Stock Market Discounting Events Big Picture - FEEDING THE BEAST!

Stock-Markets / Stock Market 2022 Nov 10, 2022 - 09:13 PM GMTBy: Nadeem_Walayat

Dear Reader

This is the first excerpt from my extensive analysis that concludes in a detailed trend forecast right into the end of 2023, well beyond the scope of what I had originally planned to be a 1 year trend forecast. Yes I posted part 2 before part 1 so that my Patrons gained immediate access to my trend forecast rather than have to wait a few days for that which they ultimately seek. This is the problem with mega-pieces of analysis in the time needed to proof read, error correct and edit so that hopefully the article makes sense to others, but still mistakes can happen such as the recent Bull Trap / Bear Trap saga illustrated. So multiple time consuming proof readings are necessary so as to whittle down the number of errors and to ensure the text matches what I meant for it to say.

And before we get started, the world took another baby step towards Czar Putin sending nukes flying as the Ukrainians apparently fired a missile at the bridge that they don't have access to,That's if the Russian tactical nukes actually work given how rubbish the Russian Army has turned out to be, as the war that was supposed be over within days of invasion instead drags on building the pressure keeps on Putin as his little fat fingers inch closer towards pressing the nuclear button.

What will nukes do to stocks?

CRASH and BURN! When the nukes start detonating in Ukraine, at which point we will have much more to worry about then where will our stock portfolios be in a years time, such as whether we will still be here! So i is a race against time, does Putin get it before he presses the nuclear button or not, on the balance of probabilities Putrid will be removed from power but it is far from being a done deal despite this being my consistent view since BEFORE the Russian tanks rolled into Ukraine approaching 8 months ago ( Putin Will Use Tactical Nuclear Weapons, Russia Starts WW3 in Ukraine) The world is literally playing russian roulette with now 2 out of 6 chambers loaded with nukes.

Stock Market Current State

Last week saw saw 2 strong up days followed by a 3 day decline that retraced some 80% of the earlier rally that left most with high expectations for NEW LOWS ahead. There are strong reasons for and against new lows i.e. that Major lows are rare for September whilst Octobers tends to be THE month with the greatest probability for major lows. My view, if there is a new low than if deep enough it could deliver buying opps in target stocks that to significant degree remain pending such as in Google, Nvidia, Microsoft, Apple, ABBV, AMazon, AVGO, GPN, IBM, ADSK, ASML, Roblox and so on. However I would expect the decline to prove highly transitory. so yes, short-term there is uncertainty for that is the season we are in for maximum volatility as voiced expectation to expect for September and October in June. Some will call a strong sell off capitulation, can volatility spike to 45+ for that signal? The VIX currently sits at 30 and remains well within it's 35 to 20 range with the current trend trajectory coming off a 35 high to thus target 20. However this IS October and thus VIX range compression to 35 to 30 looks likely for the next few weeks.

Also the market has to contend with the fact that the Fed WILL raise rates by another 75 basis points at the 2nd Nov meeting to 4%, which after Fridays strong Non Farm Payrolls looks certain. After which the market will start to discount the end to Fed rate hikes. At this point in time the most probably peak is 4.75%.

Looking at the current chart, the S&P despite falling pre-market at 3618 appears primed to resume it's bull run at any time, BUT that has been the case for the last 3 trading days! The way I see it short-term is uncertain i.e. over the next week, but beyond that, by the end of October we should be over 3800 and continue higher into the end of the year, but for the coming week, with the S&P currently at 3618, yes we 'could' dip below the 3571 low, as I personally thought 3710 would hold, but it didn't. I'll probably add another March Call option to my portfolio on a sell off to new bear market lows as well as seeking to capitalise on the drop by accumulating more target stocks.

So I will continue to buy the dip with my eye on Nvidia, Pfizer, TESLA! Yes I have finally started to accumulate exposure to Tesla, GPN, Google, IBM, maybe even some Intel, in the buying ranges as indicated by the AI table later in this article.

The bottom line is EVERYONE IS BEARISH! DOOM AND GLOOM PREVAILS, so I suspect this week could deliver an upwards surprise with eye on Thursdays CPI number where market expectations are for 8.1%. Where something like 7.9% will see stocks soar, whilst 8.3% and higher will see stocks plunge, and then there is the Capitulation inducing number of 9%.

