RECESSION RISKS 2023

Economics / Recession 2023 May 10, 2022 - 03:31 PM GMTBy: Nadeem_Walayat

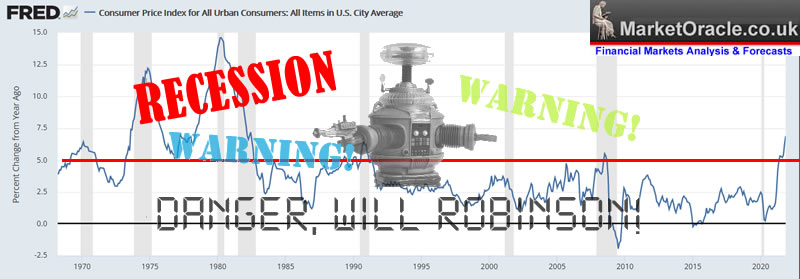

Firstly it does not actually matter if a recession materialises during 2023 or not all that matters is most people THINK it's going to happen, for asset prices discount the future which is why today stock prices are falling even if that is not being reflected in the stock indices due to the Stocks Bear Market Tornado which I will cover in depth in a forthcoming stocks article. Nevertheless there is a RISK of inflation that I have been flagging a warning of a good 6 months BEFORE the current Yield Curve inversion.

So what do you do?

Hold assets that are LEVERAGED to INFLATION!

- Good Housing

- Good STOCKS

- Good Commodities

Good in the sense you don't just go out and buy any old garbage, for instance an auction property or a high rise flat. Good stocks in that not a Snowflake that's lost half its value but still trades on 1000 earnings!

Understand this, whatever the stock market does over the coming weeks and months it will turn out to be a mere blip on the long-term charts. which is a mantra that I iterate during most market corrections and panic events.

It does not matter where the bottom of any bear market will be, all that matters is gaining exposure to AI mega-trend stocks because they will always tend to surprise to the upside that will leave most puzzled and confused as to how can stocks be trading higher when for instance the pandemic death toll is doubling every week as was the case during April 2020 when many Patrons kept asking me if they should sell now to bank gains of 50% or so, which had me rolling my eyes in their sockets, warning that it would be a BIG MISTAKE to SELL and that the thought of SELLING had not even crossed my mind at that time. Instead it would be well over a year later when I would start to distribute into the FOMO bubble valuations of late last year with the aim of capitalising on THIS SELL OFF, seeking to buy deviations from the highs in GOOD STOCKS which is precisely what I am doing right now just as most are becoming fearful of buying anything.

The key point about investing in stocks is that one is getting out of fiat currency which is 100% guaranteed to go to ZERO and into something that at the every least has a fighting chance of at least maintaining it's real terms value. What the stock price does AFTER one buys it over days, weeks and months is irrelevant, as is the case with properties for one is investing and not trading in and out like a ping pong ball.

This article in an excerpt from my most recent extensive analysis focused on UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away multiple layers of the UK housing market of to arrive at a high probability trend forecast.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my recent analysis include a look at the risks that the likes of Apple and Microsoft pose to the stock market indices Why APPLE Could CRASH the Stock Market!

And on The CRACK UP BOOM! Implications for Stocks, Housing. and Commodities, Silver Potential.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.