United States Heading for Nasty Economic Recession

Economics / Recession 2008 - 2010 Oct 27, 2008 - 03:32 AM GMT

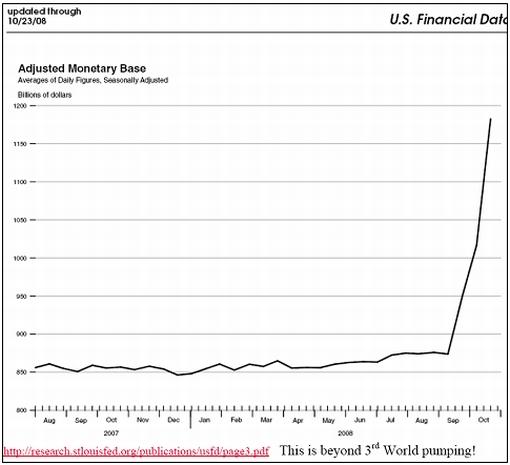

Bill King (The King Report): Adjusted monetary base surging

Bill King (The King Report): Adjusted monetary base surging

“The following chart of the Adjusted Monetary Base, as calculated by the St. Louis Fed, needs no commentary. But we must note that it is growing at a 341% annualized rate (of 4-week average). This is beyond 3rd world pumping! Yesterday in testimony before Congress about the financial crisis, Easy Al reluctantly gave a qualified confession about his role in the mess when he said he was ‘partially' wrong on derivative regulation. But Easy Al tried to direct blame at Wall Street.”

Source: Bill King, The King Report , October 24, 2008.

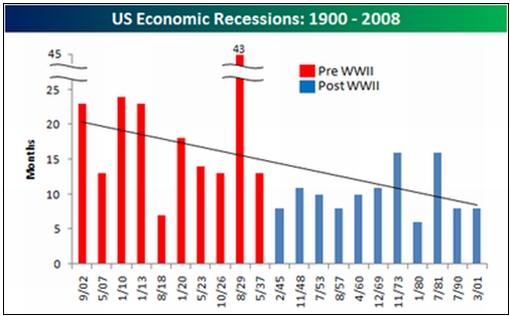

Bespoke: Duration of US economic recessions

“Below we highlight the average duration of US economic recessions since 1900. Given the recent string of weak economic reports and the freeze up in the credit markets, the question regarding the current period is no longer if we are in a recession, but when did it start. Based on the recessions shown in the chart, the average length of US recessions is 14.4 months. Using the assumption that the recession began at the start of 2008 (using Industrial Production and Employment statistics), if the current period ends up just as an average contraction, we could expect the economy to bottom some time next spring.

“As shown in the chart, there is a clear dichotomy in recessions prior to WWII (red) and after WWII (blue). Pre WWII, the average recession lasted 19.1 months. Since then, though, the average duration has been nearly cut in half to 10.2 months. While the reason for the shorter duration is up for debate, we would argue that faster information flow has allowed companies to quickly adjust activity in order to compensate for shocks to the upside or the downside.”

Source: Bespoke , October 23, 2008.

Bloomberg: Nobel economics Laureate Krugman sees “nasty” US recession

“The winner of the 2008 Nobel Prize for economics said the US is plunging into a ‘nasty recession' with a ‘lot of suffering' to come, even if policy makers succeed in unfreezing the credit markets.

“‘That's baked in,' Princeton University professor and New York Times columnist Paul Krugman said in an interview on ‘Night Talk' with Mike Schneider. ‘There is a lot of downward momentum.'

“He said a risein the unemployment rate to 7% ‘seems almost certain' and he put the odds of an increase to 8% at ‘better than even'. The jobless rate in September stood at a five-year high of 6.1%.

“Krugman voiced some doubts that the steps Treasury Secretary Henry Paulson is taking to combat the credit crisis will succeed and suggested that more might be needed.

“‘It's not clear there's enough money,' Krugman said.

“He added that Paulson may also have to insist that the banks use the money they're receiving to make new loans if the plan is to work. ‘They may need to be much more interventionist than they have been thus far,' the Princeton professor said.”

Source: Mike Schneider and Rich Miller, Bloomberg , October 17, 2008.