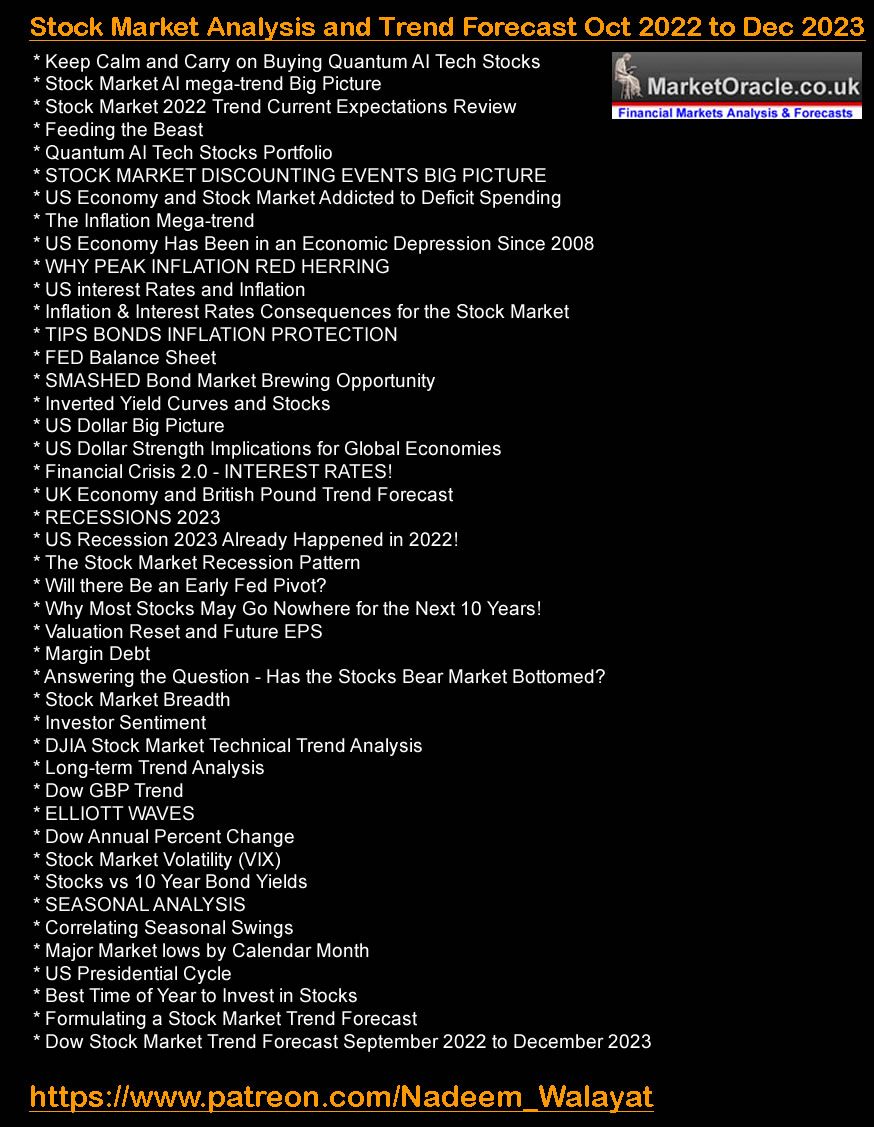

PART ONE: Stock Market Trend Forecast October 2022 to December 2023

Keep Calm and Carry on Buying Quantum AI Tech Stocks

Stock Market AI mega-trend Big Picture

Stock Market 2022 Trend Current Expectations Review

Feeding the Beast

Quantum AI Tech Stocks Portfolio

STOCK MARKET DISCOUNTING EVENTS BIG PICTURE

US Economy and Stock Market Addicted to Deficit Spending

The Inflation Mega-trend

US Economy Has Been in an Economic Depression Since 2008

WHY PEAK INFLATION RED HERRING

US interest Rates and Inflation

Inflation and Interest rates Implications for the Stock Market

TIPS BONDS INFLATION PROTECTION

FED Balance Sheet

SMASHED Bond Market Brewing Opportunity

Stocks and Inverted Yield Curve

US Dollar Big Picture

US Dollar Strength Implications for Global Economies

Financial Crisis 2.0 and Interest Rates

UK Economy and British Pound Trend Forecast

RECESSIONS 2023

The Stock Market Recession Pattern

PART TWO: Stock Market Trend Forecast October 2022 to December 2023

Will there be an Early Fed Pivot?

Why Most Stocks May Go Nowhere for the Next 10 Years!

Valuation Reset and Future EPS

Margin Debt

Answering the Question - Has the Stocks Bear Market Bottomed?

Stock Market Breadth

Stock Market Investor Sentiment

Dow Short-term Trend Analysis

Dow Long-term Trend Analysis

ELLIOTT WAVES

Dow Annual Percent Change

Stock Market Volatility (VIX)

Stocks and 10 Year Bond Yields

SEASONAL ANALYSIS

Correlating Seasonal Swings

Major Market lows by Calendar Month

US Presidential Cycle

Best Time of Year to Invest in Stocks

Formulating a Stock Market Trend Forecast

Dow Stock Market Trend Forecast September 2022 to December 2023

Keep Calm and Carry on Buying Quantum AI Tech Stocks

I must be a sucker for punishment to try and conclude my detailed 1+ year trend forecast at a time of maximum market uncertainty where major nations such as the UK are literally finding themselves on the brink of financial collapse! No really the UK financial system was a hairs breadth away from collapsing as it's pension funds that had GAMBLED ON INTEREST RATE DERIVATES with US rate hikes triggering a COLLAPSE in UK Bonds as Pension funds were forced to sell their most liquid assets, and the more UK bonds fell the more the pension funds were being forced to sell so as to meet MARGIN CALLS on their interest rate bets, which in effect was Britain's Lehman's moment prompting the Bank of England to BAIL THEM OUT by announcing that they would buy an UNLIIMITED amount of UK bonds so as to bring yields back down and thus push the capital value of Pension Funds UP so as to halt the forced selling that would have resulted in the Pensions funds defaulting and making the counterparty to their bets BANKRUPT! Yes you guessed it the BANKS BANKRUPT AGAIN! WALL STREET, LOMBARD STREET, CANARY WHARF, BERLIN! BANKRUPT! This is why whenever a patron mentions that the banks are cheap I tend to reply that you do know what they have gambled on until they explode!

In fact as soon as I saw the news flash on the screen that the Bank of England had announced they would start buying UK Bonds I immediately tried to Buy UK Bonds, first through AJ Bell and then through II.co,uk, NEITHER would offer a quote! A CRASH COMES ALONG and the piece of turd brokers stopped me from capitalising on it as I wrote in the comments section at the time. Obviously had I had time I would have investigated more options to trade bonds such as the spread betters, but they would probably have locked me out as well, the crooks of Lombard street won't let the little guys profit!

So the GAMBLING SOB'S WERE BAILEDOUT BY THE UK TAX PAYERS! That;s what happened last week! Instead the clueless lemmings that are the mainstream media and blogosfear went running off on a red herring that the it was Chancellor Kwasi Kwarteng's £45 billion uncosted tax cuts that did it! Which a. was a drop in the ocean compared to the £1+ trillion of debt piled up over recent years and b. the budget measures weren't to kick in until April next year.

