Don’t blindly buy the dip in Stocks. Do this instead

Stock-Markets / Stock Market 2021 Dec 16, 2021 - 04:33 PM GMTBy: Stephen_McBride

By Justin Spittler Stocks are under pressure.

By Justin Spittler Stocks are under pressure.

Although the big indexes like the S&P 500 have bounced back strongly so far this week... things still look dicey under the surface.

Stocks in leading industries like software, cybersecurity, and clean energy have sold off sharply.

Many investors make a huge mistake during times like this.

They blindly “buy the dip.”

They buy beaten-down stocks just because they’re cheap.

But blindly buying weak stocks—just because they’re down a lot—is the last thing you should be doing right now. More often than not, you’ll be catching a falling knife.

Instead, this is the time to be extremely patient…

And start building a watchlist of the strongest stocks within the strongest industries. Today I’ll share two industries holding up well. This is where you’ll want to start.

Then, I’ll share my thinking on where the market might be headed as we wrap up 2021 and enter 2022.

- First, let’s look at why many investors and traders are conditioned to blindly buy the dip…

In short: Our brains are trained to seek fire-sale deals.

Many investors think that if a stock down 25% is good... a stock down 50% is even better.

But this mindset leads to buying the weakest stocks. I’ll never buy a stock just because it’s sold off hard—and you shouldn’t, either.

Instead, during volatile times, you want to focus on the strongest stocks—or “market leaders.”

These stocks lead the market higher during rallies.

But just as important, they tend to fall less than most stocks during a market pullback. Sometimes, they even buck the trend entirely.

That’s right. The very best stocks hold steady or rise when most stocks are plunging.

So how can you spot a market leader?

- Focus on stocks displaying relative strength…

One way to find these opportunities is to look at stocks that maintain a bullish chart structure during broad market selloffs.

You can find these names by looking for stocks that put in “higher lows” during the recent pullback rather than “lower lows.” Or, look for growth stocks that are approaching or setting new highs.

You can also focus your attention on the strongest industries.

Right now, there are two clear standouts.

Semiconductors are the first. ”Semis” power everything these days from electric toothbrushes to Teslas.

Semis have been standout performers all year. And they continue to display a ton of strength.

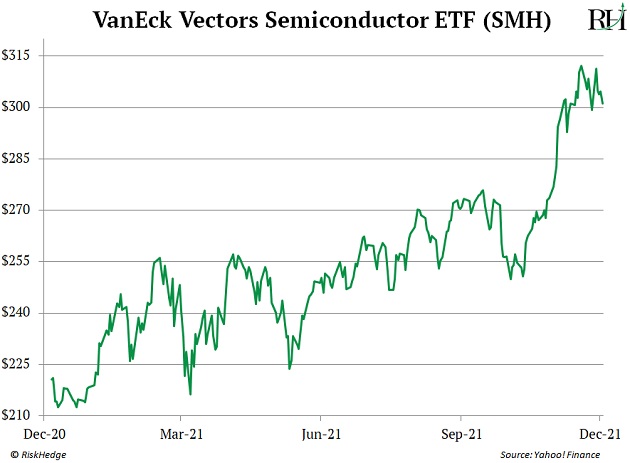

Below you’ll see the performance of the VanEck Vectors Semiconductor ETF (SMH). It’s a fund that invests in big-name semiconductor companies like Advanced Micro Devices (AMD) and Nvidia (NVDA).

SMH is holding steady near its highs as most of the rest of the market struggles. Unlike many other industries, the semiconductor industry is still in a strong uptrend.

- Housing stocks are powering higher too…

You can see what I mean below.

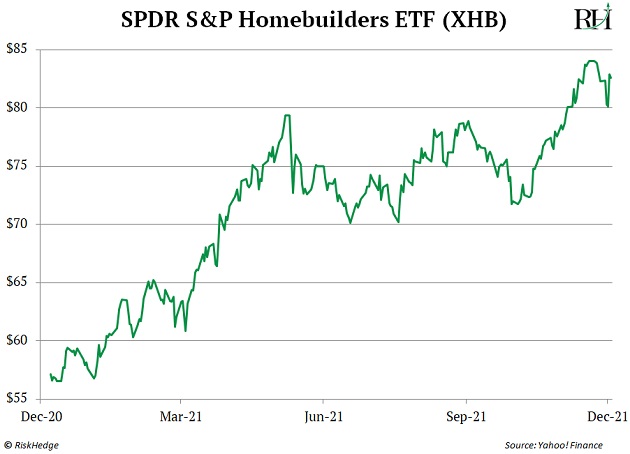

This chart shows the performance of the SPDR S&P Homebuilders ETF (XHB), which invests in homebuilder stocks like DR Horton (DHI) as well as companies like Home Depot (HD).

Like semis, housing stocks have performed well this year, and continue to show strength.

You can see that XHB is still holding up well relative to the rest of the market. It’s trading above its May highs and its 50-day moving average.

Relative to the rest of the market, homebuilder stocks look great.

So, if you’re itching to put new money to work today, I suggest looking at semis and homebuilding stocks.

Of course, I should point out one more thing...

- Stocks could remain under pressure for a few more weeks…

We’re witnessing a “flight to safety” in the markets. It’s when investors sell what they think are higher-risk investments, and buy “safer” ones instead.

You can see what I mean below. This chart shows the performance of the iShares 20+ Year Treasury Bond ETF (TLT). This fund invests in government bonds, which many investors take refuge in when they’re nervous about the broad market.

You can see that TLT just broke out to its highest level since February. This suggests bonds could head higher in the coming weeks, which is evidence of a “risk off” environment in the near term.

As a professional trader, I’ve learned to take warnings from the bond market seriously.

Bonds are the largest financial market on earth—bigger than stocks. And unlike stocks, the vast majority of bonds are managed by professional investors.

For these reasons, movement in bond prices tends to be a more reliable “tell” about where markets are headed.

Right now, government bonds are telling us to be careful. I wouldn’t be surprised if the stock market sells off one more time before it gets moving higher.

For now, I encourage you to fight the urge to blindly buy beaten-down stocks.

Instead, focus on the strongest stocks.

Those names will have the best chance of leading the market higher.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where we reveal our three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

© 2021 Copyright Justin Spittler - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.