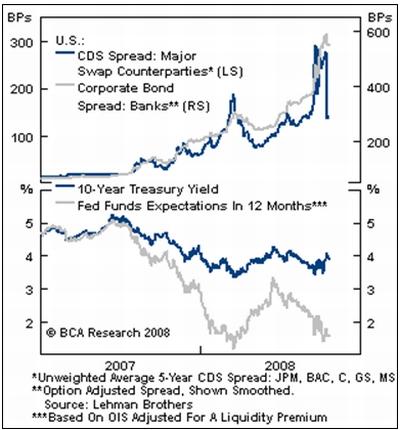

BCA Research: Will spreads finally narrow in the US?

“A sharp narrowing in major counterparty swap spreads may herald an easing in corporate bond spreads.

“There was some good news last week with a sharp narrowing in CDS spreads of the major US counterparties. These debt instruments tend to lead the corporate bond market, and the narrowing raises hope that some normalization in inter-bank lending could develop. A stabilization in counterparty risk is only the first step forward, and it will be critical for bond spreads to narrow and for banks to stop hoarding cash.

“However, offsetting this positive has been an uptick in government bond yields. If credit spreads narrow due solely to rising Treasury yields, then no economic relief will occur. The Fed needs to make it clear that policy rates will stay low in order to anchor Treasury yields. Moreover, bailout efforts need to proceed to ensure the banking system starts functioning. Stay tuned.”

Source: BCA Research , October 21, 2008.

Bloomberg: Bernanke may seek new ways to ease credit as fed rate nears 1%

“Federal Reserve officials are likely to bring interest rates down so aggressively over the next few months that they will have to search for fresh tactics to continue easing credit.

“The Fed's Open Market Committee will probably reduce the benchmark federal funds rate by half a point next week to 1%, the lowest since May 2004, according to futures trading. The official rate has never been lower since the Fed made it an explicit target in the late 1980s.

“Further cuts below 1% could turn Fed Chairman Ben Bernanke's focus away from the main rate and toward more use of alternative tools. Those might include increasing its holdings of mortgage bonds to lower costs for homebuyers and purchasing securities directly from the Treasury in order to pump more cash into the economy, Fed watchers said.

“‘If there is need for more stimulus, the Fed will buy up government debt' to keep borrowing costs low, said Adam Posen, deputy director at the Peterson Institute for International Economics and a co-author with Bernanke. That's tantamount to ‘turning government debt, as it is issued, into money.'

“Bernanke, 54, has already thrown the central bank's balance sheet into action in unprecedented ways. Working with the New York Fed, the Board of Governors has rolled out 11 new programs aimed at absorbing risk or making dollars available when banks don't want to loan.”

Source: Craig Torres, Bloomberg , October 23, 2008.

The New York Times: The guys from “Government Sachs”

“This summer, when the Treasury secretary, Henry M. Paulson, sought help navigating the Wall Street meltdown, he turned to his old firm, Goldman Sachs, snagging a handful of former bankers and other experts in corporate restructurings.”

Click here for the full article.

Source: Julie Creswell And Ben White, The New York Times , October 19, 2008.

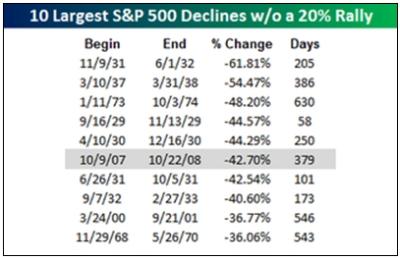

Bespoke: The worst year ever – S&P 500's worst declines

“With a 38.9% decline year to date, 2008 is shaping up to be the S&P 500's worst year ever. At this point in the year, the next closest year in terms of declines are 1931 and 1937. In both of these years, the S&P 500 was down 31% at this point in the year.

“Since its peak in October 2007, the S&P has now declined by 42.3%. On a historical basis, this is the sixth worst decline in the S&P 500 without a rally of 20% or more. As shown in the list below, outside of the Great Depression, the only period where the S&P 500 had a greater decline was during the bear market of 1973/1974. How much worse can it get?”

Source: Bespoke , October 22, 2008.

