Countdown to ES Stock Market Downleg

Stock-Markets / Stock Index Trading Jun 18, 2023 - 08:49 PM GMTBy: Monica_Kingsley

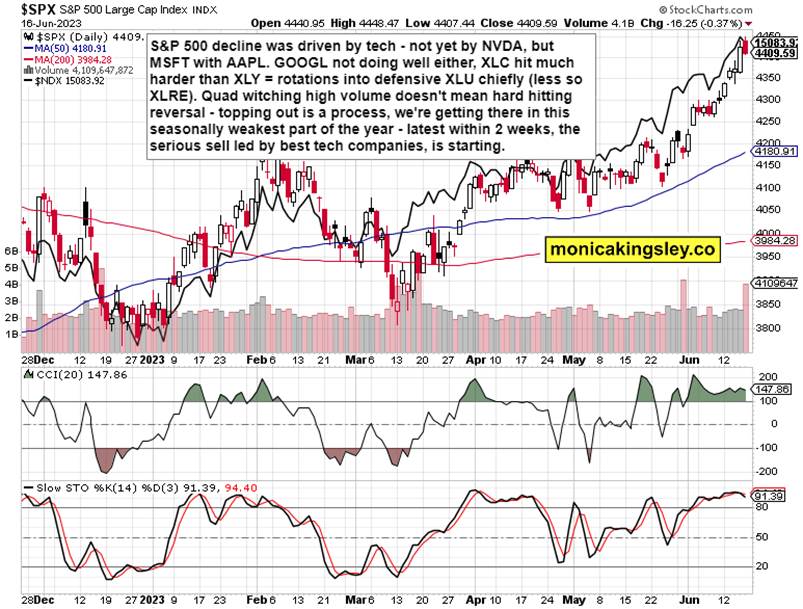

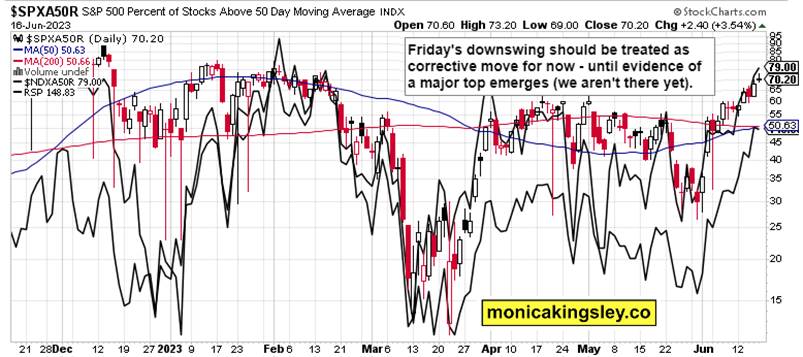

S&P 500 spike into options expiry Friday was predictably rejected, and tech led the daily reversal, joined by communications and discretionaries. This shot across the bow in the topping process (major top preceding lackluster summer culminating in Sep bottom) shows that Nasdaq wouldn‘t hesitate in leading the decline. That‘s the strength of passive investing in reverse – leading higher, and then leading lower.

This quad witching was a trial run, for I think the downtrend would establish itself within 2 weeks latest – and it wouldn‘t happen because of sharp deterioration in incoming data or proving that the mirage of avoiding recession is just that, a mirage. The market topping process thoroughly described a week ago would come from sheer overvaluation driven by AI FOMO that has taken stocks into extreme greed territory already – from realization thereof. Perhaps characteristically, while the bullish sentiment rises, stock funds are seeing outflows to bond funds.

The current rally is built on the false notion that recession has been and would be avoided, that earnings would start to rise, and that incoming data aren‘t generally bad. Further, markets still expect the Fed to cut rates, and significantly so – disregarding and challenging Powell who said no real cuts over the next 2 years, with Fed funds rate projected at 5.6%. Yet tech still keeps doubting the yields message – and its only saving grace Friday was that volume wasn‘t considerably higher.

To me, this current sky is the limit bear market rally has the hallmarks of post dotcom bubble and even the 2008 suckers‘ rallies when it was either not universally accepted that recession was already here, or it was fiercely debated whether the worst was actually over.

While it‘s notoriously hard to time the top in euphoric upswings of current Nasdaq flavor, the bubble going from developing to having developed would give way to ridiculous overvaluations and rotation the like of which we saw Friday – away from tech and other Top 10 leaders belonging to XLC and XLY in favor of defensives (XLU, then some XLRE with perhaps XLP and select XLV components) and really undevalued resource stocks from oil stocks to precious metals and base metals miners.

As I wrote on Friday:

(…) For all the arbitrary 20% delineation line in the sand, I still think that a serious downside awaits whether as drastic as during the dotcom bubble bear market described in Sunday‘s extensive analysis, or not. Given the sharp run up and AI fires still burning hot, I have question marks whether low 4,015s are the realistic target (provided the fuel for this S&P 500 burns out over the next 1-2 weeks) in place of the formerly more easily imaginable low 3,900s.

The key determinant is here – yesterday was a prime example of antidollar plays surging, with more fuel in the form of BoJ remaining as easy as before, prospects of China stimulus, and of course bets against Fed rate hikes.

Mind you, for these bets (by extension also against Fed balance sheet shrinking) to pay off, the central bank would have to be spooked into monetary policy readjustments by negative economic data – and once the stock market realized why, why they are being forced to cut and cutting, then look out below.

The dollar tellingly refused to rally much on outperforming UoM consumer confidence, and real assets (with the lagging gold that I singled out Friday as the one to lag) surged – calling recession as banished (retail sales above expectations show the consumer is still quite strong) and Fed to turn dovish. As if either couldn‘t have been farther from the truth…

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 6 of them.

S&P 500 and Nasdaq Outlook

ES is to face significant hurdle in the 4,490 – 4,510 area, overcoming which requires full sectoral cooperation on par with Thursday. I‘m though afraid we won‘t see that, and definitely not Tuesday or Wednesday – 4,460 as support didn‘t hold Friday, and the climb to merely 4,475 would take a lot of effort. If tech declined on higher volume, the path lower would have been easier – now, the bears need an immediate follow through early in the week – and market breadth doesn‘t really guarantee they would get one.

That‘s a cautious market breadth posture, and the advance-decline line of -665 is merely orderly corrective. More and continued strength in defensives beyond utilities is required.

As for ratios, both the cautious HYG:TLT and still jubilant SPY:TLT suggest that serious downswing in S&P 500 has to still wait those 1-2 weeks.

Gold, Silver and Miners

Gold is to remain relatively muted in the sessions ahead – silver would do better on continued dovish Fed bets coupled with still stubborn core inflation (even if that retreats over the months ahead finally somewhat, the Fed would rekindle the flames late this year). Therefore, mostly lean weeks in precious metals are ahead, and Thursday‘s donwswing rejection stands out.

Thank you

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.