High Risk Bio and Tech Stocks and the Quantum Entangled Stock Market

Stock-Markets / Investing 2022 Feb 02, 2022 - 10:21 PM GMTBy: Nadeem_Walayat

Dear Reader

Did you buy Google (Alphabet) near $2512 last week as I and many of my patrons did, and similar for many other AI tech stocks?

Just $4 per month for AHEAD of the curve analysis, as I calmly collected the stock certificates from the lemmings as they leapt off the stocks cliff last week.

Whilst my latest just posted extensive analysis lays out my plan of what to expect and do NEXT.

AI Stocks Multi Buying Levels to Capitalise on the Stock Market Panic of 2022

THE VALUATION RESET

INVESTORS SEDUCED BY STOCK CHARTS COMPLETELY MISS THE THE BIG PICTURE!

QUANTUM COMPUTERS

AI Tech Stocks 2022 Correction

Stock Market Trend Forecast Current State

Dow Max Draw Down 2022

ACCUMULATE DEVIATIONS FROM THE HIGHS IN GOOD STOCKS!

NEW STOCKS

The Fishes that Have So Far Gotten Away

AI Tech Stocks Funds Revision

QUANTUM AI STOCKS MULTI BUYING LEVELS

NEW Investors

NETFLIX - You Cannot Say You Weren't Warned!

ARKK MATHS

Why Putin Wants the WHOLE of Ukraine - World War 3 Untended Consequences

Pandemic Rear View Mirror - Next Potential Catastrophe?

And access to my recent timely analysis lays out how to invest in during the panic of 2022, to be soon followed by my next analysis that continues the above trend forecast into the end of 2022.

HOW TO SUCCESSFULLY INVEST IN STOCKS During 2022 and Beyond

CONTENTS:

1. UNDERSTAND WHAT INVESTING IS

2. INVEST IN GOOD COMPANIES

3. UNDERSTAND THAT WHICH ONE IS INVESTING IN

4. STOCK PRICES

5. EARNINGS CATCHUP TRADING RANGE TREND PATTERN

6. EMOTIONAL INVESTING

7. MONITORING AND LIMITING EXPOSURE IS MOST IMPORTANT

8. BUY AND SELL on the Basis of VALUATIONS

9. INVESTORS BIGGEST MISTAKE

10. BEST TIME TO BUY STOCKS

11. WORST TIME TO BUY STOCKS

12. BUY VOLATILITY

13. INVESTING TIME

14. FUND MANAGERS

15. OPTIONS

16 . INFLATION

17. INVEST AND FOREGET

AI Tech Stocks Draw down and End of Year 2022 Price Targets

CATHY WOOD ARK GARBAGE

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

The focus of this analysis is part 2 of 2 of the updated status of my High Risk Bio and Tech Stocks portfolio.

Part 1 - FED TAPER CON TRICK, Recession 2022

Whole analysis as made available to patrons -

High Risk Bio and Tech Stocks Portfolio Q4 2021 Update

Contents:

Exponential AI Mega-trend

INVESTING PRIORITY

Why Most Investors LOST Money by Investing in ARK FUNDS

ETF BUBBLE Primed to EXPLODE!

INVEST AND FORGET

BREWING FINANCIAL CRISIS 2.0 - RECESSION 2022

FED TAPER CON TRICK

CP LIE - INFLATION vs DEFLATION

UK Inflation Fraud - Real Inflation is 15%+

The 2% Inflation SCAM, Millions of Workers take the Red Pill

Why Inflation is Soaring

Flip Side High Inflation Winners

Warren Buffetts $130 billion Master Plan

STOCK MARKET CRASH INDICATOR

The Quantum Entangled Stock Market

Unloved Biotech Sector

High Risk Stocks Portfolio

COINBASE $247, Risk 1, P/E 19, +0%

TAKEDA $13.7 - Risk 1, PE 10, -19%

Western Digital $56.7, Risk 2, PE 13, -2%

ABBV $132, Risk 2, PE Ratio 11, 4% Dividend, +24%

CORSAIR $21.7 - Risk 3, PE 11, -26%

Neurocrine Bioscience (NBIX) $84, PE 18, Risk 3

ALI BLAH BLAH BABA (9988) $120, PE 17.2, Risk 3

TENCENT TCEHY (0700) $57, PE 19, Risk 4, -9%

RBLX $95. Risk 6, +7%

CRISPR $74, PE 15.3, RIsk 6, -39%

AVIR P/E 30.5 , Risk 9, -71%

APM $1.88, -37%

ACCUMULATING

AI Stocks Portfolio

Limit Orders

Best Stock Investing Platforms

CRYPTO BRIEF

OMICRON a Fuss About NOTHING

Note: The information provided in this article is solely to enable you to make your own investment decisions and does not constitute a personal investment recommendation or personalised advice.

Warren Buffetts $130 billion Master Plan

Warren Buffett's Berkshire Hathaway is sat on $130 billion of cash. Why? Waiting for the inevitable panic event? Then why didn't Berkshire Hathaway buy in March 2020?

No, Warren Buffett master plans is this -

When the markets starts to crash / roll over into a bear market the naked longs facing forced sales will seek out investors to buy them out of their positions else the the markets would face a cascade of forced panic selling and where would they look for that buyer of last resort who has advertised to all well in advance that they have a mountain of cash? Warren Buffett who will likely be able to pick up positions in his target stocks at deep discounts to market prices.

However, there is one fly in the ointment in Warren Buffetts strategy, the Fed that has increasingly been stepping in as the buyer of last resort to halt fire sales dating all the way back to 1987 when the Dow BOUNCED, when barely 3 hours before the open the Dow futures were trading at 1500 against the preceding closing price of 1710, I know because I called my futures broker to get some quotes and moved my short stops. And since market manipulation has increased exponentially! We are living in an era of the Fed ponzi bubble market! I am sure that is how history will view the past 20 years at least!

