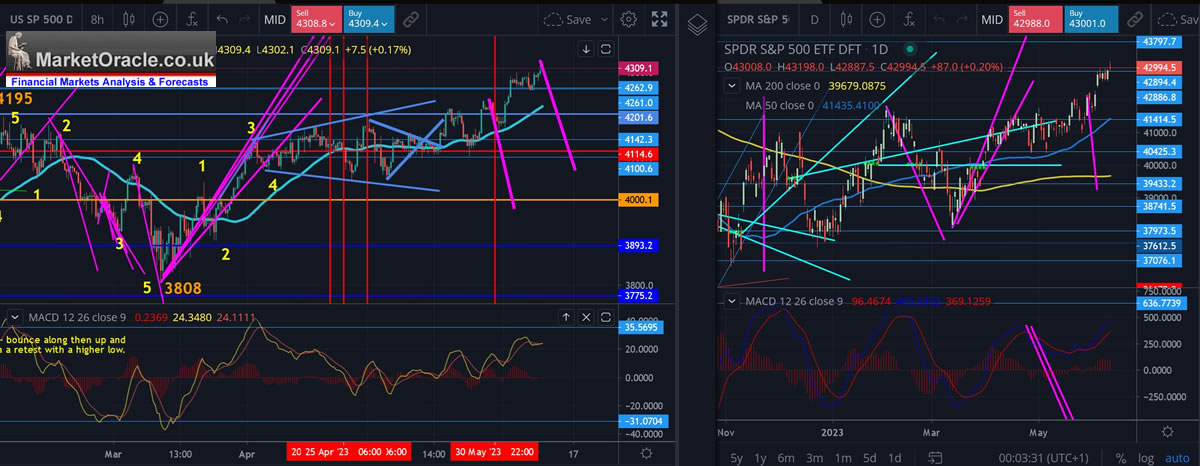

Stock Market 2023 Road Map

Continues to pull stocks relentlessly higher towards a target of 4,500 by late July. so any correction is likely to be minor i.e. something like a couple of hundred S&P points, 4100 at the lowest, where right now instead of FOMO-ing I am eyeing the run to sub 4000 during that deep pull back into October, so far the market has done nothing to negate this long standing expectation.

(Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1 )

Stock Market Conclusion

So puling everything together are we going to get that damn correction or not? Or is FOMO so strong that these crazy cooks are going to send the S&P to the moon, even so there is some sector rotation under away out of Tech stocks and into other sectors such as healthcare, so what could transpire is that the S&P experiences a minor correction as a tumble in the tech stocks is cushioned by rotation into cheaper sectors as I can't imagine the S&P powering higher whilst it's biggest weights such as Apple take a tumble. So that's how things could play out i.e. a weak correction that resolves in the final leg higher to 4500 by late July helped along by the Fed pause this week with the rally ending on the final rate hike next month. It's the timing that's the problem, this week is fuzzy, next week looks a little clearer thus on the balance of probabilities we should see the S&P trade below 4200, targeting 4100 by the end of NEXT week,

The bottom line I am positioned for a sell off where my best guess is 4100, before a final FOMO thrust to 4,500 before the big drop. But the indices mask the extent of the price movements in individual stocks i.e. AMD, Nvidia, so don't make the mistake of taking your buying and selling cues in individual stocks form the indices!

AI Stocks Portfolio

Buying ranges for Medium Risk stocks have been updated with the revised levels identified as red with the others still deemed to be valid levels.

https://docs.google.com/spreadsheets/d/13gDntQuyDP3db7WqEvOXftOxVVTJyYyB_s-O0XW2EIk/edit?usp=sharing

My portfolio currently stands at 81.4% invested courtesy of the FOMO blow off tops in AI tech stocks that has prompted me to trim hard, which compares to being about 95% invested some 2 months ago. If someone had asked me where my portfolio would be by now I would have guessed about 90% invested, so being 81.4% invested illustrates just how much selling I have been doing to capitalise on the AI tech stock FOIMO, so I am definitely positioned for a correction. Whilst my target exposure remains at 88%.

How deep could stocks correct? I suspect most stocks will retrace between 40% to 60% of their advance off the March low, some closer to 60%, others closer to 40%, it's on a case by case basis, for instance Arrow will probably retrace closer 60% down to $120.

