LIBOR Unfreezing as Fed Takes Aggressive Action to Boost Economy

Interest-Rates / US Economy Nov 02, 2008 - 01:46 PM GMT

CNNMoney.com: Bernanke discusses future of Fannie and Freddie

CNNMoney.com: Bernanke discusses future of Fannie and Freddie

“Federal Reserve Chairman Ben Bernanke said Friday that the federal government will need to continue to play a role in the future of the mortgage financing market.

“In a speech broadcast to an economic symposium in Berkeley, Calif., Bernanke said there are many alternatives that need to be considered but that all will involve a role for the federal government and federal guarantees for securities backed by mortgage loans.

“‘Government likely has a role to play in supporting mortgage securitization, at least during periods of high financial stress,' he said.

“The two government sponsored firms either owned or guaranteed about $5 trillion in mortgages between them and their problems could end up costing taxpayers hundreds of billions of dollars in future losses.

“But Bernanke said having them replaced by totally private firms could cause greater problems for the economy during a future financial crisis. Thus, he said that the federal government will likely have a role guaranteeing mortgages into the future.

“‘From a public policy perspective, a greater concern with fully privatized [firms] is whether mortgage securitization would continue under highly stressed financial conditions,' he said. ‘As I have noted, almost no mortgage securitization is occurring today in the absence of a government guarantee.'

“Bernanke did not endorse any specific alternative for Fannie and Freddie and he stopped short of advocating for the government to completely nationalize the two firms. Instead, he gave a rundown of numerous proposals that have already been raised by Fed and Treasury officials as well as other experts.”

Source: Chris Isidore, CNNMoney.com , October 31, 2008.

Financial Times: Hungary gets $25.1 billion rescue package

“The International Monetary Fund, the European Union and World Bank on Tuesday agreed to a $25.1 billion economic rescue package for Hungary to bolster confidence in its economy hit by the global financial crisis.

“The IMF said it had reached an agreement with Hungary for a $15.7billion loan programme, while the European Union stood ready with an additional $8.1 billion in financing and the World Bank another $1.3 billion. The IMF loan will be disbursed over 17 months.

“It is the biggest international rescue package for an emerging market economy since the start of the current global crisis and is the first for an EU-member country. Last week the IMF approved a $2.1 billion deal for Iceland and a $16.5 billion programme for Ukraine.

“‘The Hungarian authorities have developed a comprehensive policy package that will bolster the economy's near-term stability and improve its long-term growth potential,' Dominique Strauss-Kahn, IMF managing director, said.

“‘At the same time it is designed to restore investor confidence and alleviate the stress experienced in recent weeks in the Hungarian financial markets,' he added.”

Source: Financial Times , October 28, 2008.

Financial Times: Gulf Bank bailout

“Who would have thought it? Gulf states, or rather their petrodollar-flush sovereign wealth funds, had won a reputation for providing first aid to the ailing global financial system, taking stakes in once-revered names only to watch their value plummet. It was as if they could pour good money after bad almost indefinitely, even as the oil price fell towards $60 a barrel.

“The same aura of resilience extended to the Gulf's banks – until Kuwait's weekend rescue. Gulf Bank is the region's first casualty – not because of subprime losses or overexposure to the heady Dubai property market, but after derivative counterparties defaulted, costing it an estimated $800 million. Seven days is a long time in a global financial crisis: a week after the Central Bank of Kuwait said deposit guarantees were not needed, Gulf Bank's loss – which looks to be a one-off – forced it to guarantee all local bank deposits.”

Source: Financial Times , October 27, 2008.

Bloomberg: Shipping news suggests world economy is toast

“In the third quarter of 2007, Volvo AB booked 41,970 European orders for new trucks. Guess how many prospective purchases Volvo, the world's second-biggest maker of heavy rigs, received in the third quarter of this year?

“Here's a clue. Picture a highway gridlocked by 41,815 abandoned trucks – because Volvo's order book got destroyed to the tune of 99.63%, with customers signing up for just 155 vehicles in the three-month period, the Gothenburg, Sweden-based company said last week.

“The pathogen that has fatally infected swathes of the banking industry is now contaminating non-financial companies. ‘We're heading toward the sharpest downturn I've ever seen in Europe,' said Chief Executive Officer Leif Johansson.

“Volvo has company. Daimler AG, the world's biggest truckmaker, said earlier this month that its US deliveries slumped by a third in the first half of the year.”

Source: Mark Gilbert, Bloomberg , October 30, 2008.

Bill Moyers Journal: Interview with James Galbraith

“Bill Moyers sits down to talk about the economic future with James K. Galbraith, Chair in Government/Business Relations at the LBJ School of Public Affairs of the University of Texas.”

Source: Bill Moyers Journal , October 24, 2008.

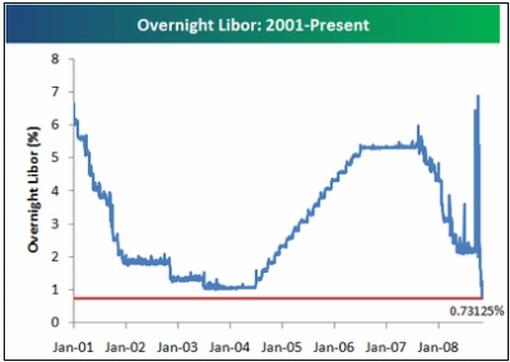

Bespoke: Overnight Libor at lowest level in years

“As a sign that the credit crisis has eased significantly for the time being, overnight Libor has dropped to its lowest levels in years to 0.73125%. After spiking to 6.43% at a time when the Fed funds rate was at 2% on September 16, and then spiking to 5.09% again on October 9, O/N Libor is now below the 1% Fed Funds Rate. Let's hope it stays that way!”

