Bearish Signals Remain for Brent and WTI Crude Oil Price

Commodities / Crude Oil Sep 15, 2022 - 09:31 PM GMTBy: Submissions

After the bearish progress, oil prices slipped slightly as worries about the global growth outlook overtook fears about the supply shortage.

Macroeconomics

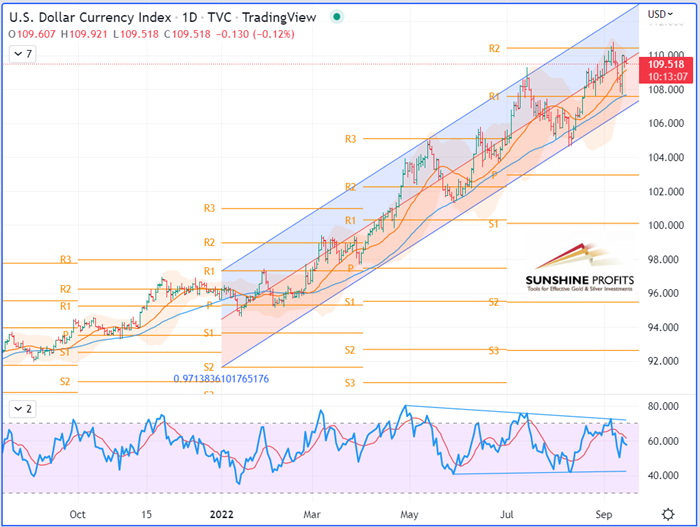

On the macroeconomic view, the greenback found support on its 50-Day Moving Average (DMA) at the beginning of the week before resuming its rally upward and approaching its monthly highs of $110-110.50. Will the quarterly R3 pivot ($115) be reached anytime soon, or will the $110.50 level be left as its two-decade high?

Regarding U.S. economic data, the inflation figures came out on Tuesday, and the Consumer Price Index (CPI) showed a slight deceleration from 8.5% in July to 8.3% in August, while the reading still appeared to have decelerated at a lower pace than expectations (as consensus forecast a drop to 8.1%). However, the Core CPI – another measuring tool for inflation that does not take into account energy prices nor volatile food – showed an increase of 0.6% in August (double the 0.3% forecast) by reaching 6.3% year-on-year, versus 6.1% forecast and 5.9% in the previous month. Therefore, these above figures may provide cover for the US Federal Reserve to deliver another hefty interest rate increase next week.

U.S. Dollar Currency Index (DXY), daily chart

Fundamental Analysis

Repeated lockdowns in China are weighing on the growth of global oil demand, said on Wednesday the International Energy Agency (IEA), after revising its forecasts for 2022 very slightly downwards, but anticipating a rebound for 2023. Overall, although slowed down, the growth of oil remains sustained, particularly because, for example, in the Middle East or the United States, it benefits from recourse to the detriment of natural gas, which has become very expensive.

Regarding Russia, its oil exports reached 7.6 Mb/d (390,000 barrels per day less than before the war in Ukraine) in August, for export revenues estimated at 17.7 billion dollars (1.2 billion less).

Meanwhile, Russian oil giant Rosneft announced Thursday a net profit up 13.1% in the first half of 2022 compared to the same period the previous year, despite adverse external factors in the midst of the Russian offensive in Ukraine. Its Chief Executive, Igor Ivanovich Sechin, pointed out that the significant increase in the cost of logistics, rail transport tariffs of 18.6% since the beginning of the year, as well as the rise in electricity costs and the unprecedented hike in the Russian central bank's key rate (currently at 8%), negatively impacted on the results.

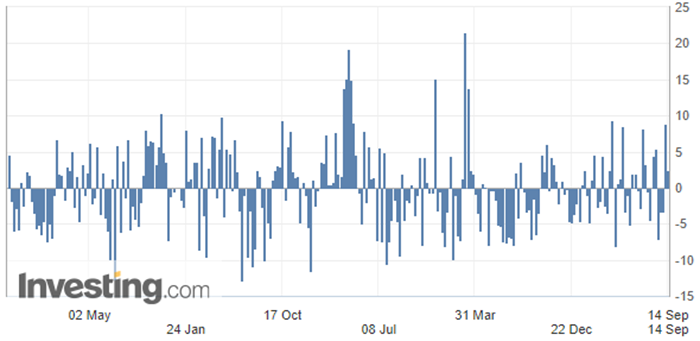

U.S. Crude Oil Inventories

On Wednesday, the Energy Information Administration (EIA) released the weekly change in the count of barrels of commercial crude oil held by US firms. During the week ended September 11, oil stocks were building an excess of 2.442M barrels, while analysts were anticipating a number three times lower.

