High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing, Fed Strategy Revealed

Economics / Inflation Apr 30, 2022 - 06:39 PM GMTBy: Nadeem_Walayat

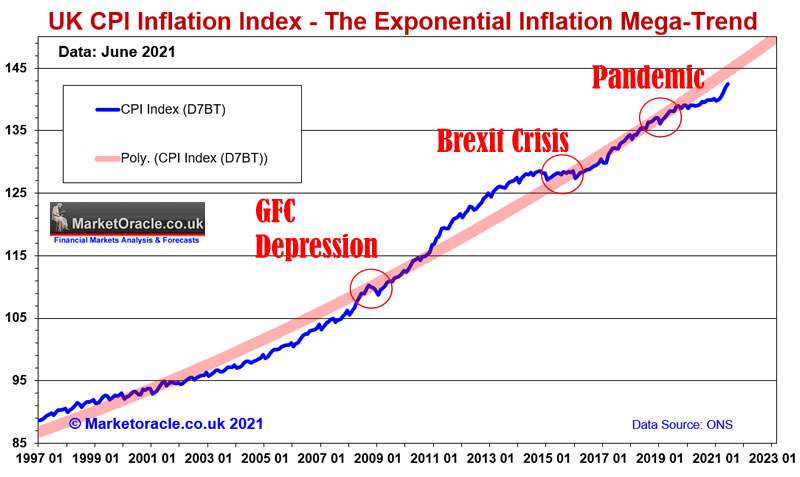

UK CP LIE Inflation hits 6.2%, whilst RPI that which most corporations raise their prices to has rocketed higher to 8.2% whilst real UK inflation stands at at least 15%, meanwhile across the atlantic US CPLIE inflation of 7.9 % stands on the brink of breaking to well above 8% with real inflation also at around 15% So much for the Pandemic deflationary depression that the clueless mainstream media had been promoting for much of 2020 and then sleep walked into the mantra of transitory inflation for the whole of 2021, finally awakening during 2022 to what amounts to out control inflation, though like gullible fools swallowing the central bankster's sales pitch of laying the blame on Czar Putin's Afghan War 2.0 in Ukraine which illustrates the extent to which what you read in the mainstream press tends to be garbage written by clueless journalists.

Instead I flagged what was likely to happen not in 2022, not 2021 but right back at the beginning of this accelerated phase of the inflation mega-trend in Mid March 2020 when the current phase of QE4EVER began when governments went on debt fueled spending binge that their central banks dutifully monetized by doubling their balance sheets, printing trillions of dollars of fiat currency without abandon so as avoid that which most were expecting the covid economic black hole! Still despite rampant money printing fools persisted with their imminent deflation mantra!

So what does one do when faced with rampant money printing? To invest in assets that are leveraged to inflation that is Quantum AI tech stocks, housing and commodities, BIG INFLATION is coming was the warning at the end of virtually every video I posted. Which is why I bought everything thing I thought I would need to buy in terms of big ticket items for several years from Mid 2020 to Mid 2021 since which time I have been largely out of the big ticket item consumption loop just as the supply chains closed their death jaws and sending inflation spiraling ever higher all whilst the government and their central bankster's utilised the pseudo science that is economics to pump out transitory inflation propaganda. You don't get transitory inflation when you print trillions of dollars and then get the central bankster's to monetize the debt by doubling their balance sheet! It's a big CON that most fell for, look journalists are good at writing reams and reams of highly polished text but at the end of the day they are what they are journalists who don't have a CLUE of what is actually going on, hence total BS, we have high inflation not because of Russia but because of rampant money printing that RESUMED without abandon in MARCH 2020!

And so far we have not even begun tinkering around the edges of mountain of money printing that STILL continues to this very day, the Fed is still printing more money, there has been no tightening so far, In fact I am pretty sure that today's Fed balance sheet of 9 trillion will be even HIGHER a couple of years from now than where it stands today! In fact we will probably see the Fed's and other central bank balance sheets more than DOUBLE again during this decade i.e. to at LEAST a $20 trillion dollar Fed balance sheet, so much for taper talk!

And thus what I have been expecting is likely to become manifest in that high inflation is likely to persist for the WHOLE OF THIS DECADE! Which means a lot of persistent pain in the West and if there is pain in the West that will translate into inflation nightmare for the developing world!

Fed Inflation Strategy Revealed

Inflation 4%: It’s a little higher than our target rate, but is definitely transitory.

Inflation 5%: Oh yes, it’s definitely transitory. Just supply chain issues.

Inflation 6%: It is persistently transitory, but it will fall soon all on its own in Q3.

Inflation 7%: Hallelujah Inflation has finally peaked!

Inflation 7.5%: It's the top now, definitely.

Inflation 7.9%: This is really the top for sure. We got this, we pressed the red button on the keyboard..

Inflation 8.5%: This is all Putin's fault! Not Ours.

Inflation 10%: Nothing to worry about. It’s to be expected with the Ukraine war still raging and China lockdown's. Plus the market has already priced it all in.

Inflation 12%: There is no way this is not the TOP now for Sure!

Inflation 15%: OK, you win, Please just make it stop!

Inflation 20%: Don’t make us go all Volcker on you now!!!

Inflation 25%: Where's my index linked retirement package, Time for a new Fed chair to finish the job I started (sort of).

This article in an excerpt from my most recent analysis extensive analysis which is on UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away multiple layers of the UK housing market of to arrive at a high probability of trend forecast.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

Which was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my most recent analysis is in the count down to earnings season The Stocks Stealth BEAR Market, AI Stocks Buying Levels Going Into Earnings

Whch is imminently to be followed by my advance look at next weeks FAANG stocks potential earnings bloodbath buying opportuntiies.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- Current Best Value AI Tech Stocks, New Tax Year Best Stocks and Shares ISA"s - Done.

- FAANG Stocks Earnings Bloodbath Buying Opportunities - Imminent

- Why Draw downs Don't Matter

- The VR Mega-trend

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.