Current State of the US Housing Market

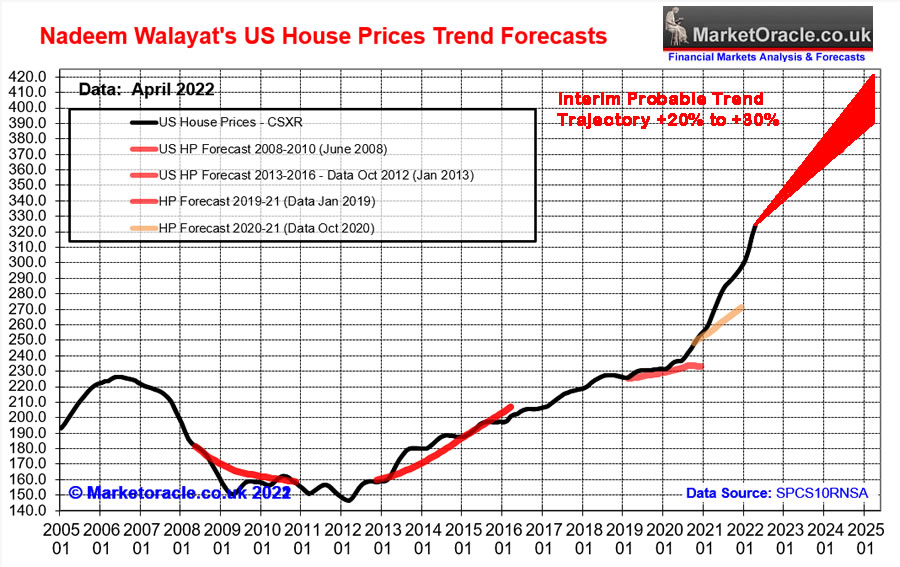

My interim view as of early July 2022 based mainly on my stock market, economy and UK housing market analysis at the time (Stocks Bear Market Rally Last Gasp Before Earnings Season, US House Prices 3 Year Probability Range) concluded in an rough expectation for US house prices to target a gain of between 20% and 30% over the next 3 years that would be punctuated by a correction during 2023.

Whilst my last look at the US housing market in early February 2023 concluded -

US house prices whilst weak during 2023 are not going to fall off a cliff as many prospective buyers hope they will, after all the so called recession saw the US economy add 517,000 jobs last month, more than double market expectations! Thus the correction looks set to mild and prove temporary with prices set to resume their bull and likely to trade at new all time highs during 2024.

First a peak at some of the primary drivers for US house prices (in order of importance).

1. Population Growth

US population continues to grow at approx 0.5% per annum for the next decade below slowing to 0.4% per year, growth courtesy of immigration without which US population would be flat lining at 0,1% per year. So whilst lower than the UK is still positive and thus should also be US house prices.

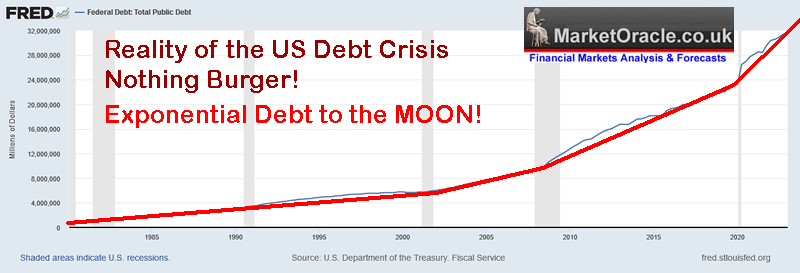

2. Inflation courtesy of money printing.

Reserve currency status allows the US to print money to the extent that the US dollar will be the last currency standing, all others will burn inflation fires before the dollar and thus this we have the US exponential debt curve that that the con men and women who call themselves politicians play acted over the nothing burger debt ceiling crisis. If anyone says US house prices are going to fall just show them this chart. You are not going to get house price falls whilst debt is increasing exponentially!

3. Growing economy.

Where's the recession that the clowns have been barking about for near 18 months? Not much sign for even stagnation let alone contraction. The US economy is strong, the risks are to the upside.

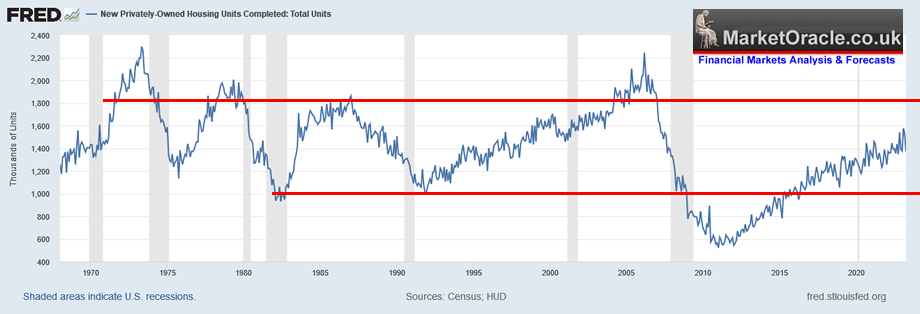

4. Insufficient new housing construction.

Whilst US home building has remained on an upwards trend trajectory since the financial crisis trough, however it is nowhere near the level of bubble territory on a spike to above 2.2 million which means there is no sign of a mania in home construction, the prospects for remain many years away and thus positive for US house picture for many more years, and rising prices are bullish for the economy.

