Russia Ukraine Tension Blinded Gold Ignores the Real Threats: USDX and Fed

Commodities / Gold and Silver 2022 Feb 16, 2022 - 02:16 PM GMTBy: P_Radomski_CFA

Gold continues to benefit from the market turmoil and has apparently forgotten about medium-term problems. Meanwhile, the rising USD and a hawkish Fed await confrontation.

With financial markets whipsawing after every Russia-Ukraine headline, volatility has risen materially in recent days. With whispers of a Russian invasion on Feb. 16 (which I doubt will be realized), the game of hot potato has uplifted the precious metals market.

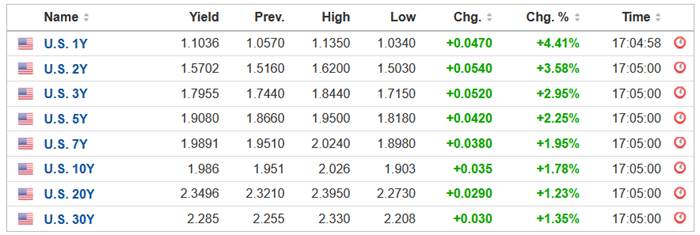

However, as I noted on Feb. 14, while the developments are short-term bullish, the PMs’ medium-term fundamentals continue to decelerate. For example, while the general stock market remains concerned about a Russian invasion, U.S. Treasury yields rallied on Feb. 14. With risk-off sentiment often born in the bond market, the safety trade benefiting the PMs didn’t materialize in U.S. Treasuries. As a result, bond traders aren’t demonstrating the same level of fear.

Please see below:

Source: Investing.com

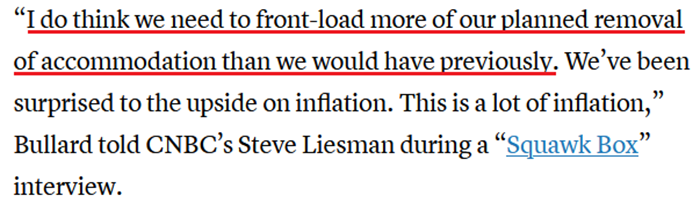

Furthermore, while the potential conflict garners all of the attention, the fundamental issues that upended the PMs in 2021 remain unresolved. For example, with inflation surging, St. Louis Fed President James Bullard said on Feb. 14 that “the last four [Consumer Price Index] reports taken in tandem have indicated that inflation is broadening and possibly accelerating in the U.S. economy.”

“The inflation that we’re seeing is very bad for low- and moderate-income households,” he said. “People are unhappy, consumer confidence is declining. This is not a good situation. We have to reassure people that we’re going to defend our inflation target and we’re going to get back to 2%.”

As a result, Bullard wants a 50 basis point rate hike in March, and four rate hikes by July.

Please see below:

Source: CNBC

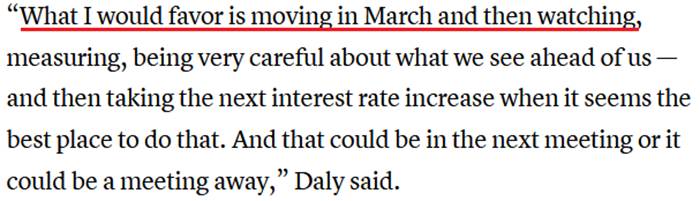

Likewise, while San Francisco Fed President Mary Daly is much less hawkish than Bullard, she also supports a rate hike in March.

Source: CNBC

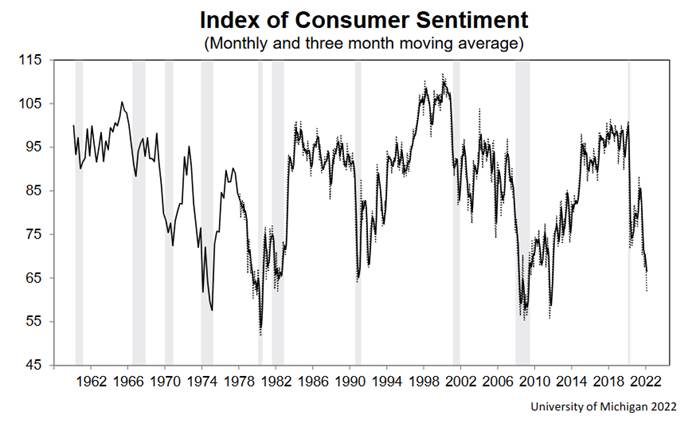

As a result, while the PMs can hide behind the Russia-Ukraine conflict in the short term, their medium-term fundamental outlooks are profoundly bearish. As mentioned, Bullard highlighted inflation’s impact on consumer confidence, and for a good reason. With the University of Michigan releasing its Consumer Sentiment Index on Feb. 11, the report revealed that Americans’ optimism sank to “its worst level in a decade, falling a stunning 8.2% from last month and 19.7% from last February.”