It wasn't the budget that caused the crisis it was the GAMBLING BANKS AND PENSION FUNDS that once more required their Sow to step in and provide them with liquidity, UK rate hikes not keeping up with US rate hikes was the fuse that primed the bomb where the pension funds derivatives were the explosives going off until the Bank of England came along and pissed on the explosion. However the whole saga could prompt the Fed to reconsider the expected 0.75% rate hike at the 2nd Nov meeting due to the contagion risk it poses to the banking crime syndicate, i.e if the UK institutions had gone down along with them would have US! See Britain is not as insignificant as most imagine it to be! We can at least still blow up the financial world!

This was the icing on the cake for a year that has been one of the indices vs what this Bear Market has actually been all about i.e. "The Greater the Deviation From the High in Good Stocks then the Greater the Buying Opportunity being Presented." Where BEAR MARKETs turn this mantra into a powerful investing message, even if one had no idea of why stocks are falling this mechanism will get one INVESTED during a bear market!

The deeper and longer the bear market runs then the more pessimistic investors become, and LESS inclined to invest, even though target stocks may have HALVED or more in price! MOST RETAIL INVESTORS RIGHT NOW ARE LESS WILLING TO BUY THAN AT ANY POINT DURING THIS BEAR MARKET! In fact they have been gambling on options in record numbers, which is why options premiums are so inflated. Me too! Though I'm focusing on the very long dated In the money options which have room to breath such as the March 3600 to 3900 Calls, rather than near month out of the money options which are destined to expire worthless.

Just look around at the stock market and you will see countless downtrodden stocks that investors have convinced themselves could go much lower and hence hold off buying until the BOTTOM IS IN, that ethereal BOTTOM that will forever keep extending into the distant future, 6 months ago stocks will bottom in June or July, now it's Mid 2023, S&P 3000 to 2000 even!

The longer a bear market goes on the further and deeper will become the perception of where it will BOTTOM! This is ALWAYS the case!

In steps "The greater the deviation from the high then the greater the buying opportunity being presented" Note there is no mention of a BOTTOM, the thought process this mantra instills is the EXACT opposite of where is the BOTTOM! And it could get much WORSE! Experience bear markets of 2008-2009 or 2000 to 2002 and then investors will have experienced such depths of pessimism that many if not most won't touch another stock for DECADE until they get sucked into the next mania right before it POPS!

Imagine if you had just one simple mechanism, just one that if you followed it would get you invested during a bear market, where the greater the decline in the market then one would perceive it as the market giving one a greater buying opportunity and thus right at the depths of the bear market one would find themselves at their greatest exposure to the market, unlike most investors who will either have thrown in the towel and sold out or have convinced themselves that the bottom is the far distant future and hence have bought nothing or been fooled by perma clueless that bonds were a safe haven only find out that bonds have fallen even more than stocks! What the HELL! You told me bonds were a safe haven! That's what you get from the perma clueless!

This is how one gets invested during a bear market. the longer and deeper it goes the more I accumulate, adding funds as I go along.

The whole point of a bear market is to deliver discounting events, it is not to profit from! You cannot get a discount if the stock prices are going up, they HAVE TO FALL ELSE THERE IS NO DISCOUNT!

The profits will come during the NEXT bull market!

So repeat after me "The greater the deviation from the highs in good stocks then the greater the buying opportunity presented"

Stock Market AI mega-trend Big Picture

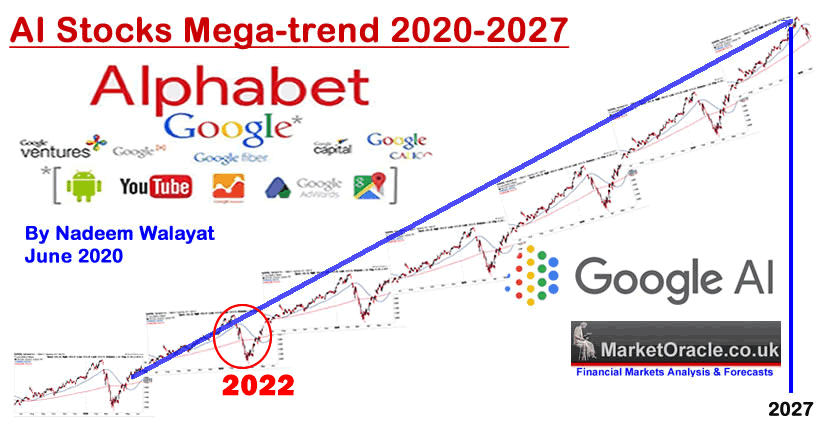

Just pause for a moment and take in the chart below, the message one should be receiving loud and clear is that I expect this bull market to run for many more years, whilst my best guess 2 years ago was that it would top in early 2027, as long as run away valuations moderated during 2022 then I don't see why this should still not remain the big picture, thus the bull market could extend to 18 years from it's March 2009 low!

12th June 2020 - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

Therefore the following graph illustrates my road map forecast conclusion of how I expect the AI mega-trend to play out over the next 15 years and why I will continue the mantra of buy the dips and panics all the way towards liquidating holdings during the next mania peak when valuations go out the window and when I will likely heavily short these same stocks all the way down towards the buying opportunity of the 2030's.

I continue to see an inevitable War with China being the primary driver for turning a Quantum AI stocks bubble mania crash into a true multi year bear market.

Thus my primary strategy remains to buy the periodic deviations form the highs in good / fairly valued AI tech stocks as opportunities arise as my Mid 2020 graph of Google illustrated that is materialising with freaky accuracy during 2022.

