Gold Price Erased Its April Rally – What’s Next?

Commodities / Gold & Silver 2023 Apr 29, 2023 - 08:03 PM GMTBy: P_Radomski_CFA

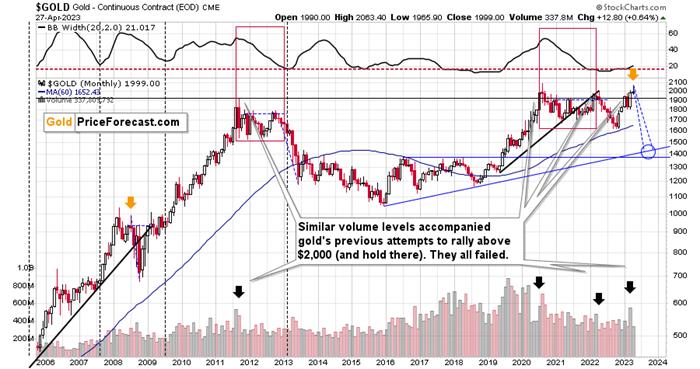

April had started with gold at $1,990, then gold moved as high as $2,063.40, and yesterday, it closed at $1,999. At the moment of writing these words, gold futures (because that’s what you see on the above chart) are trading at $1,993.

Monthly Reversal Candlestick

This means that gold formed a huge monthly reversal candlestick. Since the opening and closing (assuming that the current price will be the final price for the end of April) prices are almost identical, this candlestick is called a “gravestone doji”.

If gold moved a bit higher from here, it would create a “shotting star” candlestick based on its April price movement.

And if it moved a bit lower from here, it would… Also create a “shooting star” candlestick, just a different one.

What would the difference be?

None, because all those candlesticks are reversal patterns. In other words, the implications are almost certainly going to be bearish after today’s session, regardless of what fancy name we use to call this month’s price movement.

The only thing that could make this month’s candlestick bullish would be a rally of at least $30, which would have to happen today. And based on the analysis of gold’s pre-market decline, it’s highly unlikely that we’ll see something like that.

I wrote on numerous occasions about how important weekly gold price changes are, but monthly price changes take it to yet another level. A full month is enough time for any price noise to average-out and disappear. What ultimately happened?

This month in gold, ultimately, nothing happened except gold’s failure to break above $2,000.

The monthly reversal is a very powerful, bearish indication that points to lower gold prices in the following months.

Historical Comparison to 2008

How can things get any more bearish based on the above chart alone?

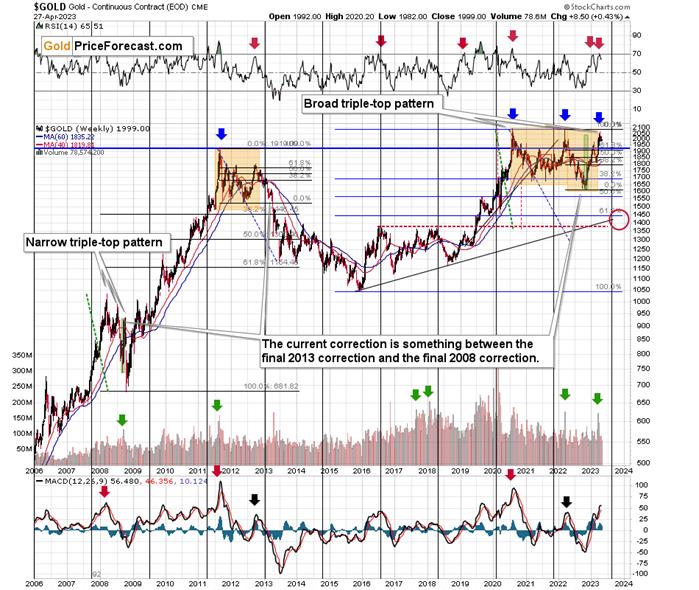

They actually can – please look at how gold started its sharpest decline of the past decades. That’s right, I mean the 2008 one.

Gold started it right after a monthly reversal! I marked the previous monthly reversal and the current one with orange arrows. The history tends to rhyme, so the implications here are very bearish.

There’s one additional thing about 2008 that I would like to emphasize here.

Namely, if you look at the size of the pre-slide corrective upswing we saw in 2008, you’ll notice that it’s practically identical to what we saw recently.

Sure, gold didn’t rally as sharply now as it did back then, but the overall size (percentage-wise) of the rallies is very similar. That’s what I marked with green rectangles.

So, yes, even though the recent rally seemed like a game-changer to many, it’s all within the self-similar pattern that ended with a massive decline.

Today's article is a small sample of what our subscribers enjoy on a daily basis. They know about both the market changes and our trading position changes exactly when they happen. Apart from the above, we've also shared with them the detailed analysis of the miners and the USD Index outlook. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

https://www.goldpriceforecast.com

Tools for Effective Gold & Silver Investments - SunshineProfits.com

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.