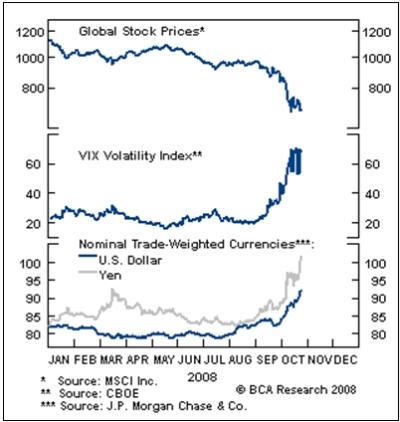

BCA Research: Risky assets still risky

“nvestor angst remains extremely elevated, despite aggressive policy support across the globe.

“Market volatility remains a readings well above previous cyclical peaks and equity markets have failed to bounce sustainably after plunging to extremely oversold levels earlier this month. The problem is that while authorities may soon begin to turn the corner on stabilizing the financial system, the growth outlook is bleak. The G7 economy faces a prolonged recession and the full extent of the fallout and profit losses are still uncertain.

“In addition, policy rates remain too elevated in Europe, Australia and New Zealand, and the recent surge in the dollar and yen add a fresh drag for these economies. Correspondingly, we advise clients to remain defensively positioned. Even if the October 10 stock market lows hold, it is likely that investors will get several opportunities to add exposure aggressively in the months ahead.”

Source: BCA Research , October 24, 2008.

Richard Russell (Dow Theory Letters): All bull and bear markets end in exhaustion

“All bull and bear markets end in exhaustion. Bull markets terminate when the bull element is exhausted and runs out of buying power. Bear markets end when the sellers are exhausted and when they have emptied their inventory of stocks to sell.

“Right now, via the Lowry's studies, I am watching to see if the Selling Pressure Index heads down on a trend basis. Its current height suggests that there's still a huge amount of stock waiting to be sold, and this represents bearish pressure on the market. At some point, Lowry's Selling Pressure Index will decline far enough so that we'll figure that the inventory of stocks to be sold has been exhausted. At that point, we'll look for a rush of buyers to enter the market.

“Right now, the Fed and the treasury are attempting to halt the primary bear trend of the stock market and the economy. I'm afraid they are fated to fail, and I don't care how many trillions of dollars the government spends. As a matter of fact, the government going so heavily into debt will probably only extend the life of the primary bear trend – while possibly sending the market lower than it would normally have fallen.

“… this primary bear market, like all others before it, will fully express itself regardless of how anxious the US government is to reverse the primary bear trend. The bear will have his way, until the last group of bears has exhausted its desire to sell. That, in a nutshell, is the tragedy of a great bear market.”

Source: Richard Russell, Dow Theory Letters , October 22, 2008.

Richard Russell (Dow Theory Letters): Buffett – risky and dangerous act

“The newspapers and advisories are crammed with articles suggesting that the bear market has hit bottom. Adding to the optimism, Warren Buffett in a NY Times editorial announced that he is selling his US Treasuries and moving into US equities. Says Buffett, ‘When everyone is greedy, be fearful. When everyone is fearful, be greedy.' Buffett noted that there is a lot of fear around these days. Lately, Buffett is enjoying his publicity, and could be doing damage. In urging American to buy US stocks, he's acting as a market timer, and he could well be far off in his timing. It's a risky and dangerous act, even though I'm sure he thinks he's being patriotic and optimistic.”

Source: Richard Russell, Dow Theory Letters , October 20, 2008.

David Fuller (Fullermoney): Stock market opportunities beginning to outweigh risks

“The question for the moment is, are we being complacent? Let's look at a little more evidence.

1. Better late than never, governments are increasingly moving to support their banking industries, while adjusting monetary policy to combat recession / deflation, rather than economic overheating (in some emerging markets) / inflation, as before.

2. The Ted spread has unequivocally peaked in my view. It is still 220 basis points above a healthy level but heading in the right direction.

3. Consequently, an ‘Armageddon' collapse of the financial system will be avoided, albeit at a cost yet unknown, and recession is a reality.

4. Commodity inflation is much reduced.

“Therefore stock markets are left with the more familiar problem of corporate profit downgrades but equity prices have already gone a long way towards discounting this temporary problem. With monetary policy becoming more benign for shares, opportunities for investors in stock markets are now beginning to outweigh risks, but beware of further downgrades for corporate profits.”

Source: David Fuller, Fullermoney , October 20, 2008.