(Source: Investing.com)

Diplomacy & Geopolitics

Chinese President Xi Jinping is making his first trip abroad on September 15 and 16 since the start of the COVID-19 crisis. In the current geopolitical context, his planned meeting with the head of the Kremlin should take on a strategic dimension at the summit of the Shanghai Cooperation Organization (SCO). This economic and military structure was founded in 2001 to ensure the security and stability of a large territory, including Russia, Central Asia, and China. It is the first time in three years that the summit has been held in person, and this year it will bring together the leaders of 15 countries, five fewer than the G20 and twice as many as the G7. In addition to China, India, Kazakhstan, Kyrgyzstan, Pakistan, Uzbekistan, Russia, and Tajikistan, which are the current member states, Iran, Belarus, and Mongolia will participate as observing countries. Finally, Turkey, Azerbaijan, Armenia, and Turkmenistan will attend the event as states interested in the SCO, as the Russian daily Moskovsky Komsomolets points out.

Technical Analysis

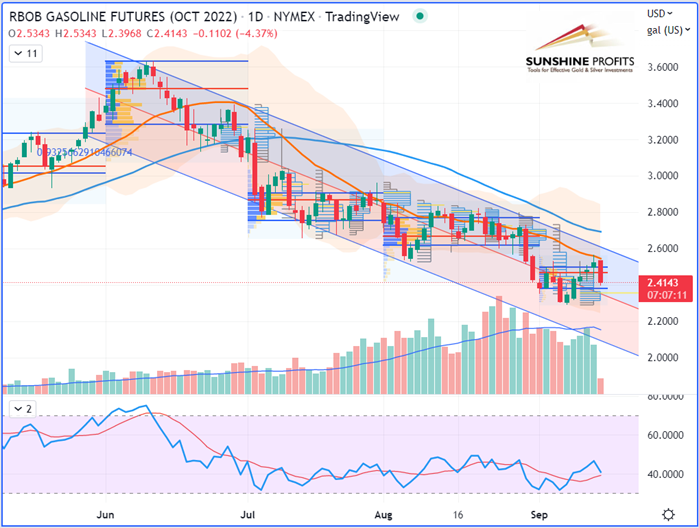

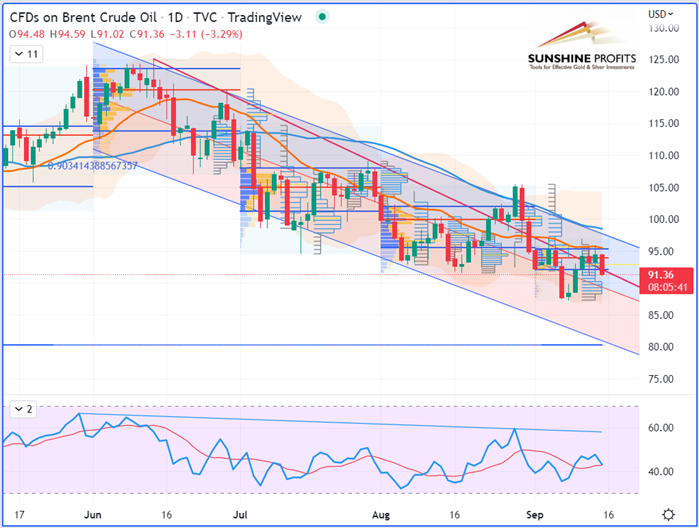

On the daily chart, WTI crude oil (October contract) is falling back to its mean regression line (or median of its regression channel), currently set at 77 periods on the daily chart to get a Pearson’s R (coefficient) above 0.87, that is to say, with a 4-month correlation over 87% for WTI, 93% for RBOB Gasoline, and 90% for Brent (see the charts below).

WTI Crude Oil (CLV22) Futures (October contract, daily chart)

RBOB Gasoline (RBV22) Futures (October contract, daily chart)

Brent Crude Oil (BRNV22) Futures (October contract, daily chart) – Contract for Difference (CFD) UKOIL That’s all, fo

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.