Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

Stock-Markets / Stock Market 2022 Dec 30, 2022 - 03:29 PM GMTBy: Nadeem_Walayat

I got my COVD AUTUMN BOOSTER JAB (Pfizer Biontech) Saturday afternoon, unfortunately I have since been paying the price in terms of side effects that kicked in some 12 hours afterwards with shivers and chills, and continue as I write some 36 hours later I am feeling like I have a light flu, lethargic, lack of energy, drowsy despite having slept for over 12 hours. some Brain fog. Still I will see this article posted even if it is the last thing I do!

US Senate Report Concludes Lab Leak Origins of SARS-CoV-2

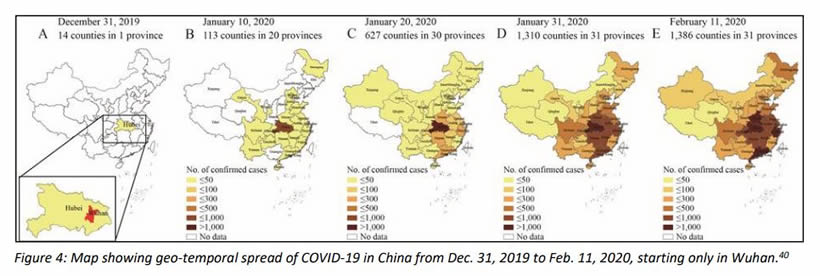

Back to the beginning, Wuhan Institute of Virology a couple of miles away from the Wuhan wet market.

https://www.help.senate.gov/imo/media/doc/report_an_analysis_of_the_origins_of_covid-19_102722.pdf

The jist of the 35 page report is that natural pandemics don't tend to start as one off events but as was the case with SARs1 and MERS there tend to be repeated outbreaks across the globe over a number of years from a large animal reservoir as the virus makes several attempts to jump species, this did not happen with SARS-Cov2 which is NEW virus that exploded onto the scene without any evolutionary history behind it i.e. there is no animal reservoir with repeat attempts to jump species, instead the virus was fully formed for human to human transmission with little genetic diversity in the initial outbreak (only 2 nucleotides difference out of 29000) amongst cases tested across China in early 2020 unlike today with the likes of Omicron that itself has sparked dozens of variants as it continues to mutate. So the virus was a finished 'product' hence spread like wildfire.

As I wrote 2.5 years ago, the silly billy's played with the genes of a bat virus and the world paid the price. First step is for China to recognise the magnitude of their error so as to prevent a potentially even worse repeat, else it WILL happen again!

The bottom line is that the case fatality rate of 0.9% (UK) for Covid-19 is nowhere as high as for MERS 50% so this time humanity got lucky as the pandemic showed just how unprepared the world was, it could have turned out to be many times worse!

Current State of the Bull Market

The Dow closed Friday at 32,403 correcting a trend that caught everyone off guard coming off a high of 33,205 which was roughly my target to be achieved Mid December! So a powerful stealth bull run has transpired!