Chief Economist, Richard Curtin said:

“The recent declines have been driven by weakening personal financial prospects, largely due to rising inflation, less confidence in the government's economic policies, and the least favorable long term economic outlook in a decade.”

“The impact of higher inflation on personal finances was spontaneously cited by one-third of all consumers, with nearly half of all consumers expecting declines in their inflation adjusted incomes during the year ahead.”

Please see below:

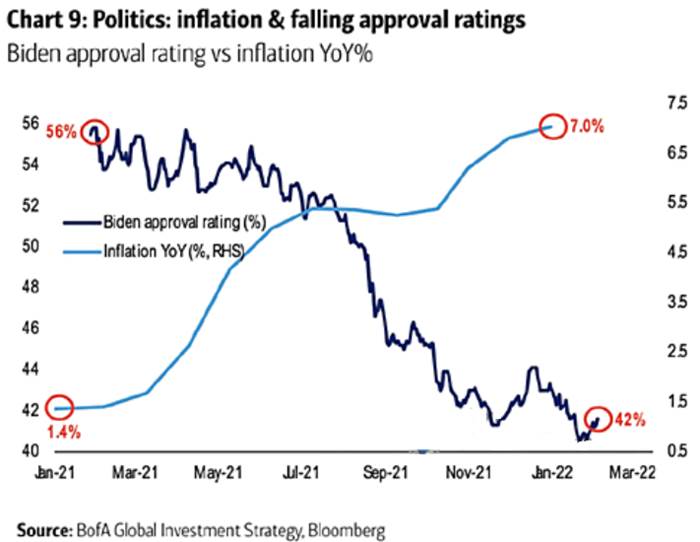

To that point, I’ve highlighted on numerous occasions that U.S. President Joe Biden’s re-election prospects often move inversely to inflation. With the dynamic still on full display, immediate action is needed to maintain his political survival.

Please see below:

To explain, the light blue line above tracks the year-over-year (YoY) percentage change in inflation, while the dark blue line above tracks Biden’s approval rating. If you analyze the right side of the chart, you can see that the U.S. President remains in a highly perilous position. Moreover, with U.S. midterm elections scheduled for Nov. 8, the Democrats can’t wait nine to 12 months for inflation to calm down. As a result, there is a lot at stake politically in the coming months.

As further evidence, as inflation reduces real incomes and depresses consumer confidence, the Misery Index also hovers near crisis levels.

Please see below:

To explain, the blue line above tracks the Misery Index. For context, the index is calculated by subtracting the unemployment rate from the YoY percentage change in the headline CPI. In a nutshell, when inflation outperforms the unemployment rate (the blue line rises), it creates a stagflationary environment in America.

To that point, if you analyze the right side of the chart, you can see that the Misery Index is approaching a level that coincided with the global financial crisis (GFC). As a result, reversing the trend is essential to avoid a U.S. recession.

As such, with inflation still problematic and the writing largely on the wall, the market-implied probability of seven rate hikes by the Fed in 2022 is nearly 93% (as of Feb. 10).

Please see below:

Ironically, while consumers and the bond market fret over inflation, U.S. economic growth remains resilient. While I’ve been warning for months that a bullish U.S. economy is bearish for the PMs, continued strength should turn hawkish expectations into hawkish realities.

To that point, the chart above shows that futures traders expect the U.S. Federal Funds Rate to hit 1.75% in 2022 (versus 0.08% now). However, Michael Darda, Chief Economist at MKM Partners, expects the Fed’s overnight lending rate to hit 3.5% before it’s all said and done.

“We have this booming economy with high inflation and a rapid recovery in the labor market – much different relative to the last cycle,” he said. “The Fed is behind the curve this time. They are going to have to do more.”

Singing a similar tune, John Thorndike, co-head of asset allocation at GMO, told clients that “inflation is now here, [but] the narrative is that inflation goes away and markets tend to struggle with change. It is more likely than not that real yields and policy rates need to move above inflation during this cycle.”

The bottom line? While the Russia-Ukraine drama distracts the PMs from the fundamental realities that confront them over the medium term, their outlooks remain profoundly bearish. Moreover, while I’ve noted on numerous occasions that the algorithms will enhance momentum in either direction, their influence wanes materially as time passes.

As such, while headline risk is material in the short-term, history shows that technicals and fundamentals reign supreme over longer time horizons. Thus, while the recent flare-up is an unfortunate event that hurts our short position, the medium-term developments that led to our bearish outlook continue to strengthen.

In conclusion, the PMs rallied on Feb. 14, as the Russia-Ukraine conflict is the primary driver moving the financial markets. However, while the PMs will ride the wave as far as it takes them, they ignored that the USD Index and U.S. Treasury yields also rallied. Moreover, with Fed officials ramping up the hawkish rhetoric, the PMs' fundamental outlook is more bearish now than it was in 2021 (if we exclude the Russia-Ukraine implications). As a result, while the timeline may have been delayed, lower lows should confront gold, silver, and mining stocks in the coming months.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.