2022 – The Year of (Gold) Inflation?

Economics / Inflation Dec 30, 2021 - 08:04 PM GMTBy: Arkadiusz_Sieron

High inflation won’t go away in 2022. Good for gold. However, it is likely to continue to climb and reach its peak. That sounds a bit worse for gold.

High inflation won’t go away in 2022. Good for gold. However, it is likely to continue to climb and reach its peak. That sounds a bit worse for gold.

If 2021 was tough for you, I don’t recommend reading Nostradamus’ predictions for the next year. This famous French astrologer saw inflation, hunger, and much more coming in 2022:

So high the price of wheat,

That man is stirred

His fellow man to eat in his despair

Yuk! So, life is about to get a little more complicated: we must now avoid becoming infected and being eaten by our fellow citizens! If you are interested in how cannibalism will affect the gold market, I’m afraid that I don’t have adequate data. Anyway, if you end up in the pot together with vegetables and your colleagues, gold’s performance probably won’t be your top priority.

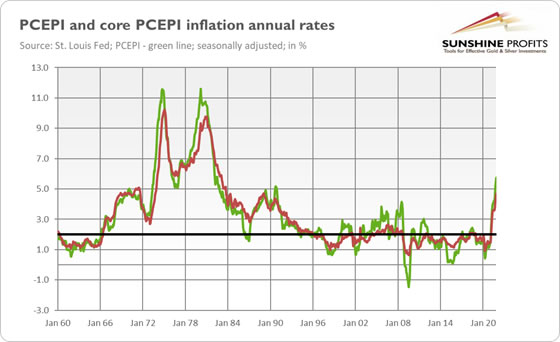

Hence, let’s focus on inflation. Last week, the Bureau of Economic Analysis released the latest data on the Personal Consumption Expenditures Price Index. This measure of inflation surged 5.7% in the 12 months ended in November, which was the fastest increase since July 1982. Meanwhile, as the chart below shows, the core index, which excludes energy and food, rose 4.7%. It was the highest jump since February 1989.

This is very important, as it shows that inflation is not elevated merely by rising energy prices. Instead, it’s more broad-based, which can make inflation more lasting. Indeed, there are strong reasons to expect that high inflation will stay with us in 2022.

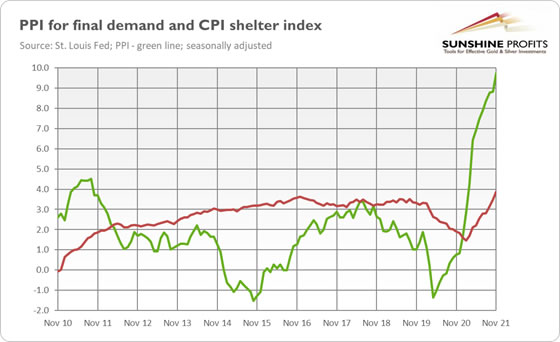

As the chart below shows, the shelter index – the biggest CPI component – has been rising recently, which should move the whole index up. In other words, surging home prices could translate into higher rents, supporting consumer inflation.

Additionally, the Producer Price Index has also been rallying this year. The final demand index rose 9.6% on an annual basis in November, the largest advance since 12-month data was first calculated in late 2010. Moreover, the commodity index surged 23%, and it was the highest jump since November 1974. All this indicates that inflationary pressure remains strong.

Implications for Gold

To be clear, inflation will eventually peak, and this will probably happen in 2022. This is because a one-time helicopter drop (the surge in the money supply) leads to a one-time jump in the price level. However, inflation is like toothpaste. It’s easy to get it out, but it’s difficult to get it back in again.

To use another metaphor, if you wait with your actions until you see the whites of the eyes of a tiger, you can be eaten (sorry for being monothematic today!). This was exactly the Fed’s strategy with the inflationary tiger for most of 2021. Yes, the US central bank accelerated tapering of quantitative easing in December, but it remains behind the curve (or, to continue the metaphor, it’s still holding the tiger by the tail).

What does it all mean for the gold market? High inflation should support gold prices. The expectations of a more hawkish Fed probably prevent a big rally, but ultra-low real interest rates are supportive of the yellow metal.

However, what is one of my biggest worries for the next year (except for the perspective of being eaten by hungry neighbors) is how gold will react to the peak in inflation. Although inflation will stay elevated, it won’t rise indefinitely. When it peaks, real interest rates could go up, negatively affecting the yellow metal.

Of course, one would say that the peak of inflation would be accompanied by a more dovish Fed, so disinflation doesn’t have to hurt gold, just as rising inflation didn’t make it shine. However, this is not so simple, and if inflation stays above 5%, the Fed could still feel obligated to act and bring inflation to its 2% target. Anyway, US monetary policy (together with fiscal policy) will be tighter compared to 2020 and to other major countries, which (together with a likely peak in inflation) creates a rather challenging macroeconomic environment for gold in 2022 (at least until worries about the negative consequences of the Fed’s tightening cycle emerge).

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.