Stock Market 2022 Trend Current Expectations Review

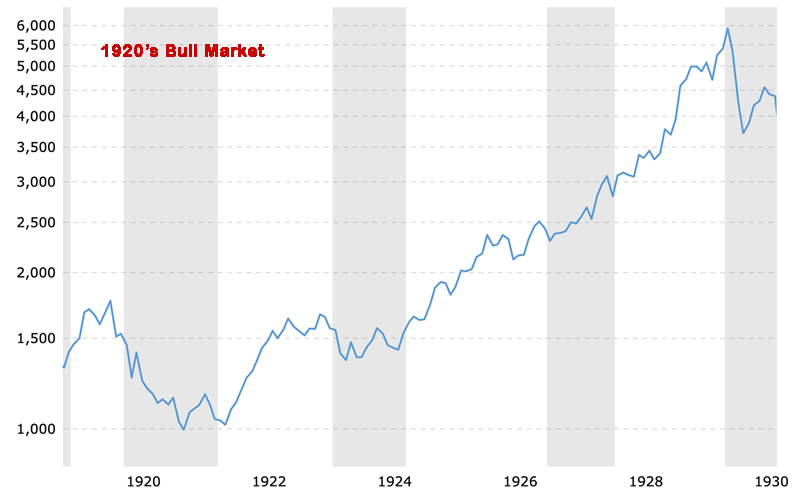

DOOM and GLOOM the END is Neigh following the Pandemic, remember what happened 100 years ago when were in a similar position ;) YES Germany burned but the US had a BIG PARTY all the way into October 1929!

This time maybe the party will terminate a little earlier some time during 2027. Don't get too narrow in ones focus, 2022 in the big scheme of things is just noise. Let the 20's ROOOAAAARRRR once more. INFLATIONARY CRACK UP BOOM HERE WE COME!

The AI mega-trend is delivering the ROAR in ever increasing waves as illustrated by each new generation of CPU and GPU - Ryzen 7000, RTX 4000 and 13th Gen Raptor Lake, the engines of disbursed AI. Crypto's were useful in creating useless demand but the key beneficiary is AI in all of it's forms and applications. This bear market IS temporary.

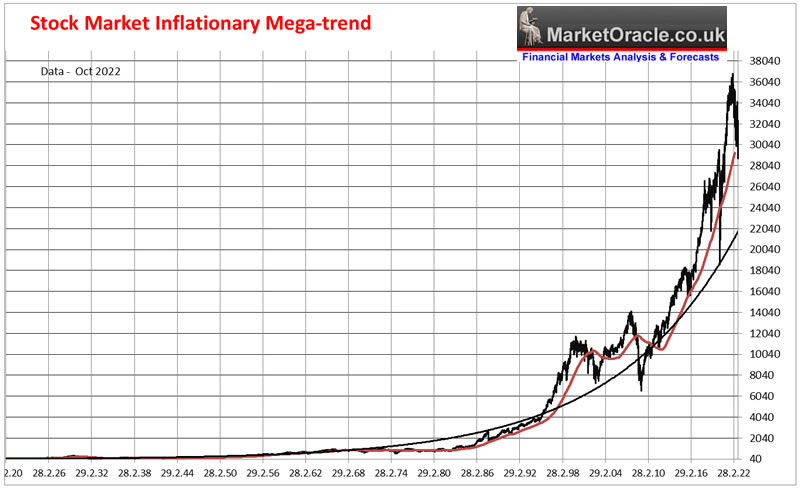

This is what the perma bear fools are fighting against, why can't they just OPEN their eyes and SEE what is blatantly obvious! The Stock Markets Inflationary Exponential Mega-trend.

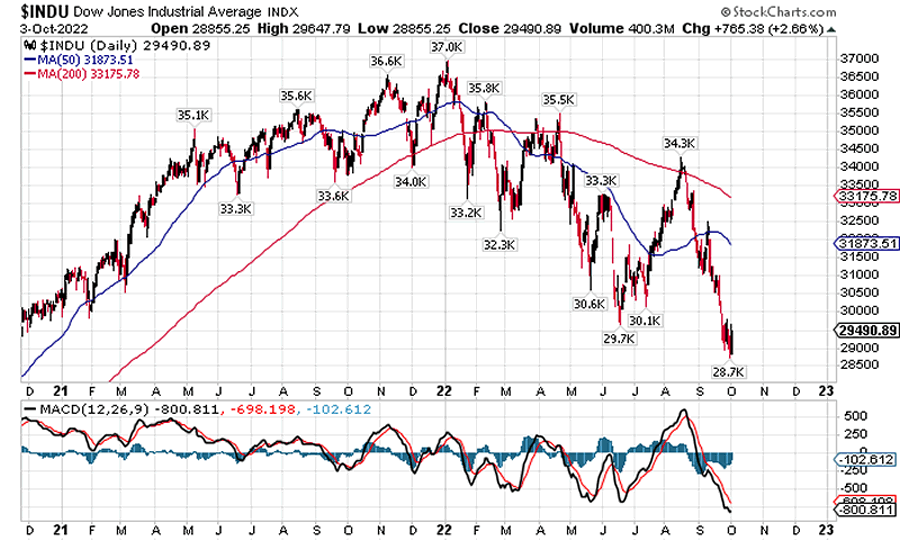

Whilst I have given my best guesstimates for the duration of this bear market in that my expectations right from the outset were that the bear market would see the Dow trade down to between 29k to 30k by the end of August, which was further refined to a target of 29,600 by between Mid August and early September to be followed by a volatile trading range that would likely see several spikes to below the bear market low down to as low as Dow 28,500 by the end of September as my most recent sum of all of my analysis trend forecast graph as of 10th of June illustrates.

Which has so far stood up well to what has subsequently come to pass which is the beauty of such graphs as there is NO benefit of HINDSIGHT.no double speak, hedging ones bets, or after the fact pattern fitting of which there is a pandemic amongst analysts i.e. tell they tell you why the market just did AFTER it's done it! Therefore this pattern remains a good starting point for this analysis to build upon and extend into late 2023.

In light of which my most recent short-term view posted as a comment on my latest article some 7 hours before Monday's open (3rd October)

S&P 3585 - Has already bottomed or the bottom is imminent (short term volatile), followed by a swing higher into Mid October, so may get one more chance for those buys today.

So if you want to know my short-term view then do check out the comments section of my most recently posted article as I do tend to comment what I expect most days.

