Motley Fool Has Made Some All-Time Picks

Personal_Finance / Investing 2022 Apr 30, 2022 - 06:15 PM GMTBy: Umer_Mahmood

Whether you are completely new to investing or a seasoned pro, it is easy to be perplexed by the many options that come up when you start looking for services and products that help with picking stocks. The internet’s universal adoption has made that much more information available at our fingertips, but it has also raised the stakes around the importance of using good sources and doing due diligence. One website that you have no doubt come across, and maybe wondered about, is the Motley Fool. Despite a bit of a silly name, this is not a stock picking service for fools – in fact, it has delivered some truly legendary stock picks that would have changed your portfolio forever had you been a subscriber at the time.

Whether you are completely new to investing or a seasoned pro, it is easy to be perplexed by the many options that come up when you start looking for services and products that help with picking stocks. The internet’s universal adoption has made that much more information available at our fingertips, but it has also raised the stakes around the importance of using good sources and doing due diligence. One website that you have no doubt come across, and maybe wondered about, is the Motley Fool. Despite a bit of a silly name, this is not a stock picking service for fools – in fact, it has delivered some truly legendary stock picks that would have changed your portfolio forever had you been a subscriber at the time.

The Basics

The Motley Fool has been in existence since 1993 and has a good record of picking stocks over that timeframe. We’ll go through some of the specifics of their returns and best picks in a little bit, but starting with one of the more detailed reviews available online will help to give you the lay of the land.

While they sometimes release teasers or limited stock picks to the general public, subscribers get access to a premium service that includes two picks per month, a “buy now” list of recommendations and a list of foundational stocks to hold forever. Overall, it is a pretty impressive suite of information that can be used by investors of any skill level. Based on their long-term historic results, if you are a young investor who is thinking about saving for retirement over the course of years and decades, the Fool’s picks could really help your cause.

Stock Advisor vs Rule Breakers

Some people are surprised to learn that despite its very well known brand, the Motley Fool is actually made up of two distinct categories of service. Motley Fool Stock Advisors is the more traditional offering, focusing on well known stocks with established track records. In theory, these stocks are somewhat less volatile and easier to predict, making them perfect for more risk adverse investors.

Their other offering is known as Rule Breakers. This stock picking service steps a little bit outside of the mould and focuses on up and coming or under the radar stocks. Not surprisingly, these stocks have the potential for greater returns as they have generally not been discovered by the market. Of course, the flip side of that is the potential for bigger losses if things go south for a company without an established track record to fall back on.

A lot of the core elements of both are the same – for instance, they each put out 2 picks per month and have the same basic sets of information available. That said, there are obviously some differences – a big one is the picks themselves. Rule Breakers and Stock Advisor very rarely recommend the same stock, meaning that which service you decide to use will result in very different investments.

Proof in the Pudding

Its fine to point to a subscription service’s longevity as evidence of its worthiness, but most investors only care about one thing: returns. Here, fortunately, the Motley Fool does perform very well. It generally produces returns that beat the market convincingly. At one point in June 2021, Stock Advisor’s cumulative returns were almost 600% - 593% to be exact. This greatly outpaces the S&P 500, a very commonly used benchmark, at a 132% return.

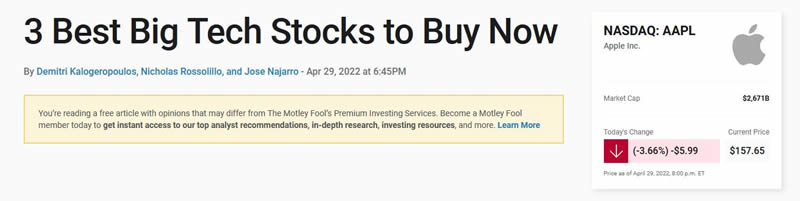

More than average returns, which are still very impressive, it’s Motley Fool’s outliers that make the service truly intriguing. They have produced multiple massive runners, including returns nearly 20,000 (twenty thousand) percent! Amazon, Tesla and Netflix are among some of these winners – it’s hard not to get carried away wondering what your portfolio might look like had you been a Fool subscriber at the time those picks came out.

A Warning For Fools

While the price point of $199 annually is very affordable compared to other similar services, it would leave an incomplete picture to not talk about potential drawbacks of signing up for the Motley Fool’s subscription service. For one thing, their picks often require patience – they recommend buyers be prepared to hold their picks for about three to five years. Indeed, many of the huge winners mentioned earlier in this article would have required a long-term hold to reap the full return. So if you are looking to become a day trader, consider the fact that there are often very specific rules – and perhaps consider getting your picks from a source other than Motley Fool.

It's also important to remember that the Motley Fool’s impressive returns are averages. That’s to say, you need to be invested in all their positions to see the same average benefit. With 24 picks a year, that’s a lot of cash required to participate – of course you can pick individual stocks rather than investing in all picks, but that increases the risk of volatility in your returns that differ from their historic average.

Finally, because the Fool is United States-based, it’s wise to be familiar with the rules around what constitutes stock investment advice and the individual investor’s responsibility to do due diligence. The regulating body in the United Kingdom is the Financial Conduct Authority.

By Umer Mahmood

© 2022 Copyright Umer Mahmood - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.