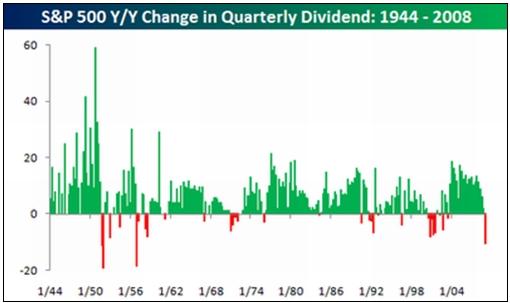

Bespoke: S&P sees dividends drying up

“New signs of stress in the US economy seem to be popping up every day, and today's news comes from S&P. According to Dow Jones, S&P sees fourth quarter dividends among S&P 500 companies declining by 10% year over year. This would make it the fourth worst quarterly decline since 1944.

“According to S&P's study, most of the decline is a result of dividend cuts in the financial sector where there have already been 35 cuts this year totalling $35 billion. This compares to only 12 cuts totalling $3.1 billion over the last five years.

“But not all the news is bad regarding dividend investing. The same S&P report also estimated that over half of all dividend paying companies in the S&P 500 plan on raising their payouts in 2009, and illustrates the importance of focusing on more than just yield when looking at companies that pay dividends.”

Source: Bespoke , October 21, 2008.

John Authers (Financial Times): Impact of sell-off on emerging markets

Click here for the full article.

Source: John Authers, Financial Times , October , 2008.

Bill King (The King Report): Dollar might be exhausted – significant pullback could appear

“… the dollar might be exhausted for now and a significant pullback could appear. However, there should be more hedge fund liquidations and commensurate dollar buying in November as investors try to meet the November 30 deadline to withdraw funds from hedgies and fund of funds.

“Then there could be one last dollar surge in December as banks, brokers, operators, non-financial companies, and other dollar shorts cover their positions for yearend. But there could be an even larger dollar-buying force in December: foreign banks, especially the Japanese, which must procure term money for yearend. But after yearend obligations are met, the dollar could be very vulnerable.

“PIMCO's Paul McCulley told investors to shun US Treasuries. If one should shun US Treasuries, one should also shun the dollar. If not for European financial chaos, the dollar would be in the toilet … ‘Deflation now, massive inflation later.'”

Source: Bill King, The King Report , October 24, 2008.

Richard Russell (Dow Theory Letters): No nation can run an empire on borrowed money

“For months I've insisted that no nation can run an empire and fight two wars on borrowed money. Sooner or later something has to give – the nation's credit standing or its currency. Now the dreaded subject is beginning to emerge. The demise of the US's world standing.

“Today, in The Wall Street Journal of all places, we see a featured piece on the op-ed page entitled, ‘The Dangers of a Diminished America'. A diminished America? How can that be? It be. The US has been getting away with it all by owning the unique advantage of printing the very money that its huge debt is denominated in. Yes, I'm talking about the reserve status of the US dollar. This is the Achilles Heel of the US. The US dollar will possess its reserve status as long as our creditors continue to accept Federal Reserve Notes, paper with nothing behind it accept the ‘full faith and credit' of the United States.”

Source: Richard Russell, Dow Theory Letters , October 21, 2008.

Hans Redeker (BNP Paribas): Euro faces growing risks

“The recent sell-off in central and eastern European (CEE) currencies might have significant negative implications for the euro, warns Hans Redeker, chief forex strategist at BNP Paribas.

“He points out that credit spreads in countries such as Russia and Turkey have widened in spite of capital injections into the banking industry by Western governments.

“‘The reason sovereign spreads are rising has its origin in private sector indebtedness and the structure of the liability side of balance sheets,' Mr Redeker explains. ‘Banks and corporates in emerging markets have not only funded in local currencies, but an increasing share of liabilities are foreign currency-denominated.

“‘Local currency is now being changed into hard currency at any cost to cover hard currency funding needs. Local currency weakness is the result.”

“Meanwhile, the lack of adequate funding will leave CEE economies, including Russia and Turkey, exposed to a significant slowdown.

“‘Of concern from a European perspective is that this slowdown is taking place in the eurozone's backyard, suggesting the region's exporters face tough times. This will weaken the euro from a cyclical perspective.

