Uk Inflation in 2023: The Current Situation

Economics / Inflation Jul 09, 2023 - 07:31 PM GMTBy: Umer_Mahmood

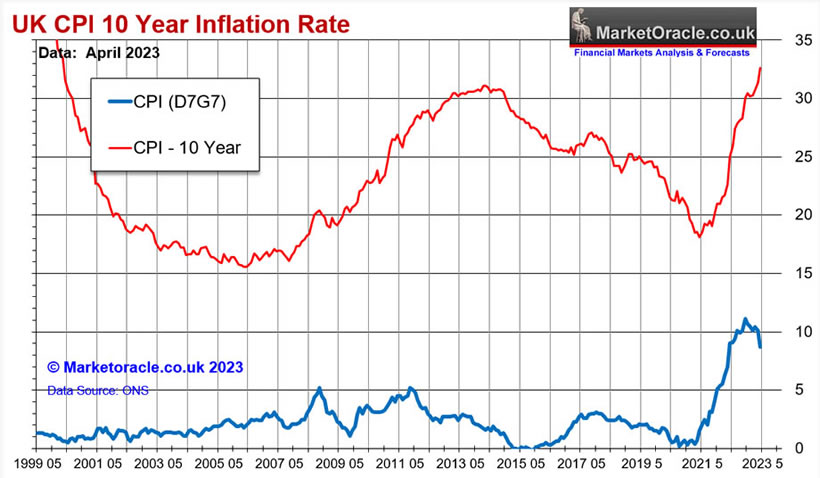

The April index falls less than expected to 8.7%. And the core figure has been at its best since 1992. After the IMF's good estimates on the economy, markets see a hawkish BoE

Difficult day for the stock markets of the Continent, which has been affected by a long series of bad news. Starting with the cold shower that came from British inflation, to which are added the fears of the failed agreement on the US debt ceiling and those about the damage that the Chinese economy could suffer from the new wave of Covid together with the ban on Micron chips. But, if on the impasse in Washington there is the belief that an agreement will arrive before 'date X', the race in prices in the United Kingdom gives us a glimpse of a dark future on the interest rate front.

A slower than expected slowdown

In April, the London cost of living rose by 8.7%, slowing down from the 10.1% in March but above the 8.2% expected by economists. Month-over-month the increase was 1.2% against the 0.7% consensus. Core inflation was worse: in fact, the figure stood at 6.8%, not only again above expectations (6.2%) but also on the highs since March 1992. On a monthly basis, core consumer prices are increased by 1.3% compared to the expected increase of 0.7%. The still volatile dynamics in the food sector weighed the most.

However, the glass is half full for Tory Prime Minister Rishi Sunak, who underlines how the numbers are in any case in a decisive slowdown compared to March and at their lowest for 13 months. And it is, even more so, after the rosy forecasts of the International Monetary Fund. According to Washington experts, for His Majesty's economy there is no longer a recession on the horizon and already in 2023 the GDP, revised upwards, will mark +0.5%. “The IMF has acknowledged that it has acted decisively to tackle the cost of living but, while it is good that it is back in the single digits, food prices continue to rise too fast. This means that we must continue to be resolute,” warned the Chancellor of the Exchequer, Jeremy Hunt.

Investors do not show the same positivity, convinced that the slowdown is too moderate. From the point of view of the markets, a basic figure still at 6.8% appears to be an indication of inflation still rooted in the economy. So much so that the Bank of England itself could intervene again in June after the 25 basis point adjustment decided on 11 May to bring rates to 4.50%. Just a week ago the governor, Andrew Bailey, reaffirmed his "unwavering" commitment to pursuing the 2% target. Moverover the brent crude oil price will creep up from current levels as major producer group OPEC+ maintains restrictions on supplies.

UK inflation set to remain high

According to Tomasz Wieladek, chief European economist at T. Rowe Price, consensus expectations on long-term inflation for the euro area and the United Kingdom could start to diverge for the rest of the year. And the main reason is the weakness in job supply and investment after Brexit. “Sell-side economists are starting to understand the idea that labor imbalances are more important than the unemployment gap in determining wage inflation. The data indicate a clear labor shortage in the UK compared to the Eurozone, especially in the services sector”, he explains, underlining how this has led to stronger wage growth in the country (6%-7%) than in the rest of the continent ( 4-5%).

The consensus among economists is that UK and euro area inflation will converge again towards 2% by 2025. “Looking at five-year Gilts and Bunds, this is what the market is pricing in. However, given the long-term Brexit-related jobs and investment woes, I think London's cost of living is more likely to surprise on the upside than that of the euro area,” concludes Wieladek.

By Umer Mahmood

© 2023 Copyright Umer Mahmood - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.