Global Economic Outlook Suggests Concerted Interest Rate Cuts

Interest-Rates / Global Economy Oct 28, 2008 - 03:11 AM GMT The financial panic that began in early September has been a body blow to global business confidence and the global economy which, according to the Survey of Business Confidence of the World conducted by Moody's Economy.com , is now in recession.

The financial panic that began in early September has been a body blow to global business confidence and the global economy which, according to the Survey of Business Confidence of the World conducted by Moody's Economy.com , is now in recession.

How bad is the shape of the US and global economy?

As part of my ongoing research, I study a large array of economic statistics - usually in graphic form. Below are a number of charts, together with cryptic comments, that I have just compiled in order to cast some light on the economic outlook. As the saying goes, a picture tells a thousand words …

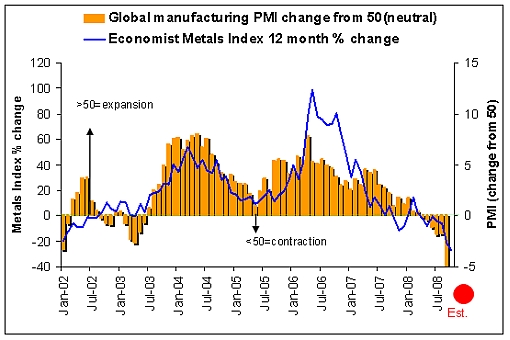

The recession in global manufacturing is intensifying.

Latest reports have it that China has joined the manufacturing recession.

The global non-manufacturing (services) sector has also caved in, especially in the light of what is happening in the global banking sector.

Even before the collapse of the global banking system a global recession was on the cards.

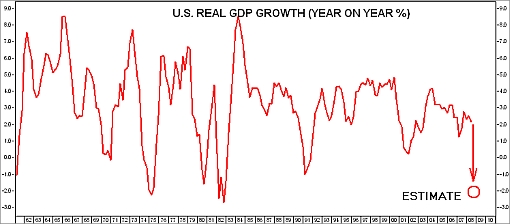

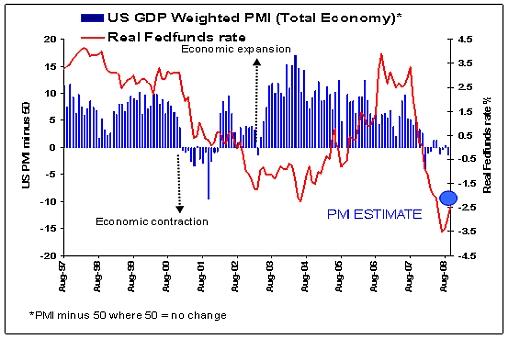

The US economy probably grew by 1.5% in the third quarter on a year ago basis, registering the first negative quarter-on-quarter growth. The liquidity crisis and the resulting stalling of global trade must have impacted severely on the purchasing managers' indices in October (to be published in November) and could be suggesting that the contraction of the US real GDP has gathered momentum.

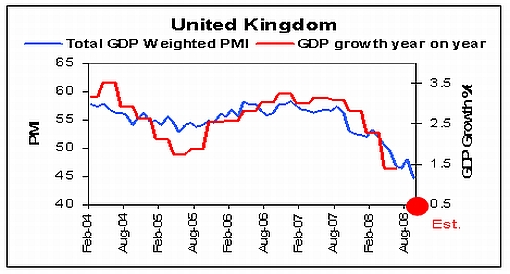

The UK economy is also heading for zero growth compared to a year ago.

Economic growth in Europe has stalled.

China is not providing any relief either as growth is losing momentum rather rapidly.

The poor global economic environment is reflected in lower commodity prices.