STOCK MARKET CRASH INDICATOR

It looks like my last article freighted a lot of patrons, which was not my intention for I already flagged that the risks of a market panic event have been increasingly long before the neural net signaled a 100%+ reading. It is what it is, an independant indicator which increases the probability for lower prices going forward hence I revised my stock market expectations lower as illustrate by the updated stock market trend forecast graph.

Where my strategy is to ride out Financial Crisis 2.0 by strategically being invested in the primarily AI stocks at near fair value i.e. near a PE ratio of 20. And buy when the opportunities arise just as we saw with Facebook, I accumulate for the long-run.

What CI18 Trigger means for me is to -

- Prepare for opportunities to accumulate in the AI portfolio stocks, as don't forget I sold out of 80% of my portfolio during the summer i.e. I hold virtually no Microsoft, Apple,Nvidia, and Amazon and sold ,most of my Google stock.

- That I need to engage in SHORTING stocks, as that is probably where the bulk of my profits for 2022 are going to come from Unfortunately shorting is VERY HIGH RISK , i.e. short-term positions usually spanning days with tight limits and tight stops and that I am rusty in the shorting individual stocks department. For instance the other day I shorted APPLE, at $173, stop $178 with a limit of $158, which got stopped out with a loss. And another very recent short was ROBLOX, shorted at $125, with a stop at $135 and exited at $96. So my response to CI18 is to start shorting stocks on a short-term basis and the more I short the easier it should become to pick the right stocks to short.

- Cancel nearby limit orders in favour of more distant limit orders. One of the benefits of holding a lot of cash on account is that I can have a lot of limit orders in place so I don't have to make decisions when prices are moving fast.

A Patron has asked me to crunch the CI18 numbers again. Firstly a reminder that the CI trigger has been pulled as of 103.4% which regardless of what subsequent runs output still means that the switch is ON. For how long depends on what transpires trend wise, i.e. last time it was short and sweet CRASH! This time it's looking more a bear market, so I am expecting individual stocks crashing with the indices gradually rolling over. However the current run results in an output of 108.5%, which does not increase or decrease the probability of what is to come because the CI18 is a switch that warns of LOWER stock prices ahead it does not tell me what will follow just to expect downwards price action i.e. to change the prism I am viewing the market through with a more downwards bias. So it is highly probable that in future runs ut will result in an even larger percentage. However I would not take any return to sub 100% as a signal for the switch being OFF. For that well you will need my analysis, for at the end of the day it is an indicator with just one job, to flag a warning to expect lower stock prices ahead.

So we are heading into what I expect to be a volatile year for stocks, but in which I see great opportunities that may either come along all at once in a panic event or in series such as we have experienced with with Intel and then Facebook and it looks like we are at the beginnings of such opportunities in AMD and Nvidia.

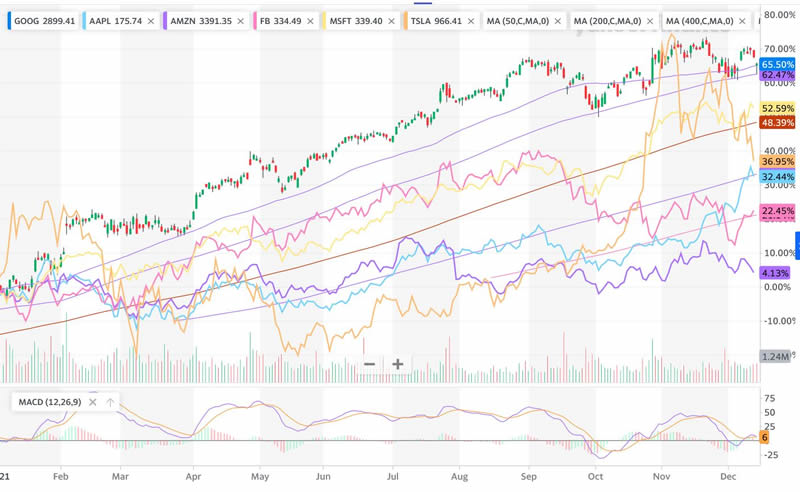

The Quantum Entangled Stock Market

The FAANG stocks are entangled with one another, which is why the likes of Amazon is still holding up there with the likes of Apple and Microsoft. and why we don't tend to get many opportunities to accumulate in the FAANG stocks at deep discounts because to get an opportunity means we are going to have to wait for an opportunity in ALL of the FAANG+ stocks to materialise.

What this means is that the entangled FAANG's tend to play pass the parcel, Google passed the parcel to Microsoft which passed the parcel to Apple, so that implies the parcel could next be passed to either FACEBOOK or AMAZON which price wise have not done much all year. So maybe I should gain at least some exposure to Amazon despite my misgivings about the stocks fundamentals.

This also illustrates why the Cathy Wood garbage stocks got propelled to ridiculous highs early Q1 2021, and then all in near unison have collapsed typically by more than 50%, taking the good down with the bad because they are all entangled with one another.

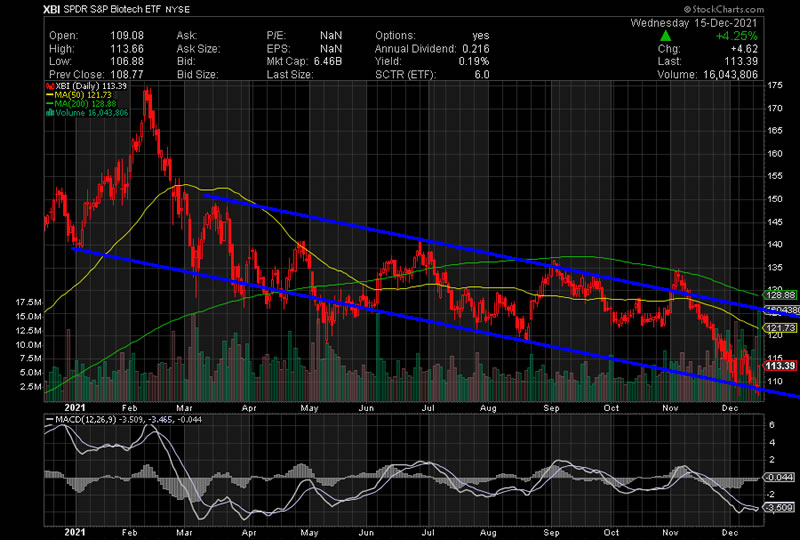

Unloved Biotech Sector

And the same it true for the unloved Biotech sector, where here's a taste of what to expect when I take a detail look at the biotech stocks. It's definitely going to take something special to buck the sector downtrend!