Source: Bespoke , October 30, 2008.

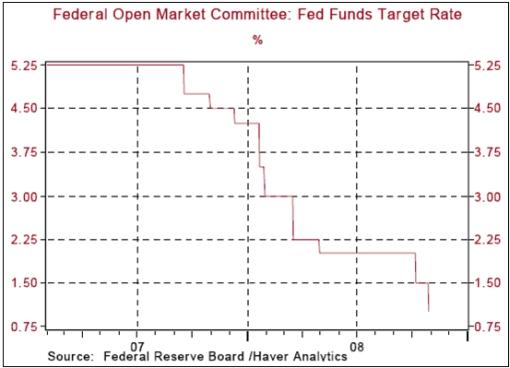

Asha Bangalore (Northern Trust): Fed takes aggressive action

“The Fed took aggressive action once again and lowered the Fed funds rate 50 bps to 1.00%, putting the total amount of easing at 425 bps since September 18, 2007. It was a unanimous vote. The discount rate was also cut by 50 bps to 1.25%.

“On October 8, the FOMC statement indicated that economic activity has weakened, while particular sectors were not mentioned. By comparison, the October 29 statement describes slowing conditions but also notes explicitly that the major culprit is consumer expenditure.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 29, 2008.

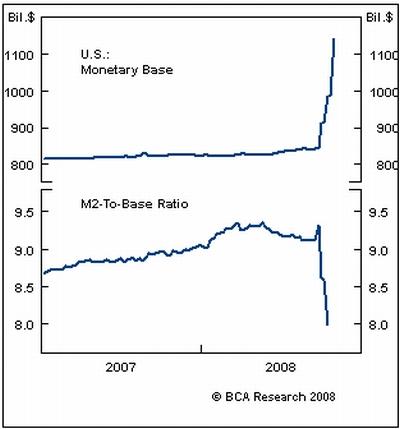

BCA Research: Fed moving closer to monetization

“The Fed funds rate may well hit zero in the next six months given the profound weakening in the economic outlook. Eventually, the Fed might be forced to print money.

“As expected, the Fed eased policy again yesterday, returning the funds rate to 1%, the level reached in the wake of the burst technology bubble. The economy is in much worse shape today than it was back then, warning that policy may have to be eased even further.

“While the Fed's program to purchase commercial paper appears to be off to a good start, the key issue is whether there is a more broad-based thaw in the credit freeze. The signs are still not encouraging on this front with many key credit spreads at or close to their peaks.

“The Fed's balance sheet has exploded upwards, but the corresponding rise in bank reserves needs to spread out into the broader economy. In this respect, it will be important to monitor the ratio of M2 to the monetary base (the money multiplier). This has plunged recently, but that may simply be due to lags. If it fails to revive, the Fed will continue to expand its asset support programs but ultimately may have to resort to quantitative easing.”

Source: BCA Research , October 30, 2008.

The Wall Street Journal: Ex Fed governor makes case for zero Fed funds rate

“With the US unemployment rate now expected to climb well above 7%, former Federal Reserve governor Laurence Meyer projects that Fed policymakers may have to lower the target federal-funds rate all the way to zero next year.

“The FOMC is widely expected to reduce the rate to 1% from 1.5% at the conclusion of its two-day meeting Wednesday. Meyer and former Fed economist Brian Sack, who are both with Macroeconomic Advisers, said they expect another half-percentage-point rate cut in December, to 0.5%. Their baseline assumption is that the easing cycle will stop there.

“‘However, the expected rise in the unemployment rate, paired with the rising threat of deflation, presents a risk that the FOMC will have to ease even further, perhaps all the way to a zero federal funds rate,' Meyer and Sack wrote in a research note.

“Meyer and Sack said they think the jobless rate will rise to as high as 7.5% from 6.1% now. They also expect a significant gross domestic product contraction of 2.8%, at an annual rate, in the fourth quarter, after a projected 0.7% decline in the third. They also expect GDP to fall in the first quarter of next year.”

“‘Plugging our interim forecast into our backward-looking policy rule suggests that the federal funds rate should be cut to zero by the middle of next year,' Meyer and Sack wrote.

“‘Our forward-looking policy rule … gives similar results if we plug in our updated forecast, as it calls for a funds rate of about zero by early 2010,' they wrote.”

Source: The Wall Street Journal , October 28, 2008.

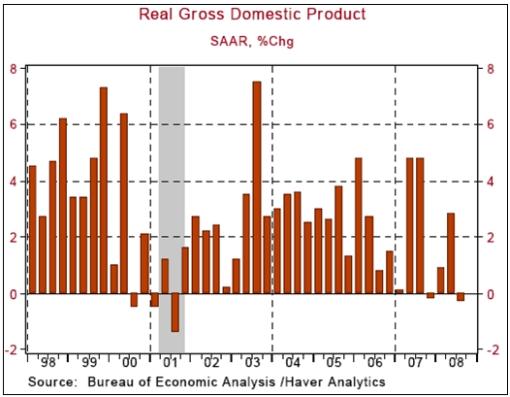

Asha Bangalore (Northern Trust): Q3 GDP – details tell a grimmer story than headline

“Real gross domestic product fell 0.3% in the third quarter, after a boost from tax-rebate dollars lifted growth in the second quarter to an annual rate of 2.8%. The decline in real GDP as seen from the headline is sobering but less troublesome than the details.

“Government spending contributed 1.15% to the headline GDP, with the defense component accounting for the lion share (+0.9%) of the increase. Going forward, state and local government spending is likely to be weaker than the already tepid growth seen in the past few quarters.

