Crude Oil: Why You Should Look Beyond Supply / Demand

Commodities / Crude Oil Nov 29, 2022 - 09:55 PM GMTBy: EWI

The primary regulator of the rises and falls in oil's prices is market psychology

As I write on the morning of Friday, Nov. 18, crude oil is on track for its second weekly decline.

The financial media usually finds "reasons" for a market's price action that are rooted in "market fundamentals," and this decline in oil's price was no exception.

On Thurs., Nov. 17, a CNBC headline noted:

Oil falls on easing geopolitical tension, China demand outlook

The gist of the story was that a rising number of COVID-19 cases in China would contribute to a lower demand for crude oil in the world's second largest economy; hence, the falling prices.

However, Elliott Wave International has observed over the years that supply and demand doesn't play as large of a role in oil's price trend as widely believed. Indeed, all too often, oil's price moves in the opposite direction from what supply and demand observers expect.

That's why we would argue -- and this may seem like a radical notion -- that changes in the supply and demand for oil are far more a result of price fluctuations than a cause of them.

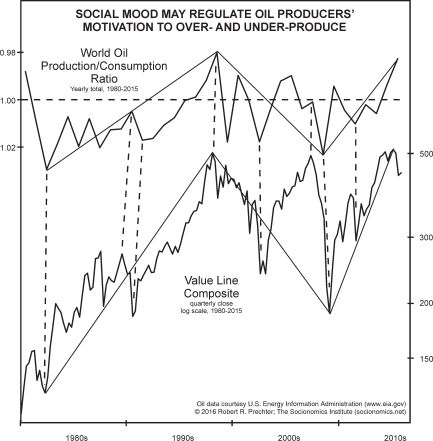

Let me explain. This chart and commentary from Robert Prechter's Socionomic Theory of Finance provides insight:

Elliott waves of social mood, as reflected in stock prices, regulate feelings of optimism and pessimism among producers, alternately motivating them to overproduce and then underproduce oil relative to contemporaneous consumption. Their optimism makes them believe business will expand, so they produce more; and their pessimism makes them believe business will contract, so they produce less. This depiction of causality accounts quite well for the rises and falls in oil's production/consumption ratio.

You may be interested in knowing that our crude oil analysis in our monthly Global Market Perspective is also based on Elliott waves of market psychology.

On Nov. 4, when the November Global Market Perspective published (the Global Market Perspective is a monthly Elliott Wave International publication which covers 50-plus global financial markets), Elliott Wave International's chief energy analyst said:

... at this juncture the intermediate-term outlook remains down.

On the date this forecast was made, WTI Crude Oil (NYMEX) closed at $91.45. As of this writing on the morning of Nov. 18, WTI Crude Oil is at $79.35 a barrel. Note that the Global Market Perspective's Nov. 4 forecast didn't mention a single "geopolitical" or "fundamental" factor. Elliott Wave International's chief energy analyst relied strictly on the bearish picture of market psychology in crude oil's price charts.

Do know that Elliott wave analysis does not always work out to a "T;" however, it's the best forecasting method for oil prices -- and other liquid markets -- of which Elliott Wave International knows. That's why Elliott Wave International has relied on it for over 40 years.

If you'd like to delve into the details of Elliott wave analysis, read Elliott Wave Principle: Key to Market Behavior by Frost & Prechter. Here's a quote from this Wall Street classic:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or "waves," that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

You may be interested in knowing that you can access the entire online version of the book for free once you become a member of Club EWI, the world's largest Elliott wave educational community.

A Club EWI membership is also free, and members enjoy instant and complimentary access to a variety of Elliott wave resources on financial markets, investing and trading without any obligation.

Join Club EWI now by following this link: Elliott Wave Principle: Key to Market Behavior -- get free and unlimited access.

This article was syndicated by Elliott Wave International and was originally published under the headline Crude Oil: Why You Should Look Beyond Supply / Demand. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.