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

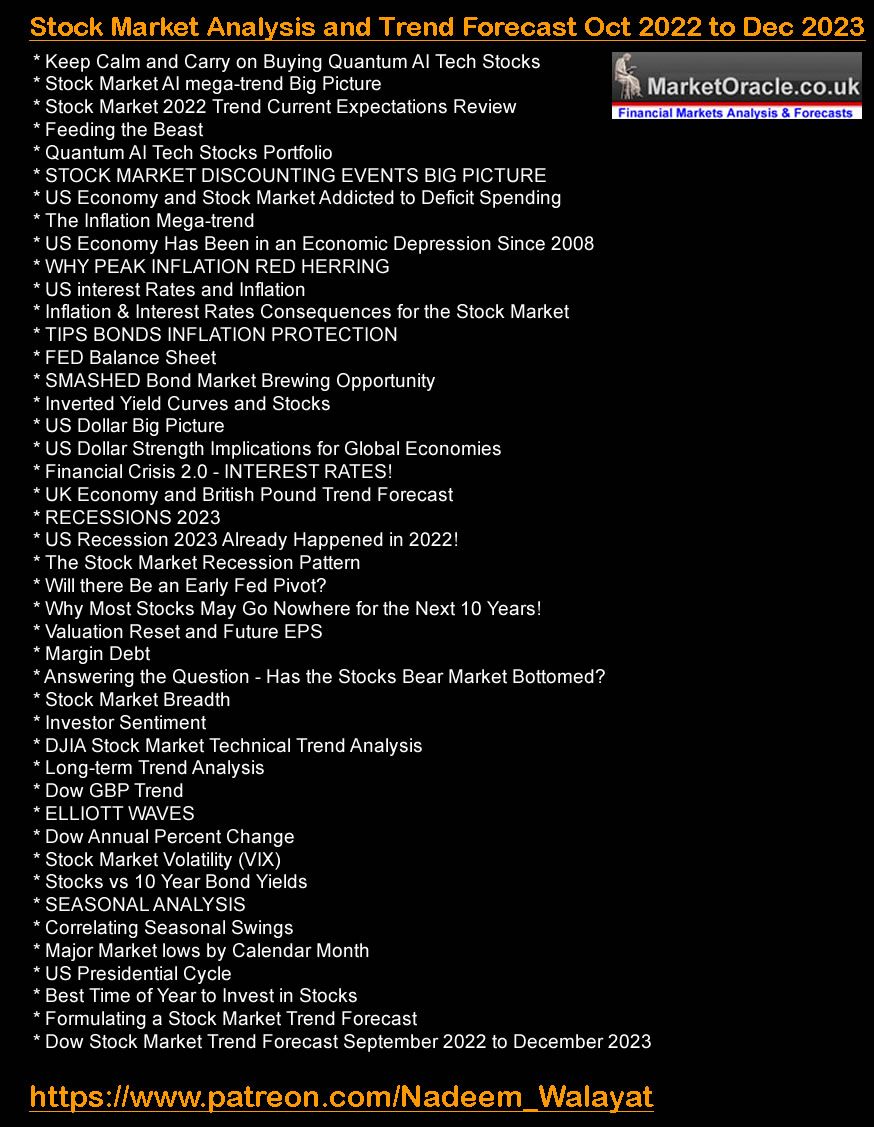

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

(TREND FORECAST CHART FOR PATRONS ONLY)

Unfortunately the Dow's bull run is not reflected in our portfolios or in the other indices such as the S&P and Nasdaq as this graph illustrates that whilst the Dow is up 10.7%, the S&P is only up 1.8%, we don't often see such deviations in performance. Meanwhile the Nasdaq was down 4.3% as the tech sector puked on earnings sending key stocks to NEW Bear market LOWS i.e. Google, Amazon, Meta and Microsoft. which prompted me to accumulate into all 4.

However, over the longer-term the S&P tends to outperform the Dow so we will likely see convergence in trend which implies to expect a stronger S&P playing catch up to a weaker performing Dow going forward. BUT, this has built in it the fact that the S&P is an index of 500 stocks! That is a lot of low volume garbage in there! Which is another warning to the index trackers rather than the stock pickers, where one is forced to take the good along with the bad and the ugly. Usually the good prevail, and lift the whole index as has been the case for decades, but that does not mean it's going to rinse and repeat going forward, the Dow outperforming is a warning shot of what could be in store for a decade of underperformance, I definitely do not have the time or inclination to dissect the 500 S&P stocks but the implications are the bad and the ugly will increasingly act as a drag on the averages. Where the only reason the Dow is outperforming is because it is a tiny pinprick of an Index of just 30 stocks. Nasdaq should fair better given that it is supposed to be 100 tech stocks sector index, though why Pepsico, Costco and starbucks amongst many other none tech stocks are doing in a tech stocks index I don't know. This is why I frown whenever someone brings up the Nasdaq and why I DO NOT LOOK at the Nasdaq at all. Where trading is concerned I prefer to focus on ONE index, used to be the Dow but for 2022 it has largely been the S&P, which I will gravitate towards in terms of future trend forecasts,