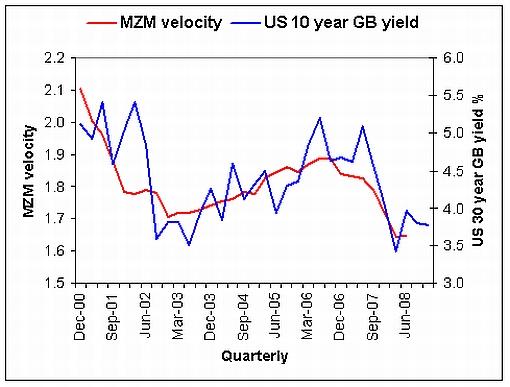

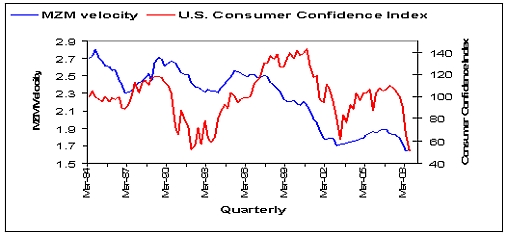

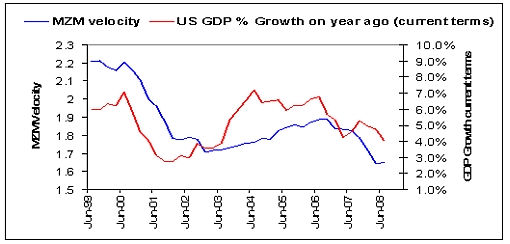

As far as the current state of the US economy is concerned, the US 10-year government bond yield is an excellent indicator of the current state of the MZM money-supply velocity and is indicating that the velocity has stabilized at the lower levels.

Given a constant velocity of 1.64, the current MZM money supply (mid-October) and a 4% inflation rate, it means the US economy has contracted by approximately 2% in the current quarter (the largest decline since 1980) or more than 7% quarter on quarter annualized, or -3% year on year (largest since 1982).

Is there any light at the end of the tunnel? Desperate times call for desperate measures.

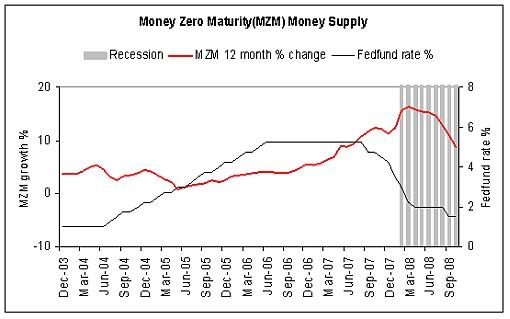

The Fed's bail-out of the banks and significant injection of funds have only addressed the solvency of banks and nothing has followed through to the economy. Not only is growth in money in circulation declining,

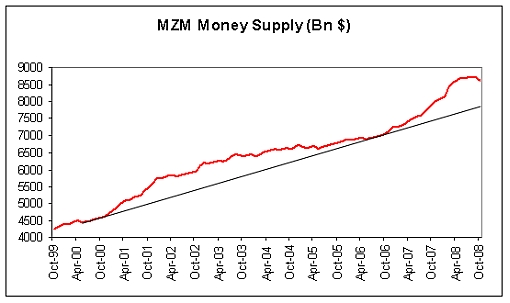

but the actual money supply is also shrinking.

To ensure that the money supply does not fall back to the trend line the Fed needs to pump $700 billion into the economy - incidentally the same as the recently enacted $700 billion bail-out law to inject money into banks.

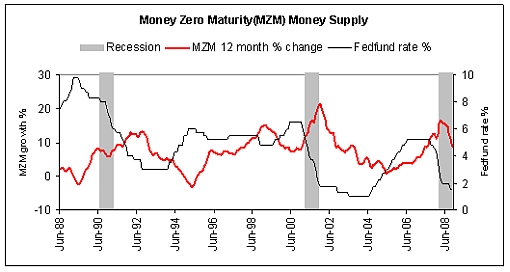

Therefore, expect the same trend in the Fed funds rate as in previous recessions.

Consumer confidence is the backbone of the US economy due to its relationship with the velocity of money supply in the economy.

The Fed needs to restore consumer confidence urgently to get the economy out of its current malaise. One major factor could be to relieve the interest burden on households. In fact, the Fed needs to cut the Fed funds rate aggressively and significantly in the near future. Failing to do so will effectively mean that the Fed is tightening its monetary policy,

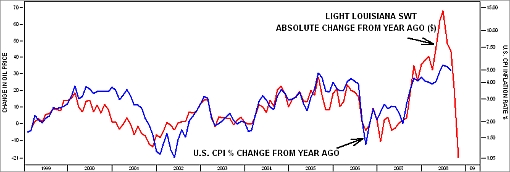

as the significant drop in commodity prices and especially the oil price will result in the US CPI inflation rate falling to approximately 1% in the next three months.

In short, expect the FOMC to cut the Fed funds rate by at least 50 basis points on Wednesday, to be followed by a further rate cut probably by December or January next year. The European Central Bank and a number of other central banks will have to ease in a coordinated fashion.

Failure by the central banks to ease decisively will endanger the US and global economy even more as deflation looms around the corner.

Note :

All the graphs used in this post are based on data from I-Net Bridge.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.