Illustrates that stocks tend to be entangled with one another, be it their sectors , artificial groupings such as FAANG, or populate highly publicised ETFS such as ARKK, which means no matter how good the fundamentals of a stock are it's going to be tough for the stock to decohere from it's entangled group, which can leave many investors puzzled as to why x,y,z stock is doing so badly when when it's cheap and earnings reports are fine, it's doing badly because it is entangled with other stocks that are not doing well either! Conversely an apparent bad stock such as Amazon can continue to trade on vapour indefinitely due to the stocks it is most closely entangled with.

However it is precisely such behaviour that tends to generate huge long-term opportunities to accumulate in unloved sectors that may have experienced huge sell offs for no other reason than the stocks they are entangled with. Global Payments Inc comes to mind which is entangled with Paypal. similarly we have the Chinese Tech Titans, though of course things are a lot more complicated than this as I don't need to remind all that the Chinese government is akin to the Fourth Reich with it's Fuhrer issuing dictats against anything that comes on his radar as a possible threat to the supreme leaders rule! So we have the Chinese Schutzstaffel to contend with when investing in Chinese stocks.

The general indices have huge exposure to the over valued tech giants as my recent in-depth analysis illustrated that in terms of indices weightings the FAANG's and Tesla account for more than 25% of the S&P! And given their high PE multiples that average more than 34 it is no wonder the the general indices PE ratio is so high at 28, strip out the tech giants and the PE multiple drops to approx 18.

What does this mean, it means that many stocks are already well into a vicious bear stocks market as a valuations shift is in progress as illustrated by the likes of Cathy Woods ARK funds, that are typically down by over 50% and it goes on from that to the biotech stocks, and to payment processors such as Paypal and GPN, so whilst the stock market is over valued however there are also a lot of bargains out there that I have been attempting to identify and accumulate such as GPN, Qualcom and recent additions of Meta-verse stocks, and where my most recent purchase was DOCU following its 40% ONE DAY CRASH straight down to my buying level of $141.

All whilst I continue to seek to accumulate into the PRIMARY AI tech stocks as and when opportunities arise as we have witnessed over the past couple of months with fist INTEL and then just the other week Facebook that dived straight down to $301 buying level and then bounced! Though there was plenty of time to buy Facebook at under $310 if one did not have limit orders in place for instance I bought on the way down with small limit orders down form $312 to $301.8 with my main buy at spot $304 (London listing).

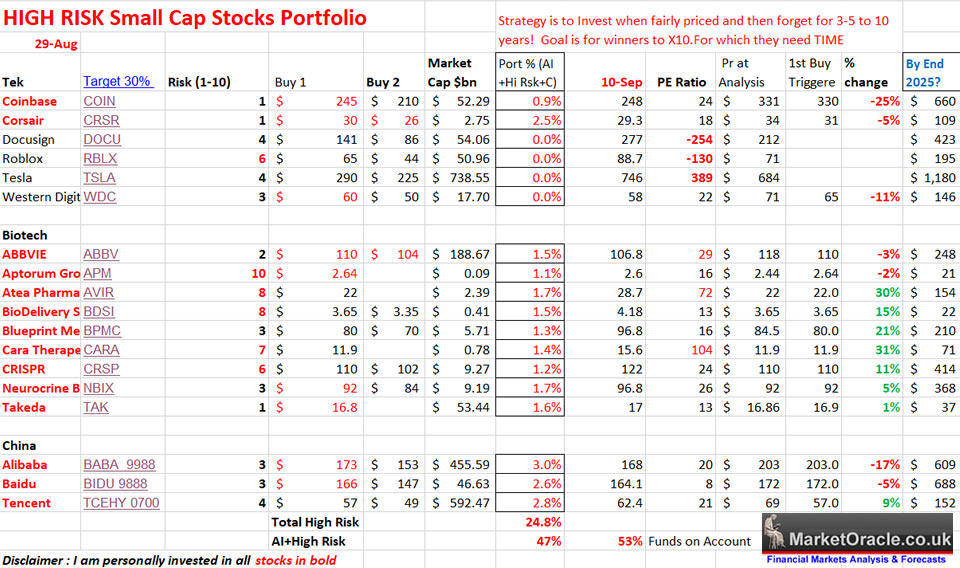

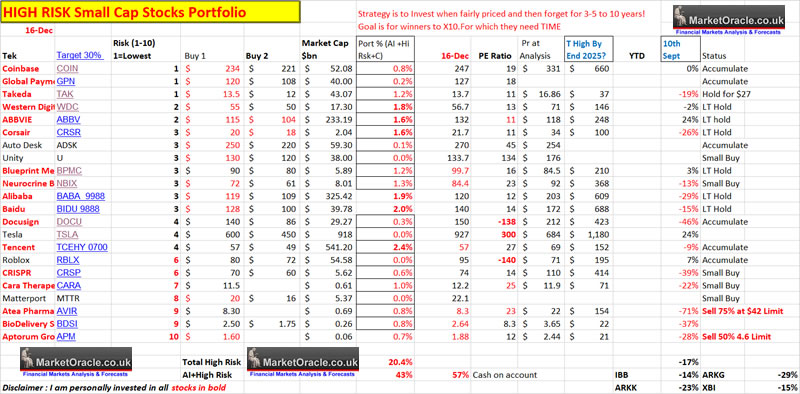

High Risk Stocks Portfolio

Here is my quarterly update of the High Risk Stocks portfolio which represents 20% of my stocks portfolio and 6% of my total assets. The list has been reordered in terms of RISK, where 1 is lowest risk and 10 is highest risk. Again if one does not understand what HIGH RISK means then do revisit my extensive preceding articles because they contain important lessons on how to invest in High risk stocks that I don't intend on repeating hear.