Feeding the Beast

For some reason most folk when looking at the charts focus on the high vs the low as if investors only buy and sell at the exact highs and lows, well maybe the mania herd bought near the highs last year to sell near the lows this year but most intelligent investors don't invest that way i.e. during the second half of last year, I sold down 80% of my AI tech stocks portfolio in advance of this bear market, including warning virtually within a few percent of the high to get ready for a bear market during 2022 and maybe even worse a crash! That was on the 5th of December 2021!

STOCK MARKET CRASH / BEAR INDICATOR TRIGGERED - 103.4% vs 100% = Switched ON!

However given that the crash / bear failed to materialise instantly i.e. the next few days, I then had to contend with messages such as this -

8th Dec 2021

Mr Nadeem

You have sent me yesterday, notice that the market would collapse – so I sold everything. Now you don’t even mention this. Surely you need to follow up on perhaps the most dramatic call in your career. Even if just to say sorry – I was wrong. I don’t know if to re buy now

R...

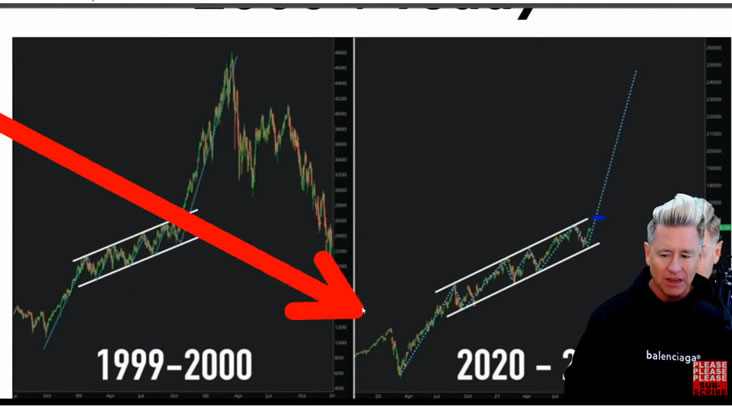

Humans are creatures of habit, they do not like change. They do not like it when a bull market changes into a bear market or when a bear market changes into a bull market since they failed to capitalise on the price drops. Hence continue to FOMO into the early stages of a bear market convinced that a final blow off top is just around the corner that they will then sell into just as many highly popular youtubers were posting at the time because no one wants the party to actually end, so it never does as off they go on a tangent looking for patterns to confirm their bias - .

As is usually the case in the earlier stages of the bear market most were in denial as they clutched at straws waiting for their final blow off top to sell into!

Youtube is good in a way that one gets to see just what was going on in the minds of many 'analysts' who talked themselves into the exact opposite view of where the market was actually headed. https://youtu.be/qM1BKHKYsYU

However, there are some clowns who never throw into the towel and have remained bullish throughout this bear market, the flip side of the perma bears, but still the likes of CNBC continues to give these blind fools air-time.