So the US checks all of the boxes for expectations for rising house prices which is set this against the perma doom merchants who have been barking about a repeat of 2008 for over a decade now!

US House Prices

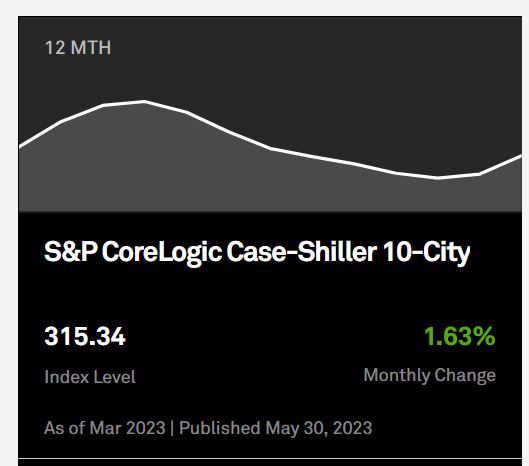

The latest Case Shiller 10 city index for March 2023 is 315.4, down form a peak of 330 in June 2022 (remember there is a 2 month lag in reporting of data). Thus US house prices currently stand 4.5% below their highs which isn't anywhere near the shrill cries of the doom merchants such as Michael Burry of Mid 2022 with his CRASH is coming mantra, who is now barely breaking even if he actually bet any money on his call.

So given that rate hikes are nearing their end and that this is NOT 2008 i.e. home owners are sat on record amounts of equity that they will likely draw upon over the coming years, so the S&P bear market / crash nothing burger that Michael Burry was barking about is already over as US house prices have resumed their upwards trend trajectory.

US Housing Stocks Mini Portfolio

In early February 2023 (Stock Market Completes Phase Transition, US Real Estate Stocks - Housing Market Part1) to capitalise on the bear market in housing stocks I released a mini portfolio to accumulate into as the stocks tumbled in the wake of the banking crisis. The following charts show how the stocks have faired in terms of delivering on an opportunity to accumulate at the original buying levels and then at the revised buying levels Mid March. Basically when accumulating one wants prices to FALL! BUT prices only fall on BAD NEWS! This is one of the biggest psychological blocks to successful investing that crops up regularly in the comments section that "the news is bad for x stock and so is it still a buy?" Well how do you think the price is going to fall? On good news? The news has to be BAD for the price to fall, as was the case with for the tech stocks the rallies will be inexplicable because the stocks will be rallying on BAD NEWS!

REDFIN - RDFN

3rd of Feb $9.45 / Current $10.49, gave a series of opps to accumulate and it is still far from being over extended, I currently stand 83% invested. The stock is trending higher, so those seeking to accumulate are unlikely to see sib $7, instead should aim for sub $9.45.

Forestar Group - FOR

3rd of Feb $15.75 / Current $21.3. Again plenty of opps to accumulate form the initial buy zone down to the $13.75 low. I currently stand 35% invested after heavy trimming down from 80% invested. The stock has had powerful rally that once its done should at least revisit $17 and probably as low as $15, as Forestar is a range trading stock i.e. tends to oscillate between $25 and $11 with the current trajectory towards $25.

(Charts courtesy of stockcharts.com)

IIPR - Innovative Industrial Properties Inc

3rd of Feb $93 / Current $70. Has proven to be a great stock to accumulate into, continues to hug the bottom end of it's buy zone, thus I stand at 135% invested.IIPR appears to be bottoming to initially target $100.