“‘The more CEE currencies weaken and CDS spreads widen the more pressure the euro will face. The risks to the euro might be greater than thought and CEE CDS spreads must be on traders' ‘to watch' list.'”

Source: Hans Redeker, BNP Paribas (via Financial Times ), October 21, 2008.

Commodity Online: Jim Rogers – commodity bull market will last longer

“Credit crisis, collapse of banking majors and inflation have led stock and commodities markets to the depths of despair in the last one month. Now that the world is gripped by recession fears, is the commodities bull market all over?

“Not really. Jim Rogers, one of the best known global commodities investors, says the commodity bull market will last longer thanks to the global economic meltdown.

“‘We have had 8 to 9 periods of forced liquidation over the past 100 to 150 years wherein everything was liquidated without regard to fundamentals. This is such a period,' Rogers told Commodity Online in an exclusive e-mail interview.

“Rogers, the best known global guru on commodities, said the commodities market is these days hit by the prospects of growth slowdown in countries like China and the large-scale economic pessimism in the US and Europe.

“‘Historically the things which have come out best on the other side are things where the fundamental have been unimpaired. Commodities are the only thing I know with unimpaired fundamentals,' he said.

“In fact, Rogers said, what is happening means there will be even less supply of everything in the future.

“‘The cyclical demand for commodities may slow, but the secular supply will be badly affected so the commodity bull market will last longer and go further in the end,' he added.”

Source: Commodity Online , October 20, 2008.

MarketWatch: OPEC to cut production by 1.5 million barrels a day

“The OPEC oil cartel on Friday said it was slashing 1.5 million barrels of oil a day in production as the world's financial crisis dampened demand for energy.

“‘This slowdown in oil demand is serving to exacerbate the situation in a market which has been over-supplied with crude for some time, an observation which the Organization has been making since earlier this year. Moreover, forecasts indicate that the fall in demand will deepen, despite the approach of winter in the northern hemisphere,' the cartel said.

“It also noted that ‘oil prices have witnessed a dramatic collapse – unprecedented in speed and magnitude – these falling to levels which may put at jeopardy many existing oil projects and lead to the cancellation or delay of others, possibly resulting in a medium-term supply shortage.”

“The biggest producer, Saudi Arabia, is cutting 466,000 barrels a day, with six-figure declines also coming from Iran, Kuwait, the United Arab Emirates and Venezuela.”

Source: Myra P. Saefong, Moming Zhou & Steve Goldstein, MarketWatch , October 24, 2008.

The Independent: Spending on gold nears $3bn as investors flee shares

“Investors spent $2.8 billion on gold on world stock exchanges in the third quarter this year, as individuals and companies fled volatile share markets.

“According to the World Gold Council (WGC), 145 tons of gold were bought on stock exchanges in the three months to September. This meant that gold held by investors on the exchanges hit 1,000 tons for the first time since the metal was introduced on the US bourse in 2004.

“Natalie Dempster, the WGC's head of investment, said: ‘The question we get from high net worth individuals and funds is no longer ‘why should we invest in gold?', but ‘where can we go to buy it?''

“James Turk, founder of Gold Money, the Jersey-based company that stores precious metals for investors, said he had seen his customer base triple in September. He added that at the end of the third quarter, the company was looking after gold and silver deposits worth $400 million, more than double the value a year earlier.

“Mr Turk said: ‘Gold is seen as a natural safe haven given the uncertainty in the banking system and the volatility in the stock market.'”

Source: Mark Leftly, The Independent , October 19, 2008.

Richard Russell (Dow Theory Letters): Erratic action in gold

“Gold is torn between two opposing forces. The negative pressure on gold is the ongoing world commodity deflation. The positive force on gold is the coming monster US government deficits which will probably raise doubts about the viability of the US dollar. How big will the coming US deficit be? The official estimate is $700 billion. Forget it, the actual deficit will be between $1 trillion and $4 trillion, probably closer to $2 trillion. In a $14 trillion economy, a $2 trillion deficit would mean that the deficit would be 14% of Gross Domestic Product. In the past, 6% was considered a crisis percentage. In Europe the legal limit is a deficit of 3% as a percentage of GDP. Deficits of above 3% brought warnings (Italy) of a crisis.”

Source: Richard Russell, Dow Theory Letters , October 20, 2008.