The S&P despite all of the hysteria surrounding the Fed meeting and Non Farms remains cool as a cucumber in terms of trend, as we see a Higher high and now a probable higher low in the making coming off the Mid October bear market low, whilst there may be more sideways to down price action given the drags we have this week with the Mid-terms and the 10th of November CPI release that could hold stocks back until after their conclusion. Nevertheless as long as the 3620 low holds then the pattern remains in tact for an eventual break higher of 3920 to target 4000+ where I would expect the S&P to achieve 4100 by Christmas and by the time this rally is done we may even see a break above 4300.

So short-term uncertainty to resolve in the S&P trending higher to target 4100 by Christmas.

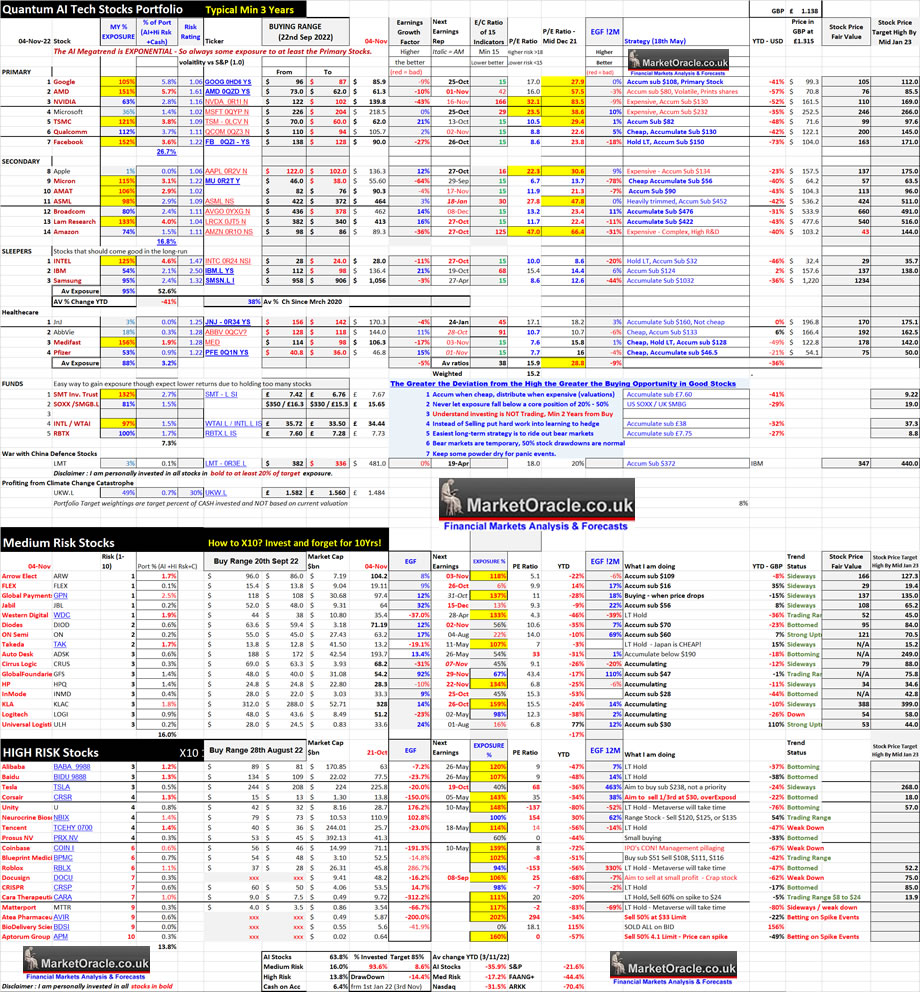

AI Stocks Portfolio

Tech sector bloodbath provided for a few more opportunities to accumulate in Google, Amazon, META and Microsoft. I am now 93.6% invested. I have also calced my draw down for the year as -14.4% (in GBP taking into account new deposits and trimming), so I am ready for the S&P to resume it's bull trend towards 4100 for an opportunity to trim after having heavily over invested in most target stocks.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Nov/Quantum-AI-tech-stocks-4th.jpg

Are I-Bonds Predicting a drop in Inflation ?

