THE 2020's INFLATION MONSTER!

Economics / Inflation Mar 12, 2022 - 10:06 PM GMTBy: Nadeem_Walayat

Many investors used to buying the dip are confused as to why rallies from the dip lows keep fizzling out with stocks once more resuming a trend to fresh lows, despite many if not most stocks now trading over 50% off their highs.

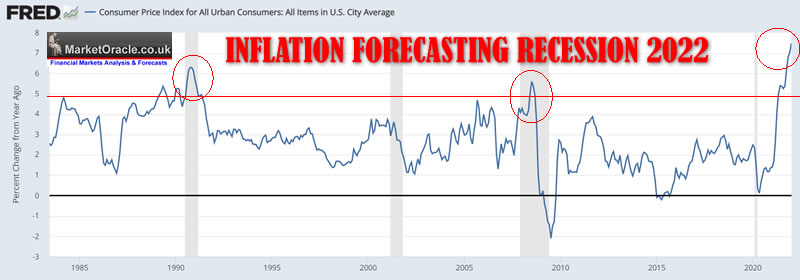

INFLATION and it's consequence of sending sleep at the wheel central banks scrambling to prevent an Inflationary CRASH!

Just in case you have not got my Inflation message, I expect HIGH Inflation to be with us for virtually the WHOLE of THIS DECADE!

YES, I understand it is hard to take such statements seriously, especially when subjected to Deflation clowns such as Cathy Wood. But I have been charting the course of the Inflation Mega-trend for well over a decade hence none of what is happening today comes as any surprise not that high inflation that will run far beyond that which most folks are able to comprehend.

And it is going to be tough for many stocks, perhaps most stocks, especially the Cathy Wood style stocks to survive let alone rise in an permanent inflationary environment.

The stocks have to have earnings growth else the inflation monster will eat them alive! Thus I see myself as having NO CHOICE but to INVEST in select stocks that grow their earnings because if one thing is for certain more than anything else it is that the value of our currencies, Dollar, Sterling, Euro, Rouble are heading to ZERO!

So what do we do?

Hold assets that are LEVERAGED to INFLATION!

- Housing

- Commodities

- And AI STOCKS!

As for the so called panic. " Understand this, whatever the stock market does over the coming weeks and months it will turn out to be a mere blip on the long-term charts as is the October 1987 Crash today." Nadeem Walayat, Oct 2008. - Which is a mantra that I iterate during most corrections and panic events so as to put things into perspective, for if investors are panicking over a barely 10% drop in the indices, then we'll maybe they should strop investing and take the time to LEARN about the market, that most stocks deviate form their highs by as much as 50% MOST years!

Most stocks have fallen by at least 10% to 25% from their highs with most stocks probably having a lot further to fall given the extent to which they had become over valued as I was warning to great extent during the second half of 2021 i.e. Aug 9, 2021 at 9:20 PM AI Stocks Portfolio Buying and Selling Levels, Bubble Valuations 2000 vs 2021

However, it does not matter where the bottom of any bear market will be, all that matters is gaining exposure to AI mega-trend stocks that grow their earnings when trading near fair value because they will always tend to surprise to the upside that will leave most puzzled and confused as to how can stocks be trading higher when for instance the pandemic death toll is doubling every week as was the case during April 2020 when many Patrons kept asking me if they should sell now to bank gains of 50% or so, which had me rolling my eyes in their socket, warning that it would be a BIG MISTAKE to SELL and that the thought of SELLING had not even crossed my mind at that time. Instead it would be well over a year later when I would start to distribute into the FOMO bubble valuations of late last year with the aim of capitalising on THIS SELL OFF, seeking to buy deviations from the highs in GOOD STOCKS which is precisely what I am doing right now just as most are becoming fearful of buying anything.

UNDERSTAND THIS - MOST INVESTORS WILL LOSE MONEY! INFLATION ENSURES THAT! As that which worked during the great Covid bull run is DEAD and BURIED! It was an anomaly! But if one flips over to CNBC or a myriad of Cathy Wood cult youtube channels one sees that nothing much has changed, they still mostly peddle the same old turd stocks that are destined to see their investments go to ZERO!

The key point about investing in stocks is that one is getting out of fiat currency which is 100% guaranteed to go to ZERO and into something that at the every least has a fighting chance at maintaining it's real terms value. What the stock price does AFTER one buys over subsequent days, weeks and months is irrelevant, as one is investing and not seeking to trade in and out like a fool.

This article is an excerpt from my latest article on continuing to capitalise on the downward spiral in stock prices in response to first Inflation Panic and now plus Ukraine War Panic. With the primary focus on identifying 5 small cap tech growth stocks to add to my High Risk stocks portfolio out of a short list of 50 stocks.

World War 3 Phase 1 - Putin WINS Ukraine War!

What Putin Plans for Ukraine

JRS.L Capitalising on Russia's War CRASHED Stocks

THE 2020's INFLATION MONSTER!

Stock Market Trend Forecast Current State

Stock Market FOMO Gives Way to FEAR of Buying the Dip

AI Stocks Portfolio Current State With Updated Buying Levels

FACEBOOK Stock 45% CRASH - Game Over for META?

FACEBOOK RINSE AND REPEAT

INVESTING LESSON - HAVE A PLAN AND THEN EXECUTE IT!

HIGH RISK STOCKS - INVEST AND FORGET

High Risk Stocks Portfolio Revised Buying Levels

GROWTH STOCKS TO CAPITALISE ON THE PANIC OF 2022

1. XXXX - RANK 1 - $121.8, PE 7.8, EGF 38%

2. XXXX - RANK 1 - $58.5, PE 9.9, EGF 30%

3. XXXX- RANK 2 - $16.7, PE 8.7, EGF 33%

4. XXXX - RANK 2 - $89.5, PE 17.2, EGF 23%

5. XXXX - RANK 2 - $49.7 - PE 196, EGF 188%

That was first made available to patrons who support my work.So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And gain access to my recent timely analysis lays out how to invest in during the panic of 2022, to be soon followed by scheduled analysis that continues my trend forecast into the end of 2022.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend Forecast Mid Feb to End 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst BUYING the War stock market panic selling.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.