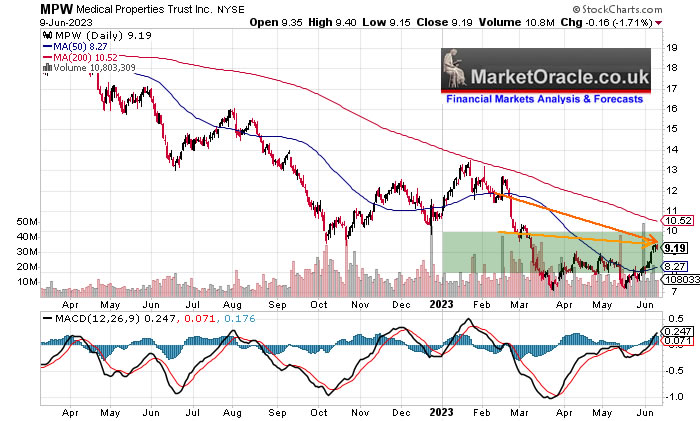

MPW

3rd of Feb $12.8 / Current $9.35 Very bad news delivered a huge collapse in the stock price down to a low of just $7 which separated the men from the boys, those who caught the falling knife vs those who became paralysed by fear as the watch the stock price bounce twice off $7 only now at $9.35 wishing it would fall once more to $7 so they can magically buy the bottom, does not work that way buddy, fortune favor's the brave.

buying zone as of 10th March $10 to $8 so still plenty of opps to accumulate. The stock price looks like it's bottomed, so no point hoping for a return to $7 for a third chance to buy, for if you did not have the courage to buy the first two times you won't be able to buy a third time either Given the blood bath I am 173% invested and it is unlikely I will add more on any further blood baths. Also note MPW yields 15% with it's ex-dividend date of 14th June.

Has proven to be a great stock to accumulate into continue to hug the bottom end of it's buying zone, thus I stand at 135% invested.IIPR appears to be bottoming that target about $100.

Apple VR Goggles

Overpriced! OVER PRICED! $3,500 is nuts for a VR/AR headset! BUT, from what I've seen the tech is good, 20 million pixels per eye vs Quest 3 expected 4 million! I think the Apple VR is over kill for right now, it's not going to sell, they are probably going to come out with a cut down version with say at half the pixel count of 10 million per eye, at perhaps $1500. However the winner for now is not Apple but META, Quest 3 is going to be announced in October and on sale for Christmas 2023 whereas the Apple headset that costs 7 TIMES more than the Quest 3 is promised for early 2024. META is going to sell a LOAD of Quest 3 headsets as what apple has done is try and normalise the price for headsets as high as $3,500 which means what once looked like an expensive toy (Quest2) now looks CHEAP! A cheap way to get a taste of VR /AR without forking out $3,500 some time during 2024.

META has first mover advantage and time to bring something out that will rival Apple, i.e. match the specs for the cut down version in say a Quest 4 at 10 million pixels per eye, within slimier functionality, if they can do that for near $500 then they will beat Apple just as Google Android mobile beats Apple IOS by 72% to 27% market share so will META in the VR / AR space.

So I will get a Quest 3 in a few months time and where apple is concerned I'll wait for the Apple i-head so I can continue to bore friends and family after I have passed on.

"Hello can anyone hear me, hey guys locking me in a cupboard is not cool, hello is anyone there ???'

South Africa Protected from AI

Whilst most in the west fear the rise of AI. there is at least 1 nation on the planet where AII cannot tread. South Africa that appears to be on the brink of going dark, a complete failure of the South African power grid as the ANC government has eaten all of the money meant for upgrading and maintaining the power grid. So if you really fear the rise of AI then there is at least 1 place one is safe from AI, though you'll need to live like MAD MAX to survive!

This article was first made available to Patrons who support my work Stock Market FOMO Maniacs Rug Pull Imminent? US House Prices Trend Current State. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $5 per month, lock it in now at $5 as this will soon rise to $7 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

For Immediate first access to ahead of the curve analysis as my extensive analysis of the stock market illustrates (Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1), that continues on in the comments section of each posted article, all for just 5 bucks per month which is nothing, if you can't afford 5 bucks for month then what you doing reading this article, 5 bucks is nothing, if someone did what I am doing then I would gladly pay 5 bucks for it! Signup for 1 month for a taste of the depth of analysis that cannot be beat by those charging $100+ per month! I am too cheap! Hence the price for new signup's will soon rise to $7 per month so lock it in now, $5 per month is nothing for what you get access to so at least give it a try, read the comments, see the depth of analysis, you won't be sorry because i do do my best by my patrons, go the extra mile and then some.

S&P

Targeting 4600 Mid Summer 2023 Top.

Also gain access to my exclusive to patron's only content such as How to Really Get Rich!

Change the Way You THINK! How to Really Get RICH Guide 2023

And my most recent article - Inflation Bond Fire of the Vanities Breeds Opportunity

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $5 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it rises to $7 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimmed the FOMO to buy the Dip analyst.

By Nadeem Walayat

Copyright © 2005-2023 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.