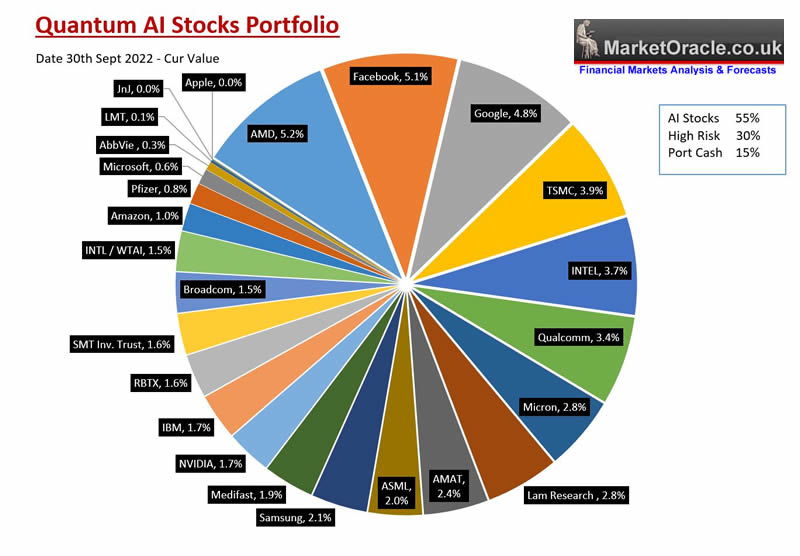

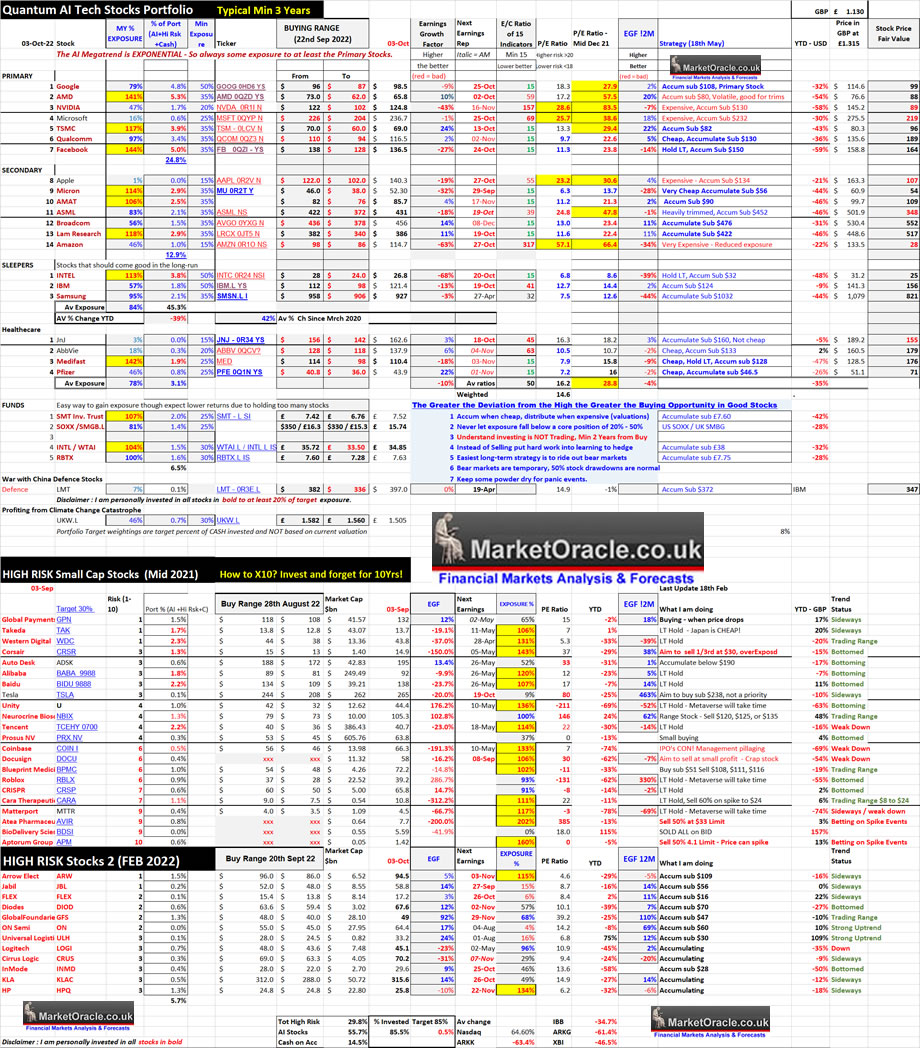

Quantum AI Tech Stocks Portfolio

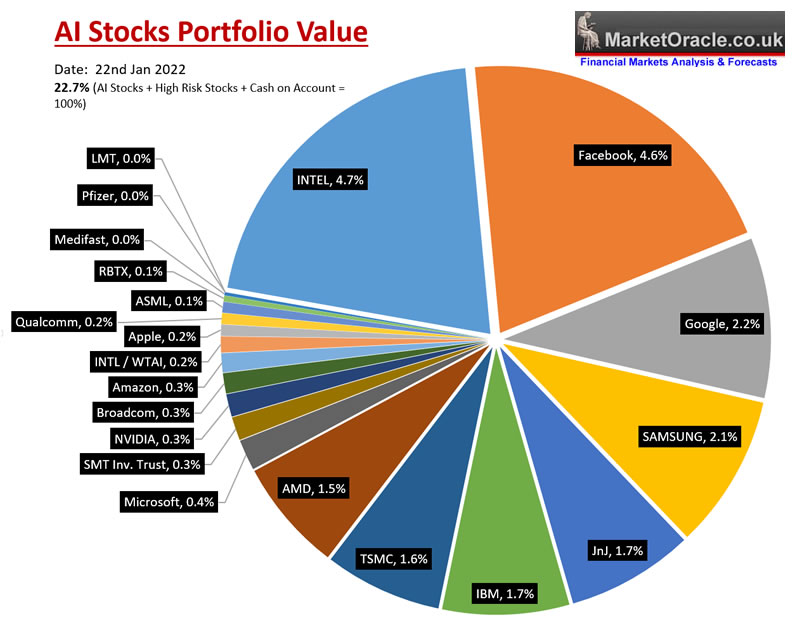

Which brings us to this BEAR market where my strategy has been NOT to seek to buy the bottom because we will only ever see the bottom in hindsight, instead my strategy has been to buy deep discounts in target stocks which has transformed my portfolio from this in January 2022 -

To this today.

Feeding the Beast by Buying the panic! My exposure now stands at 85.5% invested, 14.5% cash (3rd Oct 2022), where 100% equals total invested in AI tech stocks plus high risk stocks plus ALL cash on my investing accounts such as IKBR, AJ Bell, II, Free trade, Etorro. Furthermore since the start of the year I have added FRESH cash to accounts equivalent to 23% of the total value of my portfolio (including cash) that I will likely add more cash to during October. So if I had added no fresh cash I would now be 108.5% invested, vs approx 40% invested at the start of the year. Therefore during this bear market I have increased my exposure to the stock market by 170% compared to where I stood at the start of the year, baring in mind that I sold heavily going into the end of 2021..

Table Big Image - https://www.marketoracle.co.uk/images/2022/Sep/AI-tech-stocks-3rd-Oct-2022-big.jpg

Scouring my portfolio for what's left to buy that's worth buying in terms of the AI mega-trend then the stock that stands out is TESLA and thus I took today's (3rd Oct) sell off as an opportunity to buy a small opening stake (5.7%) in this target stock though it is still so darn expensive, trading on an PE of 77, What if the stock fell to $215 ? That would still put the stock on a PE of 65. I want to buy Tesla but I don't want to pay a ridiculously high valuation for it, ideally I am seeking about $120 for significant exposure. Instead if I am going to over pay for a stock then I should probably go for the likes of Microsoft on X25 earnings than Tesla on X77.

Understand this the smart money was distributing during the 2nd half of 2021 as they cashed in their chips and then sold / shorted during the first half of 2022, buying the dips whilst selling the bounces, the exact opposite of the retail crowd as they sought answers from media whores on the likes of CNBC who tend to pivot in their views depending on whether stocks are trading higher or lower on that day with the name of the game being to grab as many eyeballs as possible so the more dramatic the headlines the better.

The smart money needs a weak stock market and that is what we have got! A weak stock market that has most investors too scared to invest with the likes of S&P 3000, 2500, 2000 being bandied about as if these price levels are a done deal! All whilst the smart money quietly accumulates near the lows!

The smart money do not want the stock market to rocket higher until they have finished accumulating, hence stocks trading near their bear market lows.