Portfolio as of last update 10th Sept 2021

So lets see how the sector bear market translates into the biotech portfolios performance since my last update of 10th September, better or worse than the likes of XBI, IBB, ARKG and even ARKK?

Portfolio as of 16th Dec 2021.

New columns to show the change since the last update for each stock and status of the stock i.e. whether to Hold, Sell or accumulate more.

Big Image - https://www.marketoracle.co.uk/images/2021/Dec/NW-High-Risk-Stocks-16-Dec.jpg

The portfolio on an simple average basis is down 17%, which is disappointing performance! Even after all of the above one still feels the BURN of a 17% draw down! How does it compare to the sector ETF's? The IBB biotech ETF is down 14%, XBI is down 15%, ARKG 29% whilst ARKK is down 23% over the same time period.

So the starting point is to recognise that the biotech sector remains unloved with the sector on average marked down about 15%, regardless of the fundamentals of individual stocks as we await the inevitable sector rotation INTO biotech stocks.

Looking at the portfolio's poor performance it mostly boils down to the 3 highest risk bio tech stocks as being the culprits.

AVIR, BDSI, and APM. So right off the bat my response is to put a limit to Sell AVIR at $42, and Aptorum at $4.6 which are some distance from their current price. Still these are long-term plays and never say never! But yes I want to be rid of most of AVIR and APM whilst I will let BDSI ride since it has stable financials i.e. it's PE ratio is 8.6. Where I rate a better than 50/50 chance of at least 1 of these 3 stocks coming good over the next 5 years.

And here is a closer look at 12 of the high risk stocks portfolio of 22 as requested by Patron's in the comments section in order of risk i.e. low to high relative risk.

COINBASE $247, Risk 1, P/E 19, +0%

One of the three lowest risk high risk stocks which means lower long-term expectations vs lower downside risk i.e. I would be very surprised if Coinbase X10, more reasonable would be X3 it's current price, but that's for some years down the road.

Coinbase missed earnings 1.62 vs 1.79 expected, so the crypto market leader has strong revenue growth but volatile earnings. There's enough price data now to see that the stock is forming a strong base with an upward bias, given it's low PE of 20 I don't see why this should not hold any decline at worse trade into the heavy support zone of between $210 to $230 which is what the stock appears to be targeting. Though obviously the stock is heavily influenced by the bitcoin price, which recently gave many bearish technical signals, so if Bitcoin revisits for instance $30k (low probability) than it's going to be tough for Coinbase to hold these lows, though most likely we would see a temporary trend lower as Coinbase earns it's revenues from trading volume rather than holding thousands of bitcoins on it's own account.

So I am expecting a little more downside and the supports to hold for a buying opportunity. Personally I am looking to add to my Coinbase holding with my current limit orders at $234 and $221.

TAKEDA $13.7 - Risk 1, PE 10, -19%

JAPAN! A tough nut to crack! Just when you think a stock can't get any cheaper, it goes and gets cheaper! Takeda is supposed to be a relatively low risk high risk pharma stock but it is down by an above average 19%! We are about 40 cents away from the Pandemic low!

The stock now has resistance along it's $20 highs which it will need to overcome if it wants any chance of targeting resistance along $27 to $28. Unlike Coinbase Takeda never really had much upside but it gave the biotech portfolio exposure to Japan's ageing population. Technically I don't see much down side so I would expect the stock by the time of the next update to have at least returned to the $16 to $20 range.

Personally I am not looking to add to my Takeda holding as there is not enough potential reward for the added risk.

Western Digital $56.7, Risk 2, PE 13, -2%

WDC FELL sharply on it's October earnings spiking down to $50 and getting me filled on my opening stake in this tech stock that should capitalise on metaverse mega-trend.

On first glance the stock chart looks scary with the stock price seemingly headed back down towards at least $35 as has happened 5 times over the past 8 years However before it's recent sell off to $50 the stock price did make a higher high at $78, therefore I view the current price action as corrective i.e. it is highly probable that $50 was the low and so WDC should resume it's trend higher to target resistance along $85. Whether WDC will be able to break above resistance any time soon is another matter. Though given it's low PE I continue to see WDC as a good long-term investment that should eventually see the stock price break higher, perhaps to one day join the likes of Cathy Wood's ARKK and get pumped to ridiculous valuations north of a PE of 100, a potential X10!

Buying levels remain at $55 and $50, WDC is one of my largest high risk positions so I have no plans to add more.

ABBV $132, Risk 2, PE Ratio 11, 4% Dividend, +24%

Abbvie earnings soared by 38% to $1.78 per share, generates plenty of free cash flow to cover it's 4% dividend, and sales continue to grow at a health 11% per annum. So given the strong fundamentals if there is one stock on this list that should have gone up it should be this one, especially given it's low PE.

The stock is trending higher whilst the rest of the market is wavering, this is the sort of price action I am expecting for most of the biotech sector. Abbvie has a market cap of $222bn, so clearly is big enough for the funds to accumulate into and illustrates one of the problems with the smaller cap high risk stocks and why I don't expect them to trend rather drift until they spike on good news, as there won't be much institutional interest that accumulates on a regular basis as is the case with ABBVIE.

The stock has had a stellar bull run but is now hitting resistance so should correct over the coming weeks, targeting a trend to about $115. This is a big cap biotech stock so little chance of X5. But it does add some stable legs to the portfolio AND pays a dividend so I will likely add to my holding should it correct to my buying levels at $115 and $104, likely buying ahead at $116 and $108.

