What Happens to the Stock Market After a Bullish Stampede?

Stock-Markets / Stock Market 2021 Dec 11, 2021 - 06:39 PM GMTBy: P_Radomski_CFA

The bulls pumped up the market, but with fundamentals deteriorating and corporations largely responsible for the spike, regular investors will be left holding the bag.

With investors betting on a Santa Clause rally despite the deteriorating fundamentals, the S&P 500 helped the GDXJ ETF (proxy for junior mining stocks) outperform on Dec. 7. However, with short-covering and corporate buybacks primarily responsible for the daily spike, another ‘Minsky Moment’ could be on the horizon.

To explain, I wrote on Nov. 19:

While European markets have largely ignored the recent coronavirus spikes, a sharp sell-off could be the spark that lights the S&P 500’s correction. To explain, the DAX 30 Index (Germany) and the CAC 40 Index (France) both closed slightly lower on Nov. 18. However, prior to Nov. 18, the DAX 30 had closed in the green for 13 of the last 15 trading days, and one-upping its European counterpart, the CAC 40 had closed in the green for 15 of the last 16 trading days.

On top of that, the CAC 40 had an RSI (Relative Strength Index) north of 80, while the DAX 30 had an RSI north of 75. As a result, both indices are materially overbought at a time when Germany is implementing new restrictions. Thus, if a Minsky Moment strikes in Europe, don’t be surprised if the negativity cascades across the Atlantic.

To that point, after volatility erupted on cue, the DAX 30 suffered an intraday peak-to-trough decline of 7.8%, the CAC 40 dropped by 7.3%, and the S&P 500 dropped by 5.2%.

Please see below:

However, with overzealous equity bulls back at it again on Dec. 7, the PMs benefited from the risk-on sentiment. However, with the fundamental problems still present, investors may have set themselves up for more disappointment.

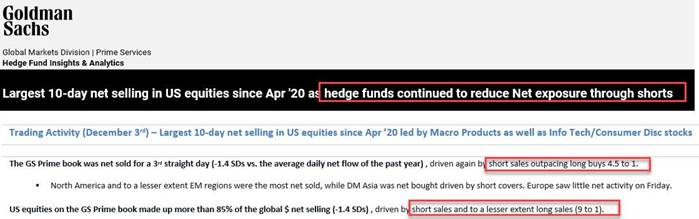

To explain, with hedge funds increasing their short bets a little too late, Goldman Sachs Prime Brokerage reported that last week, “US equities on the GS Prime book made up more than 85% of the global $ net selling (-1.4 SDs), driven by short sales and to a lesser extent long sales (9 to 1).”

In a nutshell: hedge funds increased their short bets at the worst possible time.

Please see below:

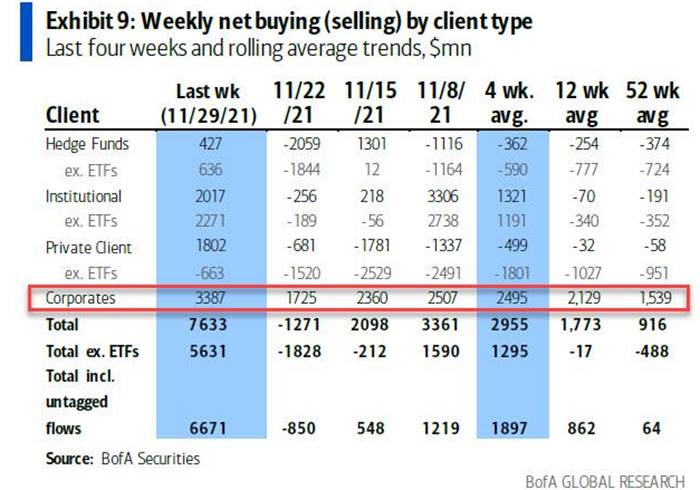

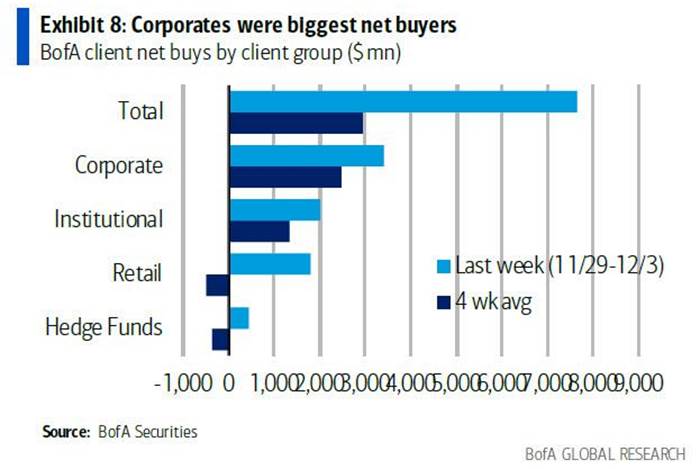

Thus, with the Dec. 7 rally driven mainly by a reversal of these positions, the profound short squeeze helped uplift the PMs. For example, Bank of America data shows that last week’s corporate buybacks were the highest weekly total since March. And by repurchasing nearly $3.4 billion of their own stock (focus on the first blue column from the left), their bids helped calm the S&P 500’s selling pressure.

Please see below:

What’s more, while Bank of America said that hedge funds and retail investors somewhat bought the dip last week (though, they’re still net-sellers over the last four weeks), corporations did much of the heavy lifting.

As a result, with retail investors running out of gas and hedge funds mainly closing out their shorts on Dec. 7, the S&P 500 should resume its correction. More importantly, though, mining stocks’ recent strength should wilt away as the drama unfolds.