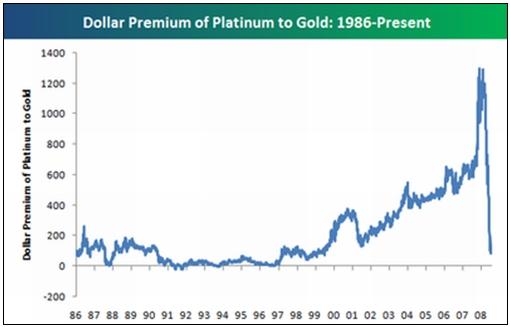

Bespoke: Platinum almost the same price as gold

“Men everywhere holding out to buy that platinum engagement ring can rejoice in the fact that the metal has declined from a high of $2,276/ounce in March to just $793/ounce today. But what's really crazy is how close platinum is trading to gold. Even though platinum is 30x rarer than gold, it is currently trading at just an 11% premium.

“Earlier in the year, there was a $1,300/ounce price difference between the two metals, but that difference is now just $83. The charts below highlight the historical premium between platinum and gold, and while it's hard to believe the two could be trading at similar price levels now, it did occur quite often in the early 90s. What is shocking is how fast the premium has declined in recent months. Instead of buying gold coins, maybe now is the time to buy platinum ones.”

Source: Bespoke , October 23, 2008.

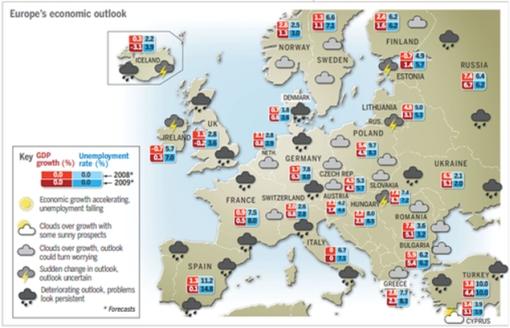

Financial Times: European weather map

“Stormy conditions prevail across Europe's economies after the arrival of a full-blown banking sector crisis this month sent confidence plummeting and threatened widespread-economic damage.

“The FT's latest European economic ‘weather map' shows the extent of the deterioration since July. In July the continent's economies had largely avoided a credit crunch but were being hit by sudden and steep rises in energy prices, compounded by the effects of a strong euro. In October, inflation is ebbing and the euro has softened.”

Click the image below for a larger picture.

Source: Financial Times , October 20, 2008.

Financial Times: ECB signals further interest rate reductions

“Signs are emerging that the European Central Bank will soon cut eurozone interest rates again, as plummeting growth prospects and tumbling inflation clear the way for a sustained loosening of monetary policy.

“Little more than two weeks after it slashed its main policy rate by half a percentage point to 3.75% as part of co-ordinated global central bank action, policymakers at the notoriously inflation-sensitive ECB are making bolder signals that further reductions are possible.

“Evidence of slower growth and falling price pressures was ‘a new element of our analysis', José Manuel González-Páramo, an ECB executive board member, told an Irish newspaper on Thursday. The ECB could ‘diminish rates without adding to inflationary risks in the medium term', he said.”

Source: Financial Times , October 24, 2008.

Financial Times: European states struggle to raise money

“Some European governments are struggling to raise money in the bond markets because of the vast financial pledges that they have made to bail out their battered banking sectors.

“Spain failed to launch a bond last week, while Belgium and Finland were having difficulty attracting investors for debt offerings after governments set aside billions to recapitalise their banks and guarantee their debt.

“Governments face problems raising money, as investors demand higher yields because of the extra credit risk resulting from the bank guarantees and the huge pipeline of sovereign debt expected over the next year, which is hanging over the market.

“The eurozone countries will have to issue an extra $263.3 billion in debt in the next year to pay for bank recapitalisations and guarantees, according to Bank of America.”

Source: David Oakley, Financial Times , October 21, 2008.

Financial Times: Pound plunges as King warns on recession

“Sterling hit a five-year low against the dollar on Wednesday after Mervyn King, governor of the Bank of England, said Britain was headed for a prolonged slowdown.

“Mr King on Tuesday night gave his gloomiest assessment of Britain's economic prospects since becoming Bank governor in 2003, saying that the country was now ‘entering a recession'.