“The contribution of net exports to growth of real GDP in the third quarter (1.13%) was close to that of government spending. However, economic growth in foreign economies has slowed and projections show weaker world economic growth (even excluding the US) in the quarters ahead compared with forecasts prior to the intensification of the financial turmoil.

“Among the other major components of GDP, consumer spending fell at annual rate of 3.1% in the third quarter, the first quarterly decline since the fourth quarter of 1991 when consumer spending dropped at an annual rate of 0.3%. The magnitude of the decline in consumer spending is the largest since the second quarter of 1980, when some households literally were cutting up their credit cards.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 30, 2008.

John Williams (Shadow Government Statistics): US economy is in a severe recession

“The reported ‘advance' growth estimate usually is massaged so as to come in close to consensus, in this case a little bit better …

“With real retail sales, housing, nonfarm payrolls, new orders for durable goods and industrial production all showing quarterly and annual growth patterns never seen outside of a recession still in deterioration, GDP reporting eventually should show a string of quarterly contractions, with the recession dating back to fourth-quarter 2006, long before the exacerbation of the current systemic solvency crisis. … official GDP surrogates such as Gross National Product (GNP) and Gross Domestic Income (GDI) have shown varying patterns of quarterly contractions. GDP is the theoretical equivalent of GDI (consumption side versus income side) and is GNP net of the trade balance in interest and dividend payments.

“Based on existing GDP, GDI and GDP reporting, the following quarters have shown inflation adjusted quarterly contractions: 1Q07 (GNP), 4Q07 (GDP), 1Q08 (GDP/GDI), 3Q08 (GDP).”

Source: John Williams, Shadow Government Statistics (via The King Report ), October 30, 2008.

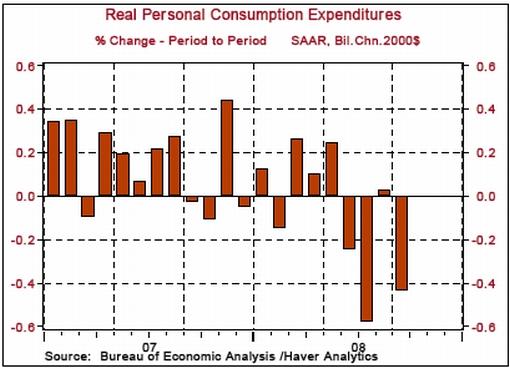

Asha Bangalore: Consumer spending on watch list, no surprises here

“Consumer spending dropped 0.3% in September, following two months of steady readings. However, after adjusting for inflation, consumer spending has dropped in three out of the last four months. In September, inflation adjusted consumer spending declined 0.4% after a nearly flat reading in August (+0.02%).

“On a quarterly basis, the decline in the third quarter (-3.1%) is the first drop since the fourth quarter of 1991. In September, real consumer spending fell 0.4% on a year-to-year basis, which is the largest drop since January 1991. Why is this sharp decline important? Consumer spending is the largest component of GDP (a little over 70%) and it has been the engine of growth. At the cost of stating the obvious, a setback in consumer spending translates into overall weak economic conditions. Keeping up with the Halloween tradition, it is scary indeed!”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 31, 2008.

Asha Bangalore (Northern Trust): Falling prices lift sales of new homes

“Sales of new single-family homes rose 2.7% to an annual rate of 464,000 in September. Purchases of new single-family homes are down 66.6% from the peak in July 2005. The August sales mark of 452,000 units appears to be the bottom for the current business cycle.

“The inventory of unsold new single-family homes dropped to a 10.4-month supply from an 11.4-month mark in August. The downward trend is a positive factor. But the elevated level continues to suggest that additional declines in home prices are nearly certain.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 27, 2008.

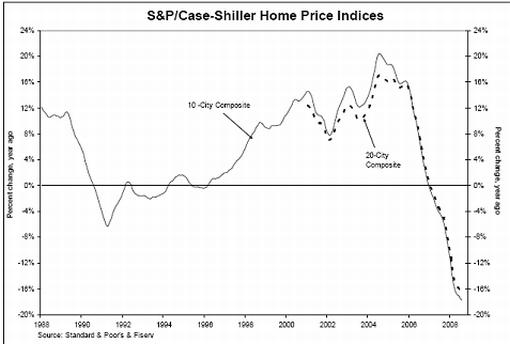

Standard & Poor's: Case-Shiller – national trend of home price declines continues into the second half of 2008

“Data through August 2008, released today by Standard & Poor's for its S&P/Case-Shiller Home Price Indices, shows continued broad based declines in the prices of existing single family homes across the United States, a trend that prevailed throughout the first half of 2008 and has continued into the second half.

“The chart above depicts the annual returns of the 10-City Composite and the 20-City Composite Home Price Indices. Once again, the indices have set new records, with annual declines of 17.7% and 16.6%, respectively. However, the acceleration in decline was only moderate in August. The July data reported annual declines of 17.5% and 16.3%, respectively.”

Source: Standard & Poor's , October 29, 2008.

The New York Times: Consumers feel the next crisis: it's credit cards

“First came the mortgage crisis. Now comes the credit card crisis. After years of flooding Americans with credit card offers and sky-high credit lines, lenders are sharply curtailing both, just as an eroding economy squeezes consumers.

“The pullback is affecting even creditworthy consumers and threatens an already beleaguered banking industry with another wave of heavy losses after an era in which it reaped near record gains from the business of easy credit that it helped create.

“Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5% of credit card debt outstanding, and could surpass the 7.9% level reached after the technology bubble burst in 2001.”

Source: Eric Dash, The New York Times , October 28, 2008.

James Quinn (Telegraph): US faces deflation to compound its misery

“One of Wall Street's leading economists has warned that North America faces a period of significant deflation next year on tops of its already sizeable economic challenges.