CORSAIR $21.7 - Risk 3, PE 11, -26%

Corsair has built up quite a brand reputation for itself in the PC hardware department and so can command premium prices for it's various PC components such as power supplies, cases, coolers, radiators, memory and even NVM drives so many enthusiasts tend to opt for Corsair components for their builds. Unfortunately something is going wrong in Corsair software department, because their software such as ICUE that controls it's expensive radiator coolers sucks, so much bloat ware that destabilise not only systems but can also easily BRICK their own hardware!

This happened to me within weeks of using a top end PC full of corsair hardware. Now with some 30 years PC building experience I had a fair idea of what to try to get it to working, I even posted a how to unbrick your corsair radiator video (https://youtu.be/jjGa1D6Xx7E) showing the steps I took to unbrick the cooler which given the response appears to be a quite common problem!

Would rubbish software put me off from buying Corsair? No, because I am well practiced at optimising systems with workarounds to bypass garbage such as Corsair ICUE, but the problem is most users don't know what to do and thus faced with a firmware bricked hardware that isn't straight forward to unbrick would opt to return it to corsair and buy something else and probably put them off from buying Corsair again. So Corsair's achilles heel may be bad software, after all Corsair is a components manufacturer and not a software company and thus this could be playing a part in hurting Corsairs sales. Nevertheless I did FOMO slightly by plowing 1/3rd more cash into Corsair stock then I had originally intended to, a decision that so far is NOT paying off.

Corsair MISSED earnings, $0.16 vs $0.25, that is a BIG MISS! Even though the stock chart may resemble a Cathy Wood stock, it's NOT a Cathy Wood stock, even after bad earnings it's PE ratio is a low 17.6. So the stock fundamentally remains under valued, in a fast growing high end gaming market. So what's gone wrong ? We'll supply chain issues and poor management. I remain invested for the long-run with no plans to buy more, with my 2025 target of $100., that's about X5 from today's price!

The Corsair stock price was nicely setting itself up for a recovery early November, primed to make a break to above $30 from the then price of $27, all the management had to do was their jobs by delivering on EARNINGS, which they FAILED to do! When a stock misses earnings investors have one of two choices, either cut losses and SELL or take the risk of playing the long game which is precisely what the high risk stocks portfolio is all about, it is not about the quarterly earnings because for stocks as small as these ($2 billion market cap) they are gong to be volatile. Nevertheless Corsair given it's brand name is a favorite of many small investors who perhaps have over committed to what is a SMALL cap HIGH risk stock expecting it to do an AMD or an Nvidia, forgetting that it took both near a decade to get the ball rolling.

Corsair offers the framework to become an AMD and Nvidia in the distant future all it needs is the management to step up and provide the company with some vision , perhaps to start producing their own GPU's and motherboards which 'should' be the natural evolution and that could set Corsair on the path towards becoming a PC builder rather than a components supplier. We'll that's what will deliver the X5 to X10 returns that I am invested for, so Corsair has potential but it's going to take time!

Looking at the price charts from day to day, week to week, even quarter to quarter is a waste of time, for it takes time to implement becoming a board manufacturer, or a PC builder, towards which Corsair has already taken most of the baby steps to make the leap to the next phase, some years down the road, Corsair will either be doing mostly the same as its dong to day or be on the road to becoming the big system builder along the lines of DELL Computers!

In terms of the stock price, there isn't much downside left, even missing earnings did not exactly result in an immediate blood bath such as we witnessed recently with DOCU, there is heavy support at $18.

Revised buying levels are $20 and $18. Even though I am seriously tempted to buy more, I cannot do it, because I have already bought it twice and it has failed to deliver. So as President Bush once said

For me to consider buying more it has to bottom and trend higher.

Neurocrine Bioscience (NBIX) $84, PE 18, Risk 3

NBIX a relatively low risk biotech stock that had a spectacular bull run to $126 into September 2018, following which has remained in a trading range waiting for earnings to play catch up. Unfortunately for the past 3 quarters at least NBIX has MISSED earnings, so it should not be much of a surprise that the stock is trading near the the bottom of it's 3 year range.

The stocks break below the series of lows at $85 has sent the stock towards next support at $72. So whilst NBIX is showing weakness however in relative terms it is a lot stronger than most of the sector, So I am not too worried about any decline and would view any sell off towards support at $72 as a buying opportunity. the quality of trend suggested that NBIX should trade to back above $85, which is near which the price currently trades at $84.4. So NBIX appears on the cusps of reclaiming the preceding trading range of $100 to $85 that could even take place as early as today's trading session (Friday 17th Dec).

Revised buying levels for this long-term biotech play are at $72 and $61. I have a limit order to buy a little more at $72.5.

ALI BLAH BLAH BABA (9988) $120, PE 17.2, Risk 3

The western investors favorite chinese tech giant has sliced and diced its way to multi year lows where so far every bottom has failed to hold. Fundamentals are weak and weakening given the Chinese Mafia's greed in extracting funds out of anyone with cash be they individuals and corporations hence Alibaba has handed over $15.5 billion to the Chinese state mafia in excess of taxes paid.

The stock chart shows Alibaba's decent towards $100 a share, more than a 50% drop from when it started to first perk my interests during Mid Summer 2021 by which time it had already fallen by 1/3rd!. So we are fast approaching a 70% COLLAPSE in Alibaba's stock price! How low can she blow? We'll $130 was supposed to be STRONG support that I suspected even during it's rally towards $180 during October that the stock price would revisit $130 which should have marked an opportune point for the stock to put in a final bottom.

However the noise out of china has increasingly pushed the prospects of Alibaba towards a break below $130, as I warned ahead of the event that a trend to $120 was probable before Alibaba broke below $130. And despite putting distant limit orders at well below the price I have so far dodged the bullet of not actually adding to my formerly sizeable Alibaba position that continues to diminish with each passing trading week.

