The Dominant Investing Theme of the Decade

Companies / Investing 2022 May 11, 2022 - 04:11 PM GMTBy: Stephen_McBride

It’s the simplest secret in all of investing:

Find the dominant theme of the decade… and bet on it.

Do this one thing right, and stock market profits will effortlessly flow into your brokerage account.

Today, I’ll tell you the dominant theme of the 2020s.

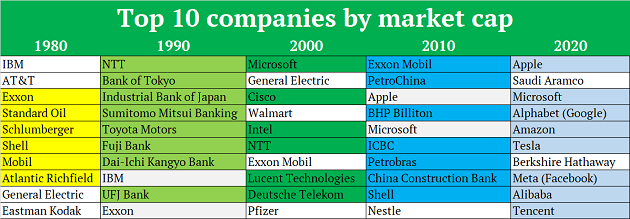

First, take a look at this table.

It shows the world’s largest companies by decade since 1980.

You’ll notice the companies are almost completely different each decade…

But you’ll also notice each decade had an obvious dominant theme…

In the ‘80s, the dominant theme was Japan. Its economy was booming. By 1990, eight of the 10 largest publicly-traded companies were Japanese.

The internet dominated the ‘90s… and by 2000, tech megawinners like Microsoft, Cisco, and Intel had climbed into the “top 10” and handed out huge profits to investors.

In the 2000s, a rapidly growing China consumed awesome amounts of raw materials, causing many commodity stocks to skyrocket.

And in the 2010s, smartphones and fast, high-quality internet gave rise to Amazon, Google, and Meta (formerly Facebook).

- For the past three years, I’ve been trying to find the dominant theme of the 2020s.

The theme that will catapult a new crop of disruptors into the top 10 by 2030.

I didn’t have a good answer… until now.

You see, blistering-fast growth is the key ingredient.

In the ‘80s, Japan’s economy grew much faster than the US.

In the early ‘90s, the internet grew 2,300% per year.

In the 2000s, commodity-hungry China grew at a blistering 10.3%.

And the rapid adoption of smartphones was the defining trend of the 2010s.

What’s the fastest-growing technology in the world today?

By a longshot… it’s blockchain—the technology cryptos are built on.

- The dominant theme of the 2020s is crypto.

Blockchain businesses will dominate 2030’s top 10 list.

Blockchain is the fastest-growing tech ever.

It’s growing almost twice as fast as the internet did in the 1990s!

In 2016, less than five million people had used crypto. That number recently hit 300 million.

And crypto is already producing some of the world’s fastest-growing businesses.

Long-time RiskHedge readers know all about Ethereum (ETH), the second-largest crypto.

Think of Ethereum like a virtual computer that allows you to transfer money, buy or sell assets, store files, and so much more. It’s like Visa, the New York Stock Exchange, and the Google Cloud Platform rolled into one.

Ethereum is just seven years old, yet it processed $11.6 trillion worth of transactions last year. That’s more than Visa, Mastercard, or PayPal…

We’ve also discussed Helium and its money-making hotspots before.

Helium is building a new type of wireless network. One not controlled by a big corporation like AT&T… but owned and operated by folks like me and you.

Today, it has 770,000 hotspots live in 171 countries. That figure is rising by 80,000 per month. Helium is the fastest-growing wireless network in history. In fact, it’s on track to have more 5G cells than Verizon by year end.

Remember…

- At least 40 years of market history tells us the dominant theme changes every decade…

I’m betting crypto is the dominant theme of the 2020s.

In fact, there’s already one crypto asset in the top 10. If bitcoin were a “business,” it would be the seventh-largest stock in the world. Ethereum slots in at #15. It has a larger market cap than JPMorgan, Mastercard, or Exxon Mobil.

By 2030, the top 10 list will be full of cryptos.

Are you investing accordingly?

Because it’s still early for crypto…

And in my premium crypto advisory, RiskHedge Venture, we’re buying world-class crypto businesses still flying under the radar.

3 Breakthrough Stocks Set to Double Your Money in 2022

Get our latest report where we reveal our three favorite stocks that can hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2022 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.