“David Rosenberg, Merrill Lynch's chief US economist, believes that deflation will occur, adding to the recessionary environment North America already finds itself in and potentially delaying the nation's economic recovery.

“Mr Rosenberg was the first Wall Street economist to declare that the US had entered a recession back in January of this year, and had also long warned of systemic problems in the global credit markets.

“‘We believe the next major macro-economic theme is deflation,' Mr Rosenberg writes in a research report. ‘Within a year, we see a very good chance that [inflation] will be running below 0% on a year-over-year basis.'

“He argues that just as the economy was showing signs of a recession nearly a year before economic growth turned negative, today's current economic backdrop is deflationary.

“The respected economist goes on to explain that deflation can become self-perpetuating, as consumers begin to defer spending on hopes of further discounts as prices fall – so reinforcing the downward pressure on demand.

“‘Likewise, firms that are faced with deflation to their top lines are typically forced to cut costs to protect their profit margins and in so doing, trigger a second-round negative income effect on their workers and suppliers, which also ends up exacerbating the trend towards lower pricing.'”

Source: James Quinn, Telegraph , October 27, 2008.

Bloomberg: Mishkin sees “significant” odds inflation may go too low

“Former Federal Reserve Governor Frederic Mishkin talks with Bloomberg's Kathleen Hays about the US government's response to credit turmoil, the housing and mortgage markets and Fed monetary policy.”

Source: Bloomberg , October 28, 2008.

Guy Stear (Société Générale): US needs aggressive fiscal package

“An aggressive fiscal expansionary plan in the US after the elections could be the safety-net that capital markets need, argues Guy Stear, credit analyst at Société Générale.

“‘Equity markets continue to slide, while credit derivatives have come under significant pressure in the past week, even though the outlook for the financial sector has become marginally better over the past fortnight,' he points out. ‘The problem now lies with the non-financial sector.'

“The markets, Mr Stear says, are counting on interest rate cuts to turn the situation around – although these cuts are expected to be relatively short-lived. ‘US Fed funds futures are still pricing in hikes from the second half of next year,' he notes.

“‘And while lower rates might help the banking system, they arguably might not do much for the non-financial sector, especially if the banks are still cagey about lending. Worries about defaults are mounting as liquidity is strained,' Mr Stear says.

“‘So the real solution to this crisis is an aggressive expansionary fiscal package. This looks easier to achieve in the US than it does in Europe, although it will need to wait until after the Presidential elections.”

Source: Guy Stear, Société Générale (via Financial Times ), October 28, 2008.

Financial Times: Pension fund gap hits $100 billion<

“US companies will need to inject more than $100 billion into their pension funds to cover market losses, putting them in a cash squeeze at a time when it is difficult to raise money.

“The cash payment, estimated by several pension industry executives, would be spread over this financial year and next year.

“Companies' pension fund losses – running at an estimated 20% in the year to date – also are expected to alter earnings this year, partly because of accounting changes.

“The 700 largest corporate plans were more than 100% funded at the end of last year, but as of last week that had fallen to about 83%, according to estimates by Mercer, a pension consultant.

“John Erhardt, a principal at Milliman, a consulting firm, said: ‘To bring company funds back to 100% funding, companies would need to put in about $50 billion this year and that again next year, for the top 100 funds. You could add another 30% to 40% to that for the rest of the funds.'

“‘Earnings will be impacted significantly. The 2008 year-end balance sheet will reflect that.'”

Source: Deborah Brewster, Financial Times , October 29, 2008.

Telegraph: Thousands of hedge funds on brink of failure

“Emmanuel Roman, of GLG Partners, said 25% to 30% of the world's 8,000 hedge funds would disappear ‘in a Darwinian process', either going bust or deciding meagre profits are not worth their efforts.

“‘This will go down in the history books as one of the greatest fiascos of banking in 100 years,' said Mr Roman, who with Noam Gottesman, co-runs GLG, a former division of Lehman Brothers Holdings with assets of $24 billion. ‘There need to be some scapegoats, and the regulators are going to go hunt people. That will be good in the long run.'

“His views were echoed by Professor Nouriel Roubini, a former US Treasury and presidential adviser known for his accurate prediction of financial crises, who estimated that up to 500 hedge funds would fail within months.

“‘It's the beginning of the decline of the US financial empire. The Great Depression ended in a massive war. I hope that's not going to happen but it's pretty ugly now,' Prof Roubini said.”

Source: Rowena Mason, Telegraph , October 24, 2008.

Bloomberg: Levitt says derivatives necessary, should be regulated

“Former US Securities and Exchange Commission Chairman Arthur Levitt talks with Bloomberg about the importance of credit derivatives to the financial markets and the need for regulation and transparency, and the outlook for executive compensation at financial firms.”

Source: Bloomberg , October 29, 2008.