It is highly enticing to want to buy Alibaba and so from time to time I do put on limit orders to buy that expire at the end of the next trading session. For instance my current Alibaba limit is at $109.6 for Fridays trading session, that is set against the last HK close of $120.7. It's a case of I want to buy but then I don't want to buy because it's probably going to keep trading lower and well there are much better opportunities out there to add to.

As for buying levels, We'll there is nearby $119 and the not too distant $109. Whilst I will continue to play a reluctant cat and mouse game with Alibaba by placing my t daily limit orders with my nose all scrunched up that so far turned out to be just out of reach, as looking at the stock chart slide from $320 to $110 Alibaba does appear dirt cheap, it's just that it has a tendency to keep getting cheaper and cheaper with each passing week. This is one of the problems of investing in foreign markets that in many ways are alien to ones experience, we don't actually have much of a clue what we are investing in where any for the chinese tech giants are concerned and are literally throwing the dice hoping to score a pair of 6's when instead all we are getting are snake eyes in a rigged chinese stock market game.

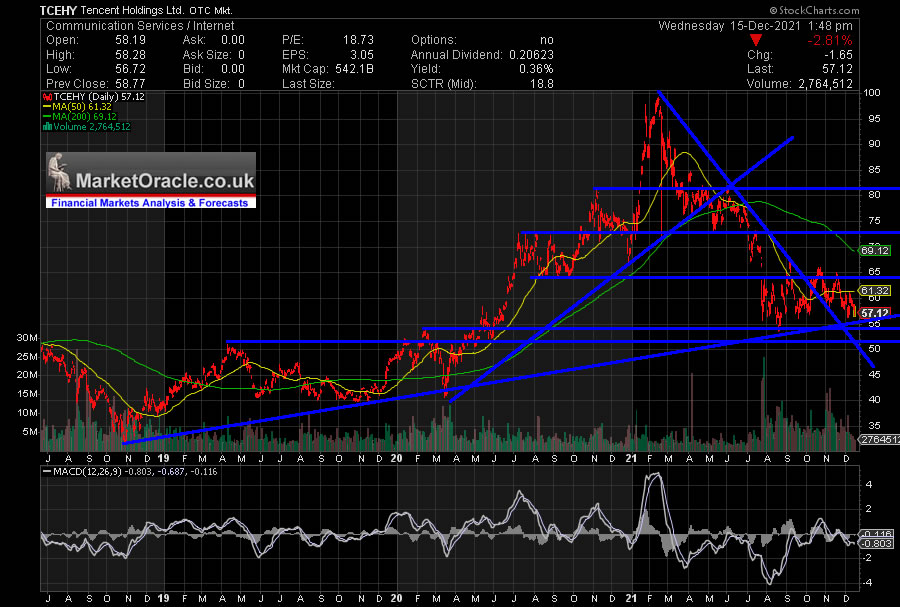

TENCENT TCEHY (0700) $57, PE 19, Risk 4, -9%

This Chinese gaming giant has seen it's stock price collapse and is desperately trying to fly under the radar of the Chinese mafia else it be hit with more CCP missiles, blasting billions more off its valuation and future revenues and earnings. However, Tencent still has huge potential giving its exposure to not just Chinese gamers, but gamers across the globe! Don't forget METAVERSE IS GAMING!

I know GAMIING has many connotations such as kids in their bed rooms playing video games, but gaming is far beyond that, it encompass what Facebook is seeking to become, a social GAMING network in Virtual Reality!

GAMING IS A DERIATIVE OF AI!

And Tencent is an important PART of the Gaming Universe.

Furthermore by hook or by crook Tencent is a major shareholder in one of the Companies I have been wanting to invest in for some time, EPIC GAMES which is privately held, due to their EPIC Unreal Engine 5 which pardon my pun is a GAME CHANGER where virtual environments are concerned. It gives the creative power to anyone with puts in the time and effort to learn Unreal Engine 5 on par with that of DISNEY and Dreamworks! And tencent owns 40% of Epic games, paid $300 million in 2013! So to buy shares in Epic Games one has to buy shares in Tencent!

The stock chart is showing multiple indications that Tencent is trying to put in a bottom, such as currently making a series of higher lows off the main uptrend line. A positive divergence in the MACD. Heavy support under the recent low at between $50 and $53. So the downside looks very limited. However so does the upside with many hurdles to overcome such as breaking above the series of highs along $65, all of which is supportive of Tencent spending a period of time trading within a range of $65 and $55 though which should have an upward bias.

I bought my first and only position in Tencent at $57 (HK $438) which means unlike most of the high risk stocks, including its Chinese brethren BABA and BIDU, Tencent currently sits on a small profit in my portfolio and so is showing relative strength against most of the stocks in this high risk portfolio and so if there is one stock to add to then it should be one of the stronger stocks on this list.

However there is one fly in in the ointment in that if buying on Hong Kong the lot size is 100 shares / $5,700 so likely a a bit rich for most folks, and thus perhaps target other exchanges such as the US Market. And there is no need to worry about delisting Tencent because it's NOT LISTED as TCEHY trades on the OTC market

Anyway TCEHY is a stock that has great potential and is trading at chart support that is showing basing price action and so whilst not CHEAP,. given what it offers exposure to either directly (it's own operations) or via strategic investments such as Epic Games then this is one of the few stocks that is worth me expanding my exposure to, hence I will be seeking to buy in the range of $420 to $450 (HK).

RBLX $95. Risk 6, +7%

Roblox us one of the primary high risk stocks to capitalise on the emerging metaverse mega-trend. However the stock is a long way from generating any earnings so is in full new shares printing mode thus diluting existing share holders which means I have not been in any rush to be an early buyer as illustrated by my extensive metaverse analysis when at the time the stock was trading at $124 after spiking to a high of $140 all on the back of metaverse FOMO. Where I personally was aiming to accumulate a small position at between $70 and $82 with the buying level at $82, so the stock price would literally need to crash before I would consider buying in this potential metaverse winner though very high risk stock. And well following the CI18 CRASH TRIGGER, this is one of the stocks I deemed to have a high probability of taking a nose bleed dive to fill that price gap on the chart and so I went short at $125, exiting at $95.