A patron commented - Interesting take on inflation: the US Treasury I-bonds (which one can invest $10k each year) will pay an annualized interest from November 1, 2022, through April 2023 of 6.89%, down from the 9.62% rate offered since May 2022. Probably an indicator that the inflation stats that are forthcoming will show we’ve peaked. https://treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

My reply - Yes that's a bit weird. how is November ibond 6.48% when it's supposed to be based on CPILIE, implies CPILIE for November will be 6.5%? What am I missing? Last reported CPI was 8.2%.

Actually looking at the rate it's now 6.89%. so looks like the 6.48% was an estimate. Still 6.89% is 2.31% LESS than CPI. According to the consensus CPI for October is forecast to be 8% vs 8.2%., so we could be finally in for a bullish CPI surprise.

Why INTEREST RATE HIKES Are INFLATIONARY!

Unfortunately I will have to leave this mostly for next time. But basically INTEREST RATE HIKES to bring INFLATION DOWN! Is NOT going to work because INTEREST RATES DO NOT CONTROL the RATE of INFLATION. So that which academics have built their whole careers on is BS! All I hear is Volcker raised rates that brought inflation down and so rinse and repeat, was it Interest rates that killed the Inflation of the 1970's? Are you sure your not lapping up the propaganda which is ECONOMICs perpetuated by the propaganda arms of Governments called central banks who's primary remit is to put up a smoke screen of misinformation so as to allow governments, to get away with printing money!

As I have voiced for well over a decade, Inflation is a function of governments PRINTING MONEY, of which QE is part of the equation i.e print money to monetize government debt, which despite all of the noise continues to this very day! Governments printing money on an epic scale for which the smoking gun is the Governments deficit spending, the US Federal Government is spending $1.4 trillion more than it earns in revenue that is PRINTING MONEY! For the UK it's about £120 billion,

What do you think interest rates hikes are going to do to the money printing? Reduce or increase money printing? Think about it!

Interest rate hikes mean that the INTEREST payments on DEBT INCREASE, so how is the government gong to fund this extra expense? PRINT MORE MONEY! Which means UPWARDS pressure on INFLATION! What's worse is that 1/4 of UK debt is INDEX LINKED! That has already seen debt servicing costs soar from £5 billion a month to £20 billion PER MONTH!

So the inflation train continues to chug along all whilst the government and central banks play their smoke and mirrors game.

More in my next post Pfizer vaccines side effects article.

This article is an excerpt form my recent analysis on the current state of the embryonic bull market Stock Market Cool as a Cucumber Despite Earnings and Fed Noise that was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock it in now as $4 per month as this rises to $5 per month in th new year.

Also access to my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

Most recent analysis includes -

- S&P500, Gold, Silver and Crypto's Trend Forecasts 2023

- Santa Battles Grinch to Deliver Stock Market Last Gasp Rally into the New Year

- Santa Sledge on the Launch Pad for Stock Market Post CPI To the Moon Rally

- Stocks Analysis Bonanza - GOOG, QCOM, ASML, TCHEY, BABA, BIDU, TSLA, WDC, RBLX, MGNI, COIN, BITCOIN CAPITULATION!

- How High Could the Impossible Stocks Bull Market Fly Into Christmas 2022

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023 - Part 2

So for immediate first access to to all of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat. Lock in now as this increases to $5 per month in the new year.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your mega-trend investing analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.