Iran crisis still ready to blow … US preparing to Attack

Politics / Gold & Silver Apr 05, 2007 - 10:22 AM GMTLarry Edelson writes:Yesterday, Iranian President Mahmoud Ahmadinejad announced he will free the 15 British sailors and marines captured on March 23. That's welcome news.

However, I don't think this political maneuver changes the underlying situation one iota. And gold's price is confirming that. Instead of falling on the news of the pending release of the hostages, the yellow metal soared nearly $10 to its highest level since last May!

My view on the Iran crisis hasn't changed one bit: Despite the potential release of the British hostages, a military strike on Iran's nuclear facilities is coming, sooner rather than later.

In fact, last week, I was in Dubai, and from my hotel room I looked out over the Persian Gulf and the Strait of Hormuz … Iran's coastline was off in the distance. You know what else I saw? U.S. warships staging war games. According to other sources, U.S. naval ships are ready to deploy missiles on a moment's notice.

So mark my words: An attack on Iran is still in the cards.

I'll tell you about the investment implications in a moment. Understanding them is absolutely essential to your financial well-being.

First, let's talk about the situation itself …

An Attack Would Be Swift, The Ramifications Long-Lasting

The U.S. doesn't want a wider war in the Middle East, and certainly not a wider ground war. But at this point, there is no stopping a missile strike to destroy Iran's nuclear ambitions.

The strike could be carried out primarily by Britain and the U.S., and it would be over in less than 24 hours. But the implications and consequences could go on for years. We live in a time when war, rumors of war, terrorism, and domestic social unrest are reaching extremes greater than anything we've seen in decades, and I don't think this will peak for at least two more years.

I'm basing this on my studies of the "Cycles of War," research that I published and copyrighted in 1988. I first told you about this research last February .

I conducted the research in the mid-1980s based on the historical patterns of domestic and international wars over a 2,600-year period. It wasn't guesswork, it was based on solid statistics and a computer program that analyzed hard economic and military data.

The pattern was clear: I discovered a 17.71-year cycle of war that has continued to prevail throughout modern history.

For example, when I performed my research, the last peak of the war cycle had occurred in 1974, just after the height of the Vietnam War. My model projected 1991 as the next peak.

Using more detailed data, in 1988 when I published the research, I fine-tuned the projections and went on record forecasting August 1990 as the point in time when the war cycle would next emerge.

In late August 1990, Iraq attacked Kuwait, right on schedule. The Iraq invasion of Kuwait, and the subsequent Gulf War I, was no surprise to me.

Fast forward to today: My current data points to April 2008 — one year from now — as the peak of the current cycle.

However, the peaks in the war cycle can vary by up to two years in duration. So it's entirely possible we will not see a peak until April 2010.

Bottom line: No matter what the exact timeline, I believe things are going to get worse before they get better. And that has critical importance to the markets and you!

Here Are the Potential Consequences And Investment Implications …

First, President Bush's popularity is already at all-time lows. Don't for a moment think it can't go any lower. Over the next 12 months, I wouldn't be surprised to see various political parties, not just the Democrats, call for Bush's resignation.

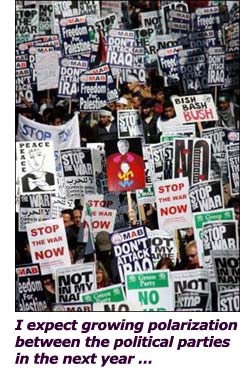

At the same time, Republicans and Democrats, already polarized, will be at each other's throats more than in any recent times.

Second, the U.S. dollar is already plunging. That in itself is very different from previous wars, where the dollar was considered a safe haven currency.

The greenback has fallen more than 25% since 2001. It barely lifted its head off the mat in 2006. And now it's starting a new leg down, sliding in value against every major currency.

This is putting upward pressure on inflation at the worst possible time. It also means money is leaving the U.S., seeking safer investments and better returns elsewhere. Gold is skyrocketing, and so are foreign stock markets.

Third, interest rates could jump sharply. You're not seeing this yet. But in my opinion, it's inevitable — due to the falling dollar.

Fourth, military and political conflict often sets the background for trade wars. Well, the opening salvo was fired last week at China, with Washington raising tariffs on certain Chinese imports.

Free trade, which in large part helped give birth to the great economic boom of the 1990s, is at danger of reversing.

Fifth, because of the falling dollar, increased military expenditures, and the very weak real estate markets in the U.S., you can expect the budget deficit and the national debt to start mushrooming again.

Sixth, every investment under the sun will be affected …

- Most U.S. stocks will get crushed. You are already seeing this in the sectors that are most vulnerable to the kind of tumultuous environment we're in. Real estate construction and property stocks are getting killed. Mortgage companies are getting destroyed, with some down as much as 90%. Blue chip stocks vulnerable to trade wars are starting to fall, with some of the blue chips already down as much as 10% in the past month.

- Meanwhile, hard asset companies are jumping again. Gold and mining shares, oil and gas shares, agricultural companies, and more are all looking very strong. I think they can easily make huge gains in the months ahead.

- Most foreign stock markets are now taking on a bit of safe haven status. Witness the new record highs in China, barely a month after a 10% correction. Japan, Hong Kong, Malaysia, Singapore are all looking good according to my models and indicators.

- Gold is already trading at the $670 level, up almost 4% in just the last two weeks. It can easily run to new record highs over $732 any day now.

- Oil is trading at $67 a barrel, up a whopping 15% in the last two weeks. But make note: The recent rise in oil is not just related to the crisis with Iran … there are other fundamental drivers as well. As I have maintained all along, the oil market is heading above $100 a barrel, with or without a Middle East crisis.

Now, more than ever, is the time to protect your money from rising inflation, the falling dollar, and violent market swings caused by geopolitical uncertainty.

Given the situation, I continue to think the bulk of your money should be kept in cash or cash-equivalent investments. In my opinion, it's wise to park as much as 75% of your total net worth (exclusive of your primary home) in such investments.

Granted, the dollar is falling and inflation rising rapidly. But as long as you keep that cash in safe, liquid money markets earning 4% or 5% a year, you're going to be ok.

For some of the remaining money, I still think gold is the best investment in the world right now. The yellow metal helps protect the purchasing power of your money … acts as a hedge against inflation … and protects you from the vagaries of a war-torn geopolitical environment.

You might consider splitting 10% of your total investing funds equally between gold bullion and gold mining shares. For gold bullion, I recommend the streetTRACKS Gold Trust (GLD), an exchange-traded fund that buys and stores the gold for you. And for a diversified approach to gold shares, I like the Tocqueville Gold Fund (TGLDX) and the U.S. Global Investors Gold Shares Fund (USERX).

The rest of your funds could be put to work in other natural resource stocks (especially energy-related companies) and Asian markets. In my view, both present great profit opportunities. For specific recommendations, see my Real Wealth Report.

One last thing: I would avoid long-term bonds, most tech stocks, and even most blue-chip U.S. companies right now.

Best wishes,

By Larry Edelson

P.S. If you're not yet a Real Wealth Report subscriber, you can join now for just $99 a year. Just click here to subscribe and download the latest issue .

Also, our whitelisting information has changed! Please click here and read the following information carefully to ensure you continue to receive Money and Markets .

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.