“He compared the recent capital flight from British banks with a ‘mild form' of a 1990s-style emerging market crisis, warning about the risk of another sharp decline in sterling and an even deeper recession.

“In one of only three big speeches Mr King gives a year, his views are bound to be taken by markets as a clear sign the Bank is gearing up for further significant cuts in UK interest rates.

“Until Tuesday night, Mr King and the Bank had refused to utter the word ‘recession', insisting that the term should only be used to signify a deep contraction in output and not two successive quarters in which the economy might shrink a little.

“On Tuesday night he had no such qualms, saying a recession was likely because the recent financial crisis had come on top of the rise in oil prices, which had already squeezed incomes.”

Source: By Chris Giles and Neil Dennis, Financial Times , October 21, 2008.

Financial Times: China growth rate slides

“China on Monday announced steps to boost its property market and help exporters after new data showed a sharper than expected decline in its growth rate, as the impact of the global financial crisis began to take hold.

“After five years of double-digit expansion, figures for the third quarter showed the annual growth rate falling to 9% – well below most pessimistic forecasts.

“The Chinese State Council, the country's cabinet, also said it was planning increases in infrastructure spending after the economy's growth rate fell for the fifth quarter in a row.

“For much of the past year, China had seemed immune to the problems in international credit markets. However, in recent weeks there have been growing signs that the economy might slow more sharply than expected, which has contributed to falling commodity prices.

“The 9% expansion in China's gross domestic product in the third quarter was below the consensus forecast of 9.7% and down from the 10.1% annual growth in the second quarter.”

Source: Geoff Dyer, Financial Times , October 20, 2008.

David Fuller (Fullermoney): China slows down, but in good shape

“While China is slowing significantly, it is unlikely to experience a hard landing. Given China's potential growth rate of around 8% to 10% and its need to find jobs for roughly ten million rural workers each year, a hard landing would mean growth of around 5%.

“The Chinese banking system appears solid compared to those in the developed world. Loan to valuation ratios have been falling, there are limited linkages to global banks, there is no dependence on foreign capital, there is no confidence crisis and credit availability has only been an issue to the extent that the government has restricted it.

“The Chinese corporate sector is in good shape. Leverage has been falling and the level of retained earnings is high, as is the return on equity. The equity market only accounts for 15% of corporate financing.

“Consumer spending is likely to remain robust. Despite the 70% slump in Chinese shares and falling house prices, consumer spending has actually accelerated recently. Chinese consumers have very high saving rates, are not very geared and only 5% of Chinese households have a significant share exposure. On top of this, the authorities have been trying to boost consumer spending via a range of policies including social security reforms, labour reforms and assistance for rural workers.”

Source: David Fuller, Fullermoney , October 21, 2008.

BCA Research: Australia – accelerating inflation, slowing economy

“While inflation still remains above the central banks comfort level, the recent decline in commodity prices will ensure that price pressures ease heading forward.

“Yesterday's release showed that consumer price inflation rose faster than expected in Q3, climbing to 4.6% YoY (from 4.3% in Q2). While this result will make policymakers nervous, it will not deter them from easing interest rates further next month. The rapid erosion in leading growth indicators, softening house prices, rising unemployment (albeit from historically low levels) and waning confidence warn that domestic activity is moderating. Furthermore, the Reserve Bank of Australia (RBA) predicted price pressures would remain elevated throughout the remainder of 2008, and possibly the early part of 2009.

“Despite this forecast, the RBA has moved to aggressively lower interest rates in the face of economic and financial market turmoil. Bottom line: Expect the RBA to cut significantly further. Our global fixed income team recommends an overweight allocation in government bonds within a globally hedged bond portfolio.”

Source: BCA Research , October 23, 2008.

New Zealand cuts key rate by 100 basis points to 6.5%

“New Zealand's central bank cut its benchmark interest rate by a record 1 percentage point to 6.5% and foreshadowed further reductions to limit damage from the worldwide financial crisis and a slump in the global economy.

“‘Economic activity will be further constrained by these international developments,' Reserve Bank Governor Alan Bollard said in a statement in Wellington today. ‘Should the outlook for inflation evolve as projected, we would expect to lower the rate further.'