So nothing's really changed in my expectations in that I expect the price gap to eventually be filled where I aim to buy my opening position at between $70 and $82 either for the long-run or to capitalise on future FOMO"s such as we witnessed during November so my buying level remains at $80. THIS IS A VERY VOALTILE HIGH RISK STOCK! That now trades on a market cap of $55billion! So invest with BOTH EYES OPEN! Whilst it has got potential but it is NOT worth $55 billion!

CRISPR $74, PE 15.3, RIsk 6, -39%

The stock initially showed great promise in it's mid summer surge to $170. However this Cathy Wood entangled darling has followed her ARK funds lower to give up ALL of the gains and then some! Worse still the stock only managed to halt it's decline along strong support that dates back to Dec 2019. The stock is weak which means that even this strong support area could ultimately break which would send the stock down towards $60 and then $50. So the stock price chart is not showing any signs of a bottom yet. CRISPR is definitely a long-term play, a stock to invest and forget and let time do it's work.

In terms of buying levels $70, and $60. I am tempted to buy a little more at $70 and then again at $60 and so have put in a small limit to buy at $70.

AVIR P/E 30.5 , Risk 9, -71%

As for a buying level well that would be where it is trading today 8.3. As above I am not looking to add but rather to reduce my exposure to this VERY high risk biotech stock, and it is possible in say a 5 years time we could look back from say $200 and wish we had all piled in at $8.3, but everything is always easy in hindsight, sitting here in Mid December 2021 it is not easy at all to want to increase ones exposure to this high risk stock that could go kaput!

The bottom line is that it is not over until the fat pharmacist sings! All it needs is time so I am fairly confident that we will at least see that price gap filled, beyond that well there are a lot of investors sitting on losses at above $55, so it is going to be tough for AVIR to break above that level, so it is a good job my objective is a far more modest.$42 for X2 return.

APM $1.88, -37%

The bottom line is that he biotech stocks such as AVIR are NOT SELLING products to consumers, they do not rely on retail sales and footfall, instead their stock prices are subject to that which flows out of their labs so there will be a great deal of volatility, for instance even if AVIR fell all the way to $1 per share that would not necessarily mean its game over, not as long as the lab work remains in progress as that is the nature of the beast one is invested in and hence INVEST and FORGET!

ACCUMULATING

Where biotech's are concerned I am more or less fully invested, just marginal buying on the fringes in the likes of CARA, CRISPR, ABBV and Neurocrine Biosciences. instead my main focus is on the relatively low risk COINBASE and GPN which is a cheaper version of paypal which I covered in my recent Metaverse article.

Next on my list are the new METAVERSE stocks, Autodesk., Unity Software, and Matterport, and Roblox.

The only other stock I am seeking to accumulate is Docusign which eventually fell to it's buying level ! Though my initial position is very small going into Financial Crisis 2.0 as the 2nd buying level of $86 illustrates.

I am also looking to expand my exposure to Tencent and I am reluctant buyer of Alibaba, both on the HK exchange,

So that was my quarterly update of the High risk stock portfolio, next update will be during late March 2022 and so it remains to be seen if by then the expected market rotation takes place into biotech stocks or not. as the over valued tech giants roll over to varying degree.

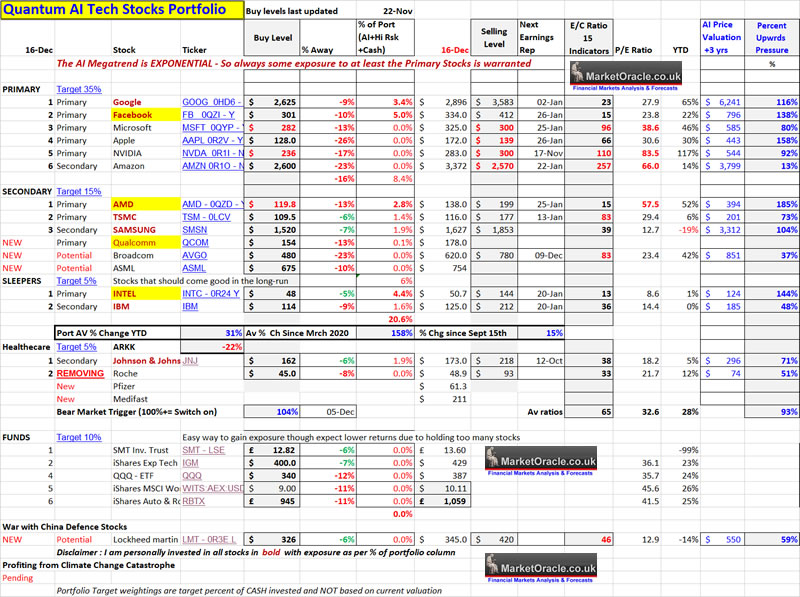

AI Stocks Portfolio

A reminder that my plan is to capitalise on a valuation reset in the over valued tech giants as they are one by one marked lower by at least 20% from their bull highs as we recently enjoyed with Facebook down to $300, with Nvidia and AMD already along their path towards triggering buying opportunities and the likes of Microsoft and Apple to soon follow suit.

Big image - Big Image - https://www.marketoracle.co.uk/images/2021/Dec/NW-Quantum-AI-Stocks-Portfolio-Big.jpg

Quick look at the primary AI stocks.

GOOGLE $ 2896

Google is consolidating its advance to $3000, I can't see it breaking out higher any time soon, so downside is more likely than not thus targeting $2700 and then it's buying level of $2612.

FACEBOOK $334

bottomed on the day we bought ! UP 7% on that week! Facebook is STILL cheap for what it represents i.e. just as Google is primarily for SEARCH, Facebook is primary for METAVERSE. Does not matter what all of the small caps or startups are doing right now for Facebook can literally throw tens of billions of dollars so that it will OWNs a large chunk of the metaverse! So I am glad it is now my largest holding and should FC2.0 deliver more buying opps then I will buy more!

