Stock Market Game Plan Ahead

Stock-Markets / Stock Market 2022 May 31, 2022 - 02:07 PM GMTBy: Monica_Kingsley

S&P 500 did fine on Friday as well, and the long streak of weeks in red, is over (for now). The rally would continue for quite a while longer – after all, we indeed got the sign inflation made its peak with the May data. Also right on schedule, the top in yields came – coupled with some retail earnings, personal income and PCE data, the stock market rally could proceed. And it has further to go, quite further to go – before peaking and rolling over to fresh lows. Yes, I don‘t think we‘re looking at a fresh uptrend, there is still much stress (to be reflected in stock prices) in the consumer arena.

For now, the key question is the degree to which VIX calms down – would it be able to keep below 23-24 to extend the shelf life of this rally? And for how long would the lull in volatility last? I think the answer is a few short weeks, before it becomes obvious that the fundamentals haven‘t changed. The consumer remains in poor shape, inflation would remain stubbornly high (even as it had indeed peaked), and the credit default swaps for quite a few (consumer sensitive) companies are rising relentlessly, which isn‘t yet reflected in underlying stock prices. I‘m talking financials too – this broad stock market rally has more than a couple of percent higher to go before the weight pulls it back down, and earnings estimates get downgraded again.

In short, this is a false dawn, but it would feel like a fresh dawn. Counterintuitively, it would be accompanied by retreating yields – regardless of the persistent inflation. Remember also my words that the Fed won‘t be able to engineer a soft landing this time, I‘m not counting on that – the conditions are so much different macroeconomically now than they were in the mid-1990s, which was the last time they could pull it off. Just ask yourself how much slack in the job market is there, what about the peace dividend now and prospects for the brighter aspects of globalization. No, I‘m not buying that – this reprieve would give way to a fresh stock market downleg, manufacturing growth would crawl to a standstill, and that‘s when the central bank would be forced to back off tightening.

The simultaneous retreat in inflation and yields would help precious metals recover from the very negative sentiment of late – the low is in, and as the Fed turn (coming early autumn) approaches (universally, there isn‘t enough pain yet to justify their change in position), the sector would slowly get into a lift-off mode, characterized by more strength in the miners. Crude oil is of course elevated, and having higher to go still – oil stocks continue remaining my prime pick. Copper has likewise put in a low, and would benefit just as much as silver from the coming Fed turn (patience). Relatively lean weeks for the red metal though remain ahead, especially with the decelerating manufacturing. Finally cryptos, these can‘t get their act together – and it‘s telling. I don‘t think this false down in risk assets would last in the environment of shrinking liquidity and commodity price inflation.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

Sharp rally on low volume, isn‘t a problem – pullbacks are to be bought. Value is running, and tech got off the ground – enjoy while it lasts. Even though seasonality is nothing to be cheerful about, this counter trend rally will overcome this headwind.

Credit Markets

HYG is leading higher, and didn‘t yet get enough ahead of itself – other bonds have likewise turned, and coupled with the dollar peak called, we have another ingredient facilitating the risk-on run underway.

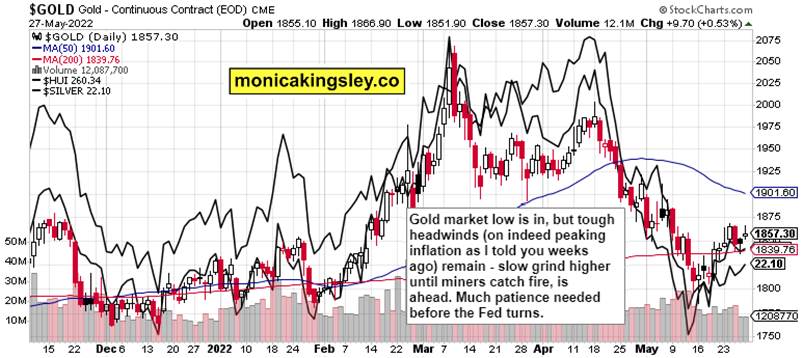

Gold, Silver and Miners

Precious metals are slowly waking up – and that‘s the way things would be in the PMs sector until the „admissible“ pain in the real economy becomes too much for the Fed to bear. Just in time to have an effect for the mid-terms – that‘s when you can expect the next upleg in gold and silver. And the metals are to be the first to sniff out the coming Fed turn before it happens.

Crude Oil

Crude oil is slowly breaking higher, still supported by geopolitics of course. Oil stocks continue leading, but as the real economy woes (reflected not only in manufacturing data to come) become apparent, black gold would feel it. For now, the times good and great beckon. Technically, the break from the long consolidation is very promising for the bulls.

Copper

Copper has turned the corner, but no rocket fuel awaits just now. It‘ll be tiring just as much as in silver – but we‘re mostly going higher from here. Of course, I have talked about other real asset areas of strength a month ago, and nothing had changed.

Bitcoin and Ethereum

Cryptos are set up for a run, and their upswing can reach quite higher still as well. The intraday correction represents a buying opportunity in the larger scheme of things – yesterday‘s volume was a positive sign.

Summary

- Bright days are here, but not forever – S&P 500 is poised to extend gains, and risk-on assets will be enjoying the coming weeks. Bonds would benefit likewise but I‘m looking for a disconnect to creep in slowly as stocks would (decidedly in my view) turn to the downside again. A couple of weeks of reasonably sharp counter trend rally await first, and these have been supported by the „green shoots“ (of infamous spring 2009 fame) in the form of peaking inflation, retail earnings and personal income data. Have a good look at today‘s extensive analysis where I talk at length what we can be looking forward in the weeks and months ahead...

- The upswing in commodities continues unabated (with copper due to real economy still about to lag before the Fed turns), and precious metals have turned the corner. Cryptos are joining in as well, in a fit of yesterday‘s strength. Overall, the open positions have been vindicated, and further gains await.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.