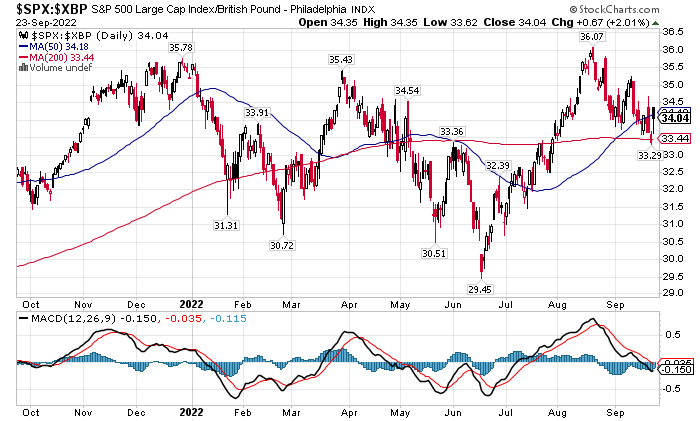

Anyway, I have put my money where my mouth is, and should the stock market continue falling I will continue to increase my exposure in target stocks, Note I am not buying Cathy Wood Turd stocks, I am buying Quantum AI tech stocks, virtually all of which will trade to NEW al time years a lot sooner than most can imagine today, so what do I care about the noise that is draw down as I have no intention of selling especially when this is what sterling has done to the so called bear market

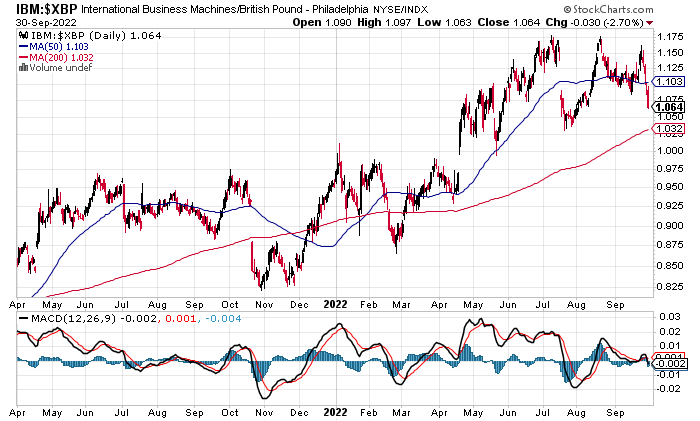

So folks keep things in perspective, the bottom is a red herring, at the end of the day the only thing that will count is if one is invested or not because one thing is for sure is that when this bear market ends i.e. stocks such as AMD stop falling to fresh dollar lows then as soon as you blink it will have rocketed higher by 20%, 30% even more leaving all those waiting on the sidelines for another dip to buy that won't materialise. And even worse for investors outside of the US who will be looking at US stocks trading at NEW ALL TIME HIGHS! I mean IBM was literally there a few weeks ago!

US investors should count themselves lucky for they actually are getting the deepest of discounts on target stocks in their domestic currency unlike folks outside of the US who rely on tax free wrappers that don't allow one to hold dollars on account.

I keep getting asked that x,y,z companies stock price has fallen by 80% or even 90% is it now a buy? The big secret to successful stock market investing is to buy companies that are growing and try to avoid companies that are stagnating or worse dying. This is the problem with blanket buy the crash dippers, you don't buy stocks just because their stock prices have collapsed, they need to be GROWING else that 90% drop could turn into a 99% drop!

STOCK MARKET DISCOUNTING EVENTS BIG PICTURE

This year will mark the 6th MAJOR discounting event since the BIG Financial Armageddon BAD BEAR MARKET that bottomed in March 2009. Zoom out of hourly and daily charts and see the true magnitude of the 2022 bear market that has so many worried of much worse to come.MSM coverage of the financial markets is akin to a fly buzzing around that needs swatting!

We have had the good fortune to have SIX DISCOUNTING EVENTS! What more could an investor ask for? If some one offered you Google today for 25% less than it was trading at yesterday would you buy it? YES? Then what are you waiting for? Google is 26% cheaper today than where it was at the start of the year!

Since my HAL9000 in December messaged me to expect a BEAR MARKET during 2022. That's at least a 20% drop from Dow 37,000, 29,600 which has been my price target since. Stocks Many of the target stocks having bid themselves up to loony toon prices during 2021 such as Nvidia, AMD, Amazon and many others have fallen much harder than 20%, many have near HALVED (AMD) and some fallen by 2/3rds (Nvidia)! What more could one ask for from a discounting event when focused on BUYING the DEVATION FROM THE HIGHS because unlike INFLATION this bear market IS TRANSITORY!

That has been my consistent message for the duration of this bear market. For the worst thing one can do is to know a bear market is coming but then FAIL to capitalise upon it because one got side tracked with irrelevance of trying to catch the exact bottom. There is no real benefit from in hindsight seeing that yes, the Dow bottomed near 29,600 that we will only know for sure when looking in the rear view mirror. What does it achieve unless one had managed to do the heavy lifting by actually getting INVESTED in target stocks during DISCOUNTING EVENT.

They call it a bear market, but it's not, it's a discounting event, 2008-2009 was a BEAR MARKET, 2000 to 2002 was a BEAR MARKET, 2022 is DISCOUNTING EVENT! That I eagerly anticipated and aimed to capitalise upon for the Greater the Deviation from the High then the Greater the BUYING Opportunity being Presented! Which in this respect has offered some fantastic opportunities, many of our wishes have come true! For instance back when Nvidia was high on cocaine at over $320, I was stating that I would not be surprised if Nvidia falls to below $140 a share. Hence marking my time until sub $140 materialised to near double my position to 35% invested in this key AI stock.

And so it has been for the duration of this "bear market", where the primary objective was on capitalising on this discounting event, i.e. new lows in target stocks to get invested so as to capitalise upon the next phase of this BULL MARKET that will likely run for another 5 years during which time we will perhaps get a couple more discounting events before we face a the prospects of a BEAR MARKET proper!