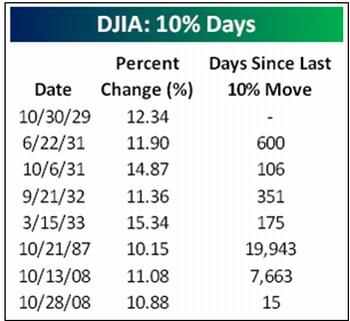

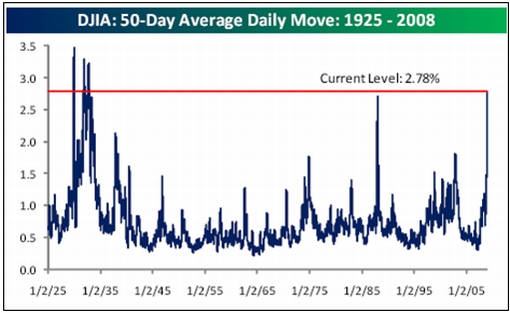

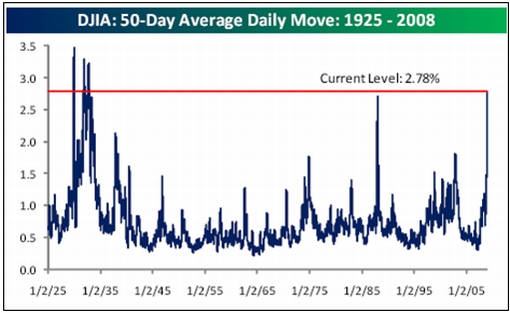

Bespoke: Another double digit move higher

“Today's 10.88% gain in the Dow was the seventh largest one-day percentage gain in the index since 1900. It was also the second 10%+ gain in the last half month (15 days), a feat that has never happened once in the last 100+ years. Below we show the context in which each prior 10%+ gain occurred. While the move in 1987 led to a prolonged rally, the moves in the 1930s proved only to be an opportunity to sell.

“The fact that the Dow is still down 15% this month even with two 10% up days shows just how unhinged this market has become. Over the last fifty trading days, its average daily percentage move on an absolute basis has been 2.78%. The wild swings make the current period the most volatile in terms of one-day moves that we have seen since the early 1930s.”

Source: Bespoke , October 28, 2008.

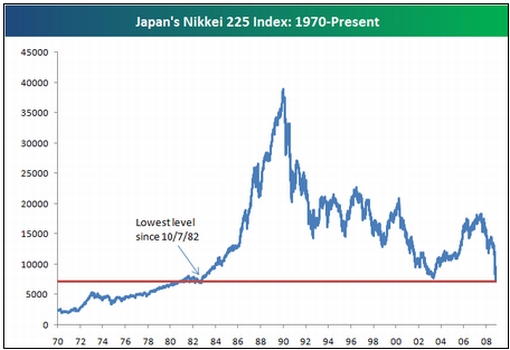

Bespoke: The lost quarter century

“Japan in the 1990s was the original ‘lost decade', even though the current decade for the US is now considered the same. But now that the Nikkei 225 is currently trading at its lowest levels since October 1982, it really is the ‘lost quarter century' for Japan.”

Source: Bespoke , October 27, 2008.

CNBC: Is this the bottom and the turn?

“The Dow gained a massive 11% in Tuesday's trading session. Is this the bottom and the turn? Wilbur Ross, Chairman & CEO of WL Ross & Co., shares his views with CNBC.

Source: CNBC , October 28, 2008.

The New York Times: Forecasters race to call the bottom to the market

“Financial forecasters are in a race to call the bottom to the bear market. And just as on the way up, when analysts competed for attention with their forecasts of bigger and bigger gains, the financial pundit class now seems compelled to out-gloom the next guy.

“‘To make a crazy forecast today is not crazy,' said Owen Lamont, a former professor at Yale who has studied economic forecasting. ‘It's not crazy to predict the Dow is going to 2,000. That's in the realm of possibility.'

“Indeed, in an era of 1,000-point daily swings in the Dow and 30% losses in the stock market, prescience is at a premium – and the dividends of a high-profile correct call can be immense.

“In 1987, a little-known strategist named Elaine Garzarelli found herself a newly minted celebrity after predicting the market would crash just days before Black Monday. This time around, longtime doomsayers like Nouriel Roubini of New York University have become media staples since many of their most apocalyptic predictions started coming true.

“Even in normal times, forecasters have a strong incentive to make extreme predictions, which is why those ‘Dow 1,000!' reports persist. ‘It's eye-popping. It's relevant. It seems exciting,' Mr. Lamont said. Such predictions attract publicity, name recognition and a bigger client base in a business where investors pay thousands, if not millions, for stock advice and investment guidance.

“‘Anyone that invests 10 cents on the basis of someone's forecast of the Dow is desirous of losing a good portion of their 10 cents,' said William A. Fleckenstein, president of Fleckenstein Capital, a money management firm in Issaquah, Wash. ‘It is almost the height of arrogance to say this is where the Dow is going to trade.'

“‘These types of forecasts are wildly off-base,' Mr. Fleckenstein said. ‘What they're always about is extrapolation. People are always extrapolating recent trends. And you don't know how far the trend is going to really run.'”

Source: Michael M. Grynbaum, The New York Times , October 26, 2008.

David Fuller (Fullermoney): How to identify a stock market low

“How will we know that capitulation selling and deleveraging is mostly over? One sign would be a loss of downside momentum by stock markets beyond the brief pause that we have seen recently. However, I think we may also need to see some weakness in the two main carry trade currencies during recent years – the Japanese yen and US dollar. Their considerable strength since July is the inverse mirror image of asset deleveraging, as people scramble to repay their liabilities in JPY and USD.

“… for evidence of a stock market low, I would look for a loss of downside momentum by share indices, coinciding with a loss of upside momentum for the yen and US dollar. Meanwhile, the proximity of the 2002 bear market lows for the S&P, plus its current downside overextension relative to the moving average (MA), suggest that some mean reversion is overdue. If accompanied by weaker carry trade currencies, we should see a rally towards the declining MA. However if the yen and dollar remain firm, we may only see a ranging reversion towards the declining MA.

“Recently, the S&P paused in its decline following the October 10 low, but remains barely steady near that level. Moreover, stock market indices for most other countries have already broken downwards once again.

“… many people feel that the fundamentals are much worse today than in 2002. They certainly have a point. Therefore, a cautious investor may prefer to wait for evidence of new bull markets before significantly increasing equity exposure. The technical signals would be base formation development followed by breaks above the 200-day MAs, which also turn upwards. I do not know when that will occur but the charts will certainly show us.”

