WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING MARKET

Stock-Markets / Inflation Apr 24, 2022 - 02:45 PM GMTBy: Nadeem_Walayat

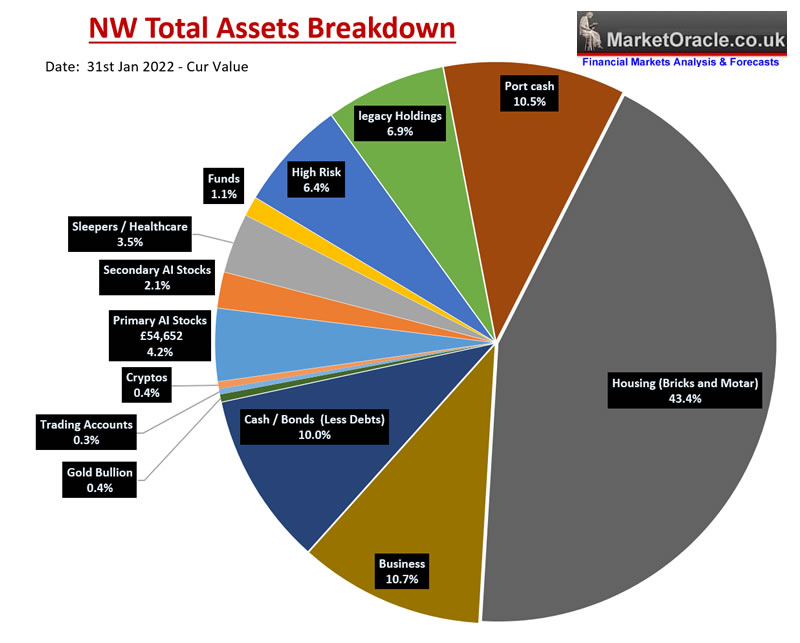

This is why one has NO CHOICE but to be invested in price volatile assets such as stocks and housing which whilst yes will move up and down in value from tim to time like a yo yo nevertheless over he long-run will be leveraged to rampant government and central bank money printing inflation so we have NO CHOICE BUT TO BE INVESTED IN SUCH ASSETS! NO CHOICE WHATSOEVER FOR THE ALTERNATIVE IS CERTAIN DESTRUCTION OF ONES HARD EARNED WEALTH which is why the largest asset class I have held for near 10 years now is bricks and mortar UK housing regardless of what the price indices do from month to month, year to year, or the clowns proclaim about imminent deflationary crashes. There is NO CHOICE BUT TO BE HOLD ASSETS THAT ARE LEVERAGED TO INFLATION AS THE ALTERNATIVE IS ONE WILL LOSE THE VALUE OF ALL OF ONES HARD EARNED SAVINGS! Which is why whenever I am asked if now is a good time to buy property I tend to remind those asking that house prices are leveraged to inflation so regardless of the tripe in the clueless mainstream press of how UK housing is unaffordable, however inflation ensures that the overall trend trajectory remains upwards for the fundamental fact that unlike fiat currency houses cannot be printed and thus house prices have confounded the clownomics in the mainstream press by soaring into the stratosphere.

Basically housing is one asset classes not to trade in and out of like one tends to do with stocks but rather to the accumulate whenever one observes deviations from the highs for the greater the deviation from the high the greater the buying opportunity presented. My focus be it in housing or good stocks is ALWAYS to BUY the deviation from the highs, whilst the focus of most would be investors are the possible draw downs as if one can buy the exact bottom, good look with that as you will only ever see the bottom in your rear view mirror, hence why most investors miss the greatest bull markets in history as they miss the bottom and then wait for the last major low to repeat and thus end up buying nothing, or if they do buy soon tend to sell on the few percent blip higher on FEAR that even lower prices are just ahead . which means investing is largely psychological, for some reason most people are wholly focused on DRAWDOWNS hence why they tend to NOT buy when prices are cheap and instead FOMO into assets when expensive, which is the exact opposite of what one should do!

BUY THE DEVIATION FROM THE HIGHS,. DRAWDOWNS ARE NORMAL, YOU WILL NEVER BUY THE BOTTOM OR SELL THE TOP, ATTEMPTING TO DO SO MEANS YOU WILL HOLD NOTHING WORTH HOLDING!

This article in an excerpt from my most recent analysis extensive analysis which is on UK House Prices Three Trend Forecast 2022 to 2025, where I pealed away multiple layers of the UK housing market of to arrive at a high probability of trend forecast.

UK House Prices Trend Forecast 2022 to 2025

THE INFLATION MEGA-TREND

WE HAVE NO CHOICE BUT TO INVEST IN STOCKS AND HOUSING

High Inflation Forecast for Whole of this Decade Due to Rampant Money Printing

Fed Inflation Strategy Revealed

Russian Sanctions Stagflation Driver

RECESSION RISKS 2023

UK Debt Inflation Smoking Gun

Britains' Hyper Housing Market

UK Population Growth Forecast 2010 to 2030

UK House Building and Population Growth Analysis

UK Over Crowding Ratio

Overcrowding Implications for UK House Prices

UK Housing Market Affordability

UK House Prices Real Terms Sustainable Trend

UK House Prices Relative to GDP Growth

UK House Prices Momentum Forecast

UK House Prices and the Inflation Mega-trend

Lets Get Jiggy With UK INTEREST RATES

Is the US Yield Curve Inversion Broken?

UK house Prices and Yield Curve Inversions

Interest Rates How High WIll they Go?

Work From Home Inflationary BOOM?

Formulating a UK House Prices Forecast

UK House Prices 2022 to 2025 Trend Forecast Conclusion

Peering into the Mists of TIme

Risks to the Forecasts

US House Prices Trend Forecast 2022-2024

Which was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

Whilst my most recent analysis is in the count down to earnings season The Stocks Stealth BEAR Market, AI Stocks Buying Levels Going Into Earnings

Whch is imminently to be followed by my advance look at next weeks FAANG stocks potential earnings bloodbath buying opportuntiies.

My Main Analysis Schedule

- UK House Prices Trend Forecast - Complete

- US House Prices Trend Forecast - 70%

- Global Housing / Investing Markets - 60%

- US Dollar / British Pound Trend Forecasts - 0%

- Stock Market Trend forecast into End 2022 - 0%

- High Risk Stocks Update - Health / Biotech Focus - 0%

- How to Get Rich - 85%

- Gold and Silver Analysis - 0%

- Current Best Value AI Tech Stocks, New Tax Year Best Stocks and Shares ISA"s - Done.

- FAANG Stocks Earnings Bloodbath Buying Opportunities - Imminent

- Why Draw downs Don't Matter

- The VR Mega-trend

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the panic selling falling knives.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.