THE INFLATION MEGA-TREND QE4EVER!

Economics / Inflation May 20, 2022 - 05:10 PM GMTBy: Nadeem_Walayat

A reminder folks that regardless of Fed propaganda and what you read in the mainstream press QE is 4 EVER! Once it starts it will not stop. As I have been iterating for over a decade now as the following excerpt from 3 years ago illustrates (Stock Market Trend Forecast March to September 2019) that CRISIS ARE MONEY PRINTING EVENTS TO CAPITALISE UPON BY INVESTING IN ASSETS THAT ARE LEVERAGED TO INFLATION!

So why has the the stock market soared, what is that the stock market knows that most commentators and economists fail to comprehend? We'll for one thing there are the dovish signals out of the Fed which go beyond a pause in their interest rate hiking cycle in response to a subdued inflation outlook. Similarly the worlds other major central banks have their own reasons to avoid rate hikes, most notable of which is the Bank of England that has been busy propagandising the prospects of a NO Deal Brexit Armageddon in attempts to scare Westminister into avoiding EXITING the European Union in anything other than an ultra soft BrExit.

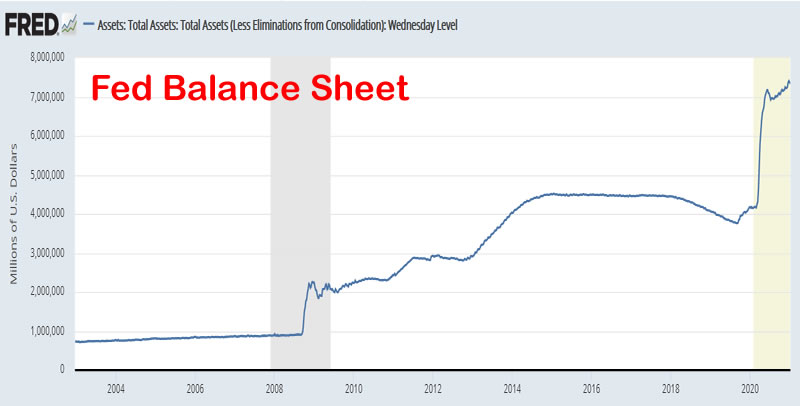

So on face value the stock market is clearly discounting not just a more accommodative interest rate environment but that QE REALLY IS FOREVER! Once it starts it DOES NOT STOP! As evidenced by the Fed's balance sheet first having exploded from about $800 billion to over $4.5 trillion, all to bailout the banking crime syndicate by inflating asset prices such as housing and stocks so as to generate artificial profits for the central bankers banking brethren. But none of this news, for I have written of it for a good 10 years now that QE will never stop as the worlds central banks will repeatedly expand QE to monetize government debt.

So I would not be surprised that WHEN the next crisis or recession materialises, QE will resume, by the end of which the Fed balance sheet will likely have DOUBLED to at least $8 trillion. And it is this which the stock market is DISCOUNTING! Just as has been the case for the duration of this QE driven stocks bull market that clearly paused during 2018 in the wake of mild Fed unwinding of its balance sheet. So forget any lingering Fed propaganda for the continuing unwinding it's balance sheet, the actual rate of of which has slowed to a trickle and thus we are probably near the point when the Fed ceases unwinding it's balance sheet because as I have often voiced that once QE starts it does NOT STOP!

So whatever form the NEXT crisis takes, the Fed will be at hand to print money and double its balance sheet, as it will periodically continue to supports asset prices such as housing which cannot be printed. We'll not until we see start seeing house building 3D printing drones emerge from the machine intelligence mega-trend that will fly around in swarms and erect designer houses anywhere on the planet.

All whilst clueless fools that populate the mainstream press and blogosfear who probably never put their money where their mouths are continue to bang the drums of NON EXISTANT DEFLATION! As I stated in opening line in my January 2010 Inflation Mega-trend ebook (download).

The worlds economies swim in an ocean of inflation that is punctuated by occasional ripples of deflation which is illustrated by the perpetual upward curve of general prices as measured by the Consumer Price Index (CPI). Inflation in the long-run impacts on virtually all commodities and asset prices.

Here's the current state of the Fed Balance Sheet during late 2020 that's looking pretty parabolic, pouring rocket fuel onto the inflation fire.

At the end of the day the money printing induced Inflation Mega-trend is the primary mega-trend that people really need to beware of and focused on so as to leverage themselves to this mega-trends consequences which is the loss of purchasing power of all currencies which is why savings should not be viewed as long-term holdings and why the likes of housing should. To further illustrate this point since the Federal Reserve bank came into being in 1913 the US dollar has lost over 96% of it's value! PRICE INFLATION! Which is why you need to hedge or leverage yourselves to MONEY PRINTING INFLATION! This is what the world's central banks do at every crisis, PRINT MORE MONEY that causes REAL INFLATION.

Which means one should take Fed rate hikes to control inflation and Quantitative tightening with a mountain of salt for as was the case in 2018/19 it will prove to be TRANISTORY!

Thus my mantra since rampant QE4EVER money printing resumed in March 2020 was to expect HIGH INFLATION, that eventually started to arrive a year later in March 2021 even on the FAKE CPILIE official measure that significantly under reports real inflation and has accelerated into the stratosphere since.

The only solution one has to preserve ones hard earned wealth is to invest in assets that cannot be easily printed, that's hard assets such as bricks and mortar and a select financial assets such as stocks with strong cash flows trading at fair multiples (most of my AI stocks). What to avoid? the no earnings garbage stocks that populate Cathy Wood's ARKK ETF's and HIGH multiple stocks that are hoovered up the masses like lambs being led to the slaughter during 2020 and where most peaked early 2021, and crash in excess of 50% since though there are still fools that cling on to false hopes of a recovery and thus continue to throw good money after bad into garbage stocks.

However, the rampant money printing path we are on is taking us along an accelerating path towards what Ludwig von Mises some 100 years ago termed as the Crackup BOOM - the END GAME Of RAMPANT MONEY PRINTING!

This article is an excerpt from my recent analysis waring of the underlying inflationary big picture and the direction of travel towards a Crack Up Boom The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential that was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis -

- AI Tech Stocks Current State, Is AMAZON a Dying Tech Giant?

- The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential

- Why APPLE Could CRASH the Stock Market!

- AI Tech Stocks Earnings BloodBath Buying Opportunity

Whilst my recent in-depth analysis is - UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away every layer of the UK housing market I could think of to arrive at a high probability of trend forecast, no following of the consensus herd here!

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

So if you want immediate access to a high probability trend forecast of UK house prices, with US and global housing markets analysis to follow soon then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- State of the Crypto Markets

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.