US Military Spending to Exceed Annual Deficits

Economics / US Military Mar 30, 2022 - 09:58 PM GMTBy: Richard_Mills

“Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed.”

– President Dwight D. Eisenhower

The guns versus butter model portrays the relationship between a nation’s investment in defense and civilian goods. Because a country has finite resources, it must choose how much to spend on defense/ the military (guns), against the amount budgeted for items that are needed for non-defensive purposes (butter). Of course, it can also buy a combination of both, and most countries do.

The one nation that doesn’t have to bother with this, is the United States. Because the US holds the reserve currency, and all the exorbitant privilege that implies, it can spend on guns AND butter. Fact is, whenever the US government runs short on funds, it simply prints more money. Or borrows it, by issuing Treasury bills that are sopped up by domestic and foreign investors. The demand for Treasuries will always be resilient, so long as the dollar remains the reserve currency. This, however, may not be the case for much longer…

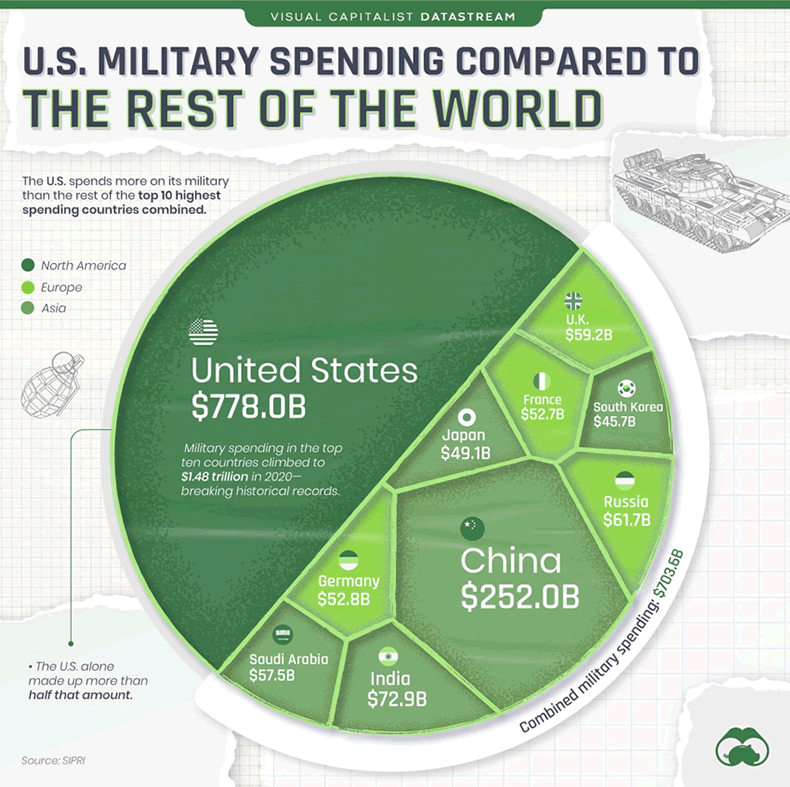

According to Breakingviews, via Reuters, the United States as top military power spends 10% of its budget on defense and has 2.3 million personnel. The US spends more on defense than the next nine countries combined.

According to World Population Review, the 10 countries with the highest military expenditures (2020 figures) are:

United States ($778 billion)

China ($252 billion [estimated])

India ($72.9 billion)

Russia ($61.7 billion)

United Kingdom ($59.2 billion)

Saudi Arabia ($57.5 billion [estimated])

Germany ($52.8 billion)

France ($52.7 billion)

Japan ($49.1 billion)

South Korea ($45.7 billion)

Source: Visual Capitalist

But this number is misleading. It grossly underestimates how much public money is actually plowed into the US military, through different departments. Allow me to explain.

This year the Department of Defense Budget is $715 billion. The Air Force is allocated $52.4 billion, including $12 billion for 85 F-35 Joint Strike Fighters, the Navy will spend $34.6 billion and the Army receives $12.3 billion.

Other parts of the base defense budget are nuclear modernization ($27.7B), missile defense ($20.4B) and long range fires ($6.6B).

The DOD will also spend $20.6 billion on space-based systems and $10.4 billion on cyberspace activities.

Now let’s look at what the $715 billion doesn’t include. The DOD budget does not count black ops, interest on the defense portion of the debt, and ongoing military obligations to veterans.

Other military expenses, such as military training, military aid and special operations, are put under other departments or are accounted for separately.

