Saudi Arabia Potential DOOMSDAY Oil Market BLACK SWAN!

Commodities / Saudi Arabia Sep 22, 2022 - 10:18 PM GMTBy: Nadeem_Walayat

Yes here's another potential black swan brewing in the background as the world continues to reel from the impact of high oil prices with the blame firmly being placed at the feet of Czar Putin, so I trundled along to take a look under the hood of the oil market and I noticed something strange that could result in an oil market DOOMSDAY Black Swan event!

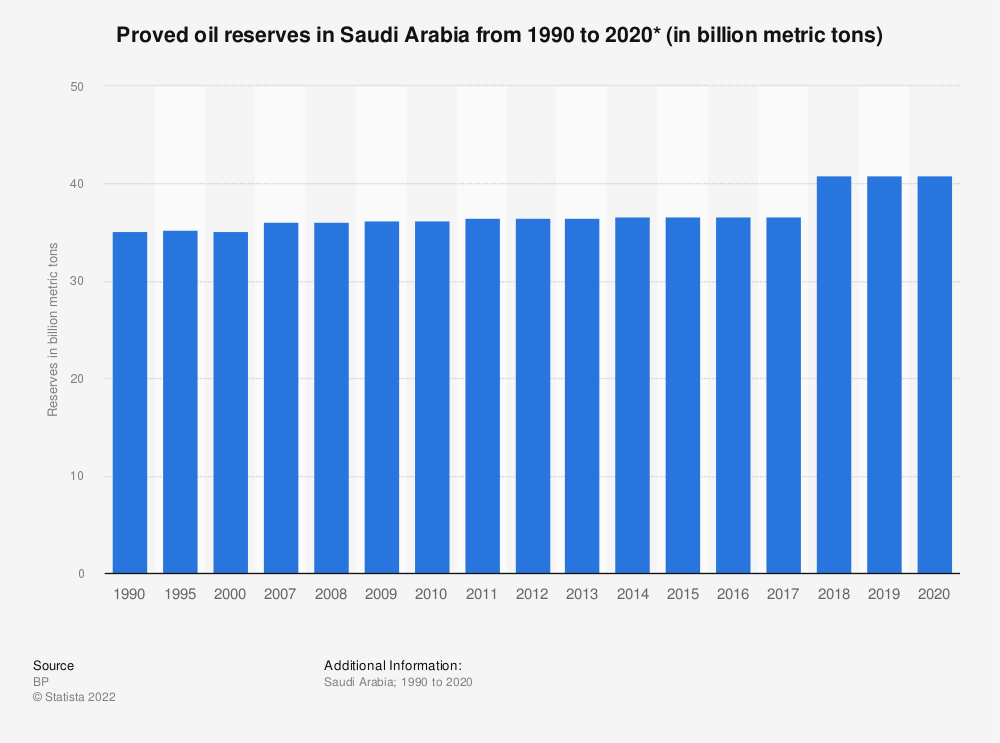

Look at the graph of proven Saudi Arabian oil reserves and what do you see?

Constant proven reserves that hovered at 30.9 billion metric tonnes for decades but then jumped in to 40.9 billion around the time when there was much media hype surrounding IPO for Saudi Aramco in December 2019 when the Saudis sold a 1.5% stake that valued the Energy giant at $2 trillion, with current plans to sell a further $50 billion of shares this year.

Do you see it?

How the hell are Saudi oil reserves constant at 30.9 billion for decades and then jump to 40.9 billion ahead of the IPO when Saudi Arabia pumps out 550 million metric tonnes of oil per year, that's 22 billion tonnes of oil over the past 40 years!

Does Saudi Arabia actually have 40 billion metric tonnes of oil or is this the mother of all ENRON's! Hence why Saudi Arabia is eager to sell more shares in Saudi Aramco before the shit hits the fan and we find out that Saudi Arabia's oil reserves are a function of a horizontal line drawn by the hand of MBS himself and his father before him, the real reserves are likely 31 minus 22 = 9 billion metric tonnes, enough to continue conning the world for perhaps another 16-18 years, instead of the implied 75 years.

This also explains why Saudi Arabia is refusing to open the oil taps and increase supply even though it would profit hugely from doing so, it's because THEY CANNOT INCREASE OUTPUT! The max output of Saudi oil fields has been stuck at 10.5 million barrels per day for decades! All they need to do to increase supply is drill a few more wells, but why would they do that if it means.

a. They will run out oil sooner.

b. That the new oil wells will only have a short shelf life.

What would it mean for oil prices when the Saudi Emperor is found to have no oil? Oil price X2? X3? X4? And what if similar is true for other oil gulf states such as Iran, Iraq and Kuwait reminds me of the Milkshake scene out of "There will be Blood".

The bottom line is this potential Black Swan could rock the world's economic and geopolitical system if Saudi Arabia was found to have lied about it's oil reserves, the clear winners would be Russia and Venezuela, I can imagine the Americans kowtowing to Venezuela, let bygones be bygones, ce sara sara, Auld Lang Syne and all that, North and South Americans are brothers and sisters, now SELL us your OIL you bas....ds.

Your analyst feeling the urge to increase exposure to oil stocks before the mother of all milkshake scams is revealed!

This analysis is an excerpt from Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan that was as first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis includes -

- September the Stock Markets WORST Month of the Year Could Deliver a Buying Opportunity

- Jerome Powell's TRANSITORY DIP in INFLATION, AI and High Risk Stocks Updated Buying Levels

- Answering the Question - Has the Stocks Bear Market Bottomed? Saudi Black Swan

- Stock Market Bear Trap SET!

- Stocks Bear Market Rally End Game

- Qualcom Harbinger, AI Predicts Future Stock Prices 3 Years Ahead, China Bank Runs

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here! Whilst completion of my extensive analysis of the US housing market is imminent.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 85%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your watching the British pound burn at the official rate of 9.4% per annum analyst.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.