Source: David Fuller, Fullermoney , October 28, 2008.

Ian Scott (Nomura): Stocks to bottom soon

“Stock markets should show signs of bottoming out soon, given the robust response of governments and central banks to the financial crisis, believes Ian Scott, equity strategist at Nomura.

“He says with markets behaving as they are, rationalising such extreme movements with economic or corporate fundamentals is virtually impossible.

“‘While it is always theoretically possible to invent an economic scenario to justify current prices, the scenario that would now be required necessitates policy failure on a scale not seen since the 1930s.

“‘Yet it is hard to imagine a more committed policy response than the one we have had, and there are now some tentative signs that it is having an impact. Stocks should bottom soon.'

“Mr Scott argues that with inflation absent, interest rates are set to come down sharply. ‘Although we would bias away from leveraged companies, we would overweight rate-sensitive sectors.

“‘Indeed, there is a stark contrast between early-cycle cyclicals – where earnings estimates have been cut, valuations are low and rate cuts will be a benefit – and late-cycle industrials where earnings estimates have barely budged and valuations are high, and which tend to underperform when rates come down.

“‘We suggest biasing portfolios in favour of media, retail, real estate and technology and away from capital goods, construction and building materials, leisure, steel and consumer staples.'”

Source: Ian Scott, Nomura (via Financial Times ), October 27, 2008.

Eoin Treacy (Fullermoney): Has dollar and yen turned into tailwind for equities

“This week has seen some extremely large moves in the currency markets. Over the last few months, two of the main beneficiaries of the liquidation of carry trades have been the US dollar and especially the Japanese yen. Both of these currencies have rallied in impressive fashion and their strength has been a considerable headwind for commodity and many equity markets. In fact there is a clear correlation between the rally in these currencies and the weakness of emerging market stock indices. The question now is whether this headwind is turning into a tailwind.

“The yen has gone from being one of the weakest currencies in the world to one of the strongest in a very short time. This has seen it advance considerably in a clearly accelerated move which is now under pressure. Although the Yen found a least short-term support today, it needs to sustain moves to significant new highs to question scope for a further retracement of recent gains.

“The dollar also rallied impressively over the last few months and encountered resistance this week. However, the commonality of this move is far less clear cut with the dollar than for the yen. The Dollar Index's rally broke its almost three-year downtrend and forced investors to reassess the medium-term prospects for the currency. It encountered resistance this week near 88, but this is so far an equal sized reaction to that posted in September. It needs to now encounter resistance below 88 and sustain a move below 84 to confirm that it has hit a medium-term peak.”

Source: Eoin Treacy, Fullermoney , October 30, 2008.

The New York Times: Are stocks the bargain you think?

“Some of the country's most famous investors, including Warren Buffett and John Bogle, have started to make the case that it's time to dive back into the stock market.

“They are usually careful to add that they don't know what stocks will do in the short term. Yet their basic message is clear enough: stocks are now cheap, irrational fears have been driving the market down lately, and people who buy today will be glad that they did.

“After a day like Tuesday, when the market rose 11%, it's easy to see the merits of the argument.

“ there is another argument that deserves more attention than it has gotten so far. It's the bearish argument that is based neither on fears that the country may be sliding into another depression nor on gut-level worries about the unknown. It is based on numbers and history, and it has at least as much claim on reason as the bullish argument does.

“It goes something like this: Stocks are truly cheap only relative to their values over the last 20 years, a period that will go down as one of the great bubbles in history. If you take a longer view, you see that the ratio of stock prices to corporate earnings is only slightly below its long-term average. And in past economic crises – during the 1930s and 1970s – stocks fell well below their long-run average before they turned around.

“To make matters worse, corporate earnings have now started to plunge, too. Assuming that they keep dropping, stocks would also need to fall to keep the price-earnings ratio at its current level.

“The 10-year price-to-earnings ratio tells an incredibly consistent story over the last century. It has averaged about 16 over that time. There have been long periods when it stayed above 16 and even shot above 20, like the 1920s, 1960s and recent years. As recently as last October, when other measures suggested the market was reasonably valued, the Graham-Dodd version of the ratio was a disturbing 27. But periods in which the ratio has jumped above 20 have always been followed by steep declines and at least a decade of poor returns.

“By 1932, the ratio had fallen to 6. In 1982, it was only 7. Then, of course, the market began to self-correct in the other direction, and stocks took off.

“After Tuesday's big rally, the ratio was just a shade below 16, or almost equal to its long-run average. This is a little difficult to swallow, I realize. Stocks are down 40 percent since last October, and every experience from the last 25 years suggests they now have to bounce back.

“But that's precisely the problem. Since the 1980s, stocks have always bounced back from a loss, usually reaching a high in relatively short order. As a result, the market became enormously overvalued.

“As Robert Shiller, the economist who specializes in bubbles, points out, human beings tend to put too much weight on recent experiences. We think the market snapbacks of 1987 and the current decade are more meaningful and more predictive than the long slumps of the 1930s, 1940s and 1970s. Of course, anyone who made the same assumption in 1930 or 1975 – this just has to turn around soon – would have had to wait years and years until the investment paid off.”

Source: David Leonhardt, The New York Times , October 28, 2008.