The DOD budget also doesn’t include the cost of overseas wars. That money is allocated to Overseas Contingency Operations. Since 2001, the OCO budget has spent $2 trillion on the War on Terror, none of which showed up under Department of Defense expenditures.

The budget for nuclear weapons is split between the Defense Department and the Department of Energy. According to the Congressional Budget Office (CBO), the DOD and the DOE have submitted plans for nuclear forces covering the period 2021-30. The $634 billion total averages out to just over $60 billion per year.

US nuclear forces consist of submarine-based ballistic missiles (SSBNs), land-based intercontinental ballistic missiles (ICBMs), long-range bomber aircraft, shorter-range tactical aircraft carrying bombs, and the nuclear warheads that those delivery systems carry.

This year almost two-thirds of the nuclear budget is within the DOD, with the largest costs being ballistic missile submarines and intercontinental ballistic missiles. The remaining third, paid for by the DOE, is primarily for nuclear laboratories and supporting facilities.

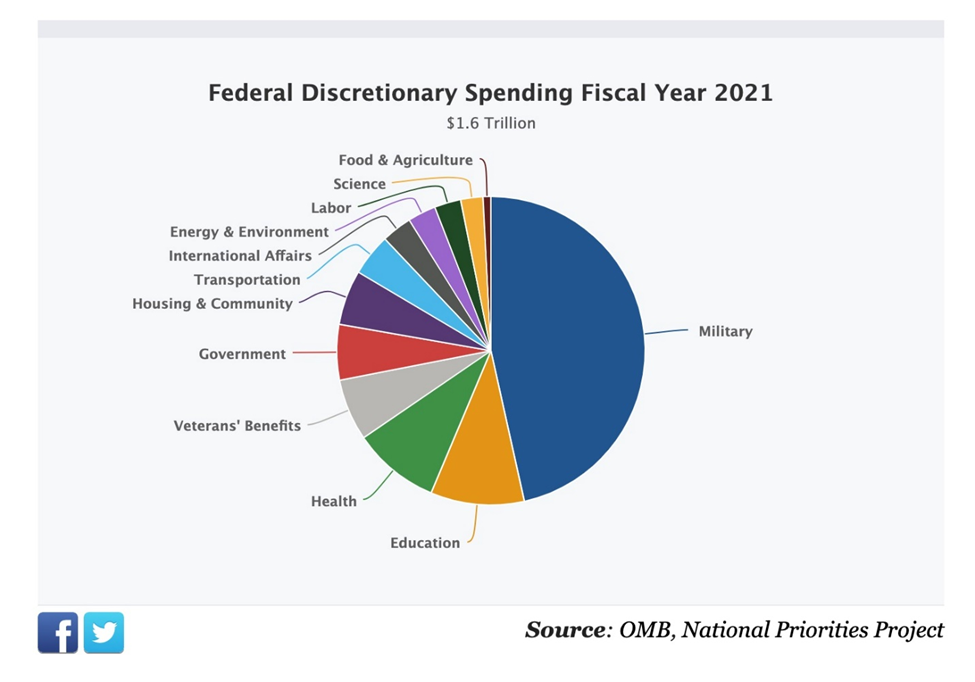

US defense expenditures are usually counted as the second largest category of the federal budget behind Social Security, but if we include all the items not normally tallied under defense spending, and departments in which much of their spending is devoted to the military effort, we find that defense spending actually exceeds Social Security. Not only that, it’s more than the expected budget deficits forecast for the next decade. Here’s how we come to that conclusion:

Government spending is broken down into three categories: mandatory spending, discretionary spending, and interest on the national debt. This year the US government expects to spend $6.011 trillion.

Mandatory spending is estimated at $4.018T, of which the biggest expenses are Social Security, budgeted at $1.196T, followed by Medicare at $766B and Medicaid at $571B.

The discretionary budget for 2022 is $1.688T. Much of this goes toward military spending, of which the largest expense is the Department of Defense budget, @ $715B. But wait. Because military spending includes Homeland Security, State and Veterans Affairs, and other defense-related departments, these costs combined come to $752.9B. If we add the bill for nuclear forces, @ $60B, total expenditures for the US military amount to $1.527 trillion!

This exceeds Social Security, @ $1.196T and is more than Medicare and Medicaid put together ($1.337T).

The CBO projects a cumulative deficit for 2022-31 of $12.1 trillion, or an average of $1.2T per year. So, while defense spending this year is less than the CBO’s forecasted $3 trillion deficit, it will surpass the $1.2T deficit the CBO expects the government to run each year from 2022-31.