One needs to learn to embrace discounting events by understanding what they are and what they mean, instead I get the impression that perhaps as a function of an emotional response on reaction to FALLING prices the exact opposite tends to happen i.e. it appears the more stock prices fall the less inclined investors become to actually invest as the decline generates reasons for why it should continue.

To get the discounts PRICE MUST FALL, Unfortunately lower prices means everything drops, there are stocks that are still pending those lower buying levels - Nvidia, Apple, Microsoft, Broadcom, Amazon, Pfizer, JnJ, ABBV, Qualcom,IIBM even Google, whilst others have achieved targets and more! AMD, Lam, AMAT, Samsung, Intel, this is the problem with indices, it's like playing stick the tail on the donkey, can one get ones target lows without the indices dropping, yes if the lows are cycled through i.e. stocks take turns to tumble, can happen, has happened, but not usually.

Accumulate at targets and then invest and forget. If one is fully invested then what you going to do? Go nuts watching every tick lower? OR INVEST and FORGET, wake up on Christmas morning to check the value of your portfolio and go WOW! Thanks Santa! Even though he died in 343 AD.

I continue to bite the cherries as they come along whilst adding fresh funds so as to capitalise on the 6th discounting event since this bull market began in March 2009 because I embrace -

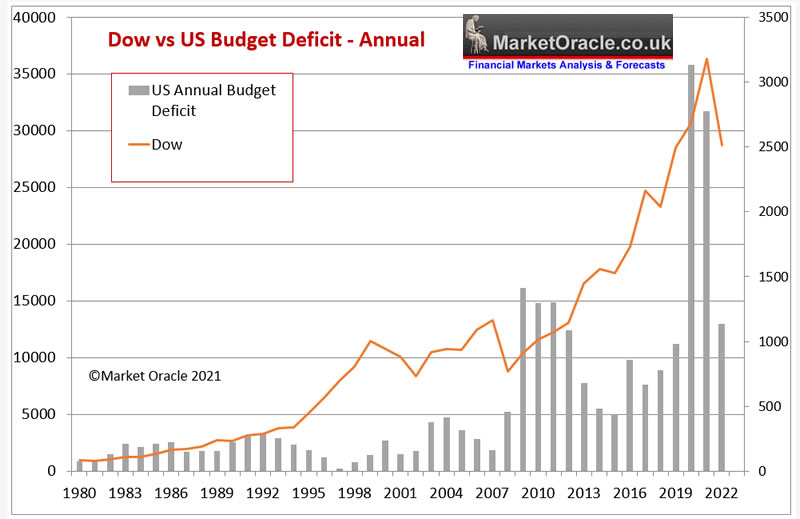

US Economy and Stock Market Addicted to Deficit Spending

What to know what tends to drive the stock market into the stratosphere? US Deficit Spending! (actually twin deficits including Trade).

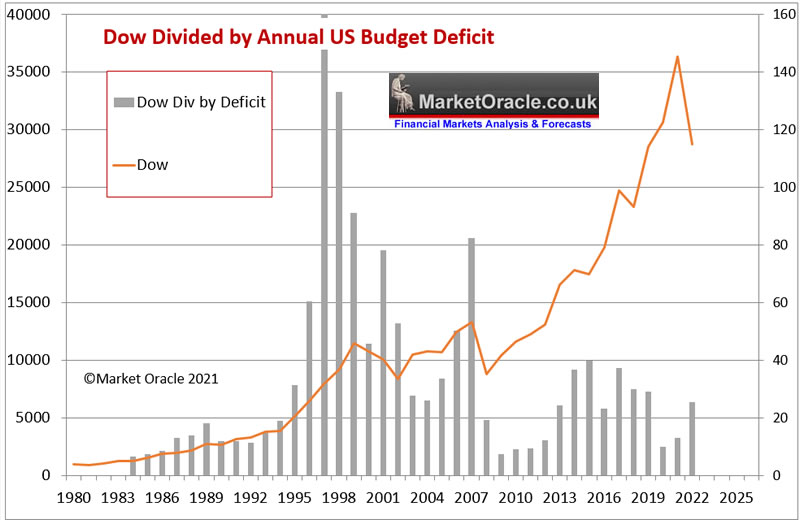

Here's the Dow divided by the annual US budget deficit. Usually the lower the reading the better the prospects for the stock market because the stocks are being fuelled by rampant money printing deficit spending that gets monetized by the central bank on an epic scale, all whilst MSM focus on smoke and mirrors.

The smaller the bars the more the US government is pumping the economy and stocks! As you can see despite the US Government attempting to reign in the budget deficit to $1 trillion, the US government literally continues to inflate stock prices because most of the spending that's going on is for consumption and NOT investment, or a one off such as for a war, so it CANNOT STOP without triggering severe economic contraction!

What's the price for rampant money printing?

INFLATION!

This article is part 1 of 6 excerpts form my extensive analysis that concludes in detailed stock market trend forecast into the end of 2023 Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 was was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month, which is soon set to rise to $5 per month for new signup's so lock in now at $4 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes -

- Stock Market Cool as a Cucumber Despite Earnings and Fed Noise

- Intel Empire Strikes Back! The IMPOSSIBLE Stocks Bull Market Begins!

- Stock Market White Swan - Why Fed Could PAUSE Rate Hikes at Nov 2nd Meeting, Q4 Earnings

- Stocks Bear Market Max PAIN - Trend Forecast Analysis to Dec 2023 - Part1

- Stock Market Analysis and Trend Forecast Oct 2022 to Dec 2023

My Main Analysis Schedule:

- UK House Prices Trend Forecast - Complete

- Stock Market Trend Forecast to December 2023 - Complete

- US House Prices Trend Forecast - 80%

- Global Housing / Investing Markets - 50%

- US Dollar / British Pound Trend Forecasts - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- State of the Crypto Markets

- Gold and Silver Analysis - 0%

- How to Get Rich - 85%

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month, which is soon set to rise to $5 per month for new signup's so lock in now at $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your stealth bull market investing analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.