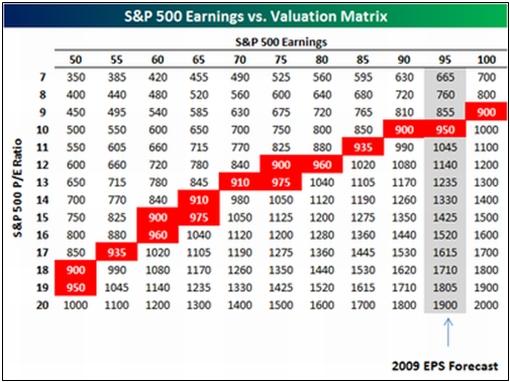

Bespoke: S&P 500 earnings versus valuation matrix

“Even though we're in the midst of earnings season, most investors really have no idea where earnings are going to be in the future. While the consensus forecast for 2009 is currently around $95, there probably isn't a person on the planet who thinks earnings will be anywhere near that high. But how much further below $95 will earnings be, and what multiple do those earnings deserve?

“With that in mind, we created a matrix to show where the S&P 500 would trade based on different combinations of earnings and multiples. Boxes highlighted in red indicate levels within 5% of where the S&P 500 is currently trading. As shown, if (and we realize there is really no chance of this happening) the consensus for 2009 EPS forecasts proves to be accurate, the S&P would currently be trading at about 10 times next year's earnings.

“So where are earnings likely to come in next year? One of the more bearish forecasts making the rounds is that earnings for the S&P 500 will come in at $60 per share next year. If that forecast proves to be accurate, that would bring the current multiple of the S&P 500 to about 15.5 times next year's earnings. While a multiple of 15 is by no means extremely cheap on a historical basis, it is hardly expensive either.”

Source: Bespoke , October 29, 2008.

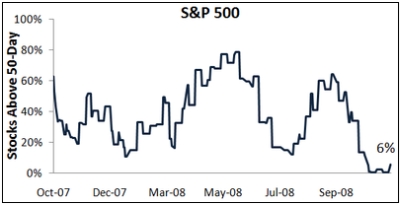

Bespoke: Percentage of stocks above 50-day moving averages

“After this week's 9% rally in the S&P 500 so far, 6% of stocks in the index are trading above their 50-day moving averages. At least it's not at zero, right?

“On a sector basis, 15% of Consumer Staples stocks are trading above their 50-days. And that is the most positive sector. Financials and Utilities rank second at 10%, followed by Health Care at 8%. Materials and Telecom are still unfortunately stuck at zero.”

Source: Bespoke , October 30, 2008.

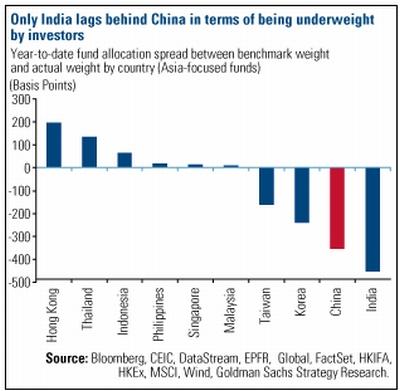

US Global Investors: Investors underweight Chinese equities

“China remains one of the most underweight countries for Asia-focused funds this year. However, given China's solid fundamentals compared with its regional peers, valuation extremes caused by global deleveraging and a potential presidential election rally in the US, sentiment might undergo a short-term improvement.”

Source: US Global Investors – Weekly Investor Alert , October 31, 2008.

Ambrose Evans-Pritchard (Telegraph): Europe on the brink of currency crisis meltdown

“The financial crisis spreading like wildfire across the former Soviet bloc threatens to set off a second and more dangerous banking crisis in Western Europe, tipping the whole Continent into a fully-fledged economic slump.

“Currency pegs are being tested to destruction on the fringes of Europe's monetary union in a traumatic upheaval that recalls the collapse of the Exchange Rate Mechanism in 1992.

“‘This is the biggest currency crisis the world has ever seen,' said Neil Mellor, a strategist at Bank of New York Mellon.

“Experts fear the mayhem may soon trigger a chain reaction within the eurozone itself. The risk is a surge in capital flight from Austria – the country, as it happens, that set off the global banking collapse of May 1931 when Credit-Anstalt went down – and from a string of Club Med countries that rely on foreign funding to cover huge current account deficits.

“The latest data from the Bank for International Settlements shows that Western European banks hold almost all the exposure to the emerging market bubble, now busting with spectacular effect.

“They account for three-quarters of the total $4.7 trillion in cross-border bank loans to Eastern Europe, Latin America and emerging Asia extended during the global credit boom – a sum that vastly exceeds the scale of both the US sub-prime and Alt-A debacles.

“Austria's bank exposure to emerging markets is equal to 85% of GDP – with a heavy concentration in Hungary, Ukraine, and Serbia – all now queuing up (with Belarus) for rescue packages from the International Monetary Fund.

“Exposure is 50% of GDP for Switzerland, 25% for Sweden, 24% for the UK, and 23% for Spain. The US figure is just 4%. America is the staid old lady in this drama.”

Source: Ambrose Evans-Pritchard, Telegraph , October 26, 2008.

BCA Research: Currency strategy after panic subsides

“Given the extreme volatility in the market, it remains too early to make large currency bets. Once the panic subsides and financial stress eases, our strategy will have three pillars.

“First, the euro and pound will be ‘trading buys' against the dollar and yen, but no more than that. The European economies and financial systems will be soggy for some time, and their central banks are still behind the curve.

“Second, the trade-weighted dollar is close to a three-year high, which will not make economic sense even after the US economy and banking system turn the corner. Most likely, the dollar will lose ground against emerging and commodity currencies with good fundamentals, but will hold its own against the euro.

“Finally, the yen is a tougher call and we recommend standing aside. On economic grounds, the currency is a sell the minute that investor risk aversion peaks. However, the Japanese balance of payments warns that policymakers would have to knock down the yen. The private sector has been burned on foreign investments too often, and any renewed Japanese ‘stretch for yield' will be moderated by interest rate cuts around the globe.”

