Stock Market Santa Rally Time

Stock-Markets / Stock Market 2021 Dec 23, 2021 - 01:09 PM GMTBy: Monica_Kingsley

S&P 500 made a first step towards the turnaround higher in the opening part of this week. Fading the rally is being countered, and yesterday‘s omicron policy response fears are being duly reversed. For the time being, Fed‘s liquidity is still being added – the real wildcard moving the markets, is corona these days. Credit markets are in the early stages of heralding risk-on appetite as returning. As stated yesterday when mentioning my 2022 outlook:

(…) Fading the FOMC rally went a bit too far – credit markets aren‘t panicking, so I doubt a fresh lasting downtrend is starting here. Chop, yes – the 4,720 area is proving a tough nut to crack, but it would be overcome. If there are two arguments in favor, it‘s the financials and HYG – the likely rebound in the former, and Friday‘s resilience in the latter. Given that Thursday‘s spurt to 4,750 evaporated so fast, I‘m not looking for a stellar year end. Positive given where we‘re trading currently, sure.

Markets are now grappling with faster Fed tapering (which has opened the way to a rate hike in Q2 2022), getting slowly more afraid of fresh corona restrictions, and dealing with inflation that‘s not going anywhere. Outpacing wage growth, with real yields being deeply negative (no, 10-year Treasury yield at even 2% doesn‘t cut it – that‘s my 2022 target, by the way), the administration would be hard pressed in the year of midterms to counter the corrosive inflation effects on poll numbers. And the Fed expects to keep tightening when the real economy is already suffering from contracting liquidity as seen also in strengthening dollar?

The central bank will have a hard time taming inflation, and in my view won‘t succeed – the persistently high inflation rates are going to be with us for years to come, and outpacing wages. … Similar to the recent high PPI reading, this is one more argument for why inflation isn‘t receding in the short run – not when demand isn‘t likewise being destroyed. As if consumer sentiment weren‘t struggling already...

For now, the year end squaring the books trading can go on, and positive Santa Claus seasonality can make itself heard still. The crypto turn that I had been looking for on the weekend, is happening with strength today. Likewise the oil and copper recovery spilling over into silver, and the reasonably good performance returning to many value stocks too. Very constructive action.

In short, the bulls have a good rebound opportunity into Christmas.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

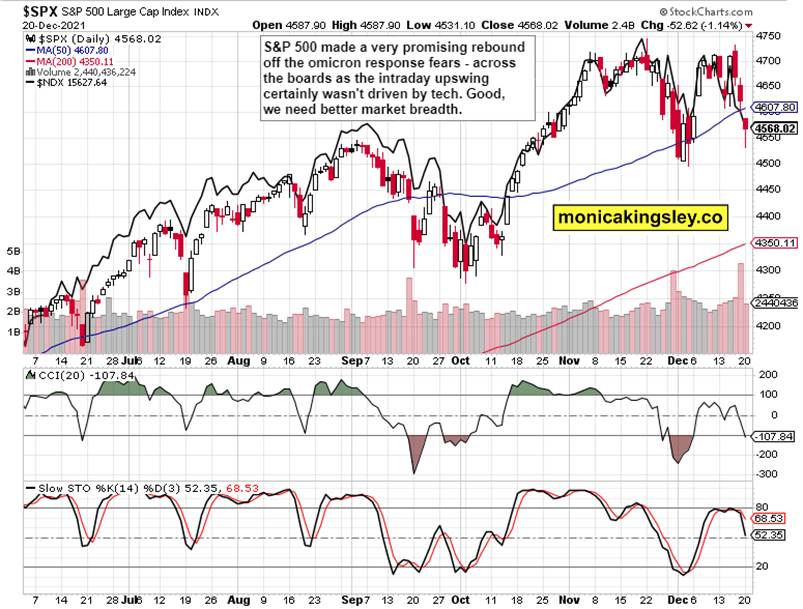

S&P 500 and Nasdaq Outlook

S&P 500 is waking up, and odds are the move would bring it back above the 50-day moving average. Looking at the volume, it‘s as if fresh sellers were nowhere to be found.

Credit Markets

HYG made an attempt to come back, and comparing it to the quality end of the bond spectrum results in a good impression – one of risk-on return approaching.

Gold, Silver and Miners

Precious metals downswing isn‘t to be taken too seriously – odds are strong that gold and silver would ride the risk-on return with gains added. It‘s about liquidity not being withdrawn by the market players.

Crude Oil

Crude oil recoved from the omicron uncertainty – to a good degree, which is a testament to the overwhelming pressure for prices to keep rising. The $72 area setback could be coming back into play still this week, if nothing too surprising happens.

Copper

Copper is leaning to the bullish side of the spectrum, driven not only by positive fundamentals and Chile elections. The low volume indeed hinted at little willingness to sell – so, let‘s look for a good attempt to rise next.

Bitcoin and Ethereum

Bitcoin and Ethereum weakness is being decisively rejected, mirroring commodities – the decline indeed hasn‘t been in the disastrous category. The bulls clearly want to move.

Summary

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.