Please see below:

And now for the grand reveal: corporations' buyback blackout period begins on Dec. 10. And since they can't repurchase more shares until the New Year, the elephant in the room won't be able to support the S&P 500. Likewise, after hedge funds covered their shorts on Dec. 7, short-covering won't be able to support the S&P 500 either. As a result, mining stocks should suffer if the negativity resurfaces over the next few weeks.

Please see below:

To explain, the red line above tracks the hourly movement of the S&P 500, while the gold line above tracks the hourly movement of the GDXJ ETF. As you can see, the junior miners often follow in the S&P 500’s footsteps. And with the S&P 500 setting itself up for another drop, the GDXJ ETF likely won’t be far behind.

To that point, with the headline Consumer Price Index (CPI) scheduled for release on Dec. 10 and the Fed’s next monetary policy meeting scheduled for Dec. 14/15, sources of volatility will arrive at a time when corporations are stuck on the sidelines.

For context, I wrote on Nov. 12:

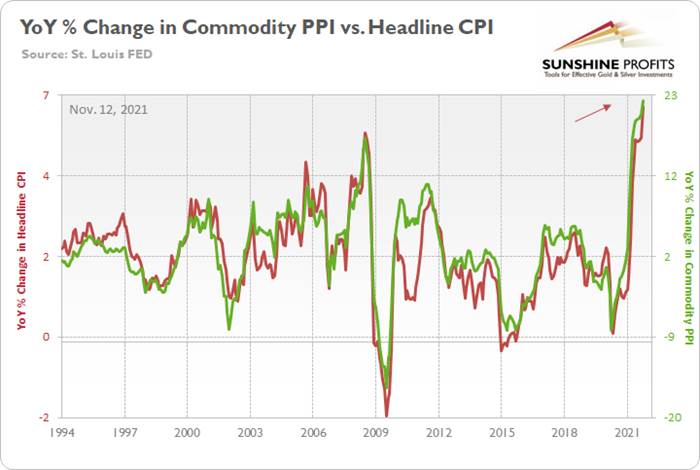

I’ve highlighted on several occasions how the Commodity Producer Price Index (PPI) often leads the following month’s headline CPI. And after the former increased by 2% month-over-month (MoM) on Nov. 9 – which is a material MoM increase – and by 22.2% YoY (a new 2021 high), it implies a headline CPI print of roughly 5.75% to 6.25% when the data is released on Dec. 10.

Please see below:

To explain, the green line above tracks the YoY percentage change in the commodity PPI, while the red line above tracks the YoY percentage change in the headline CPI. If you analyze the relationship, you can see that the pair have a close connection.

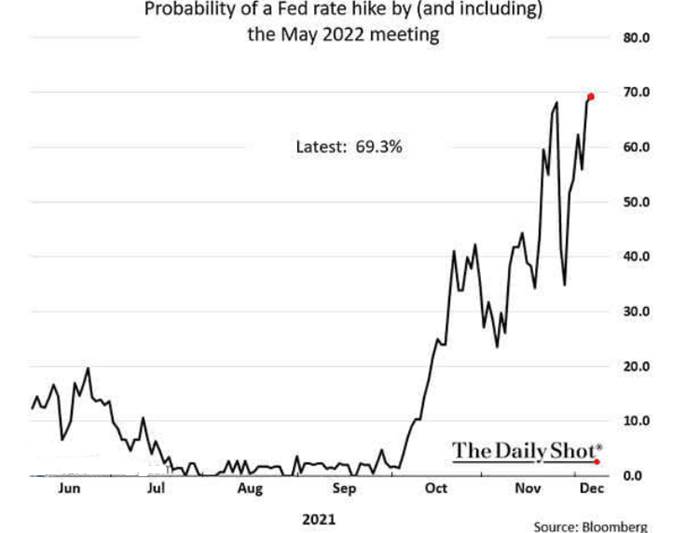

In addition, after expectations for September were pulled forward to July, and then expectations for July were pulled forward to June, now, the probability of a Fed rate hike in May 2022 has reached ~69%.

Please see below:

Also noteworthy, St. Louis Fed President James Bullard said on Dec. 3 that “the danger now is that we get too much inflation.... It's time for the [Fed] to react at upcoming meetings.”

He added: “the inflation numbers are high enough that I think [ending the taper by March] would really help us to create the optionality to do more if we had to, if inflation doesn't dissipate as expected in the next couple of months.”

For context, Bullard reiterated that he expects two Fed rate hikes in 2022.

The bottom line? While the bulls stampeded through Wall Street on Dec. 7, things aren’t as rosy as they appear. And while the PMs benefited from the renewed optimism, their tepid rallies are even more fragile. Moreover, with another inflation print on the horizon and the FOMC’s Dec. 15 decision including its Summary of Economic Projections, the hawkish revelations could rattle the financial markets. And with corporate buybacks starting their holiday vacation on Dec. 10, stock market investors are on their own to navigate what comes next.

In conclusion, the PMs rallied on Dec. 7, as risk-on sentiment reigned supreme. However, with the S&P 500 rallying by more than 2% and WTI rallying by nearly 4%, the PMs’ daily upswings were relatively muted. As a result, precious metals investors sense that caution is warranted. And with their trepidation a sign of heightened anxiety, they likely realize that going long the PMs involves much more risk than reward.

Today's article is a small sample of what our subscribers enjoy on a daily basis. They know about both the market changes and our trading position changes exactly when they happen. Apart from the above, we've also shared with them the detailed analysis of the miners and the USD Index outlook. Check more of our free articles on our website, including this one – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. You'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts to get a taste of all our care. Sign up for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.