Source: BCA Research , October 29, 2008.

BCA Research: Approval for yen intervention

“The G7 statement over the weekend gives Japan's Ministry of Finance the latitude to intervene and slow the yen's appreciation.

“The G7 made a rare unscheduled statement on currency market movements earlier. The statement comes as the trade-weighted Japanese yen rallied to an 8-year high last week. It has recently become clear that many leveraged trades were financed with borrowed yen, and unwinding of these positions has sent the currency surging. The yen is up over 22% since August, which effectively destroys exporters' profit forecasts and threatens to destabilize global markets.

“To that end, the G7 issued the following comments: “We reaffirm our shared interest in a strong and stable international financial system. We are concerned about the recent excessive volatility in the exchange rate of the yen and its possible adverse implications for economic and financial stability. We continue to monitor markets closely, and cooperate as appropriate.”

“Bottom line: If this ‘verbal intervention' does not slow the accent of the yen in the coming days, expect the Bank of Japan (acting as an agent of the Ministry of Finance) to intervene in markets and purchase yen. Still, while the medium-term effect may be positive, the immediate impact will be limited unless there are coordinated efforts on behalf of all G7 nations. For now, this outcome seems highly unlikely.”

Source: BCA Research , October 28, 2008.

Bloomberg: Jim Rogers – commodities in a recession

Source: Bloomberg (via Clip Syndicate ), October 24, 2008.

Richard Russell (Dow Theory Letters): Gold attempting to make a bottom

“Let's take a hard look at gold. It's severely oversold. From October 9 to 23 gold declined on a closing basis 8 out of 10 sessions or 80% of the time. That alone spelled oversold. Note the long ‘stems' on the first red arrow. These stems denote rejection of the downside. The blue histograms are beginning to pull back towards zero. Finally, the full stochastics are in oversold territory and are now starting to turn up. Conclusion – gold may now be attempting to establish a bottom.”

Source: Richard Russell, Dow Theory Letters , October 27, 2008.

Financial Times: Trichet says ECB may cut rates

“The European Central Bank could cut interest rates again at its next meeting on November 6, ECB president Jean-Claude Trichet said on Monday.

“‘I consider possible that the governing council will decrease interest rates once again at its next meeting on November 6. It is not a certainty, it is a possibility,' Trichet said in a speech at a banking conference in Madrid.

“‘New information is likely to indicate a further alleviation to upside risks to inflation in the medium term.'

“The ECB cut rates by 50 basis points in tandem with other central banks on October 8 and economists had already forecast further loosening by the end of the year as both growth and inflation cool.

“Mr Trichet said weakening economic growth was easing inflation fears but stressed that the ECB would only ease rates further from the current 3.75% if it felt the inflation outlook justified such a move.

“‘Any new monetary policy stance that we could decide on at our next regular monetary policy meeting must continue to allow us to tell our 320 million fellow citizens: You can be confident. We will deliver price stability in line with our definition of less than but close to 2% in the medium term,' Mr Trichet said.”

Source: Financial Times , October 27, 2008.

Reuters: Germany to spend and fight recession

“Germany say they may spend billions of dollars to bolster the economy in a bid to stave off a deep global recession.”

Source: Reuters , October 30, 2008.

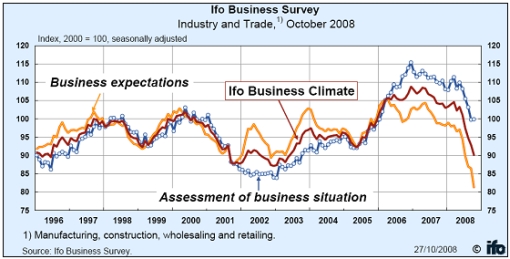

Victoria Marklew: (Northern Trust): Deteriorating outlook in Germany and the Eurozone

“Last week's PMI surveys for the Eurozone and for its various countries warned that the outlook for Q4 is deteriorating sharply. To date, the strongest of the major Eurozone economies clearly has been Germany, which may actually escape a technical recession if consumer demand keeps Q3 real GDP growth in positive territory. However, today's October Ifo business climate index for Germany – a poll of around 7,000 firms from this key exporting nation – deteriorated for the fifth consecutive month… Last week's PMI surveys from Germany also painted a very gloomy picture, with the manufacturing new orders index dropping to 39.3, the lowest since the series began in 1996, and business expectations in the services sector dropping to 34.3, the lowest since that series began in 1997.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , October 27, 2008 and Ifo , October 2008.

Nationwide: Twelve months of house price falls

“House prices in the UK fell for the twelfth consecutive month in October. The price of a typical house is now 14.6% lower than at this time last year, the peak of the market. The typical house price fell by 1.4% in October, around the same rate as the average monthly fall of 1.3% over the last year, but lower than the monthly falls recorded in each of the previous three months. The price of a typical house is now £158,872, almost £30,000 less than a year ago, but to put in context, still almost £30,000 more than five years ago.”

Click here for the full report.

Source: Nationwide , October 30, 2008.

Financial Times: Japan unveils economic stimulus package

“Taro Aso, Japan's prime minister, on Thursday unveiled a $50.8 billion economic stimulus package, the second in two months, warning of the damaging impact the global credit crisis would have on the world's second largest economy.

“‘A storm that comes once in 100 years is raging,' Mr Aso said of the global financial turmoil.

“While Japan's financial system remained sound, he said, there was no doubt that the global crisis would affect Japan's real economy. He promised to act quickly to implement bold measures to counter the downturn.

“The stimulus plan follows the passing of a supplementary budget earlier this month to fund Japan's first stimulus package this year.”

Source: Michiyo Nakamoto, Financial Times , October 30, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.