“‘The domestic economy is likely to remain in recession through to the middle of next year at least,' said Darren Gibbs, chief New Zealand economist at Deutsche Bank AG in Auckland. ‘The official cash rate will move to around 5%, if not below, by the middle of next year.'”

Source: Tracy Withers, Bloomberg , October 23, 2008.

BCA Research: Bank of Canada cuts another 25 bps

“The Bank of Canada (BoC) opted to cut the overnight rate to 2.25% yesterday, providing needed support for the economy.

“Yesterday's decision by the BoC provides needed relief to the Canadian economy. Domestic growth conditions will continue to slow in the coming months due to the rapid erosion of the terms-of-trade tailwind (i.e. the dramatic drop in crude oil prices) as well as weaker export demand resulting from the U.S. recession. Already business confidence and activity measures have eroded markedly. As for the consumer, a deteriorating employment outlook and mildly contracting house prices are weighing on sentiment and will likely undermine spending in the months ahead.

“That said, the currency is providing some relief, the Canadian economy did not experience the same housing bubble as many of its G7 counterparts, and the financial system remains well capitalized: according to the World Economic Forum, Canada's has the world's soundest financial system. Correspondingly, there is further scope to ease by the European, Australian and New Zealand central banks. Bottom line: We remain neutral on Canadian bonds within a global hedged fixed income portfolio.”

Source: BCA Research , October 22, 2008.

Bloomberg: Argentine bonds, stocks sink as takeover fuels default concerns

“Argentina's bonds and stocks plunged for a second day as a planned government takeover of $29 billion of pension funds heightened concern the South American country is headed for its second default this decade.

“The benchmark Merval stock index tumbled 15.8% on speculation President Cristina Fernandez de Kirchner plans to use the funds to meet financing needs that have swelled as prices on the country's commodity exports tumbled. Argentina hasn't had access to international debt markets since its 2001 default and demand for its local bonds has dried up in the past year on concern the government is underreporting inflation.

“‘It's the final of many nails in the coffin from an institutional investor perspective,' said Bill Rudman, who helps manage $3 billion of emerging-market equity at WestLB Mellon Asset Management in London. Argentina is ‘disappearing into irrelevance', he said.

“The yield on the government's 8.28% bonds due in 2033 surged 6.25 percentage points to 30.94%, according to JPMorgan Chase & Co. The bonds yielded 12.16% a month ago. The benchmark Merval stock index sank to a four-year low, extending its decline this week to 27%.

“Fernandez, 55, announced her plan to take over 10 private pension funds during a speech in Buenos Aires yesterday, saying the proposal would help protect retirees from the global financial crisis. The last time Argentina sought to tap workers' savings was in 2001, just before it halted payments on $95 billion of bonds. Fernandez denied in the speech that her plan is a bid to ‘grab the cash'.”

Source: James Attwood and Drew Benson, Bloomberg , October 22, 2008.

Business Day: South African economic policy jerked left as SACP calls shots

“A fundamental shift to the left in economic policy emerged from the South African ruling African National Congress's (ANC's) weekend economic policy summit with its communist and trade union allies, with clear signs that the South African Communist Party (SACP) in particular is scoring huge successes in redirecting national policy.

“Changes to policy decided at the summit include the creation of a two-tier cabinet, a planning commission, and an industrial policy that focuses more sharply on job creation.

“The changes will surprise, if not shock, analysts who had been taken in by repeated assurances by the new ANC leadership that no policy changes were envisaged.

“Yet SACP deputy general secretary Jeremy Cronin signalled the overhaul yesterday: ‘Very important and fundamental paradigm shifts are occurring.'

“This is the first time the ANC has committed itself to these changes since its elective conference in Polokwane, which saw policy shift to the left.

“The theme of continuity and change, as well as ‘continuity in change', permeated discussions at the summit.

“Cronin said ‘not everything is broken', but there would be changes aimed at ‘fixing' policy and government departments that had not yielded results.

“The planning commission, which Cronin said would come into effect soon after next year's poll, would be headed by the Presidency and would have the power to align the work of departments and organs of state to support the state's developmental agenda.

“‘The planning commission would … promote the alignment of government budgets with developmental planning, set broad targets through medium-term and long-term plans, conduct strategic risk assessment, and act as secretariat to the council of state,' a statement released after the summit read.”

Source: Karima Brown and Amy Musgrave, Business Day , October 20, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.