Technically Facebook is STILL in a downtrend, so it should at least retest the low, where if its going to bottom it has to halt any decline at around $312. However revisiting $300 once more is still possible.

APPLE $172

Apple was on FIRE as recently as yesterday following its breakout to new all time highs and briefly attaining the magic $3 trillion dollar market corp milestone. Also Apple AR and VR is on it's way! The stock should correct down to $150.

AMAZON $3,372

Italy fines Amazon $1.3 billion for abuse of power.The stock has basically gone nowhere for 18 months as earnings play catchup, stuck in a trading range. What could trigger a break out higher? News of a stock split maybe. Amazon IS a primary AI stock so I aim to gain limited exposure with an initial fractional share limit order at $3212 which should be achievable, next level below is $3000, though still I remain reluctant to buy any significant exposure higher than about $2,600.

NVIDIA $283

GPU demand madness see's Nvidia re launch a 3 YEAR OLD GPU! RTX 2060, with some extra video memory in exchange for which one is expected to pay a HIGHER price than the original launch price of 3 years ago! A reminder that Nvidia can literally print money, literally release old tech as new and sell it for a higher price! Why? Because TSMC 7nm production is running flat out, so production is shifting to old 14nm fab's.

ARM deal appears to be off, Nvidia's reaction so far has been pretty mild which shows underlying strength. The stock has just started to break below it's $290 to $330 trading range as per my expectations for the stock to fill the gap down to $230 where my buying level remains at $236, and I will seek to accumulate at least some exposure in the range of $240 to $220.

MICROSOFT $325

Just snapped up another $20 billion corp Nuance. Hiked its prices for Office products by 20%. Microsoft is experiencing volatile price action following it's recent high of $350. My expectations are for the stock to trade down to $300, I aim to gain limited exposure in the range $320 to $300 with my main buys pending achieving the buying level of $282.

AMD $138 - THE NEXT AI STOCK FOR A BIG DISCOUNT SALE?

First INTEL then FACEBOOK, it looks like AMD and Nvidia are next to start crumbling towards their deeply discounted buying levels. AMD is showing strong signs of gravitating towards at least $119.8. Where I will consider accumulating for the long-run at between $124 to $101.8 by likely increasing my exposure by at least 1/3rd.

INTEL $50.7

Intel's announcement to sell Mobile Eye saw the price spike to $55 before giving back all of the gains. Intel is clearly raising cash for it's capex programme. INTEL is due to join the GPU battle against Nvidia and AMD with their ARC GPU's and given the demand Intel should do well, none of which is reflected in the price! Intel remains a long-term bargain! There is going to come a day when it is PE will be trading at least in the mid 20's. I don't have any plans to add to my Intel position.

Limit Orders

I often get asked in the comments where have I placed my limit orders for x, y z stocks, so I compiled a list of most of my limit orders as of 14th December that excludes small minor orders on the likes of etorro and shorts (which are too short-term). Though note I do tend to adjust the limit orders from time to time i.e. current 9988 order is $109.6 against $111.6 on the 14th of Dec.

Y on the table denotes that I can buy the US stock on the London stock exchange and thus avoid fx fees as we cannot hold dollars in ISA and many SIPP providers such as AJ Bell. And the lower the limit order the larger will be the buy order. Yes, I even want to gain a sliver of exposure to Amazon via fractional shares at $3212.

One of the benefits of holding a lot of cash on account is that one can deploy a lot of limit orders against that cash.

Best Stock Investing Platforms

In response to patron requests here are what I consider 2 good 'investing platforms' for the primary reason that both allow tiny position sizes, including fractional shares and do not charge a trading commission instead make their profits off the buying and selling spread.

ETORRO

NO fees, no commission for regular stock investing, platform is US dollar based so when someone from the UK deposits funds they get converted to a dollar balance, unless one deposits dollars directly via the likes of paypal. The platform is fairly straightforward to get to grips with and offers limit orders right off the bat.

The coverage of stocks is good, for instance one can invest in other than US stocks i.e. UK and Hong Kong listings.

The only negative as far as I am concerned is that there is no ISA, or other tax free wrapper, so my exposure to Etorro is limited for tax reasons.

Follow this link to get started.

FREE TRADE

This is the best for me and likely most UK investors for the primary reason that it is basically ETORRO within an ISA tax free wrapper.

As is the case with ETORRO, no commission when trading, fractional shares, and no minimum buy.

However, there is an 0.45% fx fee when buying US stocks of which is a lot lower than most other UK brokers such as ii.co.uk and AJ Bell.

Note that for the ISA one needs to PAY a monthly fee of £3 or £10 for ISA plus LIMIT orders. However, this £10 fee can be wholly offset by depositing at least £4k as Free trade pays 3% interest on balances upto £4k thus the £10 monthly fee is fully returned as interest. Also the interest is paid on the total cash balance regardless of whether funds are committed to limit orders or not.

Free Trade also give a free share worth between £3 and £200 when signing up and depositing your first £1.

HOW to Get the FREE SHARE FROM FREETRADE

To get the FREE SHARE then you must sign up using my referral link , then we both get 1 free share worth upto £200! However you must follow the link as just downloading the app from the app store won't work, you wont get a free share that way it has to be by way of referral.

Steps to Get a free Share

1. Click this link that takes you to he Free Trade Free Share web page

2. Follow instructions to download the Free Trade App

3. Deposit at least £1.

4. Get your free share worth between £3 and £200 within 7 to 10 days.

I use both of these platforms. Etorro for trading in and out of small positions, as that is what it encourages one to do. And FREE TRADE for accumulating positions for the long-run.

Also note that UK FSCS investor protection is upto £85k so I would not go over that limit with Free Trade.

Again for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Stock Market Trend Forecast Mid Feb to End 2022

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada and China - 65% done

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $4 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst contemplating his net big buys whilst many will be panic selling.

By Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.