Remember, these figures were assembled prior to Russia’s invasion of Ukraine. President Biden on March 17 announced $800 million in military equipment would be transferred directly to Ukraine, bringing total US military aid since the Russian invasion began to $1 billion. His administration previously approved another $1 billion in aid before the invasion. Total military aid so far: $2 billion.

Ukraine isn’t the only hot spot Uncle Sam has to worry about.

On Thursday North Korea conducted its biggest-ever intercontinental ballistic missile test. State media said the ICBM flew for 1,090 km to an altitude of 6,248 km before splashing down in the Sea of Japan. Reuters reported It was the first full-capability launch of the nuclear-armed state’s largest missiles since 2017, and represents a major step in Pyongyang’s development of weapons that might be able to deliver nuclear warheads anywhere in the United States.

In a report last year, the Government Accountability Office said the US spent more than $34 billion to maintain military presences in Japan and South Korea from 2016-19, with the lion’s share, $9.2B, going towards Camp Humphreys, and the Air Force’s $3.9B to support Osan and Kunsan air bases coming in second.

The United States is by far the largest contributor to NATO, so between defending Europe from Russian aggression, and maintaining a military advantage over North Korea, I feel confident in saying that US annual military expenditures will be maintained, or more likely, increased.

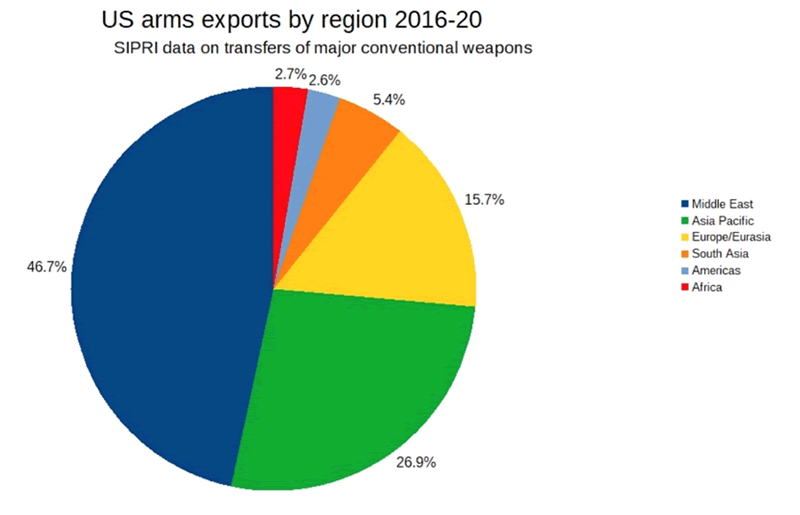

Not only does the US have easily the most powerful military with enough weapons to destroy the world many times over, it is also the biggest arms dealer.

In 2021, American defense firms struck deals to sell $175 billion worth of weapons, including $23 billion worth of F35 fighters and drones to the United Arab Emirates, and multi-billion dollar sales to Taiwan and Saudi Arabia. Since Joe Biden’s inauguration, the State Department approved an $85 million sale of Raytheon manufactured missiles to Chile and $60 million worth of Lockheed Martin’s F-16 aircraft and services to Jordan, Open Secrets reported.

Again, this does not include recent military aid to Ukraine. Tag on another $2 billion for that.

In 2018 a senior researcher at the Stockholm International Peace Research Institute (SIPRI) told the BBC that the US exports 34% of global arms sales.

Source: Campaign Against Arms Trade

That’s a lot of guns, not much butter, to return to the economic model mentioned at the top. Clearly the power brokers in the upper echelons of the US government have decided that the military industrial complex, a term first coined by President Eisenhower, should be supported in perpetuity. The reason is simple: there’s a lot more money in guns than butter.

Thousands of lobbyists work in Washington to ensure the levers of government are greased for their arms-dealing clients. Congressmen/ women and senators know that turning off the taps to government funding could result in bullet and bomb-making factory closures and defeats at the ballot box.

As Al Jazeera put it in a feature story on the sprawling industry behind war and counter-terrorism, The war-based economy allows for military and homeland departments to be virtually untouchable. Environmental and social programmes are eliminated or curtailed by billions as war-related budgets continue to expand to meet “new threats”.

