How to lock in a Guaranteed 9.6% return from Uncle Sam With I Bonds

Personal_Finance / Inflation Jul 29, 2022 - 08:42 PM GMTBy: Submissions

By Chris Reilly

By Chris Reilly

Do you want to turn inflation to your advantage?

Be a financial winner while everyone else is losing to inflation?

Today, I’ll show you a little-known investment that can do exactly this for a part of your portfolio.

Best of all… it’s guaranteed by the US government.

You’ll want to act on this soon. Because inflation just keeps getting worse.

On July 13, the government released the latest numbers...

Inflation surged 9.1% (!) in June.

That’s a new 40-year record:

Source: CNN

High inflation, as RiskHedge readers know, is bad for almost everyone and everything.

Rich people see their stock, bond, and crypto portfolios shrink. Poor people see their grocery and gas bills spike while their credit card rates soar.

The middle class gets squeezed by both.

The good news is inflation predictors are looking better “under the surface.” Government inflation readings are slow. They don’t factor in what’s been happening over the past few weeks... Like the recent drop in energy and gas prices. Per MarketWatch:

About half of the increase in inflation last month was tied to energy. The price of a barrel of oil hit $122 in June and the average cost of a regular gallon of gas in the US topped $5 for the very first time.

Yet the price of a barrel of oil has since tumbled more than 20% to around $95. And the cost of regular gas has slid to a US average of $4.64 a gallon—and it’s likely to fall a bit more.

And recently, RiskHedge Chief Trader Justin Spittler explained why the recent price action in commodities and US Treasury bonds suggests inflation is peaking.

So, relief is likely on the way. But there’s still time to lock in a 9.6% guaranteed return with a unique savings vehicle everyone should seriously consider today.

- I’m talking about “I Bonds”...

Series I Bonds are special inflation-adjusted bonds issued by the government. Any US citizen can buy them to earn a fat yield.

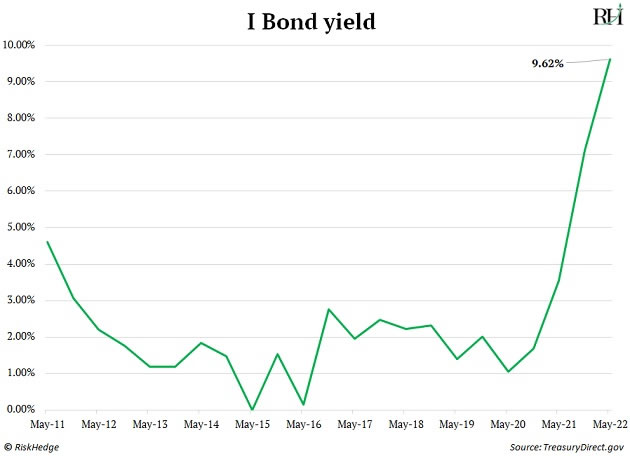

They’ve been around since 1999. But they’ve never paid as much as they do today, thanks to inflation. Take a look:

As I mentioned, the current rate is 9.6%, which is locked in for the next six months if you buy today.

On a $10,000 investment, you’ll receive at least $481 in interest for the next six months.

Not bad when you consider the current rate for a 1-year CD is 0.52% while the average APY for a money market account is a measly 0.08%.

Now, it’s important to note that the rate on the Series I Bond will change in October based on where inflation is. That’s why you’ll want to lock in your 9.6% yield soon if you’re interested.

- There are a few things you must know before buying Series I Bonds...

The biggest “catch” is you can only invest up to $10,000 each calendar year.

However, you can invest an additional $10,000 for your spouse and each of your children. So, if you have a family of four, you can put in $40,000 right now. Then $40K more on January 1, 2023.

Of course, you don’t need that much money to get started... you can buy an I Bond from the US Treasury website with as little as $25.

I Bonds are also tax friendly. You don’t owe taxes on the interest until you sell the bonds. And the interest income is exempt from state and local taxes. That’s a major bonus if you’re in a high-tax state like New York, California, or New Jersey.

Lastly, and perhaps most important:

There’s a minimum holding period of one year.

So don’t park your emergency money in these. Because you can’t access it for a year.

After one year, you can cash in your I Bonds at any time. But if you cash them in before five years, you lose the previous three months of interest.

I Bonds are the best way to grow your money essentially risk-free and beat inflation today.

You can buy the bonds directly at TreasuryDirect.gov. The website will walk you through the steps to get started.

It's easy, but fair warning: TreasuryDirect is an old, clunky government website. So, expect to deal with some minor annoyances.

But several of us at RiskHedge opened accounts and bought I Bonds for our families, and had no problems.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.