Is it time to buy the Stock Market Dip?

Stock-Markets / Stock Market 2022 Feb 10, 2022 - 03:51 PM GMTBy: Stephen_McBride

By Justin Spittler : Is it time to buy the dip?

By Justin Spittler : Is it time to buy the dip?

After all, the stock market has been a sea of red lately.

Many former highflyers are down 50%... 60%... even 70%.

That has many investors salivating to buy “cheap” shares.

And I get it…

Buying the dip can be a great money-making strategy.

But I don’t think that’s the play here.

As I’ll show you, the investing landscape has changed dramatically in recent weeks.

Instead of buying the dip in some of the hottest sectors of the past two years, like green energy… cybersecurity… and software stocks…

I have an out-of-the-box idea for you today…

I’ll share it in a moment.

But first, let me show you why it’s too early to trade some of the most beaten-down tech sectors…

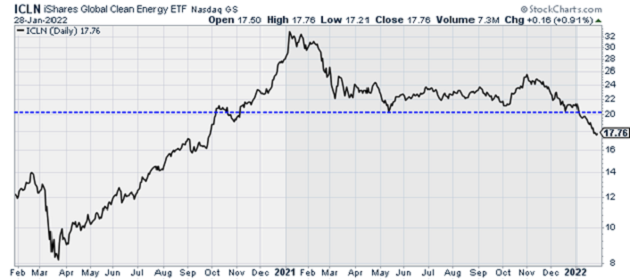

- This chart shows the performance of the iShares Global Clean Energy ETF (ICLN).

ICLN invests in solar stocks and other green energy companies.

You can see ICLN has broken down in a big way. It’s sunk to levels not seen since 2020.

Source: StockCharts

In other words, green energy stocks are taking a beating. And it could take months for the sector to get back on track.

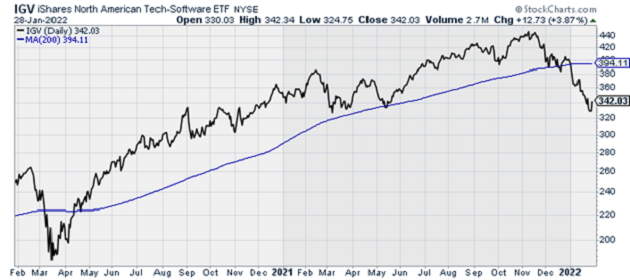

The same can be said of software stocks. You can see what I mean below.

This chart shows the performance of the iShares North American Tech-Software ETF (IGV), which invests in software companies like Salesforce (CRM), Adobe (ADBE), and ServiceNow (NOW).

Software stocks are holding up better than green energy stocks. But IGV is still trading below its 200-day moving average. It’s no longer in an uptrend.

Source: StockCharts

Now that doesn’t mean that software stocks will continue to fall. But it’ll likely be a while before they lead the market higher again.

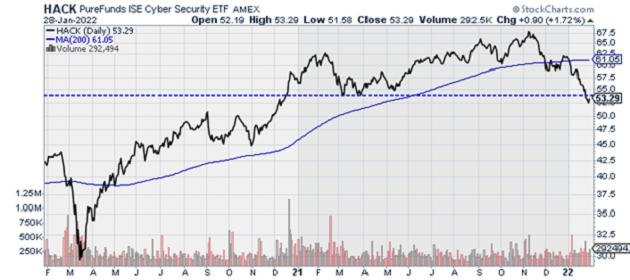

And cybersecurity stocks have their work cut out for them as well.

You’re looking at the performance of the PureFunds ISE Cyber Security ETF (HACK), which invests in companies like Fortinet (FTNT) and Palo Alto Networks (PANW).

Source: StockCharts

Like clean energy and software stocks, cybersecurity stocks were huge winners in 2020 and for much of 2021.

Thanks to COVID-19, more people than ever before started working online. Demand for cybersecurity skyrocketed, which lit a fire under cybersecurity stocks.

But cybersecurity stocks are no longer hot. HACK is trading below its 200-day moving average, and it’s now in a downtrend.

Again, this doesn’t mean cybersecurity stocks are headed much lower. In fact, they’re probably closer to a bottom than a top.

And I expect cybersecurity along with software and green energy to eventually bounce back in a huge way.

But these industries aren’t where I’m looking to put new money to work today.

- If you want to make money today, you need to think outside the box…

And one of my top out-of-the-box ideas right now is commodities.

Commodities are basic goods and raw materials. Think copper, gold, corn, wheat, coffee.

These assets tend to do very well when inflation is high, or the cost of general goods increases.

See for yourself. This chart measures the performance of the Invesco DB Commodity Index Tracking Fund (DBC) versus the SPDR 500 ETF (SPY), which invests in companies that make up the S&P 500.

When this line is falling, it means commodities are underperforming the S&P 500. When it’s rising, commodities are outperforming.

Below, you can see commodities aren’t just outperforming the US stock market. They’re breaking out to multi-year highs.

Source: StockCharts

Oil and gas stocks are also doing great.

The Energy Select Sector SPDR Fund (XLE), which invests in “dinosaur” energy companies like Exxon Mobil (XOM) and Chevron (CVX), has rallied about 23% this year. As if that weren’t impressive enough, energy stocks are the only major sector that’s positive this year.

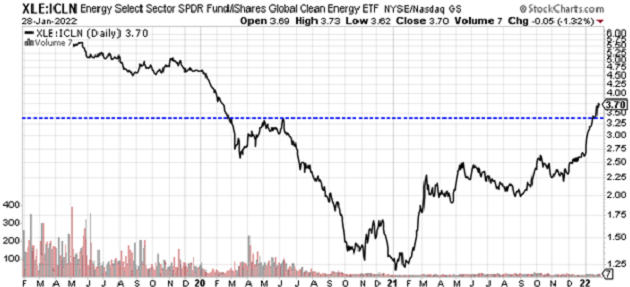

Those same “dirty” energy stocks are doing even better when compared to clean energy stocks, which most people agree are the future.

Here’s another chart. This one compares the performance of XLE with ICLN.

When this line is rising, it means dirty energy stocks are outperforming clean energy stocks.

Source: StockCharts

You can clearly see that dirty energy is massively outperforming clean energy.

So if you’re looking for a smart place to put your money while waiting for tech stocks to bottom out, consider investing in commodities and dirty energy stocks.

Although they’re unloved by most investors… I expect they’ll be two of the most profitable sectors to own for the next couple months.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

© 2021 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.