Indeed being the world’s cop, and its top military spender, comes at a very high cost, in money that could have been spent on bettering society, rather than on defending it against domestic terrorists, and funding far-away conflicts that most Americans have no stake in.

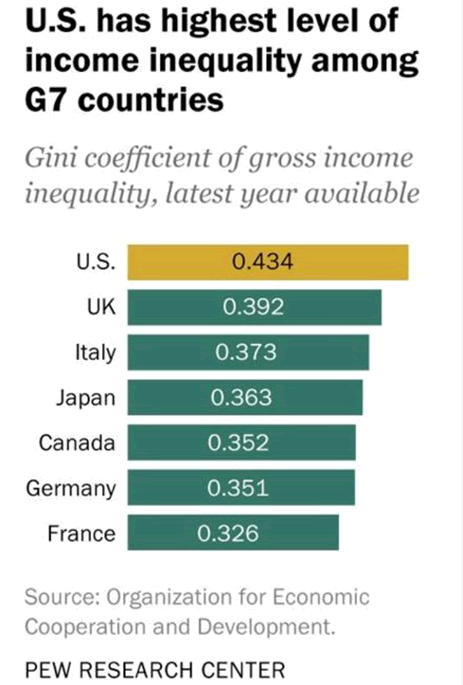

We are seeing the prioritization of guns over butter in the rampant inequality that is stalking the United States, even as the Biden administration promised a kinder, gentler America than Trump’s.

Oxfam recently calculated that the three wealthiest individuals in the States have as much as the bottom 160 million. The country has the highest Gini coefficient among G7 nations, with the top 1% of earners making about 40 times the bottom 90%.

The Guardian reported from 2003 to 2013, inflation-adjusted net wealth for a typical household fell 36%, from $87,992 to $56,335, while the net worth of wealthy households rose by 14%.

Also consider: the average US household is $150,000 in debt, and each person owes $99,000.

Yet data from the Economic Policy Institute quoted by Forbes showed that in 2020, the average CEO’s compensation jumped 16%. This compares to average worker compensation, which grew only 1.8%.

Canada’s top CEOs also had a very good year in spite of the pandemic. The Canadian Centre for Policy Alternatives examined the 100 highest-paid CEOs at publicly traded Canada-based companies for 2020. It found that their average annual compensation totaled $10.9 million — $95,000 more than their average pay in pre-pandemic 2019.

The war in Ukraine is accelerating a global food crisis that is reverberating across the world, in countries that literally depend on Russia and Ukraine for putting food on the table. (together they account for 25% of global wheat shipments)

Climate change is making it more difficult to irrigate fields and pastures. Droughts and floods are ruining crops or reducing yields, forcing some farmers into bankruptcy. Many grocery items have exploded in price due to covid-related supply disruptions, bad weather, the Russo-Ukrainian war, or a combination of the three.

Conclusion

Higher food, energy and housing prices tie into a growing crisis of affordability. Wages haven’t kept up with historically high inflation. As inflation eats away disposable income, nearly two-thirds of Americans (64%) are living paycheck to paycheck.

I see the war in Ukraine, covid, supply chain interruptions, inflation and climate change coalescing into a perfect storm of unaffordability that could eventually erupt into mass social unrest.

Global tensions are mounting. The war in Ukraine shows no signs of ending, and North Korea is back to firing off missiles. China is beefing up its military and so is India and Japan. To maintain its position as the world’s strongman, the United States will have to keep spending on equipment, technology and troops. The government continues to be pressured by its allies and the defense industry lobbyists in Washington to contribute more and more.

How much longer before Joe and Suzy Sixpack tire of the endless wars, the constant threats, the prioritization of military over social spending? When their anger boils over because they can’t afford to feed and clothe their kids, while the US controls 750 bases in at least 80 countries and spends more on their military than the next 10 countries combined? More than Social Security? More than Medicare and Medicaid combined? And let’s not forget: being the world’s biggest arms dealer?

Perhaps when the citizenry finally realizes that it will have to start paying for this madness out of their taxes, rather than being blissfully unaware of it, as the government finances its wars by printing money and issuing bonds, the chickens will come home to roost and people will say, “no more”.

We just wrote an article on the possibility of Russia moving to the gold standard. When US exorbitant privilege ends because the most populous half of the world isn’t trading with American dollars, when foreigners stop buying Treasuries because the government can’t afford to pay its bondholders, when the dollar is no longer worth the paper it’s printed on, perhaps the government will finally realize they can’t keep treating the population like cogs in a pitiless military machine.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2022 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.