Stock Market Another Fail Attempt

Stock-Markets / Stock Market 2023 Dec 17, 2022 - 10:50 PM GMTBy: Donald_W_Dony

Following the December 06, 2022, Market Minute titled "Recap of key market structure going into Q1" The benchmark equity index (S&P 500) has made another failed attempt to rise. In mid-December, the index reached the downward sloping trend at 4070 at immediately retreated.

This is the fourth failed attempt to cross the line.

The S&P 500 is now down 19% since the start of this year (Chart 1).

.jpg)

There are a number of factors that are contributing to the index's decline.

1) The bull market is very mature. It has been advancing now for 14 years.

2) Record high inflation. Inflation recently hit a 40-year high.

3) The rapid rise in interest rates. The Fed has delivered four jumbo rate increases of 0.75%. The December print of 0.50% only adds to the swift increase.

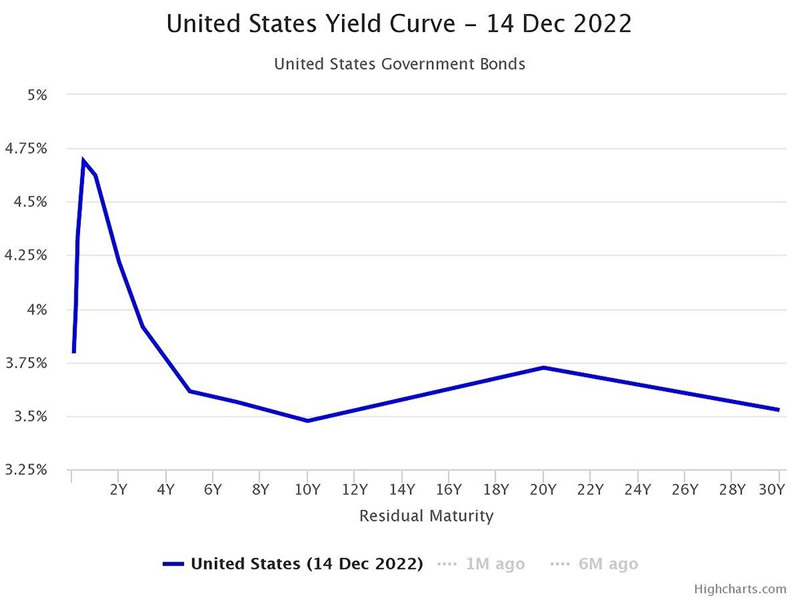

4) An inverted yield curve since mid-July (Chart 2). Since the 1960's whenever the US yield curve has been inverted for longer than 6 weeks, a recession and sharp market correction occur. The yield curve has been inverted for 23 weeks.

There are a number of other deteriorating economic signals. US home sales are at the lowest levels in 10 years, CPI continues to hold at near-record levels, and US business confidence is rapidly declining and is now at a level not since 2020.

Bottom line: Stock markets are continuing to decline. Mature equity markets, record inflation, and inverted yield curves are sending signals of challenges ahead.

Our models point to a sharper weakening in Q1. Our target for the S&P 500 is 3250, 27,700 for the Dow and 18,000 for the TSX.

The once-a-year promotion of our research is now on. When you subscribe to a 12-month subscription, you will receive an additional 3 months of our cutting-edge analysis. The reports cover commodities, international equities, and US and Canadian equities. Price targets are given plus recommendations. Our reports are designed for both the retail investor and the professional investor.

With the markets moving into a major correction and possible recession in 2023, can you afford not to have great analysis?

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2022 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.